Unlocking Opportunities in the Asian Petrochemical Industry’s Next Chapter

Petrochemical Industry Overview

Good Evening,

We continue to explore the energy space, and we have arrived at the final step in the barrel’s lifecycle- the Petrochemical process. It

This is largely a free article, with a section on valuations made variable to the premium subscribers only. Tomorrow’s piece, focusing on companies (HengLi and Wanhua) will be entirely behind the paywall. We’d love to have you, so by all means consider subscribing to join the conversation.

In terms of admin, we do not believe the noise surrounding the GS conference currently warrants a dedicated update. Instead, our focus has shifted to inflation, which is quickly becoming a priority topic. We aim to release a piece on this within the next week. The more we analyze it, the more convinced we are that inflation is key to understanding the likelihood of stimulus, the mechanics behind it, and its interplay with the global economy. We will strive to complete this analysis promptly, as we believe it will provide valuable insight to the ongoing discourse.

Following this, our attention will turn to Coal, Wind, and Solar. We encourage everyone to share their preferences regarding the level of depth they’d like us to cover. While all three topics are important and will be addressed, the depth of coverage for each will depend on public demand. We can offer a general overview (1), a comparative analysis (2), or a detailed review and deep dive (3) into the industry and its key participants. Please let us know your preferences by replying to this email or leaving a comment below, ranking your preferred level of depth for each topic.

Do note that deeper dives will require more time, which may which may extend the timeline for covering other industries. On the horizon, we have a review of the x-EV Hard Tech space, which includes Chips (not those ones!) & Semiconductors, Automation & Robotics, and Electrification Technologies. Beyond that, we’re also planning a review of High-Speed Railways and the opportunities within that sector. There’s plenty to explore, and while it’s hard to pick a favorite, Energy remains our immediate priority.

Let us know what you’d find most helpful—we look forward to your input!

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

With that out of the way, on with the exploration of the Petrochemical space in Asia.

The petrochemical industry is undergoing a profound transformation, shaped by a confluence of challenges and opportunities. Years of oversupply, volatile margins, and shifting global demand have created a highly polarised sector where resilience and innovation are paramount. At the same time, emerging trends such as energy transition, sustainability, and advanced materials are opening up new avenues for growth. This review delves into the recent performance of key players, evaluates current valuations, and highlights the strategic directions shaping the industry’s future. By focusing on leaders in the shape of Hengli Petrochemical and Wanhua Chemical, we will explore how companies are adapting to the evolving landscape and positioning themselves to capitalise on the next wave of opportunities in the petrochemical space. But first, let’s take stock of where we are.

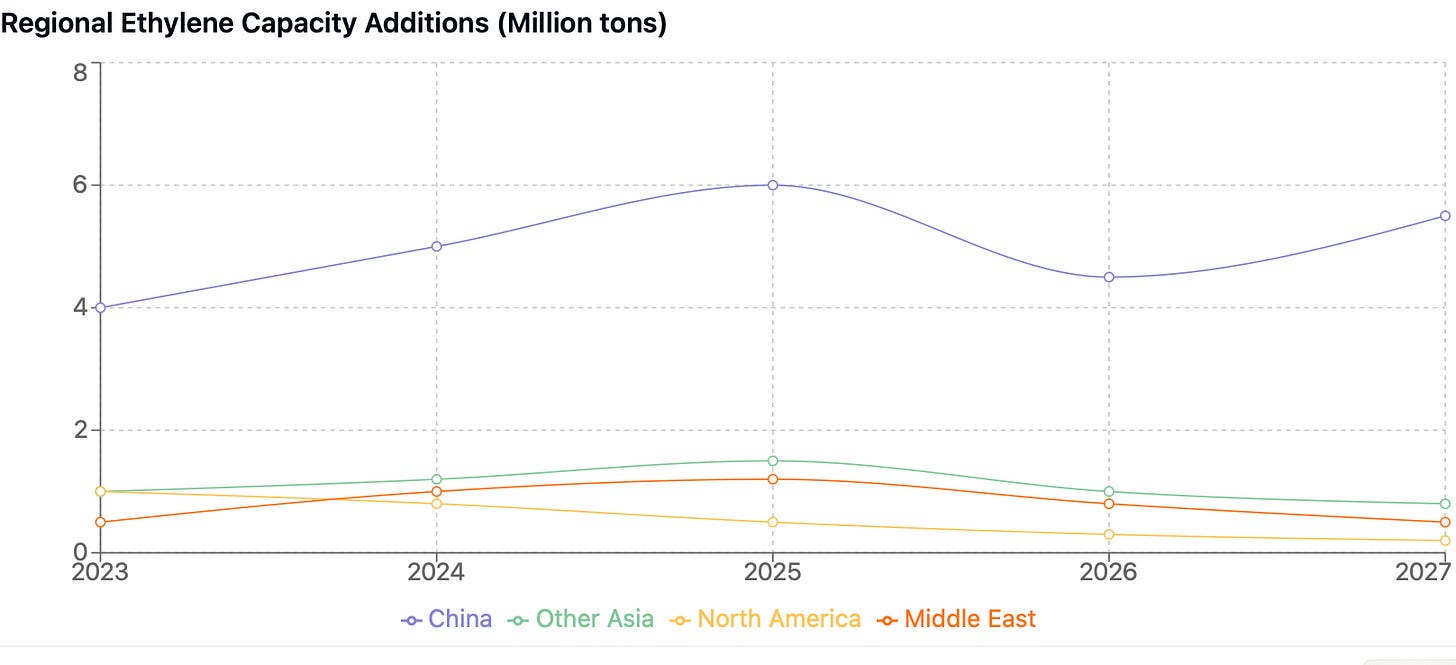

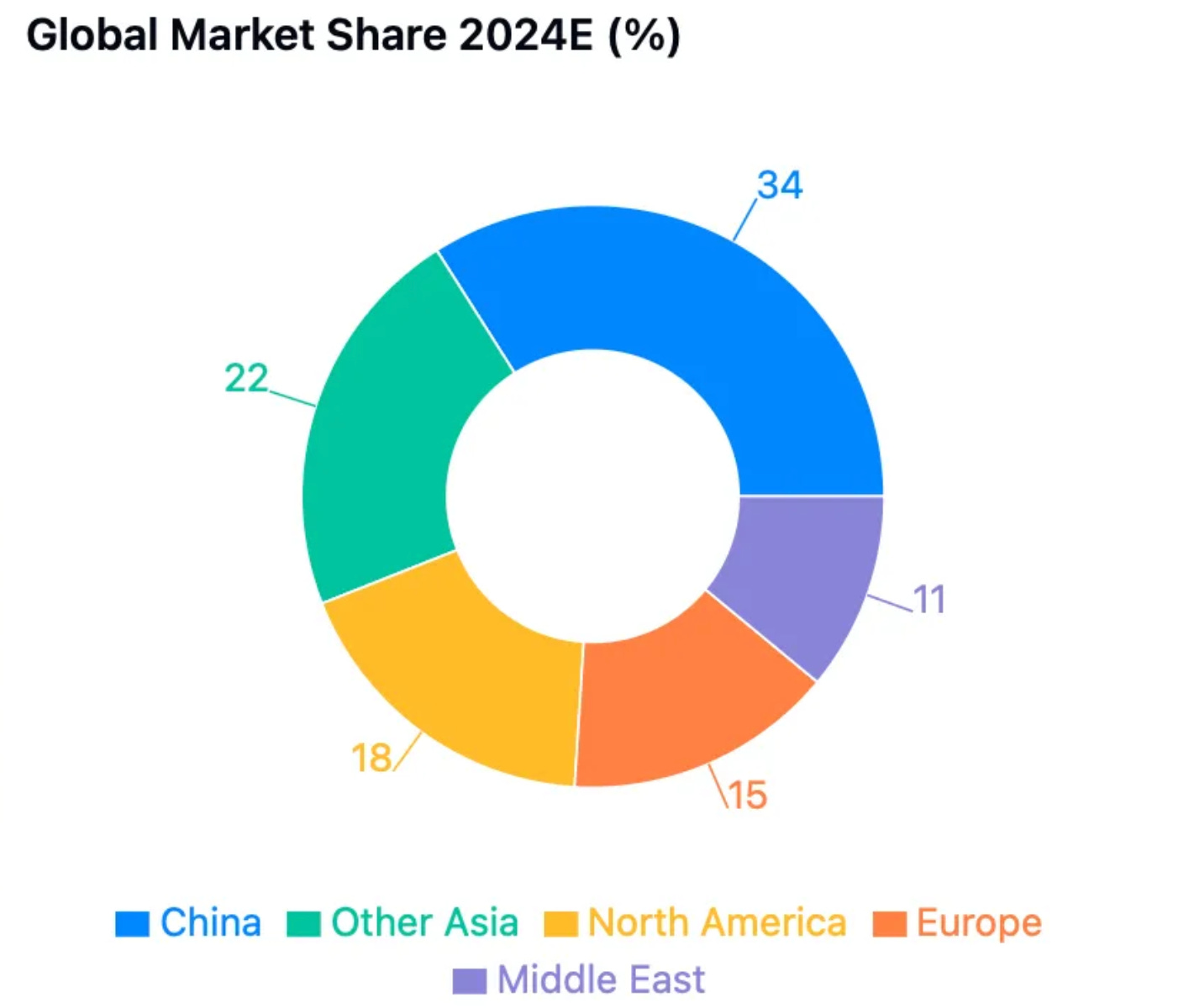

The petrochemical industry’s oversupply challenges stem from a combination of aggressive capacity additions, weak demand, and structural inefficiencies. Over the past decade, significant capacity expansions in Asia, particularly China, have outpaced demand growth.

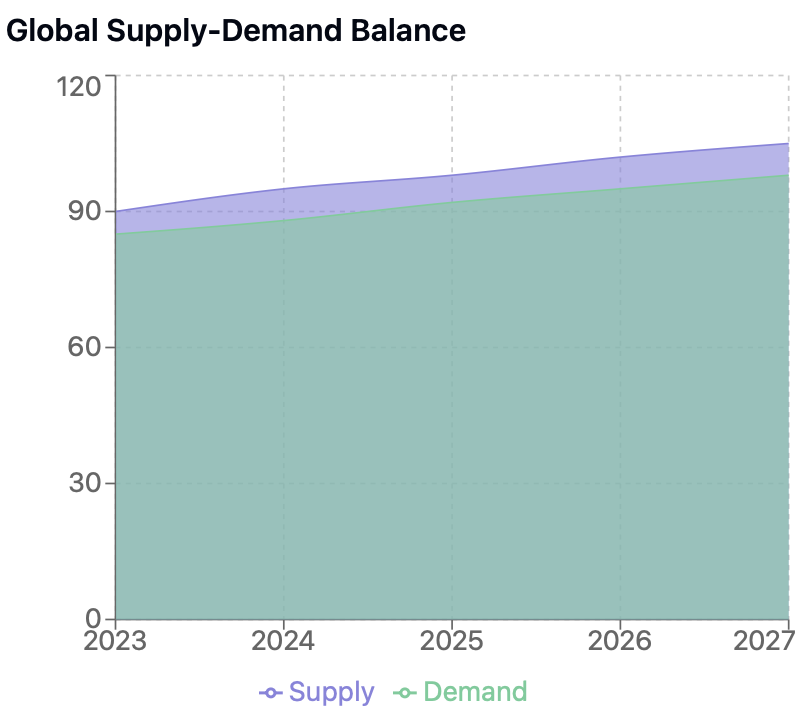

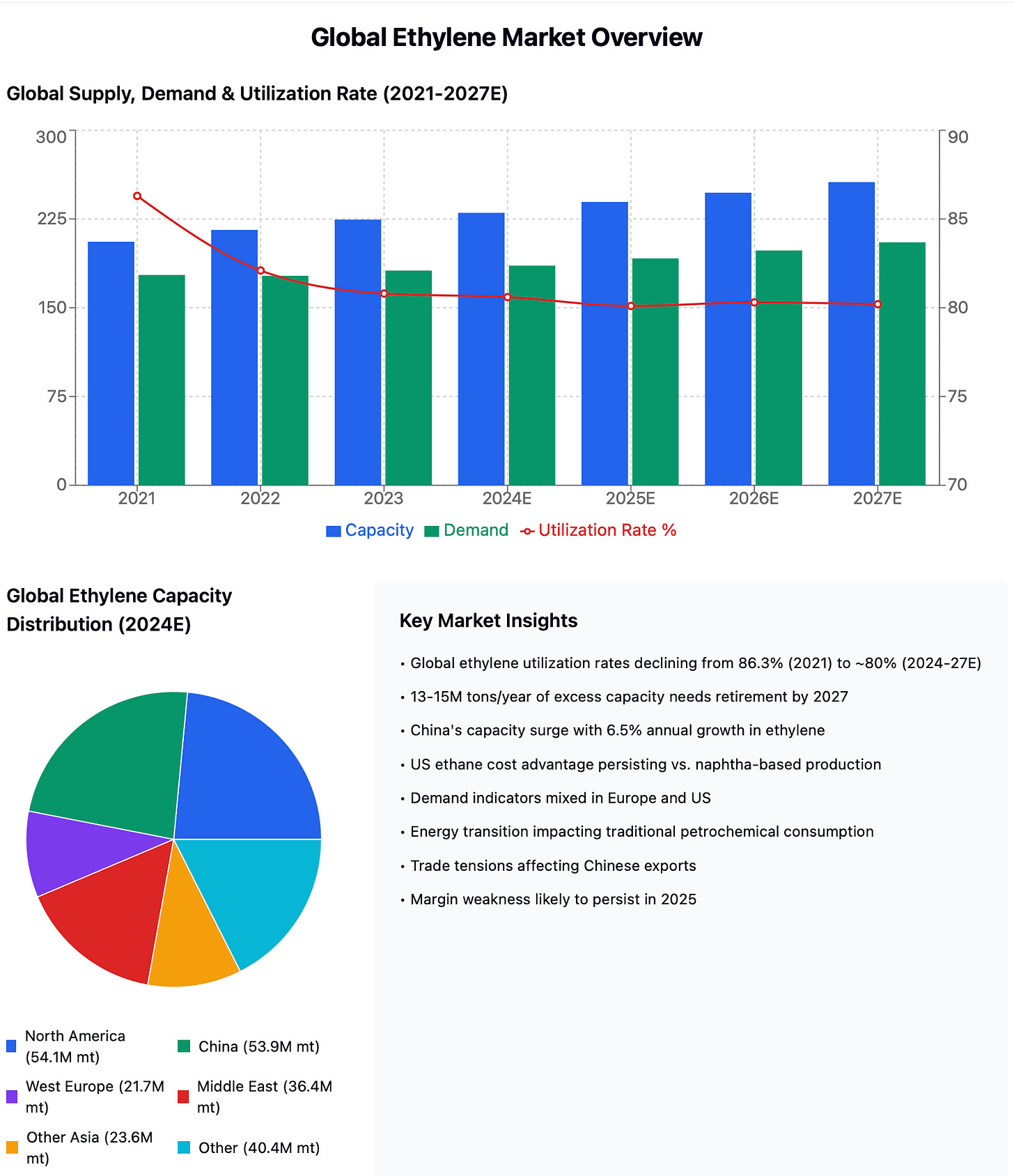

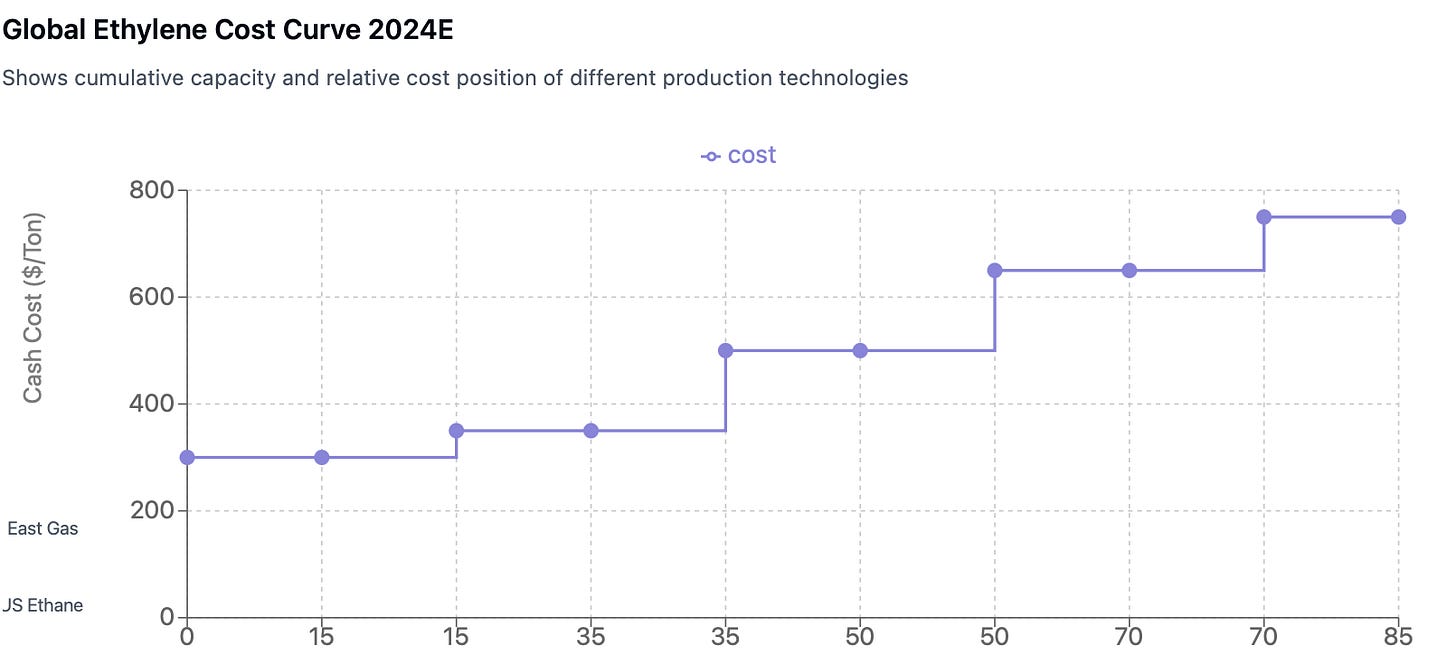

China’s ethylene capacity, for instance, increased at an annual rate of approximately 6.5%, reaching ~44 million tons/year by 2024. Projects like Wanhua Chemical’s MDI expansions and Hengli Petrochemical’s integrated crude-to-chemicals facilities have added substantial volumes. Globally, around 10 million tons/year of ethylene capacity was added during 2023-2024, yet only 2.5 million tons/year of closures have been announced, leaving a substantial 13-15 million tons/year of excess capacity requiring retirement by 2027 to restore mid-cycle margins.

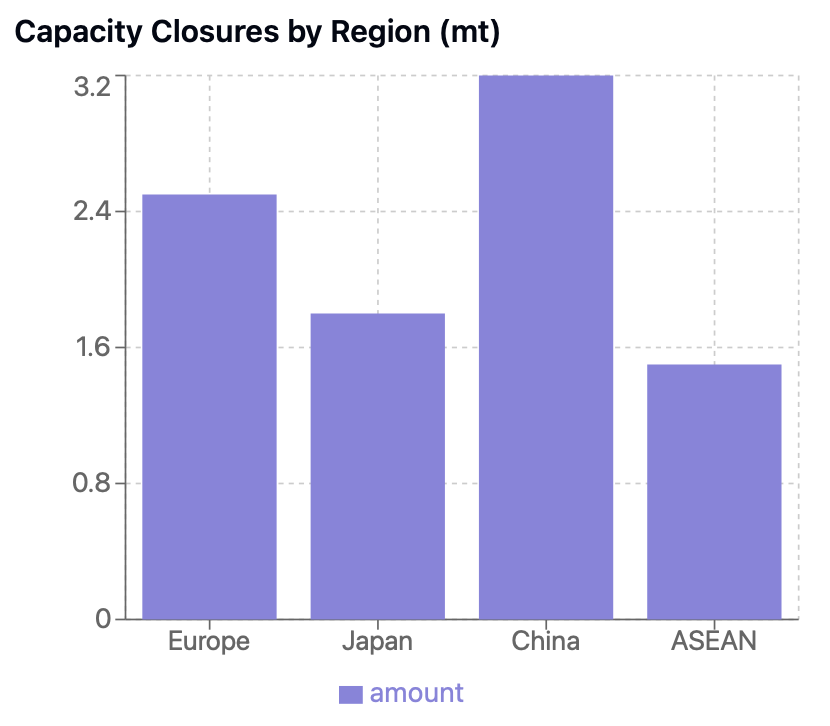

Prolonged weak demand has exacerbated the situation. China’s GDP growth slowed to 4.7% in 2024, impacting downstream industries like construction, automotive, and textiles. Globally, vehicle production remains below pre-2019 levels, reducing polymer demand. The energy transition further dampens demand for traditional petrochemical products, with coal-related petrochemical consumption expected to decline by 5-22% by 2030. Trade tensions and potential tariffs on Chinese petrochemical exports to the US add to the pressure, as over 50% of China’s polyethylene and polypropylene output is export-reliant. Technological advancements like crude-to-chemicals integration, while efficient, have intensified the oversupply. For example, Hengli’s Dalian plant processes 20 million tons/year of crude oil, contributing to olefin and aromatic oversupply. Despite balance sheet stress among producers, capacity closures remain slow, particularly in high-cost regions like Europe and ASEAN.

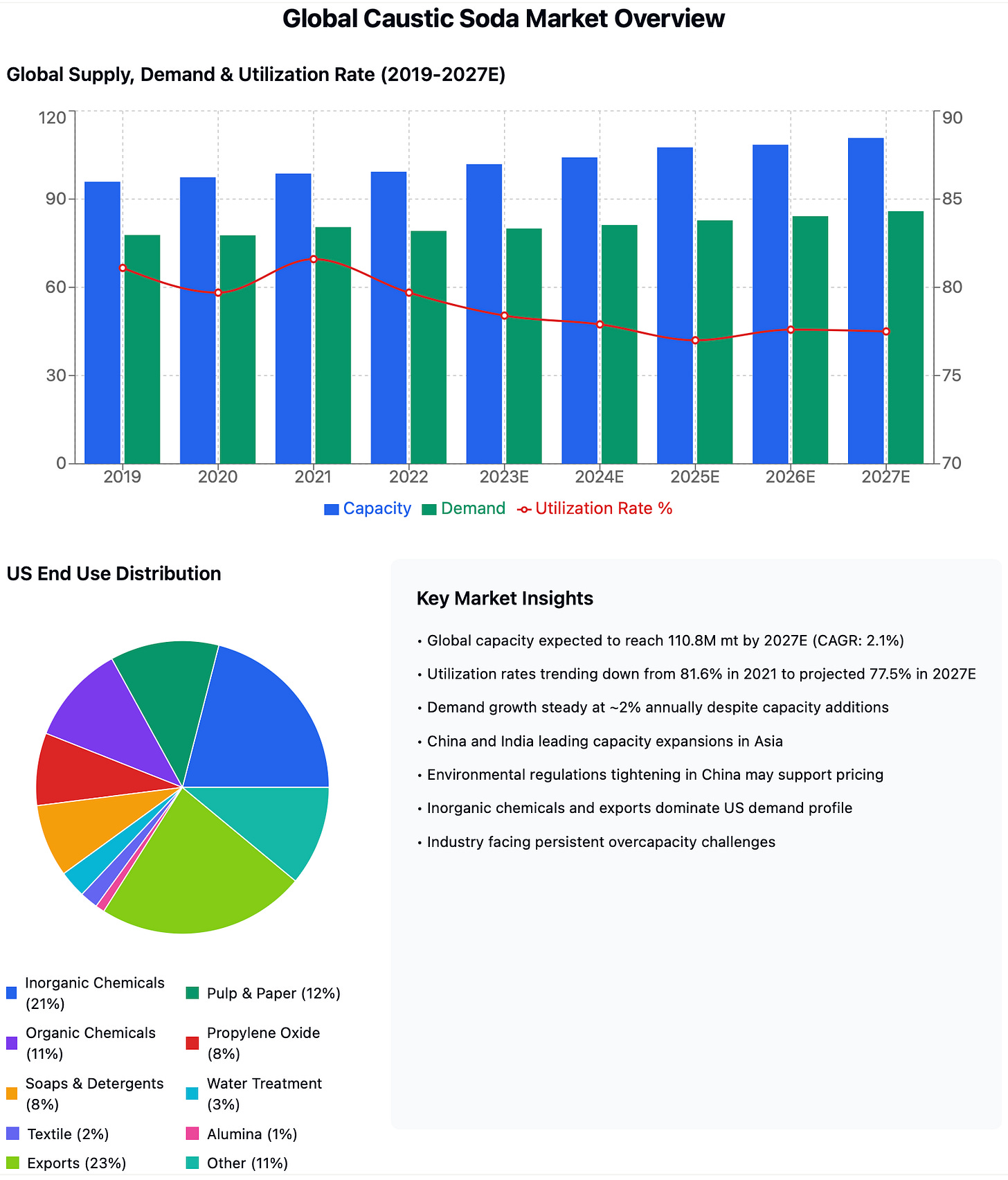

Caustic soda, a key co-product of chlorine production, has also faced challenges. Oversupply from new capacity additions in China and declining downstream alumina and paper demand have pressured prices, which dropped to RMB400/ton in Q3 2024, compared to RMB800-1,000/ton in previous years. The caustic soda market is further constrained by the weak global macroeconomic environment, which has limited demand from industries like textiles and chemicals. However, potential tightening of environmental regulations in China, aimed at curbing excess chlorine capacity, may reduce supply and support prices in 2025.

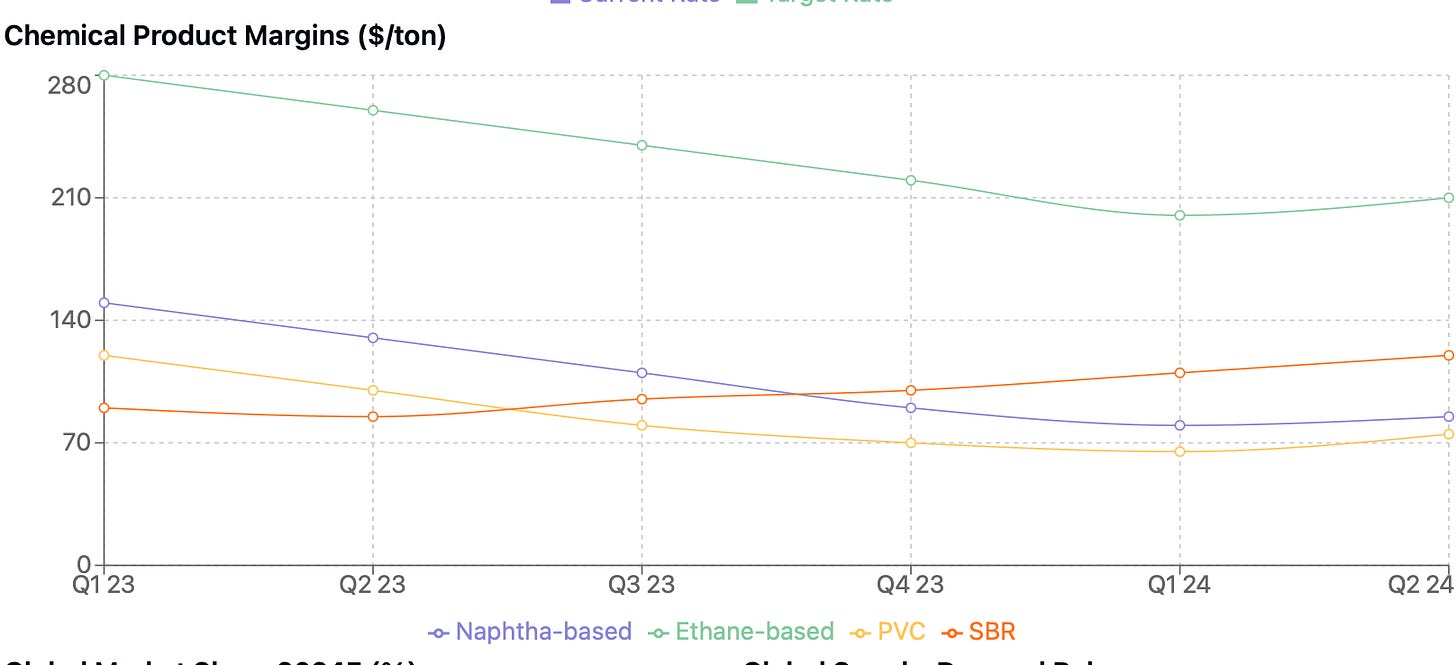

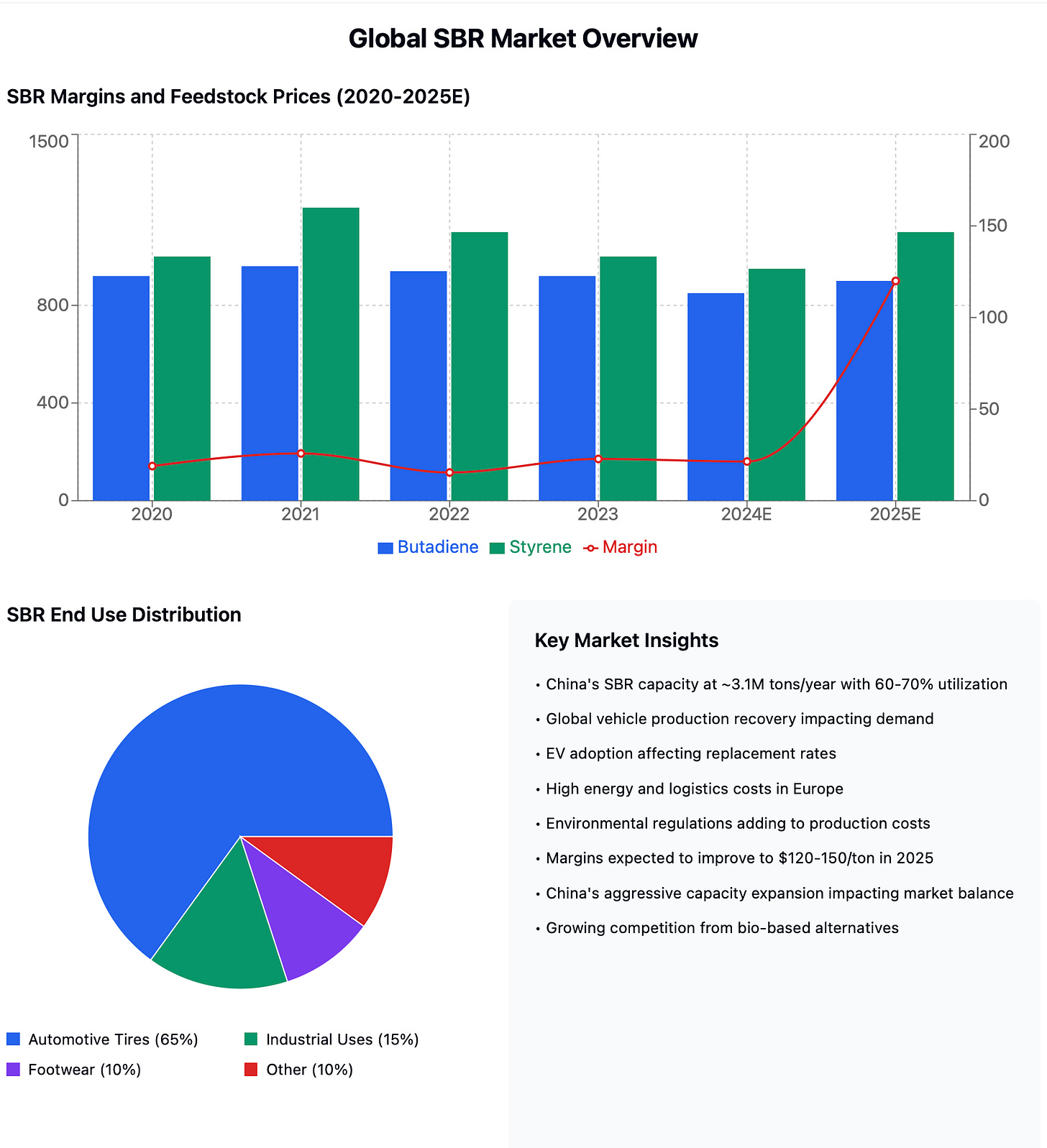

Styrene-Butadiene Rubber (SBR) is an interesting case study too. The margins have been under significant pressure due to rising feedstock costs, weak downstream demand, and regional overcapacity. Key feedstocks such as butadiene and styrene have seen volatile pricing, with butadiene averaging $920-960/ton and styrene trading between $1,000-1,200/ton in 2024. These price levels reflect tightened supplies from lower cracker utilization rates and higher energy costs. As SBR producers, particularly those reliant on imported feedstocks, struggle to manage rising input costs, margins have compressed further.

Demand from the automotive and industrial sectors, the primary drivers of SBR consumption, has been subdued. Global vehicle production, while recovering, remained below pre-2019 levels in 2024, limiting tire demand. Electric vehicles (EVs), a growing segment, have lower tire replacement rates compared to internal combustion engine (ICE) vehicles, further dampening demand. Industrial applications such as conveyor belts and seals have also faced headwinds due to slower industrial activity in regions like Europe and ASEAN. The result has been a weaker demand backdrop, compounding oversupply issues in the SBR market.

China’s aggressive SBR capacity expansion has contributed to regional imbalances. With SBR capacity reaching ~3.1 million tons/year and utilization rates around 60-70%, China has created an oversupply situation that has pressured global prices. Export markets in Europe and the US have offered little relief, with trade barriers and economic uncertainties limiting growth opportunities. Meanwhile, high-cost producers in regions like Japan and South Korea are struggling to compete with more efficient Chinese producers, intensifying price competition and further eroding margins.

Additional pressures have come from energy and logistics costs. Elevated natural gas and electricity prices in Europe have increased production costs for SBR manufacturers. Freight costs, particularly for exports from China to the US and Europe, have remained high, reducing the competitiveness of these products in key markets. Environmental regulations in China have also added to production costs, as stricter compliance measures for emissions and waste management weigh on the profitability of producers. Furthermore, the growing adoption of recycled and bio-based alternatives to traditional SBR introduces longer-term challenges for conventional producers.

Looking ahead to 2025, the outlook is cautiously optimistic, with demand expected to recover unevenly across segments. Overall commodity demand in China is forecast to grow between -3.5% and +3.0%, an improvement from 2024’s range of -10.2% to +4.4%. Key drivers include infrastructure projects, property sector stabilization, and robust EV production, with NEV output projected to grow by 30% year-on-year. This will drive demand for petrochemicals like polypropylene and polycarbonate, as well as industrial metals like copper and aluminum, expected to grow 3-4% year-on-year. Renewable energy growth, including solar and wind installations, will also boost demand for specialty chemicals. However, structural challenges persist.

Ethylene utilization rates are forecast to hover around 80%, below the 86% mid-cycle average required for margin recovery, and PTA and polyester markets are likely to remain oversupplied through 2026.

Profitability in 2025 is expected to remain constrained, though select areas may see improvement. Integrated naphtha-based cracker margins are likely to remain near break-even, while MDI margins could benefit from tightening supply, with prices in China already rising to ~RMB10,550/ton in Q4 2024 and projected to increase another 5-10%. Refining spreads for Hengli Petrochemical are expected to widen to RMB1,629/ton in Q4 2024 and further improve as crude oil costs decline. Regionally, China’s policy measures to stimulate infrastructure and energy projects will drive domestic demand growth, while weaker markets in ASEAN and Japan could see additional capacity shutdowns.

Similarly, SBR margins are expected to see some recovery. Feedstock prices are projected to stabilize, with butadiene averaging $850-900/ton and styrene settling at $950-1,100/ton. A gradual rebound in global automotive production, particularly in the EV segment, should support SBR demand, while tire replacement cycles in China may provide additional upside.

Capacity rationalization in Europe and Japan, where high-cost producers face closures or reduced operations, is expected to ease oversupply pressures and improve regional pricing dynamics.

Despite these positive trends, risks remain. Persistent overcapacity in China, slow economic recovery in Europe, and potential trade restrictions could limit the pace of margin recovery. However, with feedstock prices normalizing and demand gradually improving, SBR margins are projected to rise to $120-150/ton in 2025, a notable improvement from the break-even or negative levels seen in 2024. Structural adjustments, including capacity rationalization and tighter supply controls, will be crucial for sustained recovery in the SBR market.

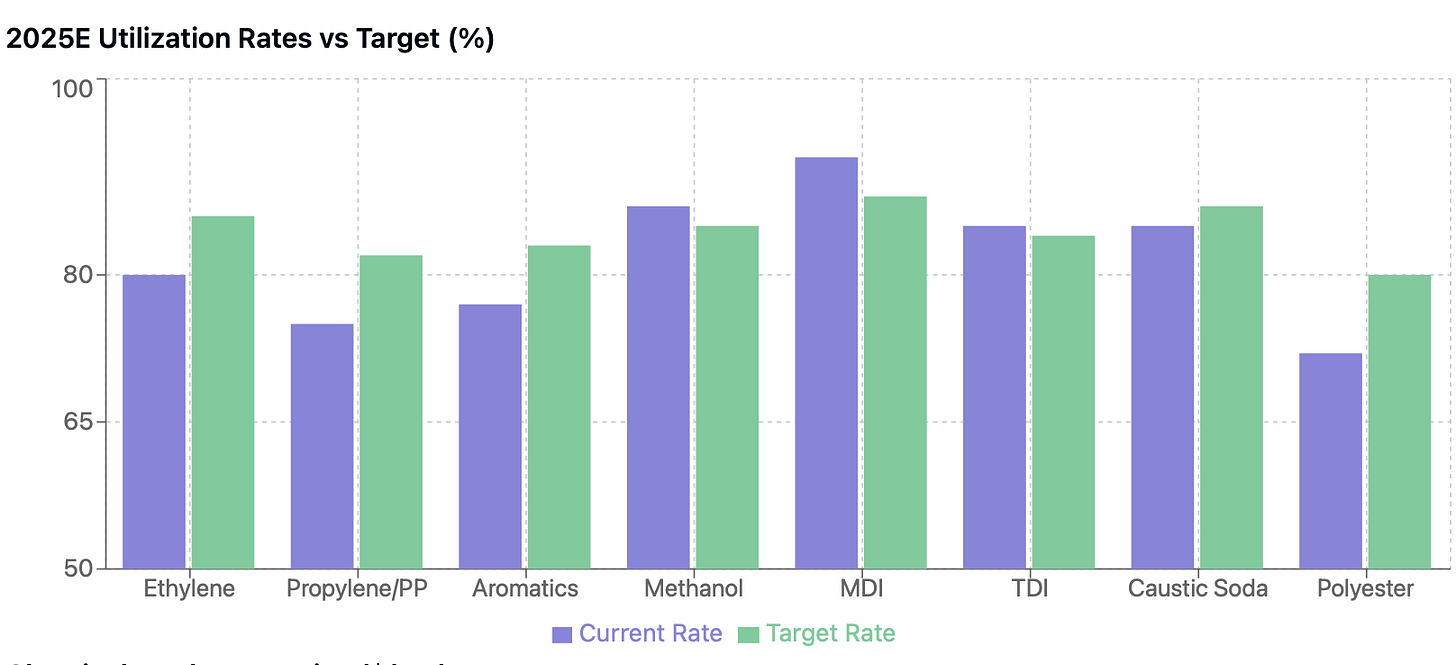

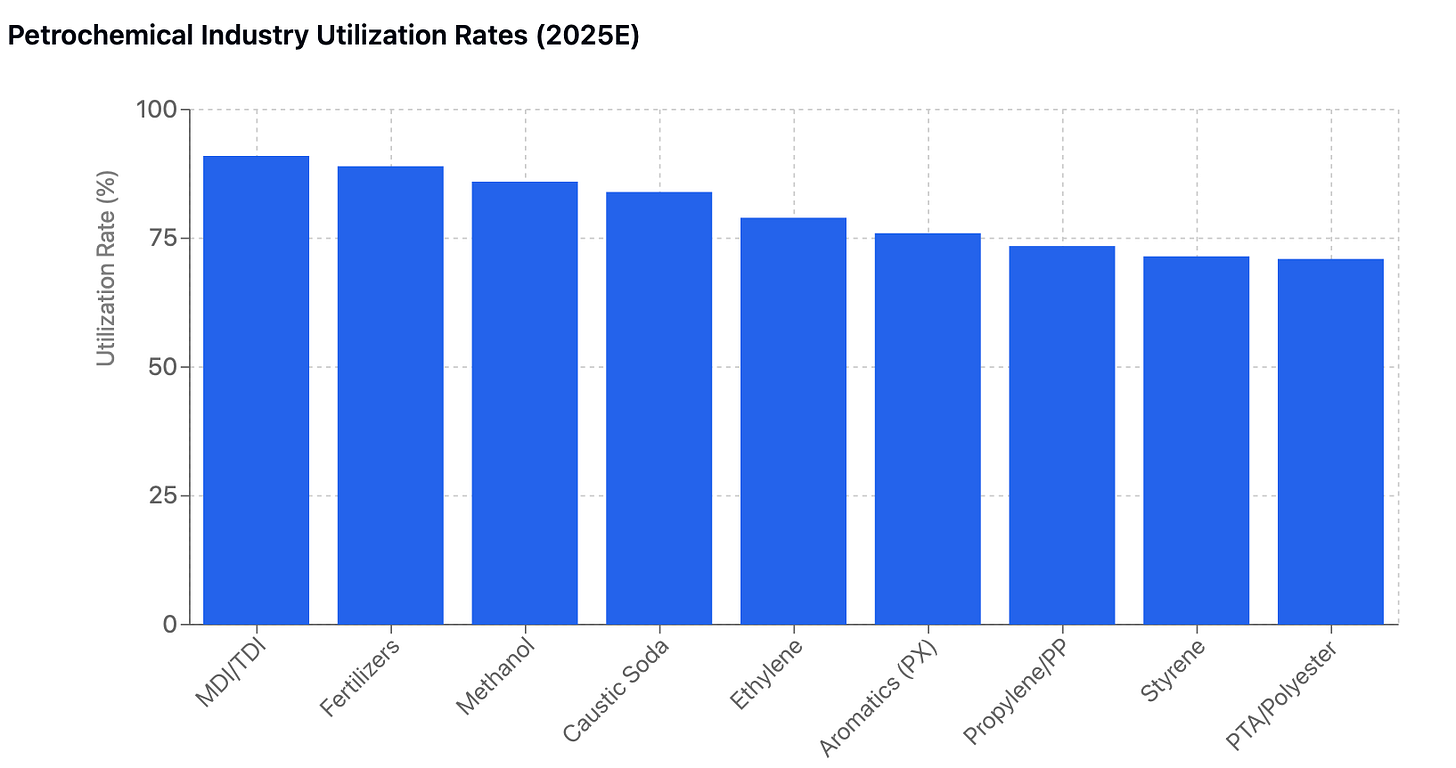

As the petrochemical industry transitions into 2025, the outlook for utilization rates across key chemical segments reflects the interplay of gradual demand recovery and lingering oversupply challenges. While policy-driven initiatives in infrastructure, renewable energy, and EV production are expected to boost demand for certain products like methanol, polyurethanes, and fertilizers, structural imbalances in capacity continue to weigh on bulk chemicals like ethylene, polypropylene, and aromatics. Regional dynamics further complicate the picture, with China’s aggressive capacity expansions exacerbating oversupply, even as high-cost producers in Japan, Europe, and ASEAN face mounting pressure to rationalize operations. Against this backdrop, utilization rates will vary significantly across chemical categories, providing insight into where the industry might stabilize and where structural reforms remain essential.

Ethylene and Derivatives

• Utilization Rate: ~78-80%

• Trend: Ethylene utilization rates are expected to remain below the mid-cycle average of 86%, reflecting continued oversupply in the market .

• Drivers: Excess capacity from large integrated naphtha-based crackers in China, coupled with slower-than-expected demand recovery in downstream polyethylene (PE) and ethylene oxide (EO), will keep utilization rates subdued. Demand from packaging and construction sectors, though improving, may not offset the additional capacity .

Propylene and Polypropylene (PP)

• Utilization Rate: ~72-75%

• Trend: Propylene and PP will experience relatively low utilization rates due to significant capacity additions and slower recovery in automotive and consumer goods demand .

• Drivers: The ongoing ramp-up of propane dehydrogenation (PDH) units in China and increased PP capacity will keep the market oversupplied. However, the demand for PP in packaging and EV components may provide some relief .

Aromatics (Paraxylene - PX, Benzene, Toluene)

• Utilization Rate: ~75-77%

• Trend: Utilization for PX is expected to remain under pressure, while benzene and toluene may see moderate recovery .

• Drivers:

• PX: Overcapacity from large-scale integrated refineries and weak demand from polyester markets will cap utilization rates. However, improving margins in late 2025 due to reduced capacity additions could support gradual recovery .

• Benzene and Toluene: Demand from styrene and polyurethane markets may support utilisation, particularly with potential tailwinds from infrastructure growth .

Methanol

• Utilization Rate: ~85-87%

• Trend: Methanol is expected to achieve relatively stable utilization rates, supported by demand from methanol-to-olefins (MTO) plants and energy-related uses like fuel blending .

• Drivers: A surge in downstream MTO capacity in China, coupled with steady demand for methanol as a fuel additive, will help maintain utilization rates despite capacity additions .

Styrene and Polystyrene

• Utilization Rate: ~70-73%

• Trend: Weak downstream demand from construction and automotive sectors will constrain utilization .

• Drivers: Global economic uncertainty and trade barriers for Chinese exports will weigh on demand. However, gradual recovery in consumer electronics and packaging could provide modest support .

Polyurethanes (MDI/TDI)

• Utilization Rate: ~90-92% (MDI), ~85% (TDI)

• Trend: MDI will likely achieve high utilization rates due to tight supply-demand dynamics, while TDI will face slightly lower rates due to lingering overcapacity .

• Drivers:

• MDI: Strong demand from insulation, construction, and home appliances will drive high utilization, especially in China.

• TDI: Oversupply issues persist, though some recovery is expected as older capacities are retired .

Caustic Soda and Chlorine

• Utilization Rate: ~83-85%

• Trend: Caustic soda will see steady utilization, supported by demand from alumina refining, paper, and textiles .

• Drivers: Tightening environmental regulations in China may reduce excess capacity, improving utilization rates slightly. However, weaker demand from downstream chemicals like PVC (polyvinyl chloride) could cap gains .

Polyester and PTA

• Utilization Rate: ~70-72%

• Trend: Overcapacity will keep utilization rates low for PTA and polyester, with gradual improvement expected in the second half of 2025 .

• Drivers: Subdued demand from the textile sector, combined with continued capacity expansions, will weigh on utilization. Recovery in exports and easing global trade tensions could offer some relief .

Fertilizers (Urea, Ammonia, Phosphates)

• Utilization Rate: ~88-90%

• Trend: Fertilizer utilization rates are expected to remain robust due to steady agricultural demand across Asia .

• Drivers: Policy support for food security and infrastructure investment in rural areas will sustain fertilizer demand. Energy cost fluctuations may introduce some volatility .

Despite challenges, companies like Hengli and Wanhua are better positioned to thrive, as they are strategically exposed to high-performing segments of the chemicals market while leveraging cost efficiency and targeted capacity expansions. Hengli is set to reduce annual capex to ~RMB5 billion post-2025, which will enhance free cash flow and support its high-dividend policy. Its strong presence in aromatics and refined products, with utilization rates for PX projected at 75-77% in 2025, positions it to benefit from the gradual recovery in polyester demand and downstream profitability. Similarly, Wanhua is poised to capitalize on robust MDI demand, with utilization rates for MDI expected to reach 90-92% in 2025, supported by strong consumption in construction and home appliances. By 2030, Wanhua could control 39% of global MDI capacity, solidifying its market leadership. However, global oversupply and uneven demand recovery will continue to weigh on bulk chemicals like ethylene, where utilization rates are expected to remain at 78-80%, well below mid-cycle levels. For sustained recovery, structural adjustments, particularly capacity closures, will be necessary to rebalance supply-demand dynamics in the broader market.

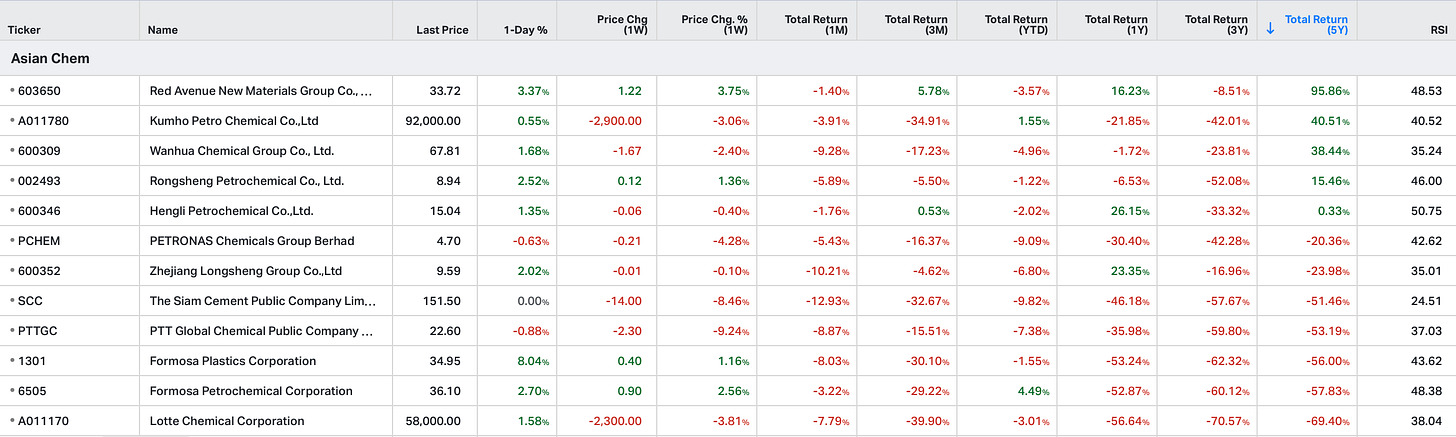

Performance Trends in the Petrochemical Sector

The performance of companies in the petrochemical sector has varied significantly over the past few years, shaped by structural factors such as supply-demand imbalances, regional dynamics, and operational efficiencies. Strong performers like Wanhua Chemical and Hengli Petrochemical have demonstrated resilience through strategic positioning, cost efficiency, and focus on high-growth segments, while others have struggled amid oversupply and weak profitability.

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.