Good Morning,

Every now and then we are faced with a conundrum. A great idea that doesn’t quite fit the remit of the fund. Now there’s an added dimension to this - the remit of this Substack. Yet we still find ourselves with excellent companies we know and love that maybe are not exactly top of mind for the broader public, or are difficult to invest in. We tend to leave those be on account of time scarcity, but then on occasion the valuations just seem to appealing to ignore. This is one such time, while we can not buy this company for PACAT due to size, and it does not fit the Panda Portfolio remit, We feel compelled to get the word out. We did try to keep it moderately concise, but we hope it did not take away from the substance of the report. This report is not behind a paywall, so feel free to enjoy it.

We are writing this in the conjunction with other materials on Energy that we kicked the year off with. You can find them below:

Oil market outlook

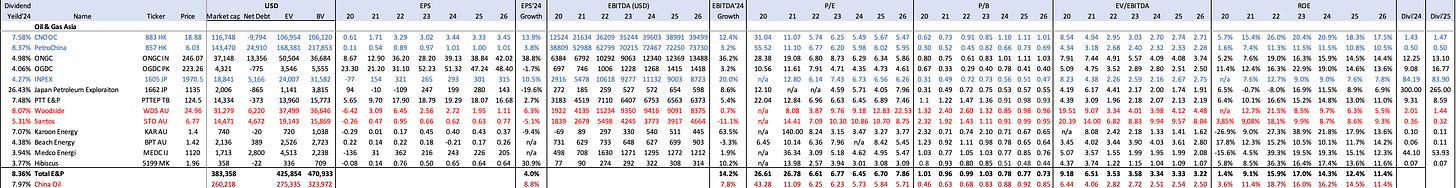

Asian Oil Equities and Cnooc

China gas growth and Petrochina

Refining in China: Sinopec

Refining in Asia: Thai Oil

Petrochemicals Outlook

My Petrochemical Romance: Wanhua vs Hengli

Do please check them out if you haven’t already. We tend to keep the most interesting stuff behind a paywall, and we would appreciate your custom - do join in if you are interested.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

With the admin done, let’s dive in!

Hibiscus Petroleum Berhad is Malaysia’s first Special Purpose Acquisition Company (SPAC), established in 2011. It was founded by Dr. Kenneth Gerard Pereira, alongside Dr. Pascal Hos and Ms. Joyce Vasudevan, with the vision of becoming a leading independent upstream oil and gas exploration and production company .

Initially focused on oil exploration, the company faced significant setbacks during its early ventures in the Middle East, Norway, and Australia, resulting in substantial investment losses. By 2015, Hibiscus pivoted its strategy toward acquiring mature and producing oil and gas assets, a move that transformed its business model into one focused on sustainable production and cash flow generation .

• 2015: Acquired a 50% stake in the Anasuria Cluster in the UK North Sea from Shell and Esso, marking its entry into international markets. This deal positioned Hibiscus as an upstream operator .

• 2016: Entered Malaysia’s upstream oil sector by acquiring a 50% stake in the North Sabah PSC from Shell. This was its first major domestic acquisition .

• 2021: Achieved a milestone acquisition from Repsol, which included a 35% stake in the PM3 CAA PSC (Malaysia-Vietnam), a 60% stake in the Kinabalu PSC (Malaysia), and other assets. This acquisition significantly boosted its production capacity and 2P reserves .

• 2024: Expanded its geographical footprint by acquiring a 37.5% interest in Brunei Block B MLJ from TotalEnergies. This move provided entry into Brunei’s upstream sector and added valuable gas reserves to its portfolio .

Core Philosophy

Hibiscus thrives on its ability to acquire mature assets from major oil companies, optimize production, and extend asset lifespans through strategic investments in technology and infrastructure upgrades. The company is committed to delivering value for stakeholders while ensuring sustainability through efficient resource utilisation .

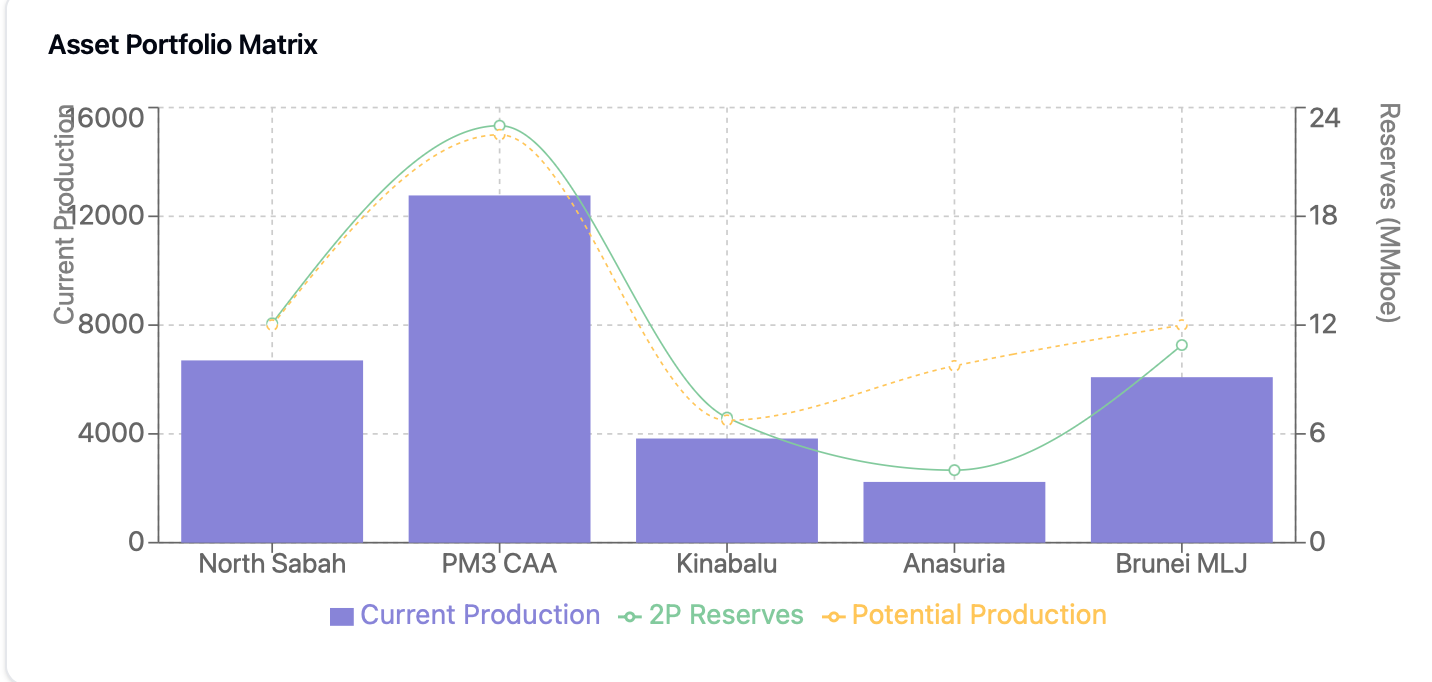

Asset Overview

Hibiscus’s portfolio includes assets in Malaysia, the UK, and Brunei, with a mix of oil and gas reserves, producing fields, and development opportunities. The company’s assets have been central to its growth story.

North Sabah PSC (Malaysia)

Acquisition: Purchased from Shell in 2016. Hibiscus holds a 50% participating interest as operator.

Fields: Includes four producing fields (St Joseph, South Furious, SF30, and Barton) and pipeline infrastructure that connects to the Labuan Crude Oil Terminal.

Reservoirs: Comprised of Miocene-age sandstone reservoirs.

Key Projects:

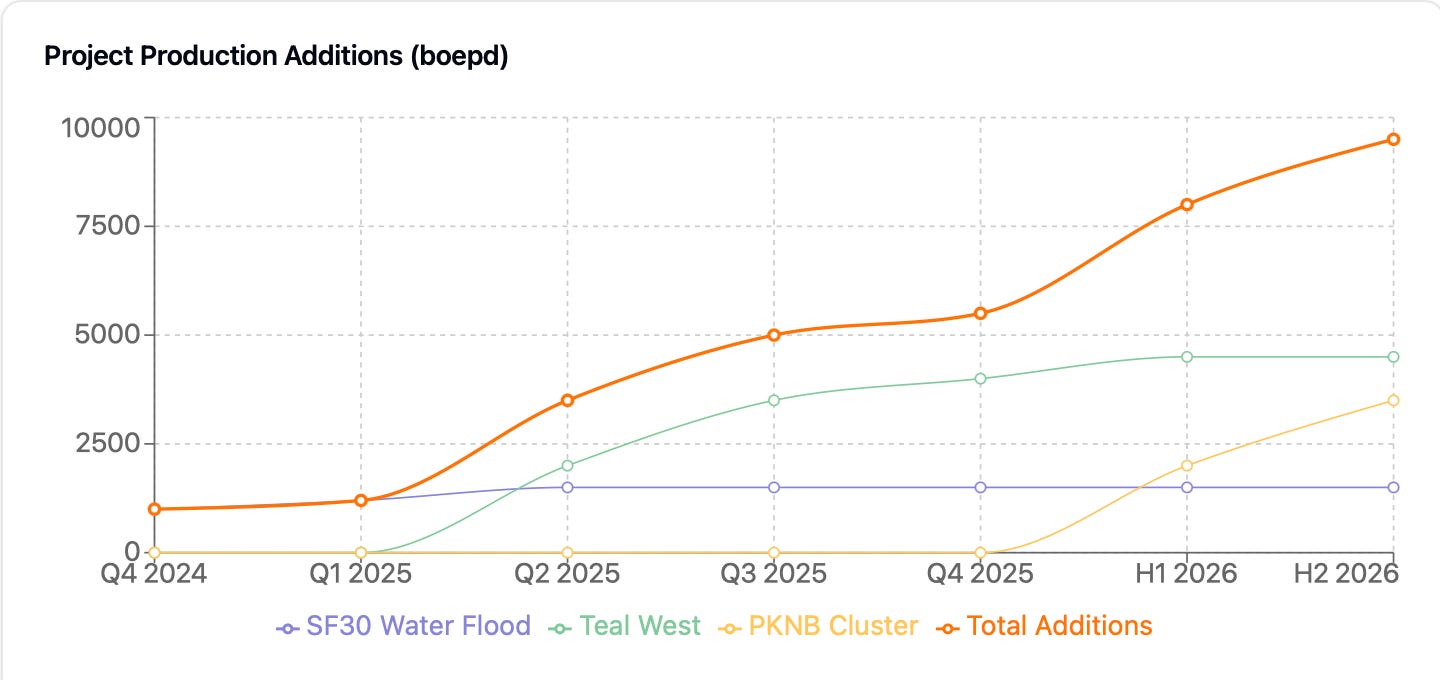

• SF30 Water Flood Phase 2: Involves drilling five oil-producing wells and six water injectors to maintain reservoir pressure. Expected incremental production of aorund 1,200 bopd by FY26. Water injection enhances oil recovery by displacing hydrocarbons trapped in the reservoir matrix .

• Compressor Upgrades: Improved compressor capacity aims to reduce wellhead backpressure, optimizing production.

PM3 CAA PSC (Malaysia-Vietnam)

Acquisition: Part of the 2021 Repsol asset purchase, with Hibiscus holding a 35% interest.

Location: A cross-border field in the Malaysia-Vietnam Commercial Arrangement Area (CAA), producing oil and gas.

Reservoirs: Composed of Miocene sandstones with moderate to high permeability and porosity.

Production Facilities: Includes fixed platforms tied to floating production storage and offloading (FPSO) units.

Key Projects:

• PKNB Cluster Gas Development: Significant 2C gas reserves (~47 MMboe) identified, planned for tie-back to PM3 facilities. Targeting production commencement post-2027 upon PSC extension.

• Bunga Orkid & Bunga Aster Wells: Infill drilling campaign in FY22–24 successfully added production and reserves. Future appraisal of the Bunga Aster-1 reservoir could yield an additional 4.2–16.8 MMboe .

Kinabalu PSC (Malaysia)

Acquisition: Purchased in 2021 as part of the Repsol deal, with Hibiscus holding a 60% interest.

Fields: Produces oil from multiple platforms, including Kinabalu Main, East, and North fields.

Reservoirs: The field contains stacked sandstones within the Miocene and Oligocene formations.

Production Infrastructure: Oil is processed offshore and exported via pipelines.

Key Projects:

Compressor Optimisation: Low-pressure and high-pressure compressors being upgraded to reduce wellhead backpressure and increase hydrocarbon recovery. Completion expected in FY25.

Anasuria Cluster (UK)

Acquisition: Acquired a 50% stake from Shell and Esso in 2015.

Fields: Includes Guillemot A, Teal, Teal South, and Cook fields.

Reservoirs: Comprised of Paleocene and Eocene-age sandstones with relatively high porosity and permeability.

Production Infrastructure: Oil is processed via the Anasuria FPSO, capable of handling 25,000 bopd and 85 million standard cubic feet per day (mmscf/d) of gas.

Key Projects:

Teal West Development: Planned tie-back to the Anasuria FPSO. Initial drilling to be completed by 2025, with first oil expected by late 2025 or early 2026. Incremental production: ~4,000 boepd

Brunei Block B MLJ

Acquisition: Acquired a 37.5% interest from TotalEnergies in 2024.

Location: Offshore Brunei, near existing Hibiscus facilities in Sabah.

Reservoirs: Contains stacked sandstone reservoirs with significant gas and condensate reserves.

Production Infrastructure: Tied to centralized processing and exporting facilities.

Key Projects:

• Tie-Back Opportunities: Hibiscus plans to develop smaller, adjacent fields through tie-backs to Block B infrastructure.

• Future Exploration Potential: Hibiscus believes the block’s reserves are conservatively estimated, with potential for upside .

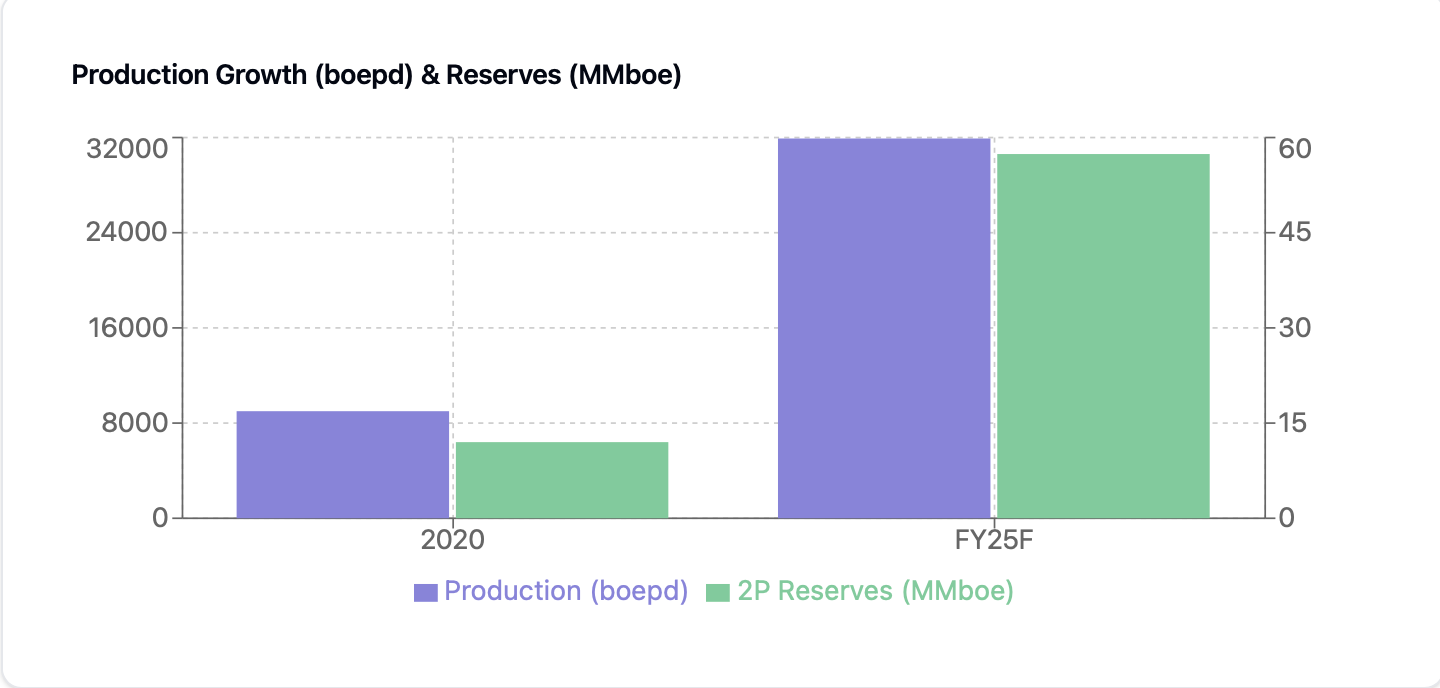

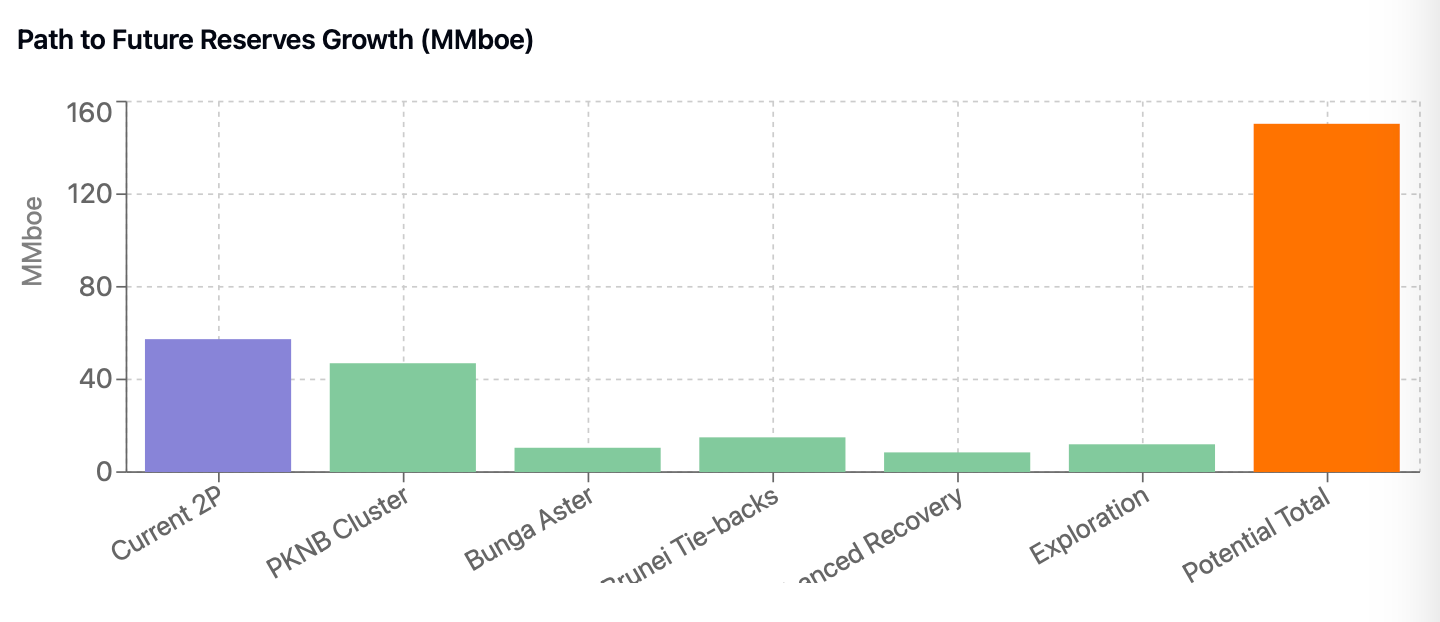

Reserves

2020:

Total 2P Reserves: ~12 MMboe.

Contributors:

• Primarily from North Sabah (~75%) and Anasuria Cluster (~25%).

• No contributions from PM3 CAA, Kinabalu, or Brunei assets .

FY25F (Current):

Total 2P Reserves: ~57.4 MMboe (Million Barrels of Oil Equivalent).

Contributors:

• PM3 CAA: ~40%

• North Sabah: ~21%

• Kinabalu: ~12%

• Anasuria Cluster: ~7%

• Brunei Block B MLJ: ~19% .

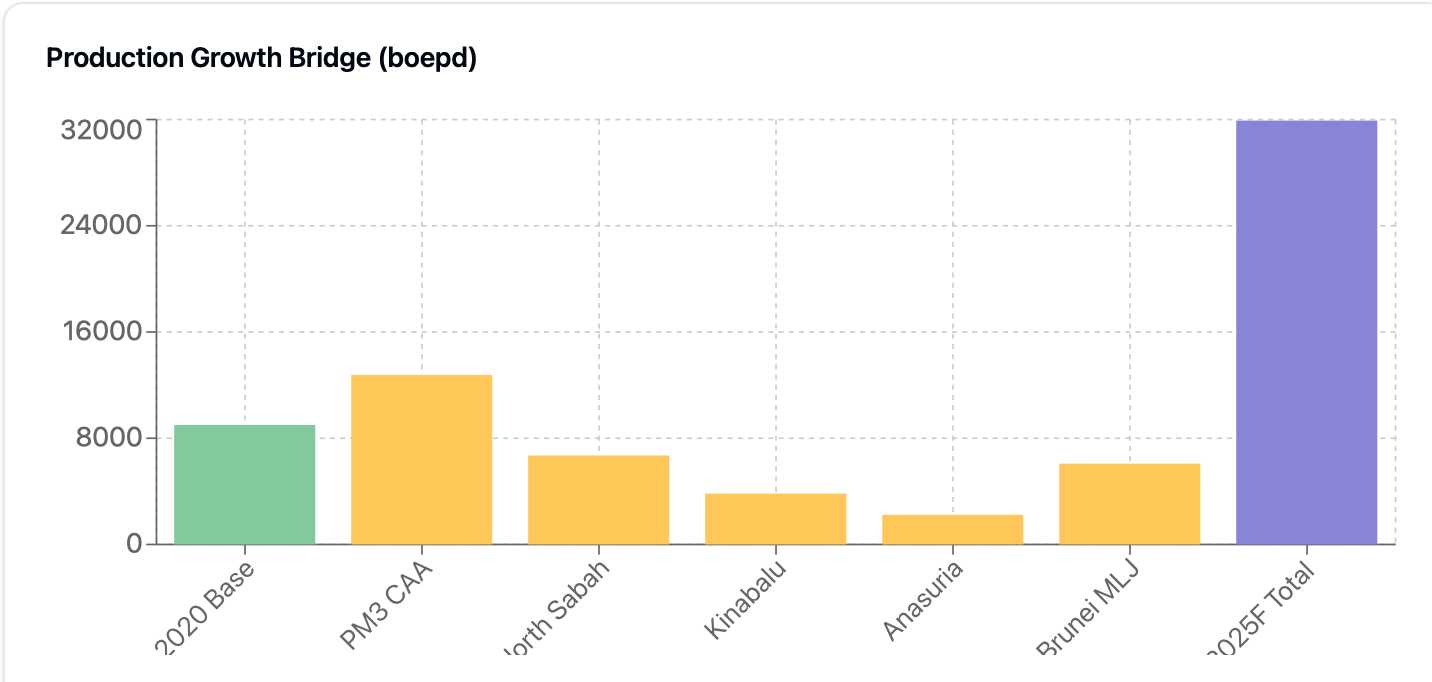

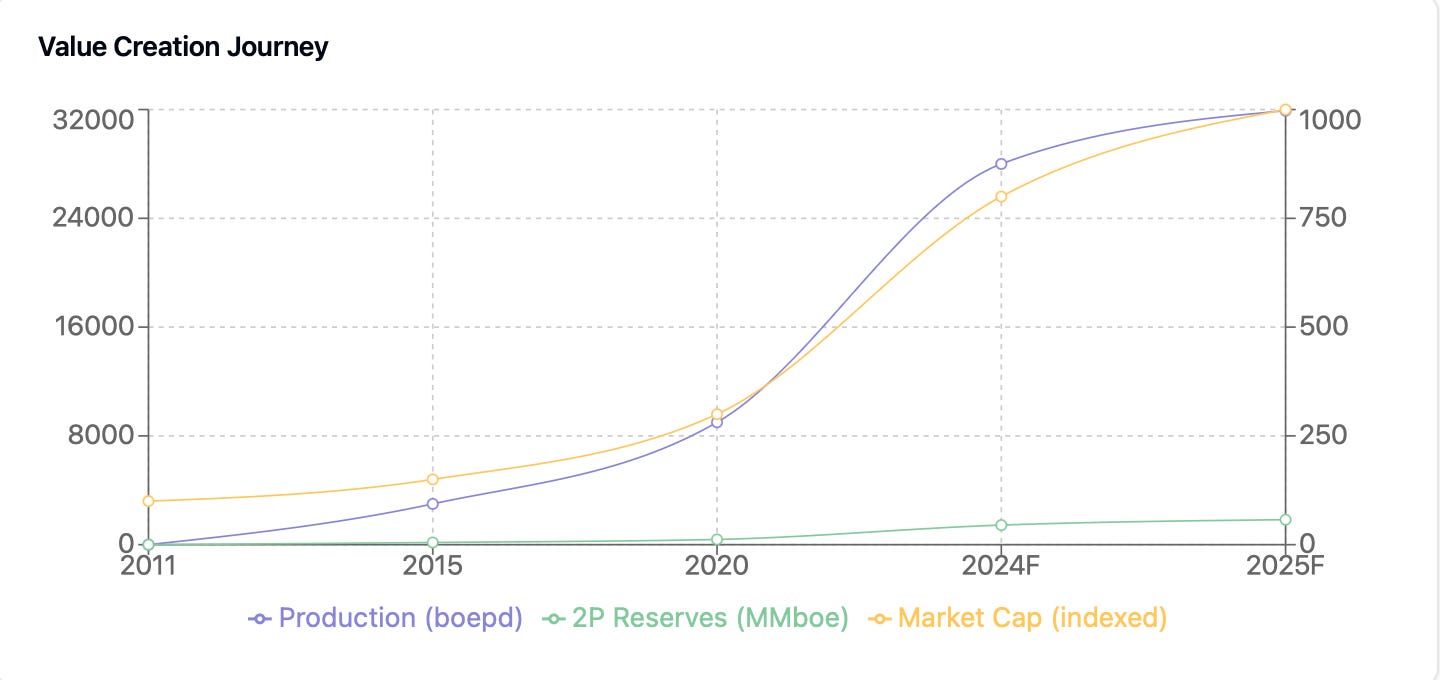

Production

2020:

Net Production: ~9,000 boepd.

Contributors:

• North Sabah: ~6,000 boepd.

• Anasuria Cluster: ~3,000 boepd.

• No contributions from PM3 CAA, Kinabalu, or Brunei .

FY25F (Current):

Net Production: ~31,919 boepd.

Contributors:

• PM3 CAA: ~12,768 boepd (40%).

• North Sabah: ~6,702 boepd (21%).

• Kinabalu: ~3,830 boepd (12%).

• Anasuria Cluster: ~2,234 boepd (7%).

• Brunei Block B MLJ: ~6,085 boepd (19%) .

Key Changes (2020 to FY25F):

Reserves Growth:

• Nearly 5x increase in 2P reserves from ~12 MMboe to ~57.4 MMboe.

• Driven by strategic acquisitions of PM3 CAA, Kinabalu, and Brunei Block B MLJ .

Production Growth:

• Production more than tripled from ~9,000 boepd to ~31,919 boepd.

• Significant new contributions from PM3 CAA and Brunei Block B MLJ .

Diversified Asset Base:

• In 2020, production came from just two assets (North Sabah and Anasuria).

• By FY25F, five major assets contribute, reducing reliance on individual fields .

Future Production Outlook

Ongoing Projects

PM3 CAA PSC (Malaysia-Vietnam):

Gas Development at PKNB Cluster: Hibiscus plans to develop the sizeable gas reserves in the PKNB Cluster through tie-backs to PM3 CAA infrastructure. Production is expected to commence post-2027, contingent on an extension of the PM3 CAA PSC .

Impact on Production: If the PSC is extended, production volumes from PM3 CAA are likely to stabilize beyond FY27, contributing significantly to group output.

North Sabah PSC (Malaysia):

SF30 Water Flood Phase 2: This enhanced oil recovery project involves drilling five oil producer wells and six water injector wells. It is expected to add 1,200 barrels of oil per day (bopd) by FY25-FY26 .

Long-term Sustainability: The field is undergoing continuous optimisation to extend its productive lifespan.

Kinabalu PSC (Malaysia):

Compressor Upgrade Project: Enhancements to low-pressure and high-pressure compressors aim to increase oil production by reducing backpressure at the processing facilities. Completion is expected in FY25 .

Anasuria Cluster (UK):

Teal West Development: Scheduled to achieve first oil by late 2025 or early 2026. This project will add ~4,000 boepd to group production and bolster the Anasuria Cluster’s contribution .

Brunei Block B MLJ:

Phase 1 Development: Hibiscus is working on monetising nearby reserves through tie-back opportunities to Brunei MLJ infrastructure. Initial production is expected to ramp up steadily, contributing ~6,000 boepd in FY25 .

Future Reserves Outlook

Potential Upside

PM3 CAA PSC Extension (Beyond 2027): Hibiscus is likely to secure a 10- or 20-year extension for the PM3 CAA PSC. If granted, the extension could: Add significant 2P gas and oil reserves from the PKNB Cluster.

Extend the production runway, reducing depreciation and maintaining reserve levels .

Exploration Success:

Potential reserves additions from ongoing exploration campaigns, such as:

• Appraisal of the Bunga Aster-1 oil reservoir at PM3 CAA, which could yield 4.2–16.8 MMboe .

• Further delineation of reserves at Brunei Block B MLJ.

New Acquisitions: Hibiscus aims to continue its strategy of acquiring mature producing assets from major oil companies. Expansion opportunities in Brunei and other ASEAN markets are under consideration .

Financial and Strategic Drivers

Capex Plans:

FY25 Capex: USD283 million, focused on:

• Teal West: USD88 million.

• North Sabah: USD62 million .

• Capex for FY26 will prioritise production ramp-up and asset optimisation.

Growth Catalysts

Higher Production in FY26: Expected production boost of ~5,000–6,000 boepd from the SF30 Water Flood Phase 2 and Teal West projects. Group production is projected to stabilize at ~35,000 boepd by FY26 .

Diversification into Gas: Increased focus on gas development (e.g., PKNB Cluster and Brunei Block B MLJ), aligning with the global energy transition .

Rerating Opportunities: Potential PSC extensions, production ramp-ups, and exploration successes could trigger valuation reratings for Hibiscus, particularly as its reserve and production profiles improve .

Hibiscus Petroleum could explore several strategic acquisition opportunities and partnerships to further expand its production and reserves. Based on its history and current trajectory, here are some potential deal types and opportunities they might consider:

Acquisitions of Mature Producing Assets

Hibiscus has demonstrated success in acquiring mature assets from major oil companies. These assets often have remaining production potential that can be optimized through low-cost operational improvements.

Key Opportunities:

Regional Focus (Southeast Asia):

Indonesia: Mature fields in Sumatra or offshore Natuna Basin, where assets are being offloaded by Chevron, ExxonMobil, or other IOCs. Chevron has been divesting its Southeast Asian assets, including those in Indonesia. These assets encompass mature fields with existing production infrastructure, presenting opportunities for operators like Hibiscus to optimize and extend field life.

Brunei Expansion: Acquiring adjacent fields or PSCs to Block B MLJ, leveraging existing infrastructure.

Shell’s Abadi LNG Project Stake: Shell has been seeking to divest its interest in the Inpex-led Abadi LNG project in Indonesia. While primarily a gas project, it represents a significant asset in the region.

Malaysia

ExxonMobil’s Malaysian Assets: ExxonMobil has agreed to transfer operations of its assets under two production-sharing contracts in Malaysia to Petronas. While this transfer does not equate to a sale, it indicates Exxon’s strategic shift, potentially leading to future divestment opportunities.

Shell’s Malaysian Assets: Shell has been rationalizing its portfolio, which may include divesting mature assets in Malaysia. These assets could offer Hibiscus opportunities to enhance production through operational efficiencies.

Vietnam

Santos’ Vietnamese Assets: Santos has previously divested its Southeast Asian assets, including those in Vietnam. Remaining assets or interests from other operators looking to exit the region could be potential targets.

Why This Strategy Works:

Hibiscus specialises in extending the life of mature fields.

High potential for value creation through enhanced oil recovery (EOR), waterflooding, and compressor upgrades.

Expansion into Gas-Focused Projects

With the global energy transition, gas-focused acquisitions align with long-term demand for cleaner fuels. Hibiscus’s entry into the gas-heavy Brunei Block B MLJ positions it well to expand in this domain.

Key Opportunities:

Malaysia and Vietnam: Additional gas clusters near PM3 CAA, including potential opportunities in the South China Sea. Gas developments tied to Malaysia’s demand for LNG exports via PETRONAS.

Australia: Gas-heavy fields in the North West Shelf Basin, where companies like Woodside Energy are focusing on divesting mature assets.

Why This Strategy Works:

Gas demand is rising, particularly in Asia, for LNG and power generation.

Tying gas developments to existing infrastructure can reduce costs and accelerate production timelines.

Participation in Decommissioning and Redevelopment Projects

Acquiring fields that require significant decommissioning or redevelopment can be cost-effective, especially if the assets are underutilized.

Key Opportunities:

North Sea (UK/Norway): Fields where aging infrastructure has led to production declines but with potential for redevelopment. Partnerships with operators looking to minimize decommissioning liabilities.

Southeast Asia: Joint ventures with PETRONAS, Pertamina (Indonesia), or PTT (Thailand) to take over marginal fields that require cost-efficient operatorship.

Why This Strategy Works:

Hibiscus has demonstrated strong operational efficiencies in redeveloping mature assets.

Decommissioning partnerships can help unlock value from technically challenging projects.

Exploration of Adjacent Assets

Hibiscus can expand its reserves by acquiring or exploring fields adjacent to its existing portfolio, leveraging infrastructure and operational synergies.

Key Opportunities:

Brunei: Acquire or explore additional concessions near Block B MLJ for tie-back opportunities.

Malaysia (North Sabah, PM3 CAA): Exploration of additional reserves in adjacent clusters like the PKNB Cluster at PM3 CAA.

Why This Strategy Works:

Existing infrastructure and operational experience reduce costs and risks.

Tie-back projects offer fast-track development and reduced capex.

Deal Selection Criteria for Hibiscus:

Production Growth Potential: Assets that can quickly ramp up production or enhance reserves.

Synergies: Fields located near existing infrastructure to minimise development costs.

Financial Feasibility: Acquisitions that align with Hibiscus’s balance sheet and cash flow generation.

Energy Transition Alignment: Opportunities that include gas reserves or future-proof energy projects.

Detailed Financial Analysis of Hibiscus Petroleum

This section delves deeper into key aspects of Hibiscus Petroleum’s financial performance, including revenue, profitability, cash flow, debt, capital allocation, and risk management.

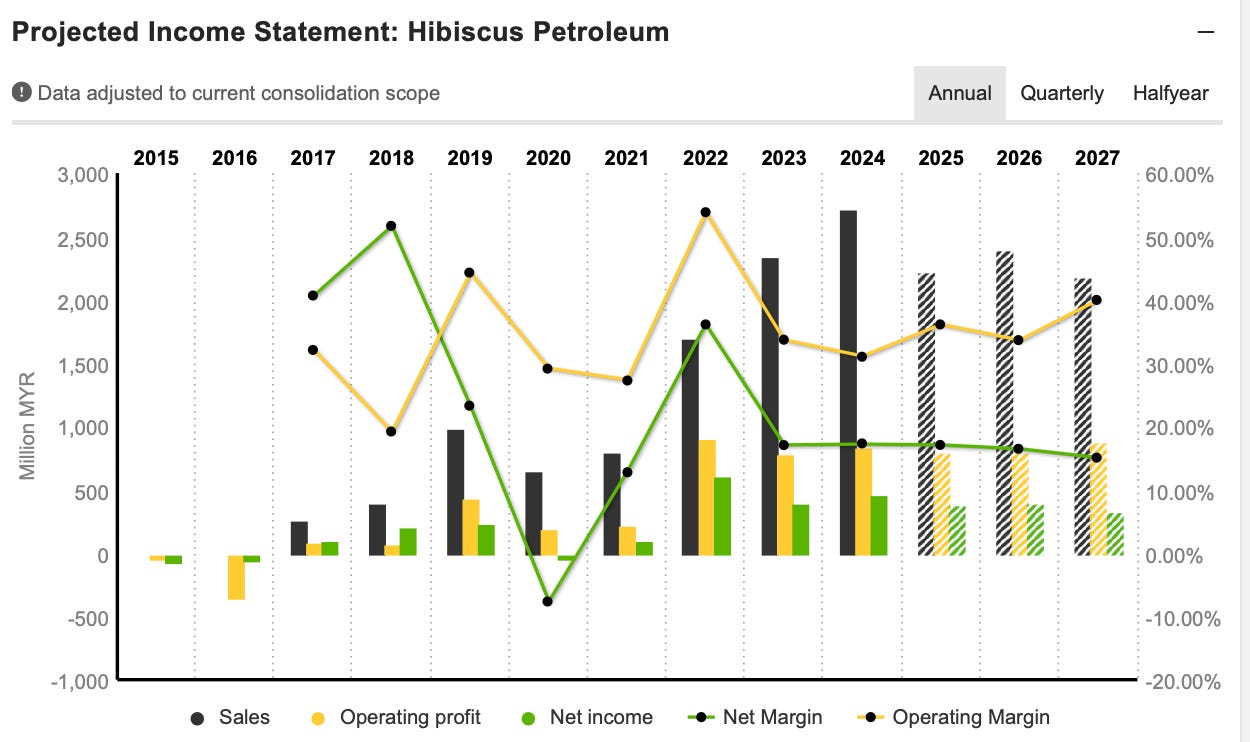

Revenue and Profitability

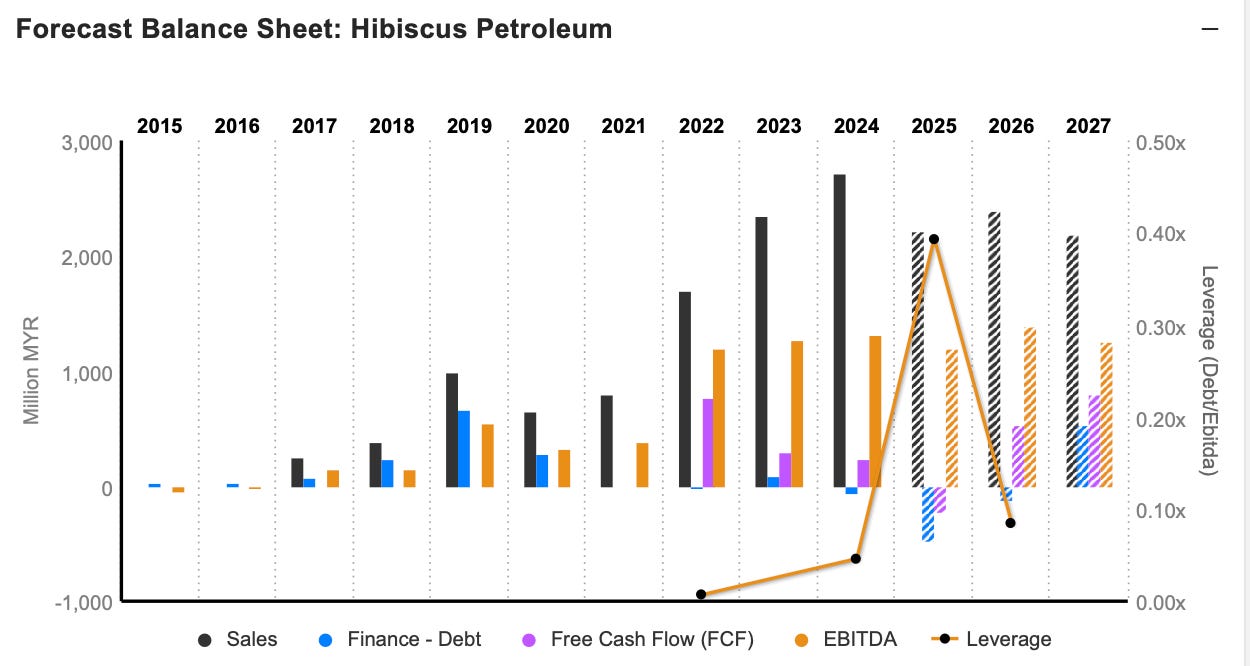

Revenue Trends

2024 Performance:

Revenue: ~MYR 2.7 billion, driven by strong contributions from PM3 CAA, North Sabah, and Brunei Block B MLJ acquisitions.

Revenue saw a jump from 2021 due to Repsol asset integration and sustained high Brent oil prices in 2022-2023.

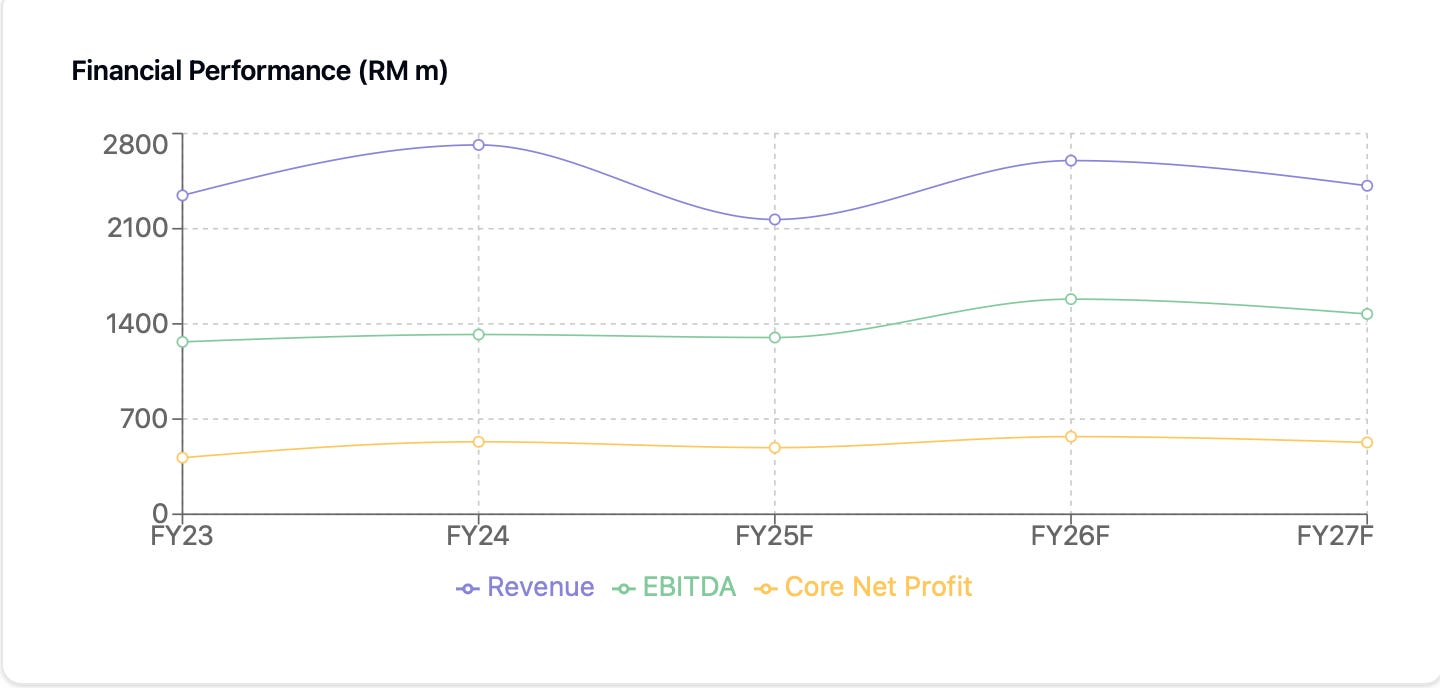

Future Outlook:

2025-2027 Revenue Projections: Stabilizing above MYR 2.5 billion annually due to:

Additional production from SF30 Water Flood Phase 2 (North Sabah).

Incremental volumes from the Teal West project by 2026.

Gas production from Brunei Block B MLJ.

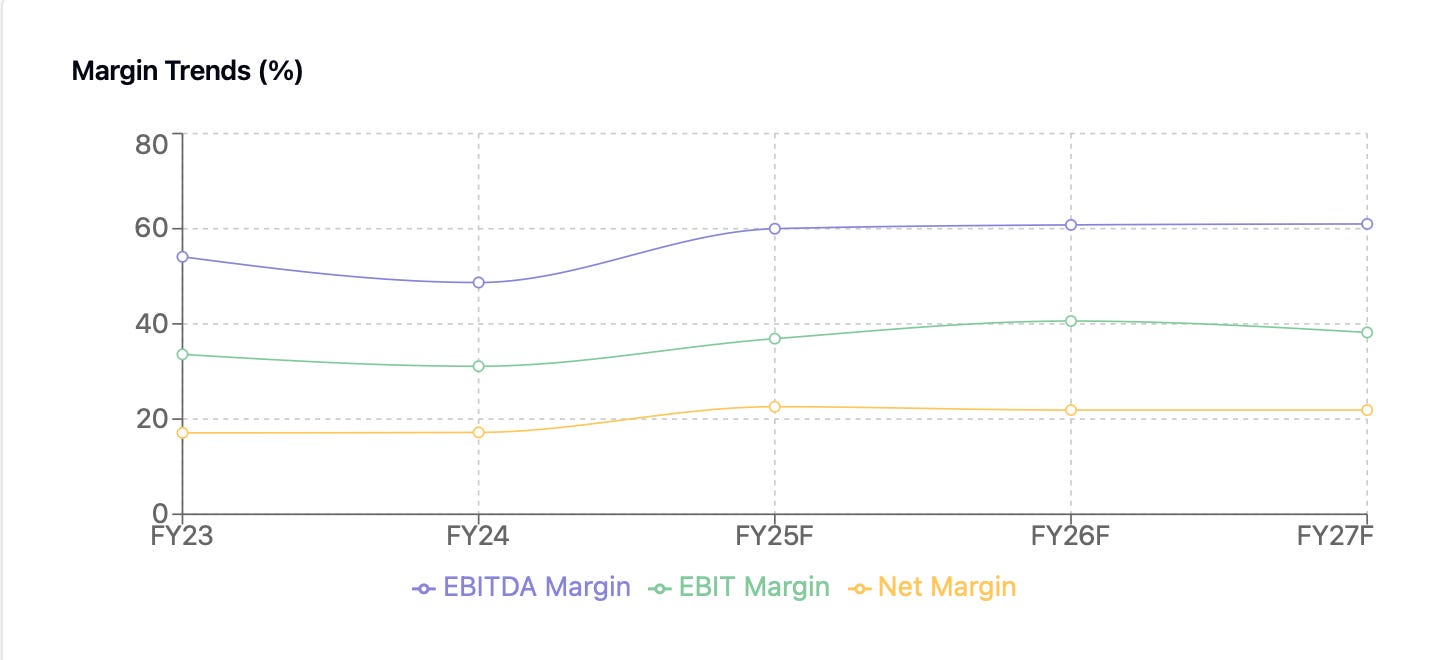

Profitability

EBITDA:

2024 EBITDA: ~MYR 1.32 billion, supported by efficient operations at PM3 CAA and cost control measures across assets. EBITDA margins are expected to stabilize around 45%-50% by 2026.

Operating Profit: Improved operating profit margins (~30%-35%) are driven by reduced maintenance costs post-2025.

Net Profit: Fluctuations in net income are linked to oil price volatility and one-off expenses (e.g., maintenance campaigns, deferred taxes for Anasuria Cluster in 2024).

Net margins are expected to rise post-2025 as new production projects ramp up.

Cash Flow Analysis

Free Cash Flow (FCF)

Historical Performance: FCF was under pressure in 2024 due to heavy capex (~MYR 1.3 billion), primarily for the Teal West and North Sabah projects.

Future Projections: FCF is expected to turn positive from 2026 onwards as capex reduces and production normalizes.

Key drivers for FCF improvement:

• Stabilization of Brent oil prices above USD 70/bbl.

• Reduced opex from infrastructure upgrades and efficiency improvements.

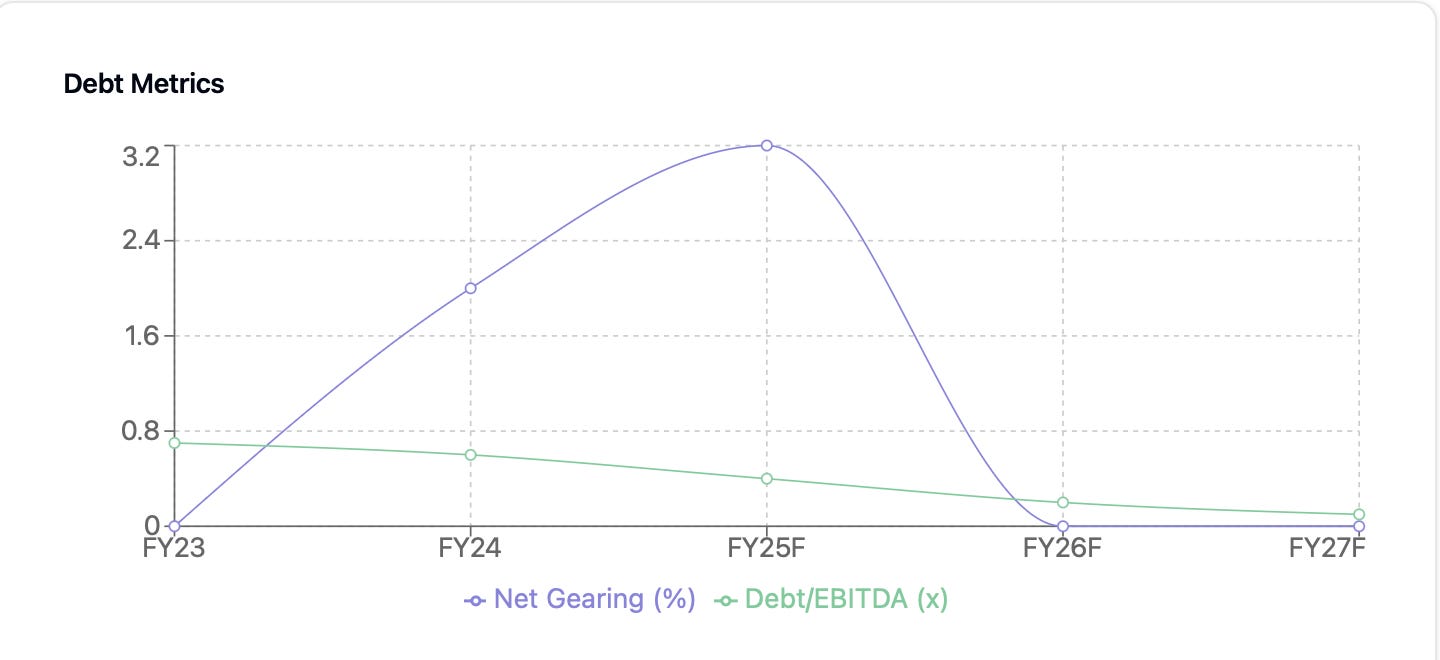

Debt and Leverage

Debt Levels

Debt spiked in 2024 due to acquisitions (e.g., Brunei Block B MLJ) and capital-intensive projects. Total debt is projected to decrease after 2025 as EBITDA grows and cash flow improves.

Leverage Ratios

2024 Leverage (Debt-to-EBITDA): ~0.4x, reflecting a conservative approach to borrowing. Expected to decline to ~0.2x by 2026 as capex normalizes and production ramps up.

Capital Allocation

Capex Plans

2024 Capex: USD 283 million allocated for:

• Teal West: USD 88 million.

• North Sabah: USD 62 million.

• Maintenance and minor projects across assets.

2025-2026 Capex:

Focus shifts toward sustaining production and exploring gas reserves at PM3 CAA and Brunei Block B MLJ.

Dividend Policy

Hibiscus follows a flexible dividend policy linked to Brent oil prices:

Guidance: 8 sen/share if Brent averages above USD 70/bbl; 10 sen/share if Brent exceeds USD 80/bbl.

Yield: ~4% at current share prices (~MYR 2.00).

Financial Resilience and Risk Management

Liquidity Position

• Hibiscus maintains a healthy liquidity buffer, supported by:

• Cash reserves (~MYR 688 million as of 2024).

• Access to undrawn credit facilities for future growth initiatives.

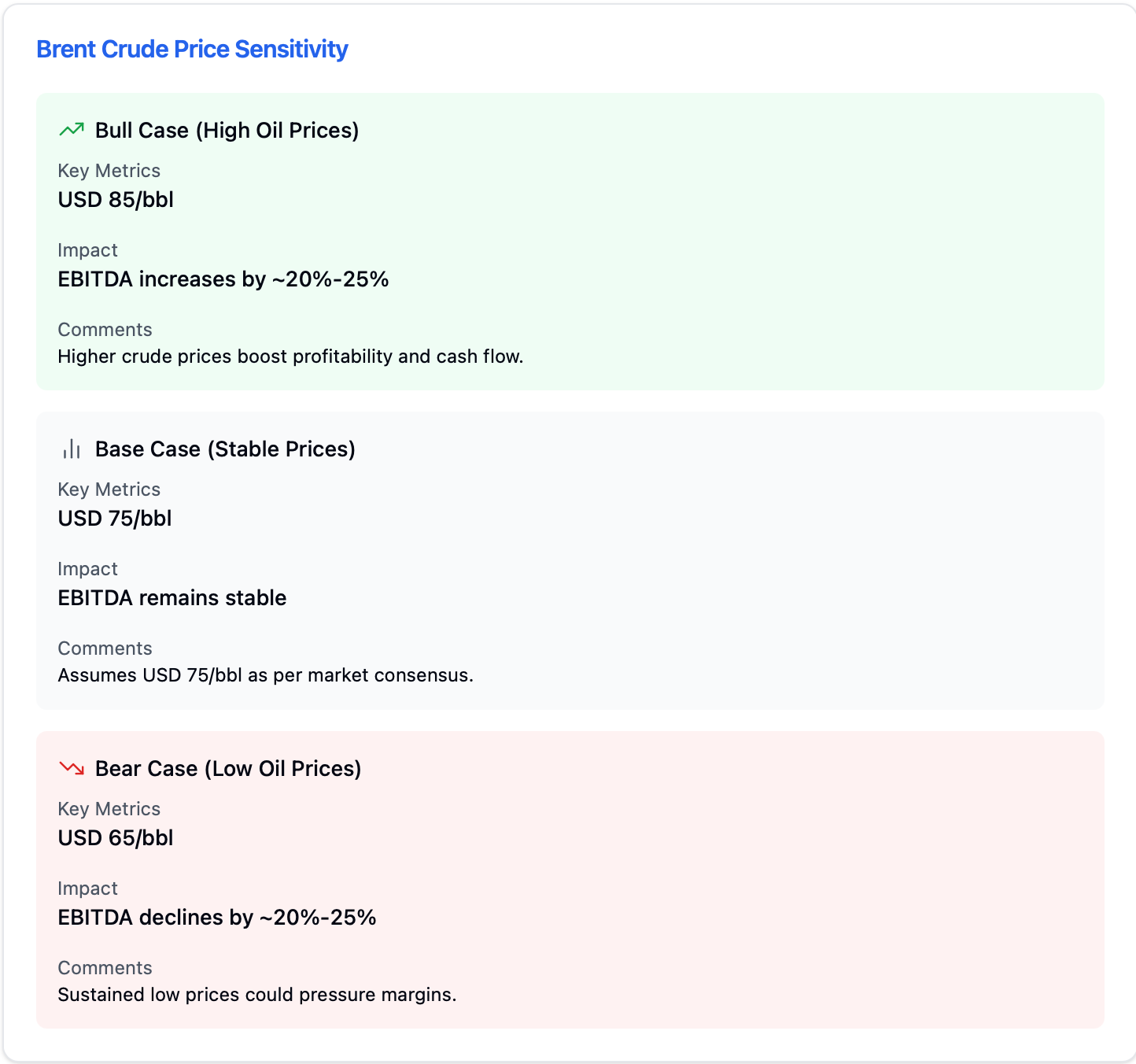

Oil Price Sensitivity

• Brent crude oil price fluctuations significantly impact revenue and profitability:

• Every USD 5/bbl change affects net profit by ~25%.

• Mitigation: Diversifying into gas (e.g., Brunei Block B MLJ) reduces dependency on crude oil prices.

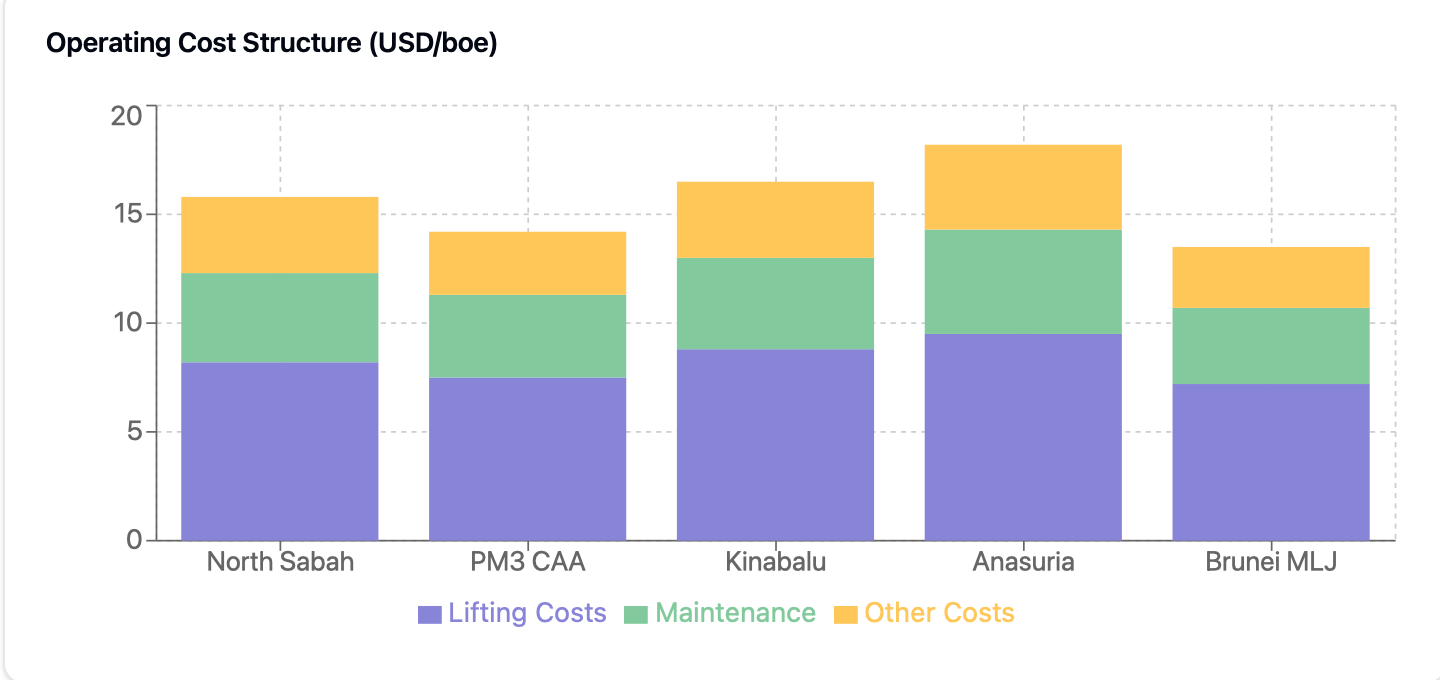

Cost Management

• Post-2024, cost reductions are anticipated as major maintenance activities are completed:

• North Sabah: Compressor upgrades and waterflood projects to lower opex.

• PM3 CAA: Enhanced efficiency from infill drilling campaigns.

Currency Risks

Revenue is predominantly USD-denominated, while costs are in local currencies (e.g., MYR, GBP).

The company benefits from a weaker MYR against the USD but remains exposed to foreign exchange fluctuations.

Cost Control and Operational Efficiency

Opex Reduction: Maintenance activities (completed in FY24) and infrastructure upgrades will lower operating costs per barrel:

• Compressor upgrades at Kinabalu and North Sabah.

• Improved uptime at Anasuria FPSO post-2024.

Field-Specific Cost Control:

PM3 CAA: Lower production costs due to economies of scale from increased output.

North Sabah: Water injection projects to improve recovery rates while minimizing operational downtime.

General Cost Discipline: Hibiscus has consistently maintained low opex relative to peers, averaging ~USD 15-20/boe across assets.

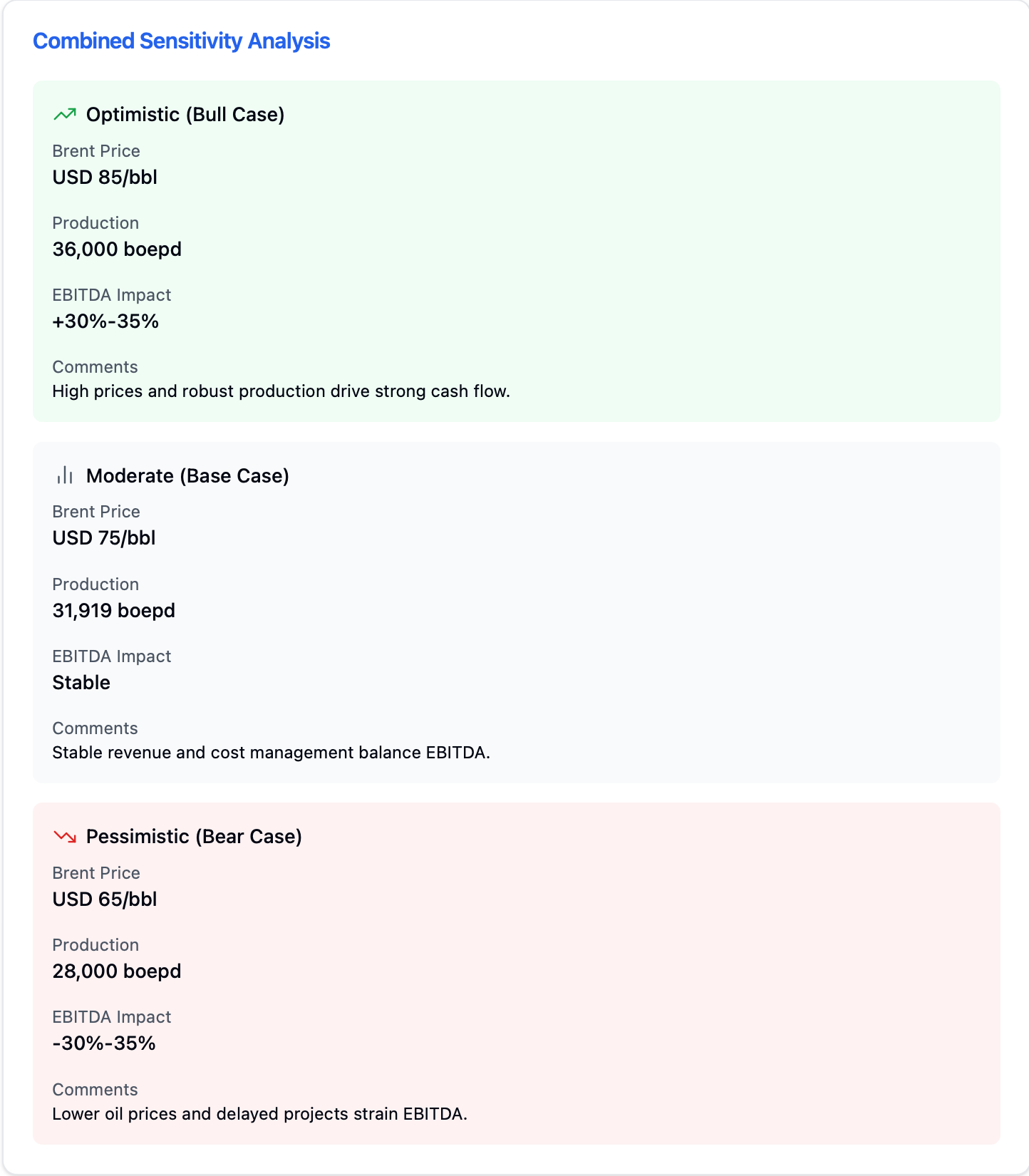

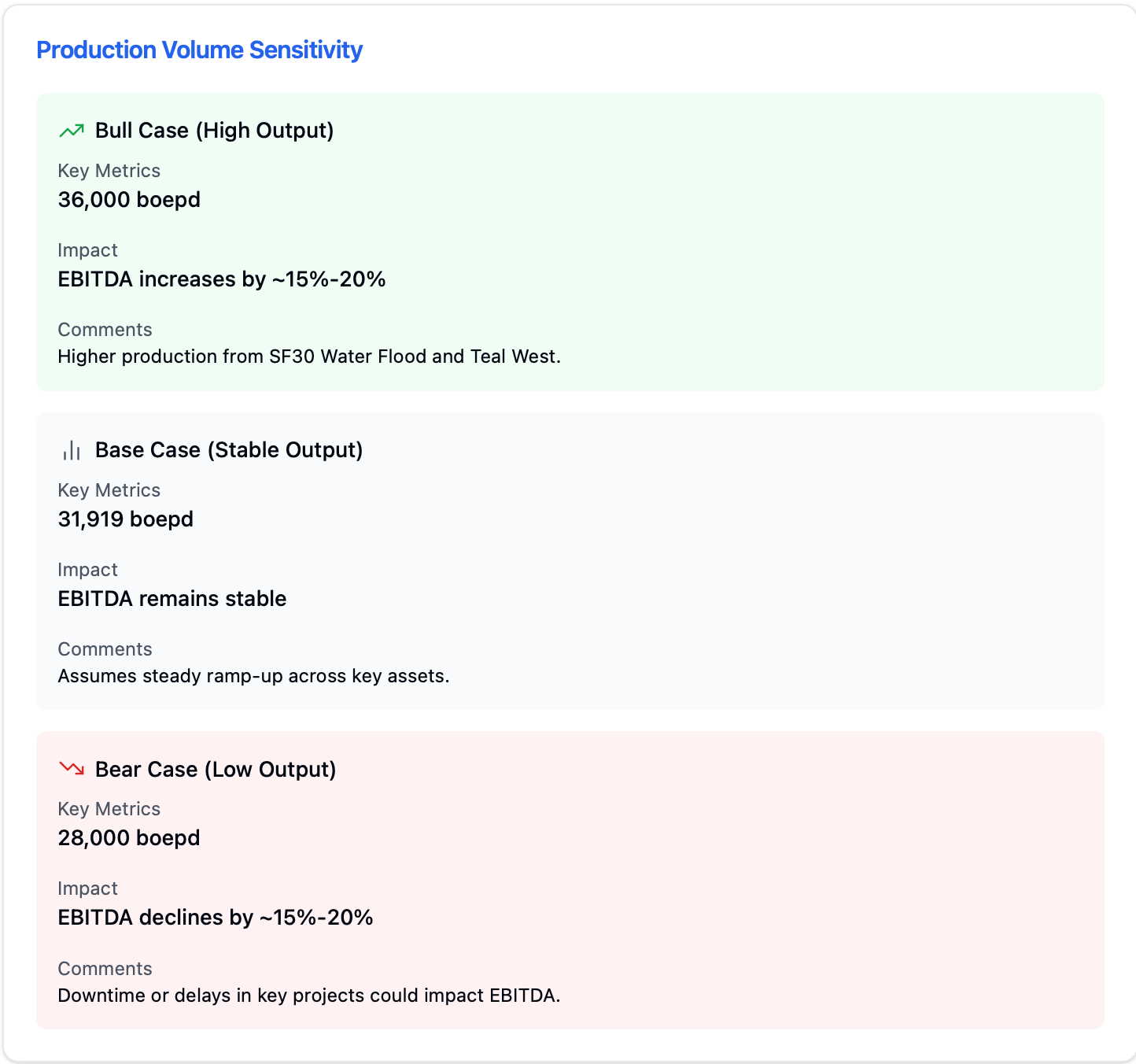

Scenario Analysis

Key Insights from Scenario Analysis

Robustness to Oil Price Volatility:Hibiscus remains resilient in low-price scenarios (~USD 65/bbl) due to its low opex and increasing gas contributions. A diversified asset base mitigates risks from individual project delays or underperformance.

Upside Potential in Production Growth: Successful execution of Teal West, SF30 Water Flood Phase 2, and Brunei Block B MLJ projects could elevate production beyond 35,000 boepd by FY26, significantly boosting EBITDA.

Operational Flexibility: The company’s ability to adjust capex and maintain a low debt-to-EBITDA ratio ensures financial flexibility in adverse scenarios.

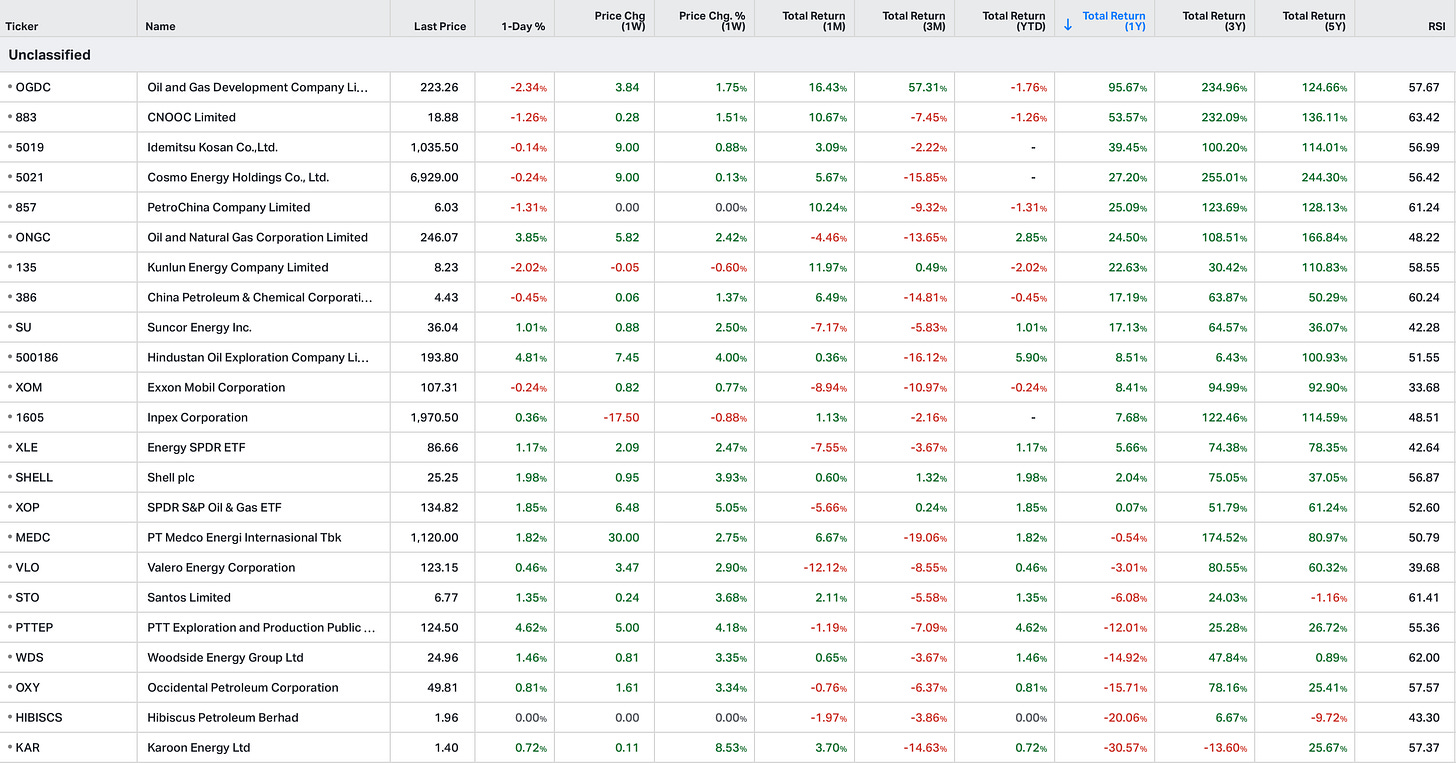

Performance Analysis and Valuations

Over the 1-year, 3-year, and 5-year horizons, Hibiscus Petroleum’s relative performance highlights both its strengths and challenges within the oil and gas sector. Over the 1-year period, HIBI has underperformed, delivering a return of -22.76% compared to key peers like CNOOC (+57.31%) and ExxonMobil (+17.84%). This performance reflects market concerns about project execution risks, including delays in major developments such as the Teal West and SF30 Water Flood Phase 2, as well as investor skepticism about Southeast Asian markets amid geopolitical uncertainties. However, Hibiscus’s disciplined operational focus and low leverage have provided some resilience, avoiding steeper declines.

Looking at the 3-year performance, HIBI has posted a modest decline of -8.08%, a stark contrast to the robust gains of regional leaders like CNOOC (+203.67%) and Cosmo Energy (+247.82%). This underperformance stems from Hibiscus’s concentrated asset portfolio and slower-than-expected ramp-up of new production volumes. While its operational efficiency remains a strength, the market’s focus on global energy diversification and larger, more diversified players has drawn attention away from niche operators like HIBI.

Over the 5-year horizon, HIBI’s returns reflect the challenges of scaling operations and competing with better-capitalized peers. The company’s lack of geographic diversification and reliance on a few large projects has limited its ability to capture broader sector tailwinds, such as rising energy prices in 2022. However, Hibiscus has successfully maintained financial discipline and operational efficiency, setting the stage for future growth through its recent acquisitions and development projects. Moving forward, with production ramps at key assets and a diversification into gas-heavy projects like Brunei Block B MLJ, Hibiscus has the potential to deliver a more competitive performance over the next five years.

Hibiscus Petroleum’s valuation metrics highlight its position as a deeply undervalued player in the oil and gas sector compared to its peer group, particularly those of similar size and operating in the Southeast Asian region. It trades at a P/E ratio of 7.9x, significantly below the peer group average of 11.4x, with regional peers such as Medco Energy at 8.4x and larger players like CNOOC at 5.7x. This discount reflects market concerns over its concentrated asset portfolio and execution risks on new projects like Teal West and the SF30 Water Flood Phase 2.

Similarly, Hibiscus’s EV/EBITDA multiple of 2.52x is well below the peer average of 3.27x, indicating skepticism about its future cash flow sustainability despite its strong operational efficiency. For comparison, regional peers like PTT E&P and Santos trade at 3.2x and 3.3x, respectively, benefiting from diversified asset portfolios and investor confidence.

When analyzing its P/B ratio, Hibiscus trades at an exceptionally low 0.44x, compared to the peer average of 0.83x, and trails peers like PetroChina at 0.45x and Medco Energy at 1.23x. This low multiple highlights the market’s underappreciation of Hibiscus’s asset base, particularly its undeveloped gas reserves in Brunei Block B MLJ and PM3 CAA.

Despite these discounts, Hibiscus’s niche focus on acquiring and optimizing mature assets at attractive valuations provides significant upside potential. Its disciplined financial management, evidenced by low leverage (Debt/EBITDA below 0.4x) and its ability to produce at a low cost (~USD 15-20/boe), positions it favorably against regional peers. As Hibiscus executes on key projects and monetizes its undeveloped reserves, its valuation gap could narrow, offering compelling opportunities for investors.

Panda Perspective:

Hibiscus Petroleum stands out as a compelling niche play in the oil and gas sector, leveraging its expertise as an efficient operator of mature fields and its proven track record of value creation through strategic acquisitions. The company’s operational efficiency, reflected in its low-cost production (~USD 15-20/boe), and disciplined capital management make it uniquely positioned to unlock value from assets that larger players may overlook. Hibiscus’s ability to revitalize and extend the life of mature assets, such as the North Sabah PSC and Anasuria Cluster, underscores its capability to extract maximum value from existing resources while minimizing costs. Furthermore, its strategic focus on acquiring assets at attractive valuations, exemplified by deals like the Brunei Block B MLJ acquisition, provides a clear pathway for growth. With low leverage, strong free cash flow potential, and a growing portfolio of high-return projects like Teal West and SF30 Water Flood Phase 2, Hibiscus has the operational and financial flexibility to continue expanding its asset base, capturing opportunities in Southeast Asia and beyond at a time when many major operators are divesting. This combination of operational expertise, prudent capital allocation, and market positioning makes Hibiscus a highly attractive investment for those seeking exposure to an agile and focused upstream oil and gas player. When an asset is undervalued to this degree it almost makes no difference if the price target should be MYR5 or MYR6, whatever uncertainty exists over the exact revenue projections in the future can be made up with multiple expansion once the investor interest comes in.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**