Good Morning, and welcome to 2025!

We are up and running here in the Panda office, excited to be back from our sojourn to the north of England. While Merry, it was really rather colder than this Panda-themed newsletter writer is used to, or enjoys, quite frankly. Nevertheless it was a great reminder just how valuable heating is, so what better way to start the year than pay homage to it and dive in head first in to Energy.

Before we do though, some housekeeping. This will be the general overview of the oil market, with some commentary on my end. It is generally available, but for the every end of the report that focuses on positioning implications. If you like it please consider becoming or upgrading to being a premium subscriber.

The second installment of this series will be exclusively for premium subscribers and will focus on our preferences in the Asian oil sector. In that piece, we will cover CNOOC and PetroChina. Following this, during the week of the 6th, we will dive into China’s refining and petrochemical sector, with a particular focus on Sinopec and Hengli Petrochemical. This analysis will also be exclusively available to premium subscribers.

Looking ahead to the week of the 13th, we will shift our focus to “King Coal”, examining the current state of coal miners in China. Our analysis will present a detailed thesis on coal usage in China, projecting trends through the 2040s. We are particularly keen to receive feedback on this long-term perspective and its implications.

As a disclaimer, we will be in New York the week of the 6th, so the posting schedule may be affected by that, as we have client meetings and a presentation at the StoneX Resources Day . Likewise, if you are in NYC and would like to grab a tea or a drink do reach out! Don’t have that many slots left, but do have some.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

With all that out of the way on to the Oil Market.

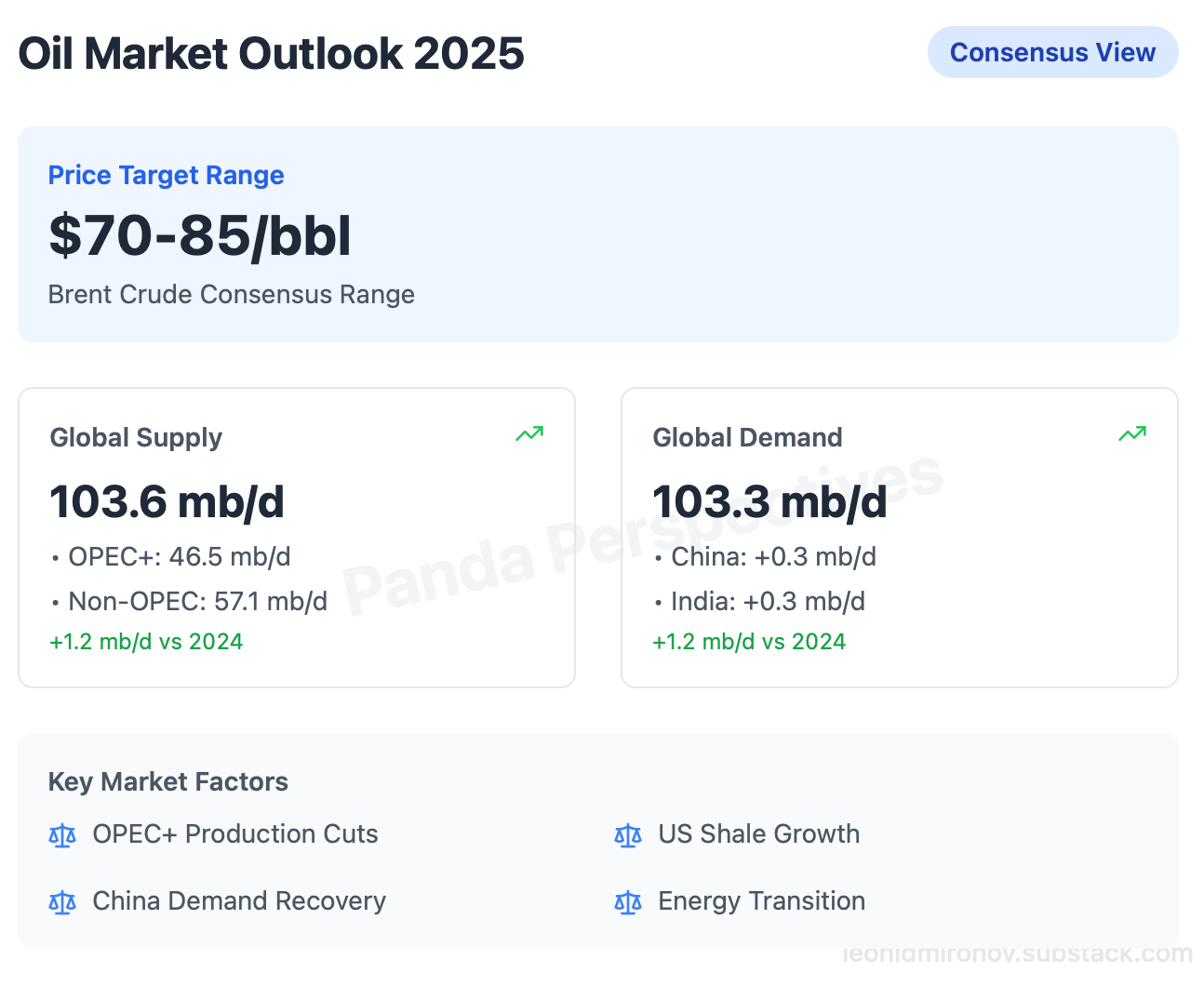

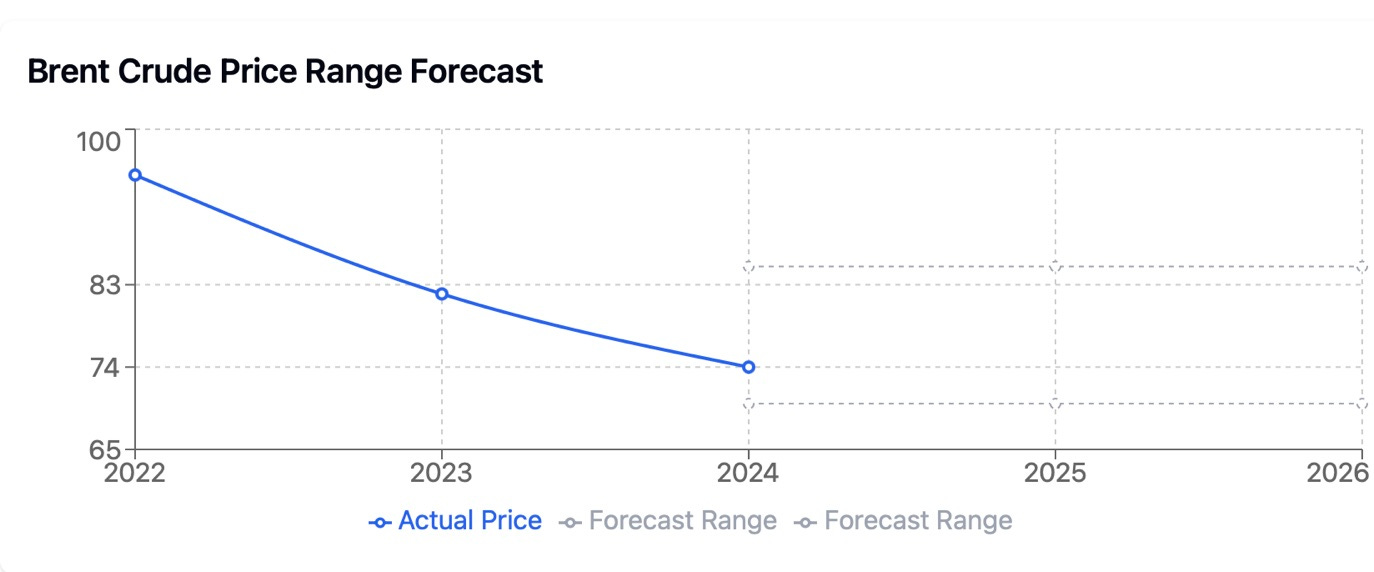

In 2024, oil prices experienced relative stability, with Brent crude averaging around $76 per barrel, supported by supply cuts from OPEC+ and robust demand from key markets. However, the year also saw periods of price volatility driven by geopolitical tensions, particularly in the Middle East, and economic headwinds in China, which dampened demand growth to just 0.1 mbpd. Global inventories drew down by 0.5 mbpd, creating a tighter market environment. Speculative interest waned, with net managed money positioning falling to historically low levels, reflecting bearish sentiment. Despite these fluctuations, the market largely traded within a range of $70–85 per barrel, providing a foundation for the more balanced outlook projected for 2025. This was a welcome reprieve from the volatility of 2020-2023 period.

We anticipate the oil market in 2025 to see crude trading within a $70–85 per barrel range, reflecting a delicate balance between supply-side expansion and moderate demand recovery. However, heightened potential for volatility remains a defining feature of the market, driven by geopolitical tensions, structural shifts in energy consumption, and evolving supply-demand fundamentals. Essentially, we see the market as balanced, with higher prices incentivising greater OPEC production and lower prices disincentivizing shale and tighter OPEC+ compliance.

The Downside risks to prices stem from the anticipated inventory build, with global stocks projected to increase by 0.3 million barrels per day (mbpd)in 2025. This contrasts with the 0.5 mbpd drawdown seen in 2024, signaling a shift from supply tightness to relative balance. Additionally, high spare capacity within OPEC+, estimated at 4.6 mbpd, adds to price pressures, as this buffer could be deployed rapidly in response to market disruptions or rising prices. Weak economic recovery in key demand centers, particularly China, alongside persistent trade tensions and accelerated adoption of alternative energy sources, further underscores the bearish risks .

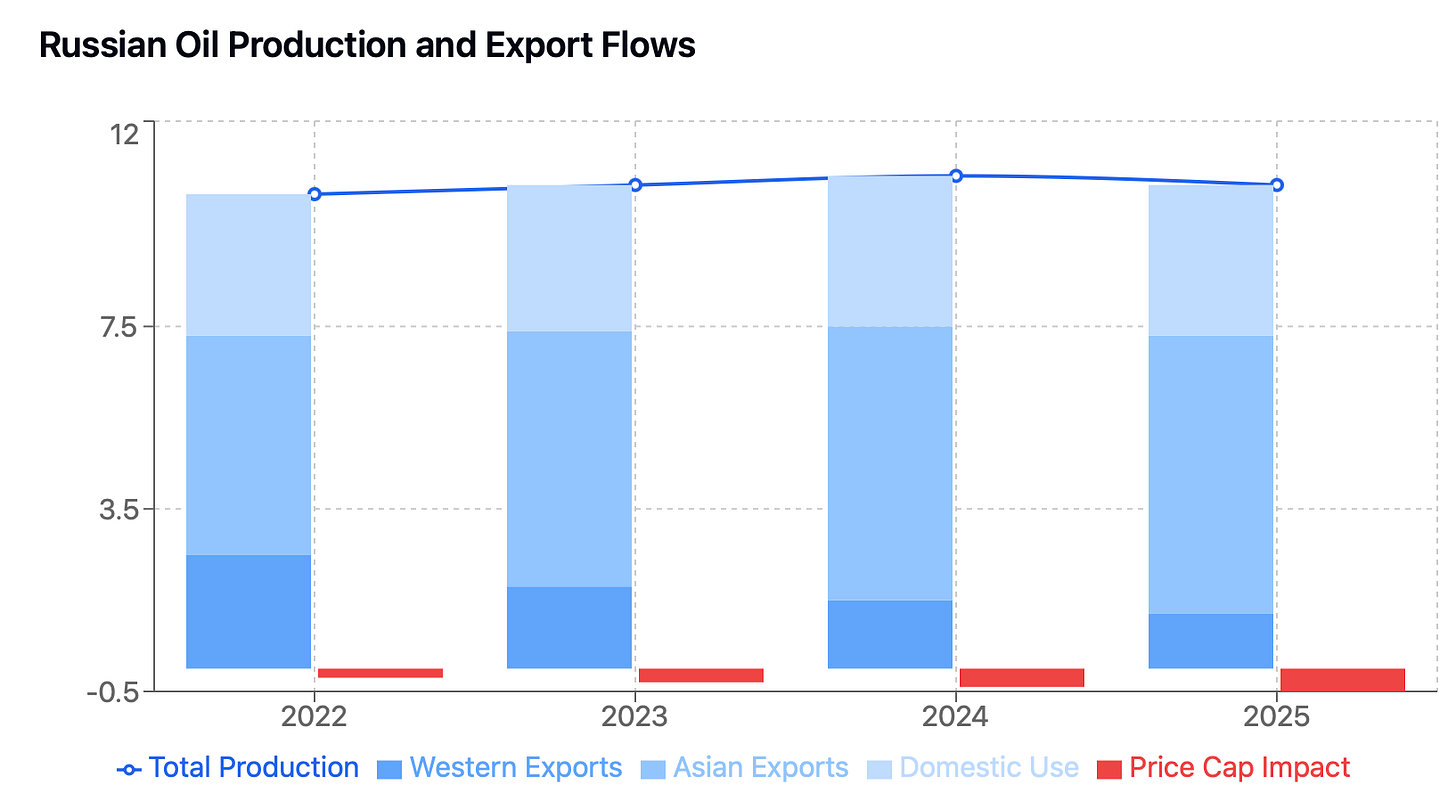

Conversely, upside risks to prices remain significant, but less likely. Geopolitical uncertainties, particularly in the Middle East, could disrupt supply chains and push prices higher. Limited physical capacity to deploy OPEC’s spare production and ongoing sanctions on Russian oil exports exacerbate potential tightness in the market. Additionally, China’s economic stimulus measures, while modest, could provide unexpected support to global demand, especially if industrial and infrastructure activities exceed expectations .

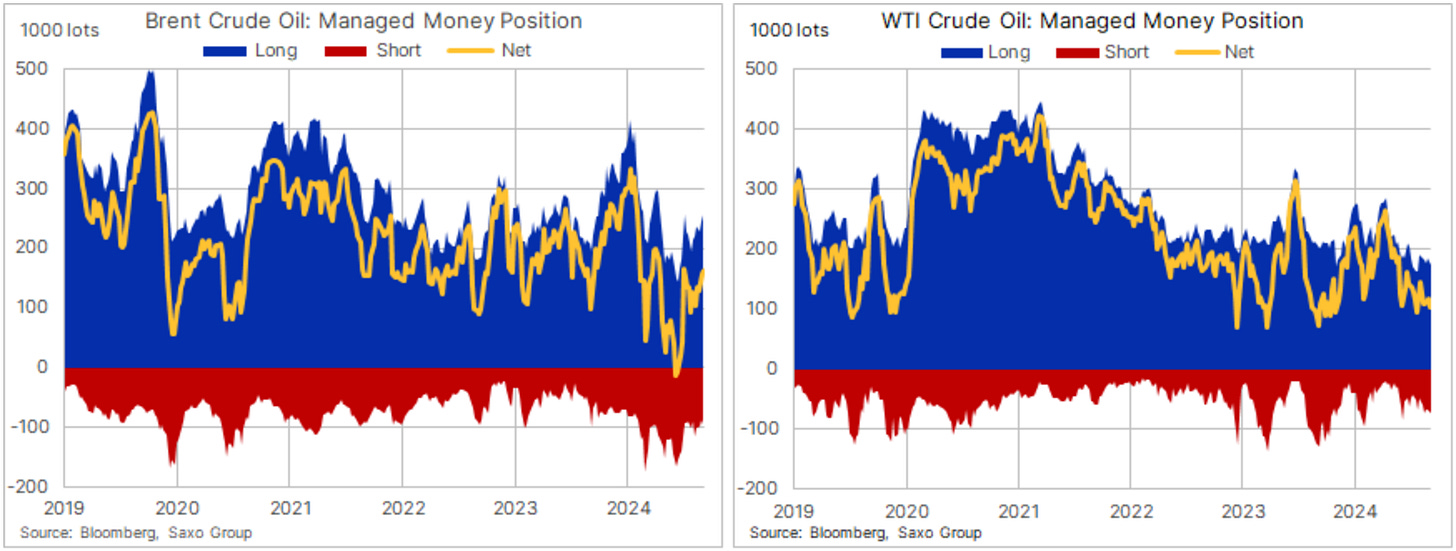

Market signals also point to potential price recovery. Net managed money positioning, a key indicator of speculative interest, has dropped to 236 million barrels, sitting at the 4th percentile of historical levels. This indicates a highly bearish sentiment but also suggests room for a rebound as financial demand recovers. Such shifts in market sentiment, coupled with unforeseen geopolitical events or supply disruptions, could lead to periods of heightened volatility within the broader trading range .

China’s evolving role in the market adds another layer of complexity. While structural changes in its energy consumption, such as high EV penetration and renewable energy adoption, are dampening demand growth, its sheer consumption base and strategic influence as the world’s largest oil importer ensure its continued impact on global pricing dynamics. Furthermore, shifts in Chinese crude purchasing strategies, including increased reliance on discounted Russian crude, are altering trade flows and potentially stabilizing prices .

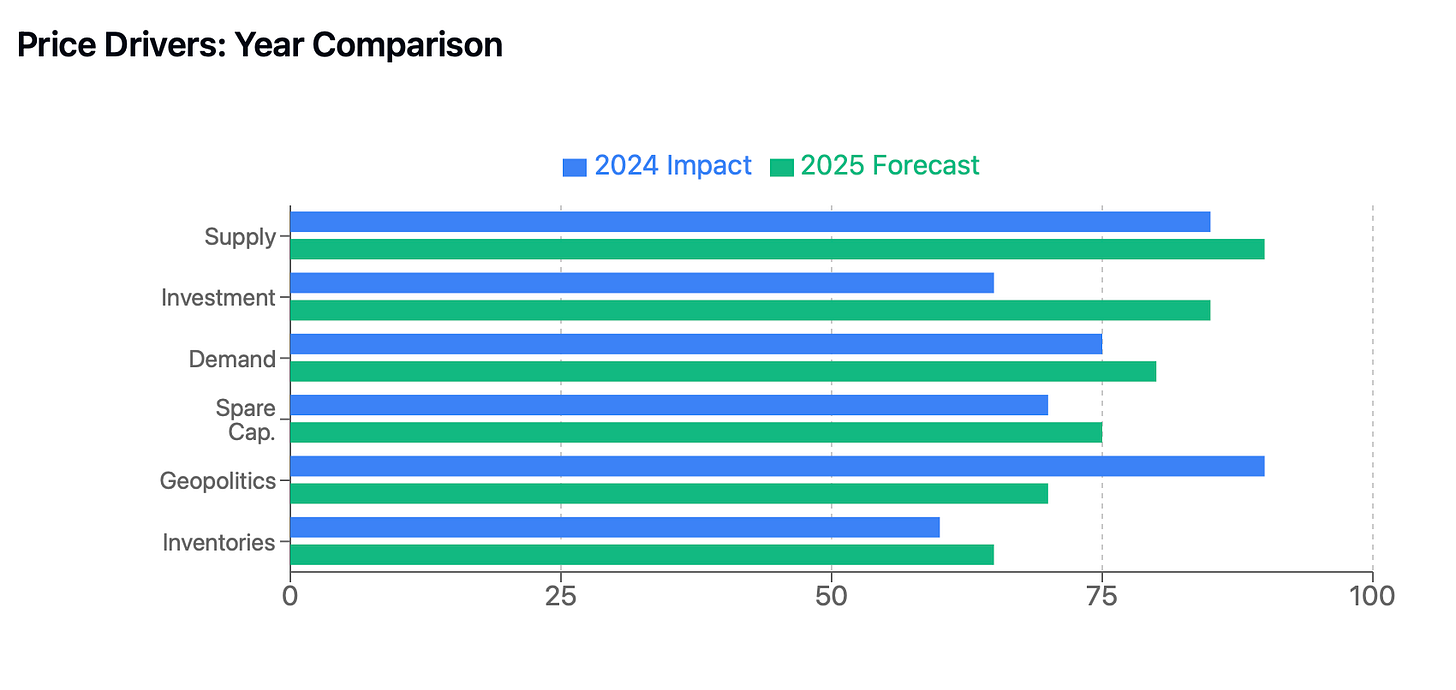

We wanted to present this thinking in a more visual way. We believe that the relative importance of Supply challenges will stay high and even go higher, while Geopolitical impact will moderate. Supply dynamics will remain a steady influence, as how can they not!? Incremental increases from OPEC+ and U.S. shale stabilise the market. However, the role of investment sees a significant rise, highlighting greater capital allocation toward upstream projects, refining capacity expansions, and energy infrastructure development. This shift signals a longer-term strategic focus on production sustainability and market competitiveness. Demand also grows in importance as modest recoveries in China and India, alongside global consumption patterns, counterbalance structural changes such as increased EV penetration and renewable energy adoption.

Spare capacity, particularly from OPEC+, sees a reduced role in 2025, as the market has learned to deal with it and treat it as being offline, if OPEC says so. Conversely, inventories play a more prominent role, with projected stock builds introducing downward pressure on prices and signaling a shift from the drawdown environment of 2024. Geopolitical risks remain a key factor, though their influence slightly diminishes as markets adjust to ongoing uncertainties in the Middle East and Russia.

Overall, the interplay of these drivers—stable supply growth, increased investment, shifting demand dynamics, and inventory build-ups—creates a nuanced and potentially volatile price environment, but within a range. This evolution underscores the importance of closely monitoring both structural and cyclical factors to navigate the complexities of the 2025 oil market. The chart serves as an illustrative reflection of how these forces align and shift over time.

Now we shall look under the hood a little, and focus on demand and supply sides of the market.

Supply-Side Dynamics

The supply side of the oil market in 2025 is defined by a careful balancing act among OPEC+, U.S. shale, and other non-OPEC producers, with strategic decisions shaping the market’s response to fluctuating demand and geopolitical challenges. Global supply growth is anticipated to be robust, yet tempered by structural considerations and cost dynamics, positioning 2025 as a pivotal year for supply-side strategies.

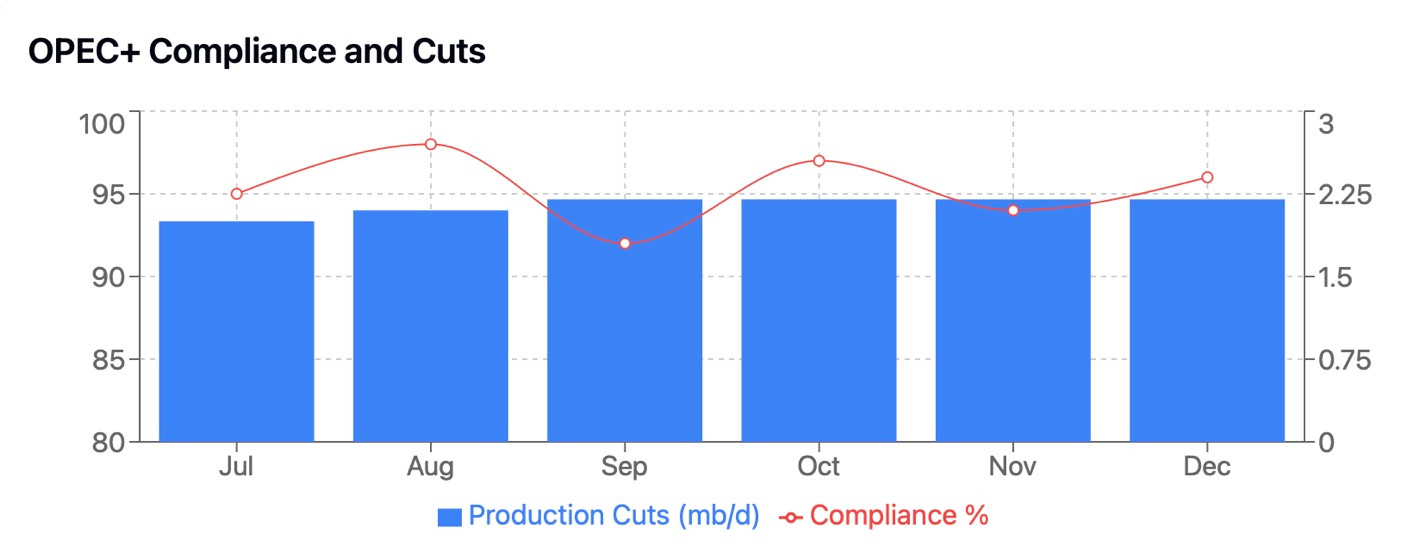

OPEC+ remains a central player, with plans to unwind 2.2 million barrels per day (mbpd) of voluntary production cuts incrementally throughout the year. This strategy reflects a deliberate approach to balancing market stabilization with the need to regain market share after years of restrained output. By gradually increasing production, OPEC+ aims to manage price pressures while preventing an oversupply scenario that could depress Brent crude prices. Despite this strategy, the group retains significant spare capacity—estimated at 4.6 mbpd as of late 2024—providing a cushion against potential supply disruptions .

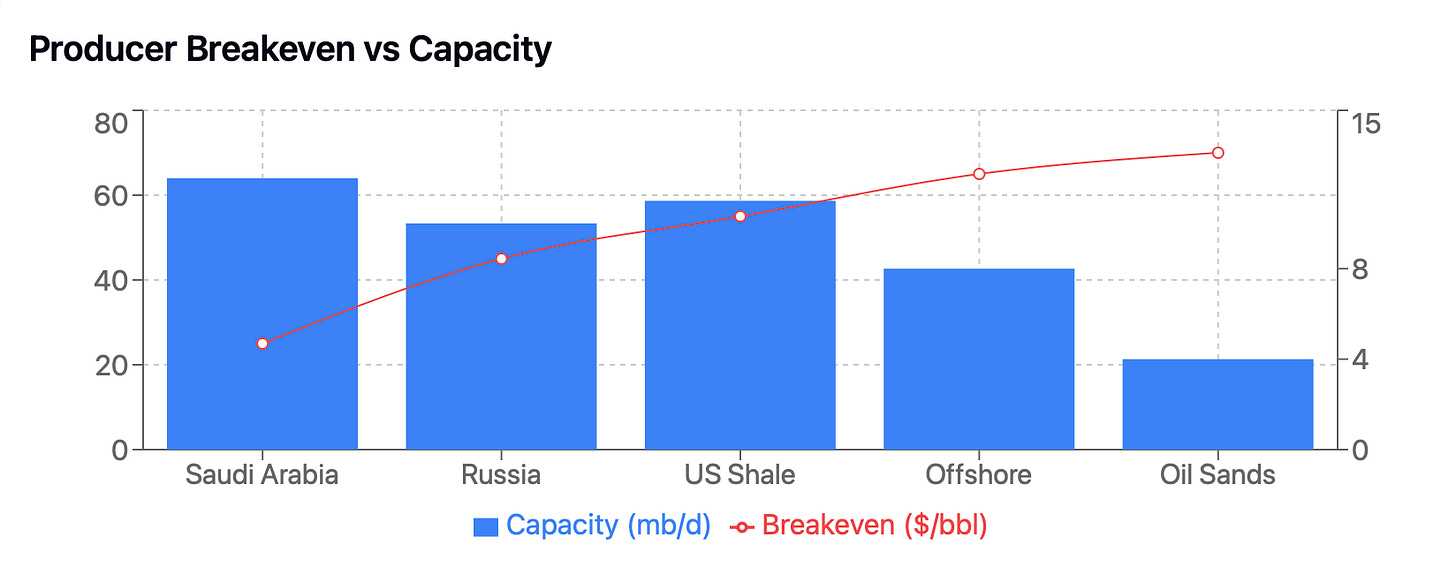

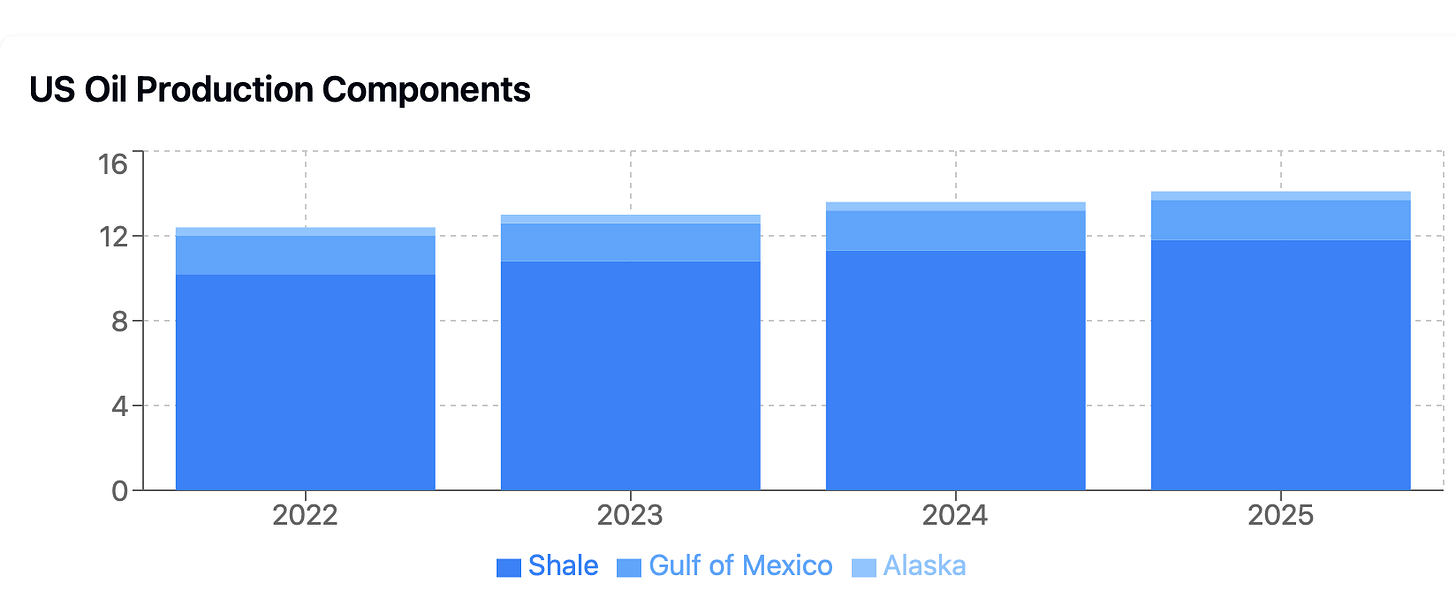

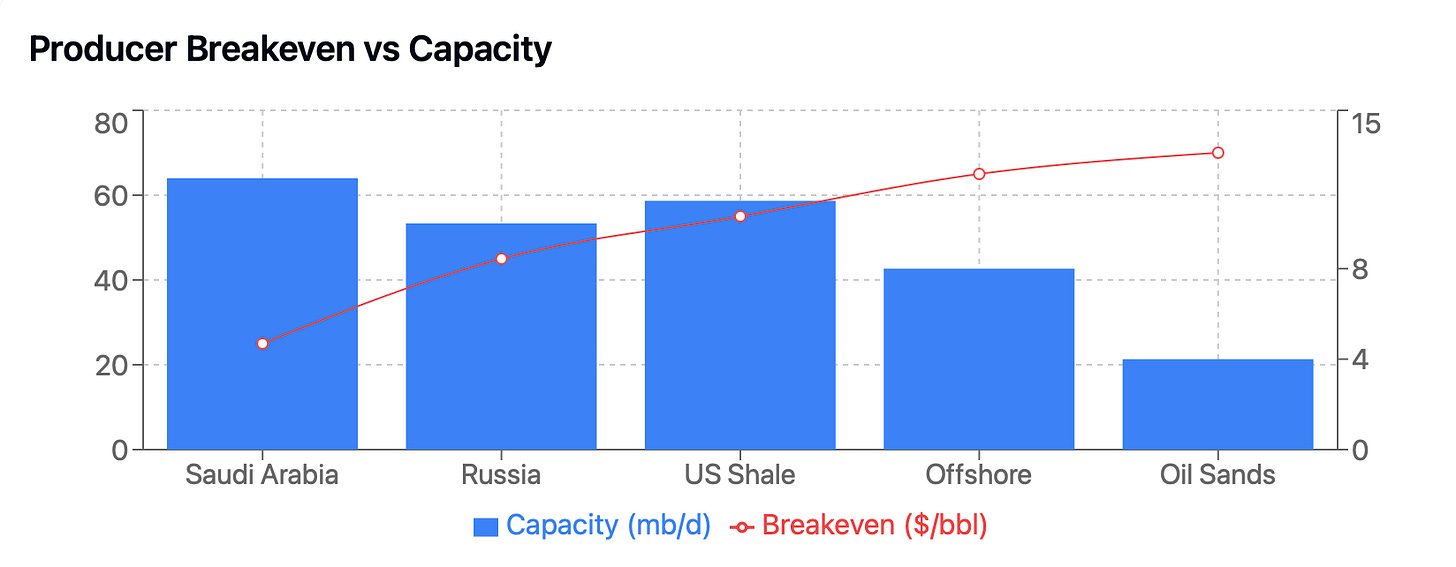

Non-OPEC producers are also poised to contribute significantly to global supply growth. U.S. shale, the world’s primary marginal oil producer, is forecast to grow by 0.5 mbpd in 2025, driven by resilient output from the Permian Basin. This growth is supported by relatively high Brent crude prices, which have hovered around $74 per barrel, but remains cost-sensitive. Breakeven prices for U.S. shale average $55 per barrel, with profitability heavily dependent on Brent remaining above $50 per barrel. The cost disadvantage of U.S. producers compared to their Middle Eastern counterparts underscores the importance of sustained price levels for maintaining production momentum .

Canadian oil production is also on the rise, with capacity increasing to 6.6 mbpd, reflecting its growing prominence in the global supply landscape. This increase is attributed to investments in oil sands projects and enhanced extraction techniques, which have improved production efficiency and reduced costs. Additionally, other non-OPEC producers, such as those in Brazil and Norway, are expected to maintain steady contributions, further diversifying global supply sources .

Geopolitical factors remain a key influence on supply dynamics. Oil flows through critical chokepoints, such as the Red Sea, have largely recovered despite ongoing regional tensions. However, the potential for disruptions in the Middle East remains an upside risk to prices, underscoring the need for resilient and diversified supply chains. Moreover, the strategic flexibility of OPEC+ and the high spare capacity it retains provide a stabilising force in the face of potential shocks .

Cost dynamics and production sensitivity further shape the supply outlook. U.S. shale producers, characterised by short production cycles and high variable costs, remain highly responsive to price changes. If Brent crude prices fall into the $50–70 range, U.S. production growth is expected to slow, with a potential decrease of 0.3 mbpd for every $10 drop in Brent prices. Conversely, if prices exceed $90 per barrel, the response is muted due to capital discipline among U.S. producers, reflecting a shift toward long-term profitability over rapid output expansion .

Demand Landscape

The demand side of the oil market in 2025 reflects a measured recovery, shaped by regional dynamics, structural changes in energy consumption, and the ongoing global energy transition. While global oil consumption is projected to grow by 1.2 million barrels per day (mbpd) in 2025, this represents a moderate pace compared to pre-pandemic levels, signaling a shift in traditional growth patterns.

China’s role as a key driver of global oil demand continues, albeit with structural changes tempering its growth. Demand in China is forecast to increase by 0.3 mbpd, recovering from the subdued 0.1 mbpd growth recorded in 2024. The rebound is supported by modest economic stimulus measures and a resurgence in industrial and infrastructure activities. However, high electric vehicle (EV) penetration and a growing share of gas and renewables in China’s energy mix are limiting the expansion of traditional fuel demand. This reflects a broader shift in China’s energy policy, emphasising sustainability and energy diversification, which is moderating its historical dominance as the engine of global oil demand growth. We’ll discuss China in a separate section.

India remains a bright spot in the demand landscape, with oil consumption expected to grow by 0.3 mbpd in 2025. The country’s expanding middle class, rapid urbanization, and infrastructure investments are driving strong demand for transportation fuels and petrochemical feedstocks. India’s consistent growth underscores its rising importance as a counterbalance to slower demand in other regions .

OECD Europe, in contrast, is witnessing demand softness, with a recent decline of 0.5 mbpd, reflecting slower economic growth, high energy prices, and accelerated adoption of renewables. This trend highlights the structural headwinds faced by developed economies as they transition toward greener energy systems .

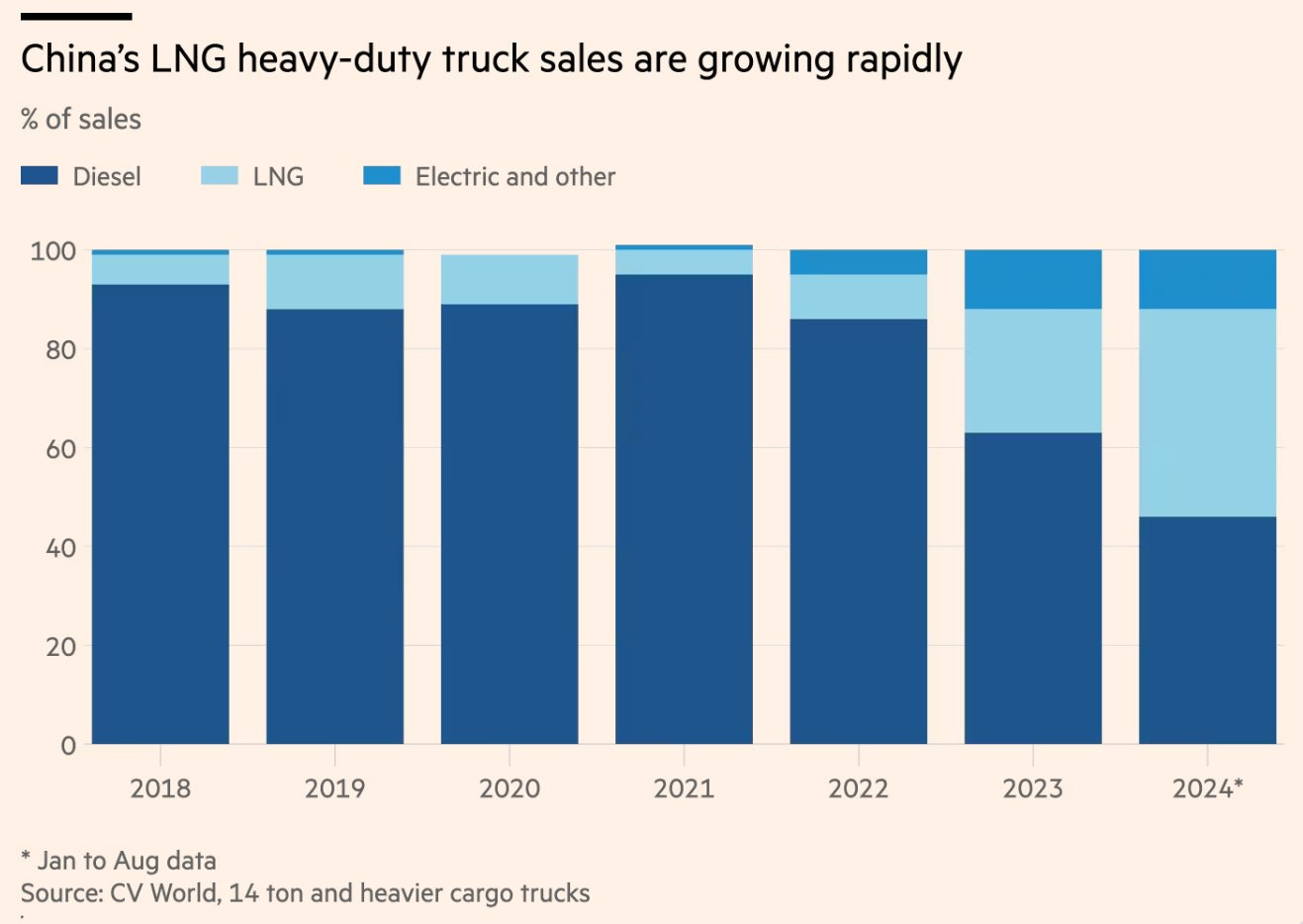

Global consumption patterns are further influenced by the energy transition. The accelerating adoption of EVs continues to erode traditional fuel demand, particularly in transportation. Meanwhile, gas and renewables are taking an increasingly prominent role in energy portfolios, particularly in regions with supportive policy frameworks. This transition is particularly evident in China and Europe, where government mandates and incentives are reshaping consumption patterns .

The forecasted inventory build of 0.3 mbpd in 2025 suggests a market shifting from tightness toward relative balance. However, this inventory growth does not imply a lack of demand strength; rather, it reflects the realignment of supply to meet evolving consumption patterns. Additionally, trade flows are becoming more regionally diversified, as shifts in demand centers and logistical adjustments drive changes in global oil movement .

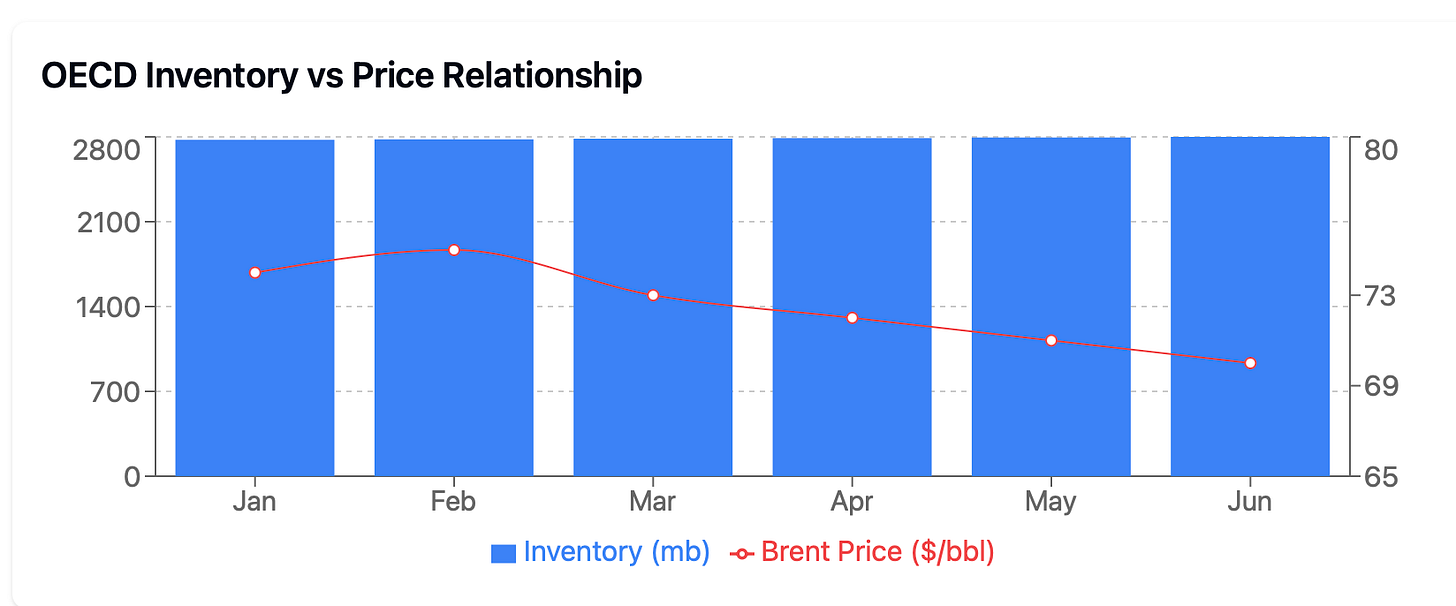

Inventories. OECD inventory levels remain a vital indicator of global oil market dynamics, with a direct and well-established relationship to price trends. As the chart demonstrates, when OECD inventories rise, oil prices typically fall, even when inventory levels are already relatively high. This correlation makes OECD inventories a reliable signal of supply-demand balance, reflecting the broader market’s perception of whether supply is exceeding or trailing demand.

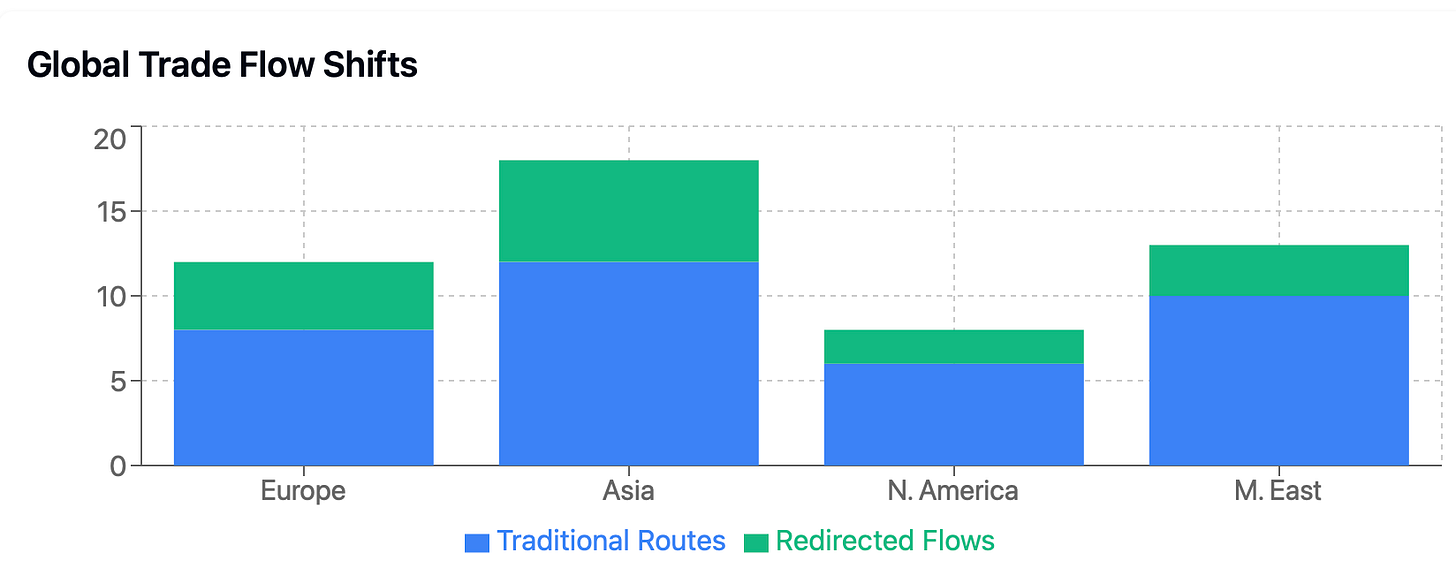

However, the global oil market has undergone significant structural shifts that complicate the interpretation of these inventories. Refining centers have moved closer to demand growth regions, particularly to India, the Middle East, China, and the Dangote Refinery in Nigeria, which now service high-demand areas in Asia and Africa. These regions consume crude near their refining hubs, making the barrels stored there more immediately useful and strategically valuable than those held in traditional OECD markets like the U.S. and Europe. As a result, the role of OECD inventories as a global benchmark now reflects conditions in markets with slower demand growth, rather than the rapidly expanding consumption hubs.

Additionally, Middle Eastern crude increasingly stays within the region, thanks to its expanded refining systems, or it takes shorter trips to India and China rather than traveling to the U.S. or Europe. Similarly, Europe has shifted away from Russian oil, sourcing instead from the U.S., West Africa, North Sea, and Mediterranean regions without significantly increasing transit times. This optimized supply chain allows refiners to hold fewer barrels, reducing their reliance on inventories for operational needs.

These changes have led to excess barrels accumulating in OECD markets such as the U.S. and Europe, even as pipeline expansions improve logistics. In essence, these barrels often represent surplus supply rather than a reflection of tight demand conditions. Yet, the market continues to interpret rising OECD inventories as a bearish signal, putting downward pressure on prices.

Despite the evolving landscape, OECD inventories remain relevant because of their transparency and consistent reporting. They provide the clearest available indicator of global supply trends, even as the geographic distribution of storage and consumption shifts. Rising OECD inventories still signal an oversupplied market to traders and refiners, leading to lower prices. However, understanding these inventories in the context of shifting trade flows and refining centres is crucial to accurately assessing their impact on global oil markets.

Key risks to demand growth include:

Weaker-than-expected economic recovery in China, which could curtail industrial and transportation fuel needs.

Geopolitical disruptions, particularly in the Middle East, which could impact consumer sentiment and trade flows.

Structural adoption of alternative energy sources, which continues to reduce the reliance on oil in major consuming economies .

Despite these challenges, the sheer scale of China and India’s consumption bases ensures that even modest growth rates translate into significant absolute demand increases. This underscores the critical role of these markets in supporting global demand and stabilizing oil prices.

China. China. China.

China’s oil market remains a focal point in the global energy landscape, with its supply and demand dynamics reflecting the interplay of economic recovery, structural changes, and energy transition strategies. While growth in China’s oil consumption has moderated, the country’s vast energy needs and evolving policies continue to shape global oil markets.

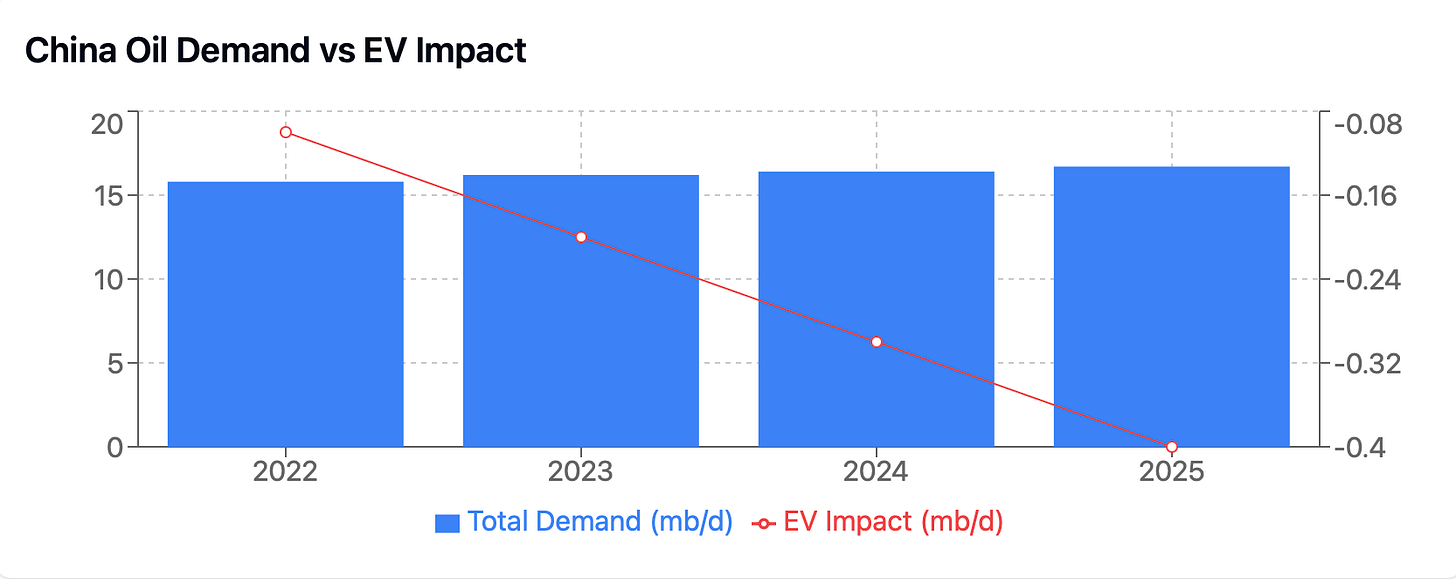

China’s oil demand is projected to grow by 0.3 million barrels per day (mbpd) in 2025, rebounding from the subdued 0.1 mbpd increase in 2024. This recovery underscores the modest impact of the government’s economic stimulus measures, which aim to bolster industrial activity, infrastructure development, and consumer spending. However, the pace of recovery remains muted compared to historical growth rates, highlighting the structural shifts in China’s energy landscape.

The transportation sector, traditionally a significant driver of oil demand, faces increasing disruption from electric vehicles (EVs). EV adoption in China continues to surge, with over 30% of new car sales expected to be electric in 2025, up from approximately 25% in 2024. This transition is projected to displace around 0.2 mbpd of gasoline demand by the end of the year, particularly in urban centers where electrification is most concentrated. Similarly, the country’s expanding high-speed rail network is reducing reliance on jet fuel and long-distance road transport .

In the petrochemical sector, demand for naphtha and other oil-derived feedstocks is expected to grow, supported by steady domestic production of plastics, packaging, and other industrial materials. While the growth of the petrochemical industry remains a bright spot, it is increasingly influenced by global sustainability trends, including the push for recycling and the use of alternative materials, which could temper long-term expansion .

China’s broader energy transition is reshaping the oil demand landscape. Natural gas and renewables are capturing a growing share of the energy mix, with solar, wind, and hydropower expected to account for over 50% of new capacity additions in 2025. These developments align with China’s carbon neutrality targets but reduce reliance on oil for power generation and industrial applications .

Economic factors further constrain demand growth. Although the government’s stimulus programs have provided a lifeline to the manufacturing and construction sectors, lingering challenges in the real estate market and slower-than-expected export growth are capping industrial output. These headwinds are particularly evident in heavy industry, where diesel consumption remains below pre-pandemic levels .

Despite these moderating influences, China’s sheer scale ensures its continued importance in global oil markets. As the world’s largest crude importer, China’s consumption is expected to reach 15.8 mbpd in 2025, accounting for nearly 16% of global demand. This vast base means that even incremental growth translates into significant absolute volume increases, reinforcing China’s critical role in balancing global supply-demand dynamics .

China’s Oil Supply in 2025

China’s oil supply strategy in 2025 reflects its dual priorities of enhancing domestic production to bolster energy security while maintaining its position as the world’s largest crude oil importer. While domestic output is expected to see modest growth, the country’s reliance on imports underscores its vulnerability to geopolitical risks and price volatility. At the same time, strategic investments in refining capacity and storage infrastructure highlight its ambition to remain a pivotal player in global energy markets.

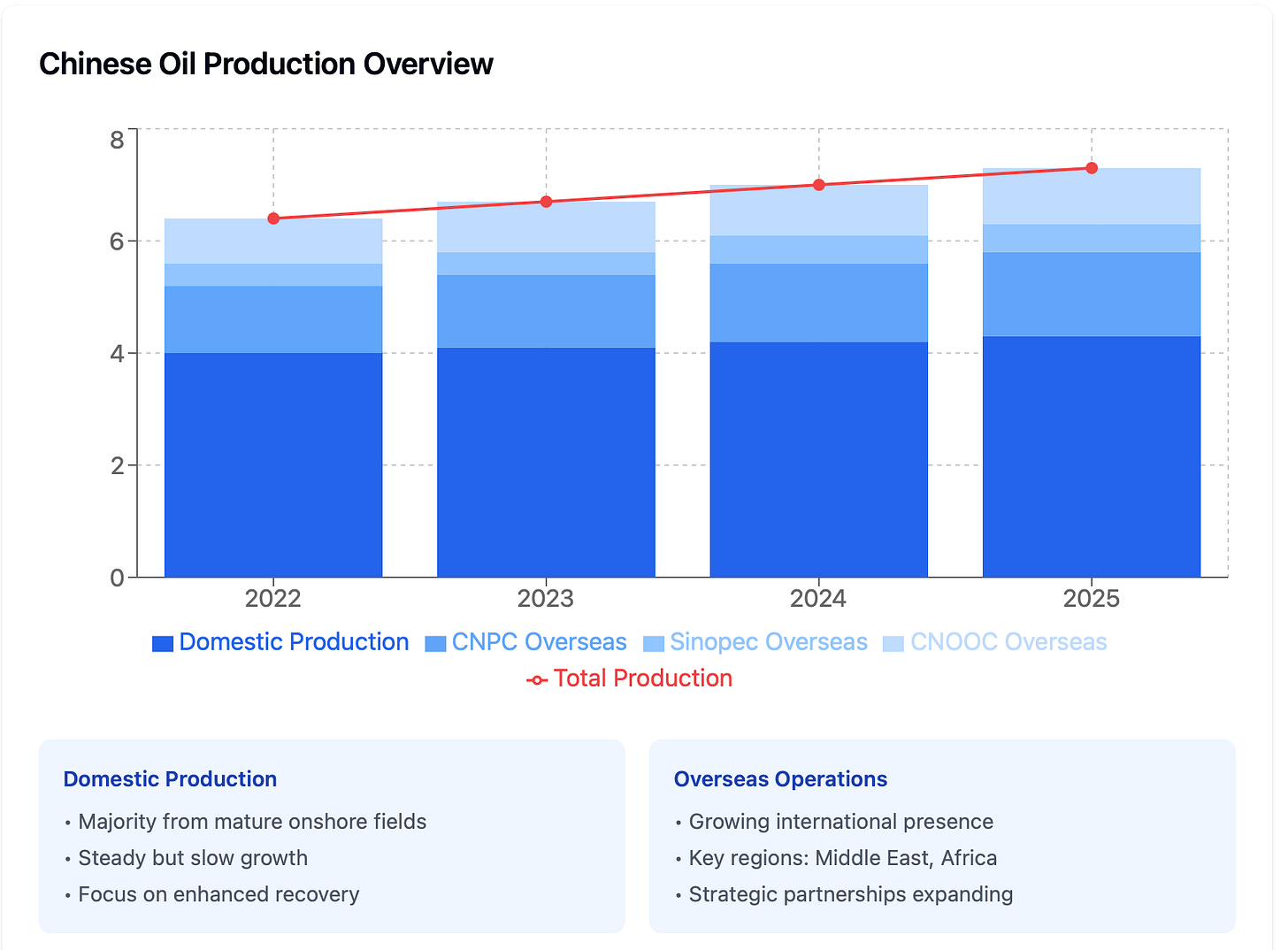

Domestic Production:

China’s domestic oil production is forecasted to increase modestly in 2025, supported by investments in enhanced recovery techniques and optimization of mature oil fields. Total production is expected to approach 4.2 million barrels per day (mbpd), a slight uptick from previous years. Key state-owned enterprises, such as PetroChina and Sinopec, continue to dominate upstream activities, focusing on stabilizing output in major basins like the Daqing and Shengli fields .

Efforts to expand production include:

Enhanced Oil Recovery (EOR): Techniques such as waterflooding and chemical injection are being increasingly deployed to boost output from aging fields.

New Discoveries: Investments in offshore exploration, particularly in the Bohai Sea and South China Sea, are contributing to incremental production growth. However, these projects are capital-intensive and often face logistical and environmental challenges .

China is actively expanding its domestic shale oil production as part of its strategy to bolster energy security and reduce reliance on imports. Although shale oil remains a small component of the country’s total oil output—approximately 1.9% as of 2024—production is growing steadily, with significant advancements in key basins such as the Jimsar Shale Oil Demonstration Zone, Jiyang Shale Oil Pilot Project, Tarim Basin, and Sichuan Basin. Leading the development of these resources are companies like CNOOC, Sinopec, and CNPC, which are leveraging advanced drilling technologies to overcome technical challenges.

Despite these measures, China’s domestic output growth remains limited, meeting less than 30% of its total oil consumption, necessitating heavy reliance on imports.

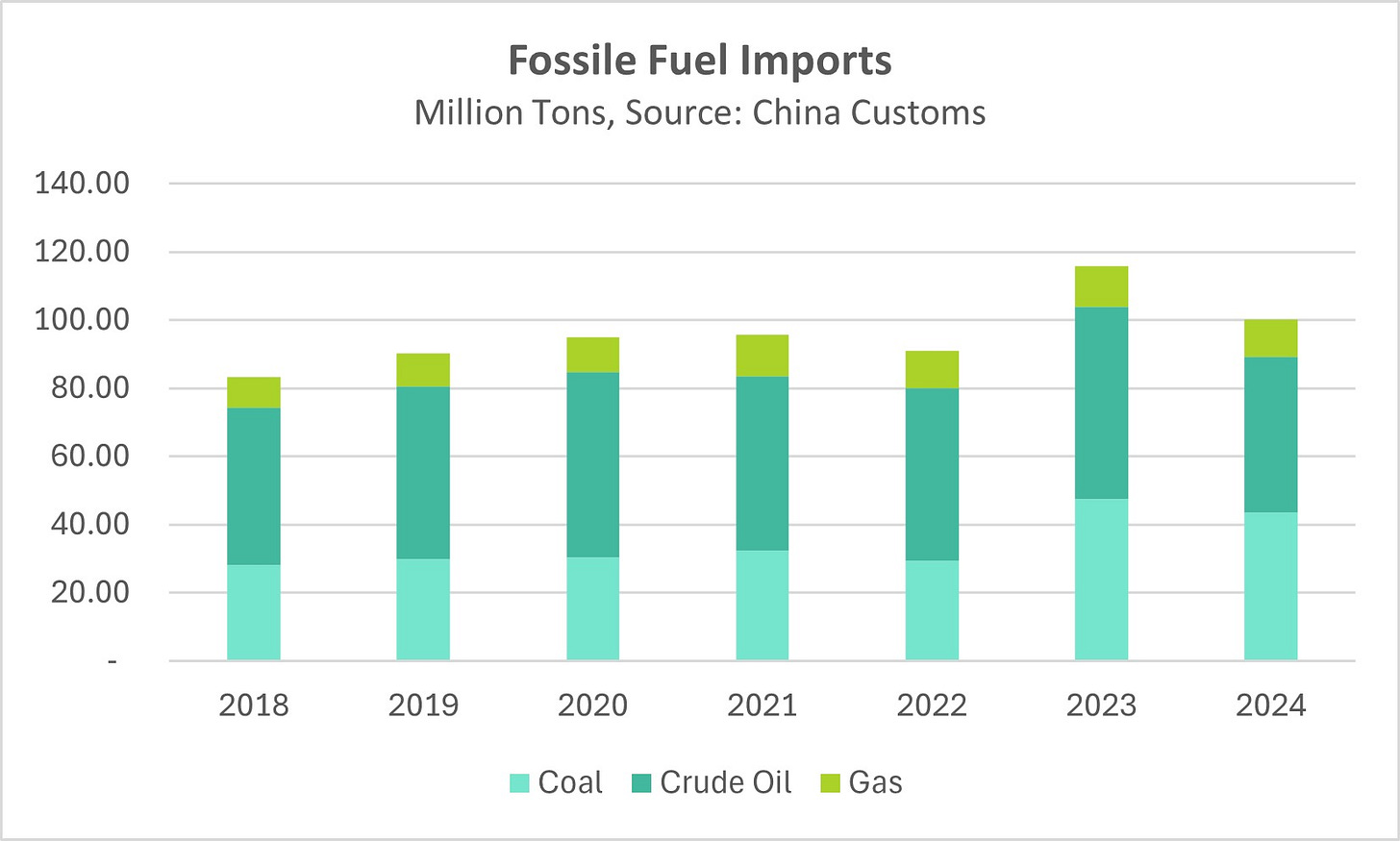

Crude Oil Imports:

China remains the world’s largest crude oil importer, with import volumes projected to exceed 11.6 mbpd in 2025, representing over 70% of its total consumption. This reliance is driven by domestic production shortfalls and growing energy needs in the industrial and transportation sectors. Key sources of imported crude include:

Middle Eastern Suppliers: Saudi Arabia and Iraq continue to be dominant exporters to China, benefiting from long-term supply agreements and competitive pricing.

Russia: Despite geopolitical sanctions, Russian crude remains a significant component of China’s import mix, facilitated by discounted pricing and the expansion of pipeline infrastructure, including the Eastern Siberia–Pacific Ocean (ESPO) pipeline .

Diversification of Sources: In recent years, China has increased imports from Africa and South America, reflecting its strategy to reduce dependence on any single region. Countries such as Angola and Brazil have seen rising crude sales to Chinese refiners .

China continues to expand its strategic petroleum reserves (SPR) to safeguard against supply disruptions and price volatility. The SPR is estimated to exceed 1.5 billion barrels in 2025, equivalent to over three months of imports at current levels. These reserves provide China with significant flexibility to manage market shocks, such as geopolitical tensions in the Middle East or supply chain disruptions .

Additionally, China is investing heavily in storage infrastructure, including both onshore tank farms and floating storage units. This capacity expansion ensures the country’s ability to handle increased import volumes and optimize purchasing strategies based on price fluctuations.

Refining and Processing:

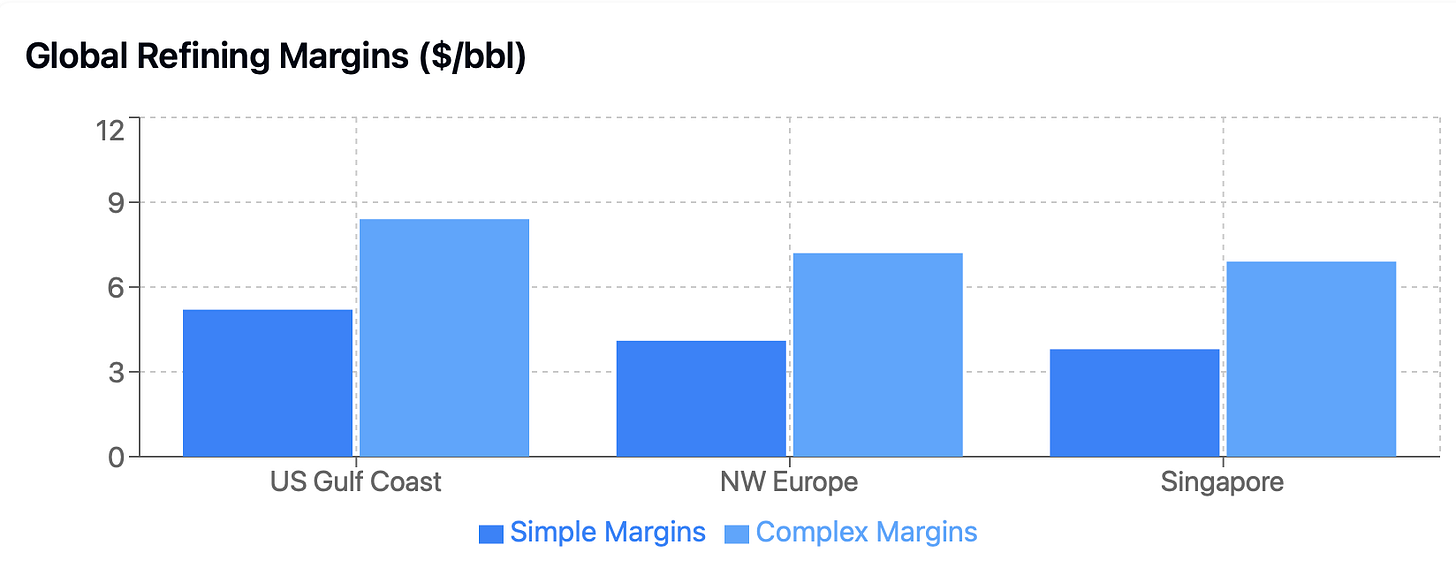

China’s refining capacity is projected to grow further in 2025, with total capacity exceeding 18 mbpd, making it the largest refining hub in the world. The expansion is driven by both state-owned giants and private refiners such as Hengli Petrochemical and Zhejiang Petrochemical. These facilities are designed to process a wide range of crude grades, including heavier and sour crudes, giving China greater flexibility in sourcing .

Key trends in refining include:

Focus on Petrochemicals: Many new refineries are integrated with petrochemical complexes to maximize value addition and meet domestic demand for chemicals and plastics.

Shift Toward Export Markets: With domestic fuel demand plateauing, Chinese refiners are increasingly targeting export markets, particularly in Asia and Africa .

We will have a more detailed look at the Petrochemical and Refining Space in due course. For now though this is a reasonable starting off point.

Strategic Implications for Market Participants in 2025

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.