Refining Asia’s Future: Thai Oil’s Challenges and the Shifting Regional Landscape

Thai Oil: TOP TB

Good Morning,

We’ve had a very exciting day at the StoneX Natural Resource Day yesterday - big thank you goes out to the entire team for organising such an mazing even and hosting us.

It was interesting to talk about China and listen what perspectives people bring to the table. Seemingly there was little bullishness to be found. We shall talk about it in more detail in the weekly wrap, as this will allow for the impressions to settle.

In the mean time our foray in to the energy space continues. We wanted to get a note out this week, and its a little different, as for the first time out company in focus isn’t Chinese. While doing the work on Sinopec, we have bumped in to a reality of a non-china refining balance improving in 2025, and so it seemed appropriate to have a closer look at the situation.

As usual, the general review of the x-China landscape is free, while the Thai Oil focused part is for premium subscribers only. I think it’s a very interesting time for Thai oil as their well publicised challenges have led to a de-rating. Should they turn around it, the reversal should be quite dramatic too. If you are interested in that sort of thing, do consider joining.

We are travelling back today but both Weekly Wrap and Portfolio Review will be published this weekend, if a little later than customary.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

Let’s get in to it!

Refining Asia’s Future

The refining landscape in Asia outside China is characterised by tightening supply-demand dynamics, capacity shifts, and evolving utilisation rates. In 2025, refining capacity additions in the region are expected to slow to 0.1 million barrels per day (mb/d), following 1.0 mb/d of expansions in 2024. This deceleration is driven by the planned closure of 0.5 mb/d of aging and inefficient capacity in early 2025, particularly in countries like India, Southeast Asia, and the Middle East. These closures are part of broader structural reforms aimed at increasing efficiency and maintaining profitability in a competitive market. Meanwhile, demand for refined products in the region is expected to grow by 0.9 mb/d in 2025, outpacing capacity additions and supporting higher utilization rates. This dynamic is set to bolster gross refining margins (GRMs), especially in markets like Singapore, which serves as a benchmark for the region.

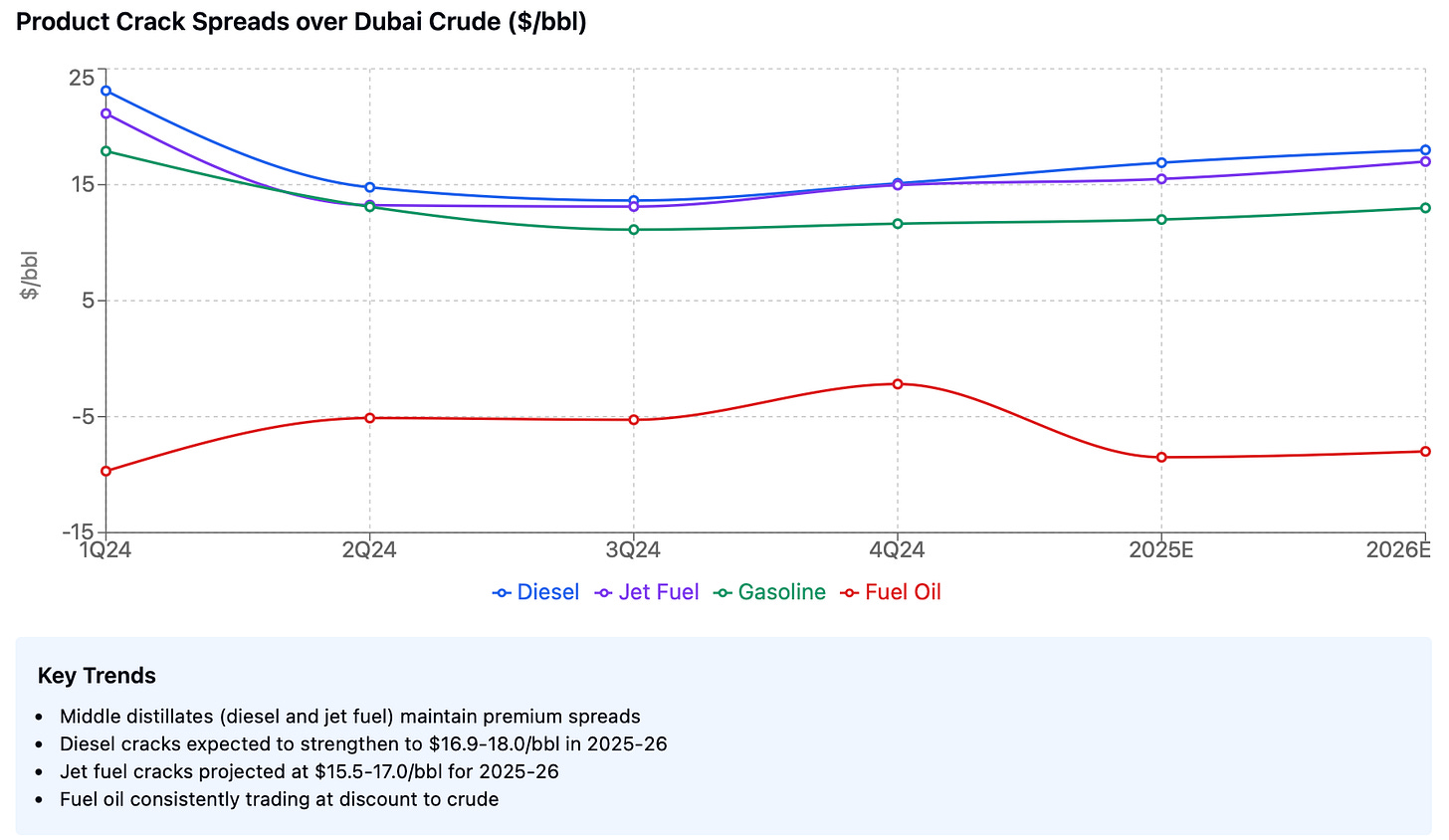

Singapore complex GRMs are forecast to recover to $5.7-$5.6 per barrel in 2025-2026, exceeding the historical mid-cycle average of $5.2 per barrel. Key drivers include rising middle distillate demand and a shift toward lower crude premiums as new, more efficient refining capacity from the Middle East enters the market. Diesel and jet fuel cracks are expected to lead the recovery, with diesel cracks projected at $16.9-$18.0 per barrel and jet/kerosene cracks at $15.5-$17.0 per barrel. This reflects robust demand for high-margin products in both domestic and export markets.

Leading regional refiners are well-positioned to benefit from these dynamics. Thai Oil, for example, is undergoing a transformative expansion with its Clean Fuel Project (CFP), which will add 125,000 barrels per day (bpd) to its capacity and significantly improve its ability to process lower-cost, heavier crude oils. Once operational by 2026-28, CFP is expected to enhance Thai Oil’s gross refining margins by $2-$4 per barrel, aligning with tightening regional dynamics and the rising demand for cleaner fuels. Similarly, Viva Energy in Australia leverages government-supported refining margins and a diversified product portfolio, while Reliance Industries in India benefits from strong domestic demand and its integrated petrochemical operations. The competitive positioning of these refiners underscores their ability to capitalize on improving margins and utilization rates.

Despite the positive outlook, risks remain. Competition from Middle Eastern refining giants such as Kuwait’s Al-Zour, Saudi Arabia’s Jazan, and Oman’s Duqm poses a significant challenge. These new complexes, designed to export large volumes of refined products efficiently, could put downward pressure on Asian refining margins. Additionally, while non-Chinese Asia is tightening its market, global refining capacity remains ample, creating potential headwinds for GRMs should demand falter or new capacity come online faster than anticipated.

Overall, the refining landscape in non-Chinese Asia is transitioning toward tighter supply-demand dynamics, with refiners in the region benefiting from higher utilization rates and improved GRMs. However, the success of this shift will depend on the region’s ability to balance capacity rationalization with demand growth, while also addressing competitive pressures from other global players. Thai Oil, among others, is well-positioned to navigate this evolving landscape and emerge stronger post-2026, supported by its strategic investments and alignment with clean fuel trends.

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.