Sinopec: Refining Resilience and Strategic Transformation in a Changing Energy Landscape

Sinopec: SNPMF US, 386 HK, 600028 CH

Good morning form a very cold and breezy New York City,

We will be speaking at the StoneX Resource Day tomorrow, so wanted to get a note out in the meantime to continue our exploration of the China energy space.

A quick reminder that so far we have covered:

Overall landscape with a focus on CNOOC

China Gas with a focus on Petrochina

Today we’re continuing withe the Theme and focusing of Refining, and thus Sinopec. As usual, we’re making the broad industry overview section free, and the deep dive on Sinopec as well as questions and queries thereafter are for premium subscribers. We’d love to have you so feel free to signup and/or upgrade.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

And on to Refining!

China Refining.

China's refining sector is approaching a strategic inflection point, characterized by evolving demand patterns, intensifying competition, and an accelerating energy transition. Our analysis suggests that while near-term cyclical pressures persist, structural advantages for integrated players remain intact, with Sinopec particularly well-positioned to navigate the transition.

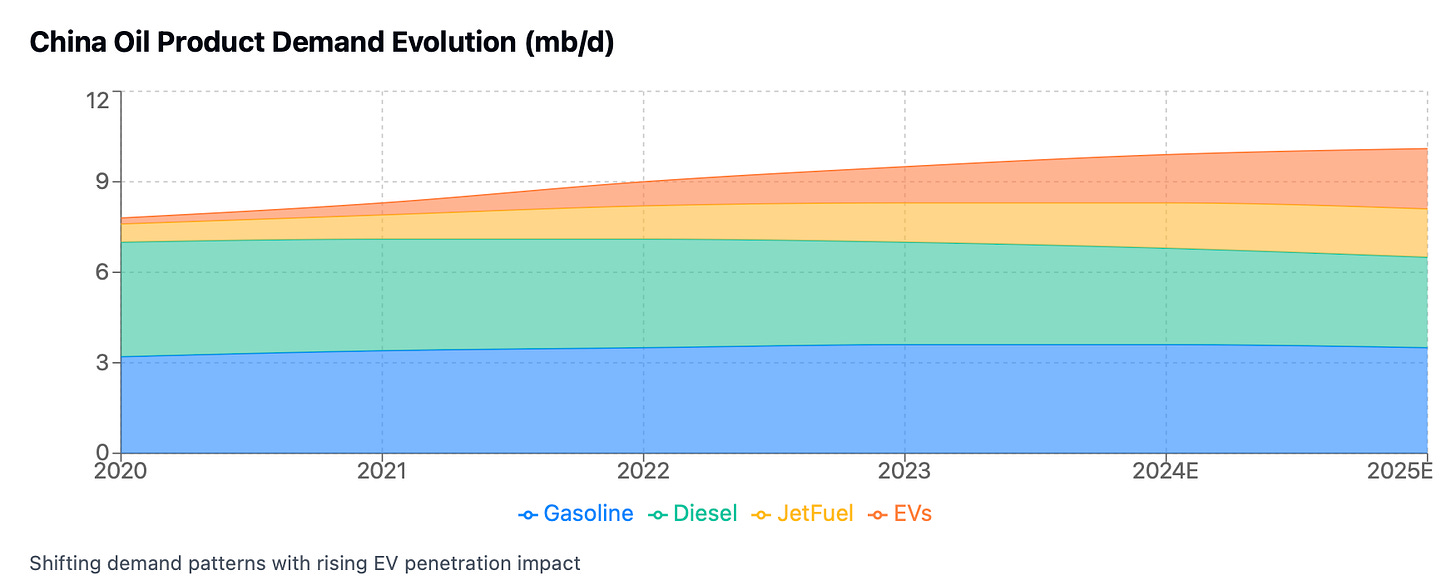

Our analysis reveals a more nuanced demand picture in China's transportation fuel market than the commonly cited peak oil narrative suggests. While overall demand patterns are shifting, they're doing so at varying rates across different products, creating a complex transition landscape.

Gasoline consumption has shown remarkable resilience, maintaining levels around 3.6mb/d despite accelerating EV adoption, largely supported by continued growth in the passenger vehicle fleet and increased mobility patterns. Diesel demand, though experiencing structural decline at -5.2% year-over-year, has seen this decline rate moderate significantly, particularly as the impact from gas-for-diesel substitution in heavy transport begins to plateau. Meanwhile, jet fuel demand continues its strong post-COVID recovery trajectory, posting 15% year-over-year growth as both domestic and international air travel normalizes. This segmented evolution across product categories points to a prolonged plateau in overall transportation fuel demand rather than an imminent sharp decline, providing integrated refiners with a valuable window for strategic repositioning and gradual transition toward higher-value products and new energy initiatives.

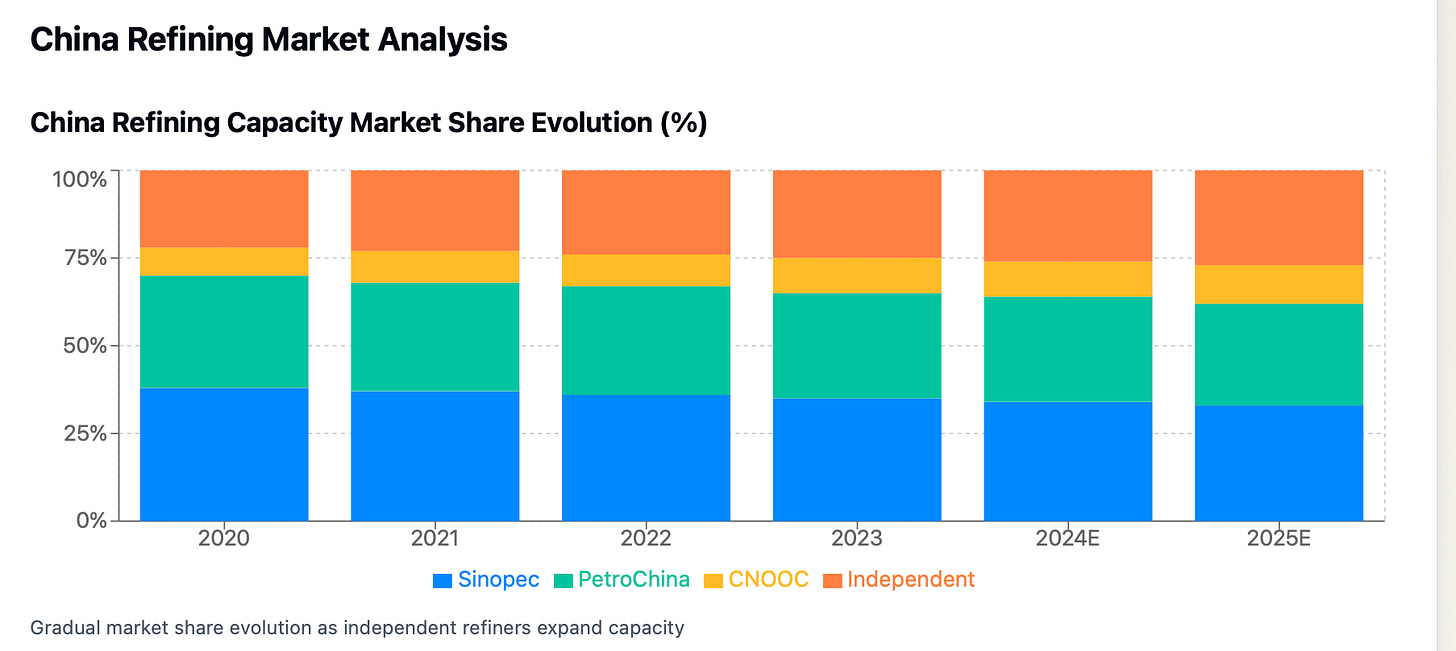

China's refining competitive landscape is undergoing a significant structural shift, marked by accelerating fragmentation as independent refiners expand their footprint to control 25% of total capacity, up from 22% in 2020.

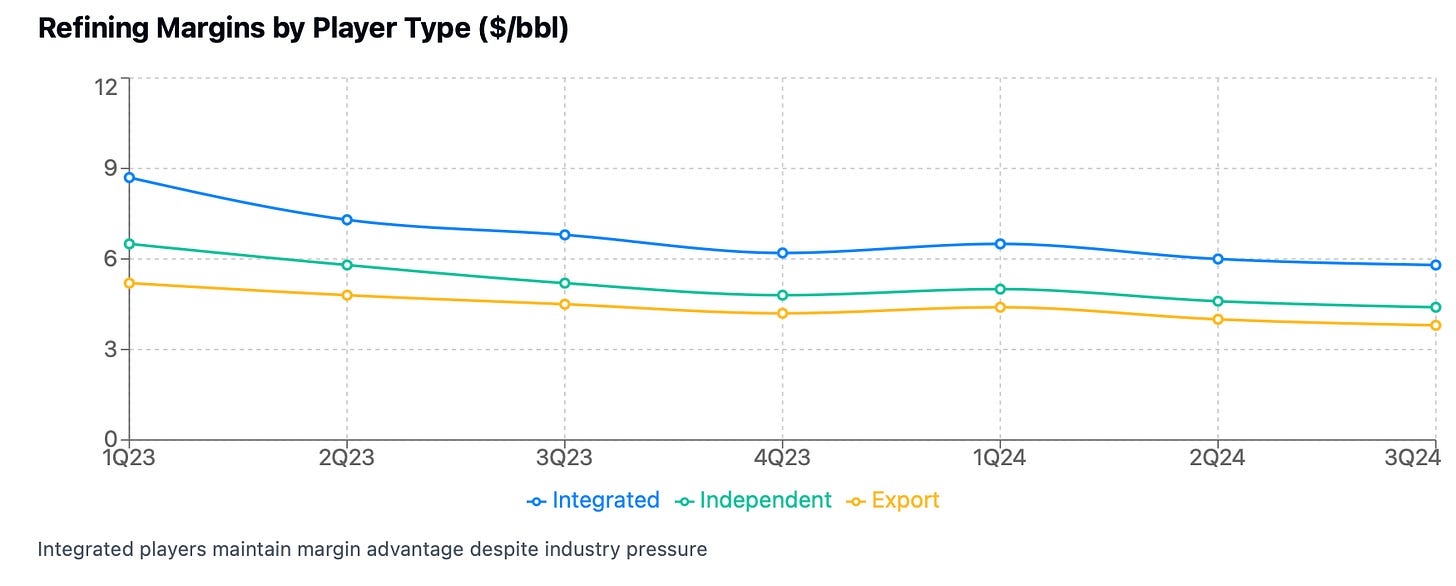

However, despite this increasing competition, integrated players continue to demonstrate substantial structural advantages that translate into sustained economic outperformance. In operational metrics, these players maintain a commanding 10-12% utilization rate advantage over independent refiners, while consistently capturing a $2-3/bbl margin premium versus pure-play operators.

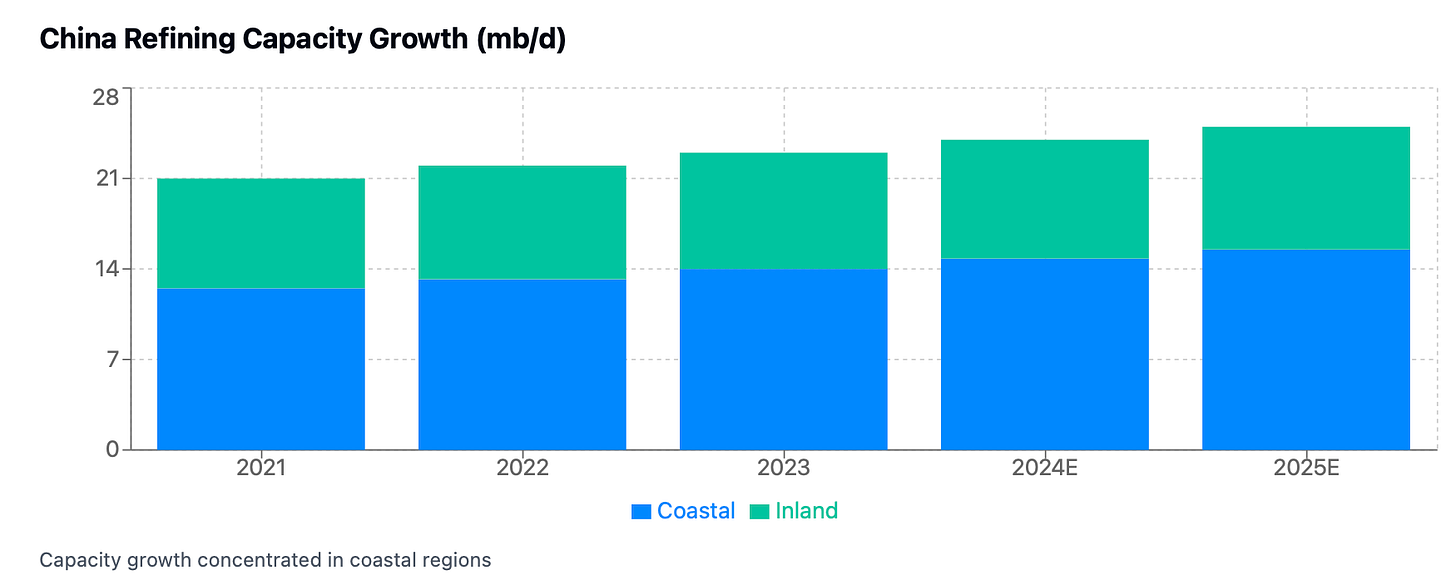

This outperformance stems from superior feedstock optionality and significant procurement leverage, enabling more efficient operations across market cycles. Perhaps more critically, integrated players hold dominant positions in strategic coastal locations, controlling 75% of prime capacity positions with superior logistics infrastructure and proximity to demand centers. This geographical advantage is further enhanced by their more sophisticated refining configurations, evidenced by Nelson Complexity Indices exceeding 10, enabling greater flexibility in product slate optimization.

When combined with their ability to capture value across the entire hydrocarbon chain - from crude procurement through to retail distribution - these advantages create a sustainable competitive moat that appears likely to persist despite the evolving industry structure.

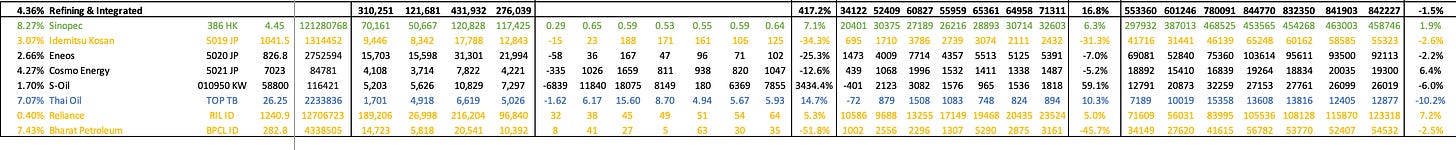

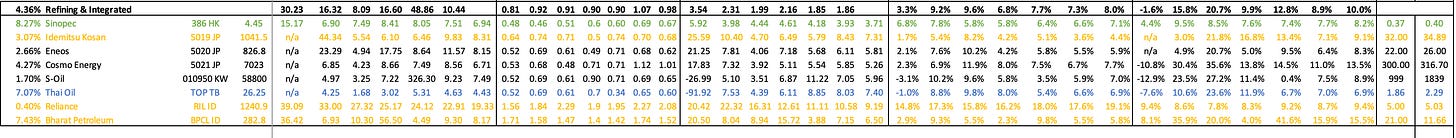

Looking at the performance of Refiners in the context of the broader energy space, its clear performance stratification between integrated majors and pure-play refiners, with three-year total returns ranging from +212% for CNOOC to +51% for Sinopec within the Chinese majors. This dispersion reflects varying exposure to downstream operations, with companies holding higher refining exposure generally commanding lower multiples. Notably, Japanese refiners like Idemitsu Kosan have delivered respectable returns despite regional overcapacity concerns, suggesting the market is rewarding operational excellence and strategic positioning in key demand centers.

Valuation metrics across the sector reveal compelling disconnects. Asian refiners broadly trade at compressed multiples versus global peers, with Chinese majors clustered in the 7-9x P/E range compared to 8-12x for global integrated players. Current EV/EBITDA multiples of 4-6x appear to embed overly pessimistic assumptions about long-term growth prospects and energy transition risks. This valuation gap appears particularly pronounced in North Asia, where Japanese and Korean refiners command premium valuations of 9-11x P/E despite facing similar structural challenges.

Regional patterns provide additional nuance to the investment case. Chinese state-owned enterprises trade at notable discounts despite commanding superior scale economics and prime asset positioning. Southeast Asian players exhibit higher return volatility, reflecting their smaller scale and more fragmented market positions. The stark valuation divergence between North Asian and Chinese refiners appears difficult to justify on fundamentals alone, suggesting potential opportunity in select names. We will explore those in more detail behind the paywall.

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.