AS 2024 rolls to a close, 2025 becomes that much more real, so let’s get ready for it! This is the second instalment of our 2025 Outlook series, focusing on equities and key themes therein. The third instalment will be with stock ideas and thoughts on stock selection, it will be published on Boxing Day and will be for full subscribers only. If you are interested, do please subscribe and/or upgrade.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

Stylistic note: I have stopped doing the automatic USD conversion for amounts, as it seems to only have generated requests for GBP and CAD and AUD lines, which, while not difficult to implement just makes every number 2 lines long, and thats too much. I think, Dear Reader, you should be able to convert the RMB value in to any currency you need with relative ease these days, so to streamline the text i’m sticking to RMB only, unless it seems appropriate that a USD amount needs stating.

Following our comprehensive analysis of the Chinese economy’s outlook for 2025, we now turn to the equity market, building a narrative grounded in the broader economic environment and policy direction. As the world’s second-largest economy navigates a year of both opportunity and uncertainty, the equity market is set to reflect these dynamics, shaped by domestic recovery efforts, global macroeconomic trends, and structural transformation priorities.

Our outlook takes a theme-based approach, reflecting the key drivers that will underpin market performance. While sectoral insights naturally intersect with these themes, this structure allows us to focus on the forces shaping investor sentiment, policy direction, and corporate performance.

These themes capture China’s strategic pivot toward innovation, sustainability, and domestic resilience, while addressing risks from geopolitical challenges and global economic headwinds. From the energy transition to infrastructure growth, from technological leadership to shifts in capital markets, these themes provide a roadmap for navigating the opportunities and challenges of China’s equity markets in 2025. There are a total of 8 themes (lucky number!).

China’s equity market in 2025 offers a compelling mix of growth and opportunities, supported by steady earnings, strategic policy measures, and evolving market dynamics. While risks such as trade tensions and deflationary pressures persist, investments in domestic consumption, infrastructure, and healthcare provide robust avenues for growth. By carefully navigating sectoral and thematic trends, investors can position themselves to capitalize on China’s continued economic evolution. So let’s explore those thematic trends in detail.

Valuations: Finding Value in a Divergent Market

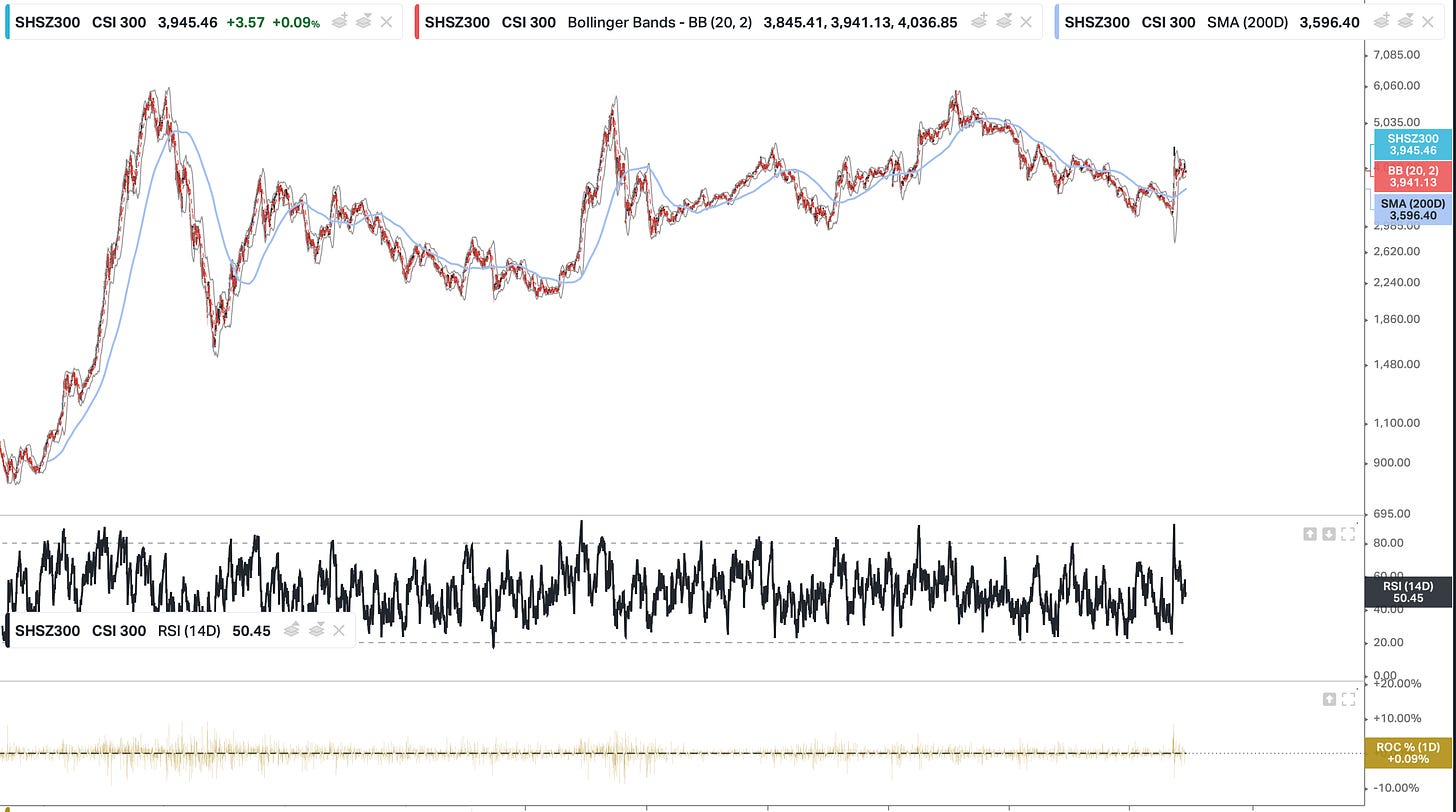

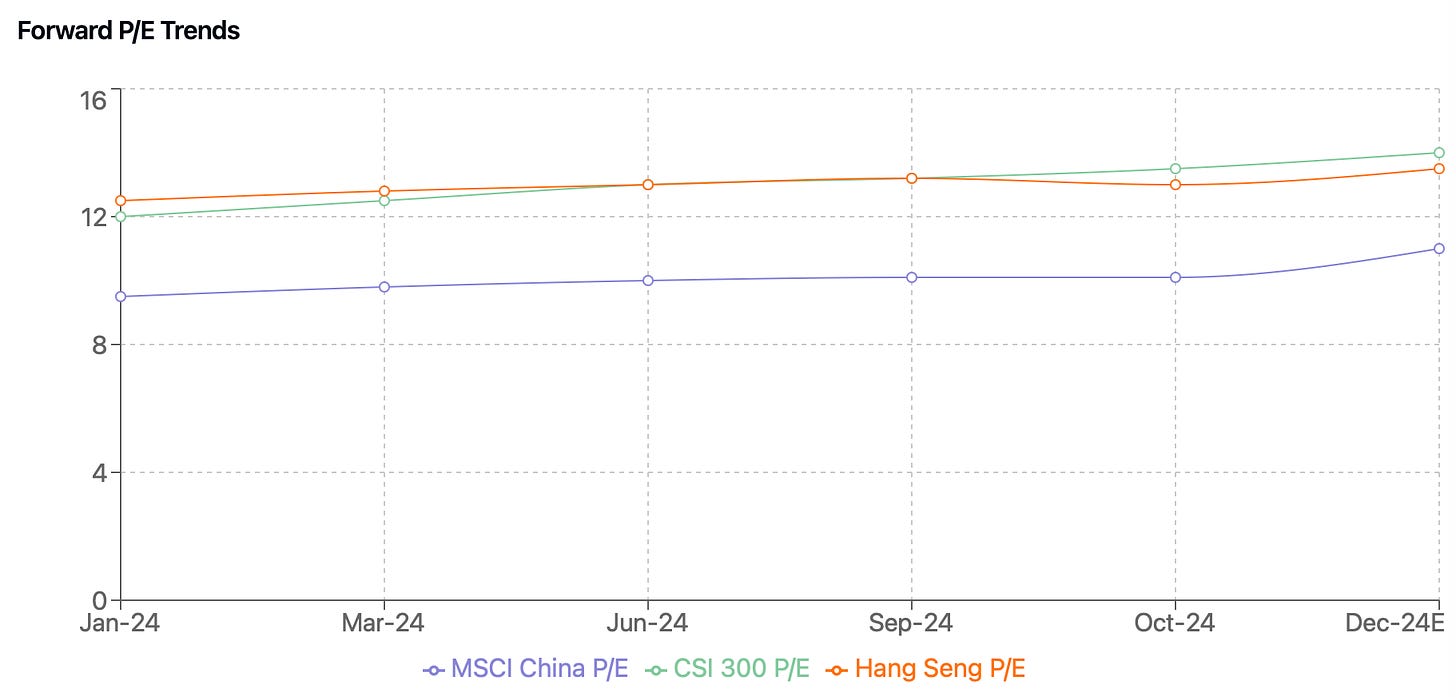

Let’s first acknowledge the obvious - Chinese Market has not performed for some time, and as such it is still over 40% off its ATH of 2007 ( 5800 level). This did not stop the chinese companies from increasing their earnings and growing thier footprint globally. As a result, Chinese equity valuations present a compelling opportunity in 2025, with significant dispersion across sectors creating both risks and opportunities. The MSCI China trades at 9.9x forward P/E (-0.7 standard deviations versus 10-year average) while the CSI300 trades at 13.5x (+0.7 standard deviations), reflecting different investor bases and market dynamics. This valuation divergence, combined with sector-specific opportunities, creates a rich environment for selective investors.

The "China discount" remains pronounced, with MSCI China trading at a 46% discount to developed markets and 23% discount to emerging markets ex-China. These discounts are at the high end of their historical ranges despite similar, if not better, earnings growth profiles for 2025. This suggests significant potential for multiple expansion as policy delivery and earnings growth materialize.

Sector valuations show remarkable dispersion. Consumer staples trade at 19x forward P/E but remain 1 standard deviation below historical norms. Healthcare, having underperformed in 2024, trades near cycle lows at 20x forward P/E with light positioning. Internet companies trade below mid-cycle PEs with attractive 0.6x PEG ratios, making their AI optionality appear inexpensive. The banking sector, at 5.5x forward P/E and 0.7x P/B, reflects ongoing concerns but offers value as asset quality stabilizes.

Policy support is creating valuation catalysts. The infrastructure sector trades at 8x forward P/E with strong earnings visibility, supported by fiscal stimulus. Advanced manufacturing valuations are recovering, with industrial automation trading at 15x forward P/E, reflecting expectations of higher capital expenditure. These sectors benefit from both policy tailwinds and structural growth drivers.

Regional comparisons highlight China's relative value. While ASEAN markets trade over 1 standard deviation cheap and India/Taiwan trade 2 standard deviations expensive, China's mixed picture offers selective opportunities. Hong Kong's market, at 13x P/E (-1 standard deviation), presents particular value given strong southbound flows and improving sentiment.

Our top-down PE model suggests MSCI China should trade at 11x forward P/E (12.5x on a median stock PE basis) and around 14x for CSI300 by end-2025. This forecast incorporates potential growth and liquidity impacts from higher US tariffs and Chinese fiscal policy responses. We estimate that every RMB1 trillion of additional fiscal stimulus could improve index PE by 0.7 points, everything else being equal.

From an investment perspective, we identify several opportunities. First, sectors trading at historical discounts with clear catalysts for re-rating offer compelling value. Second, companies with strong earnings visibility and policy support provide a margin of safety at current valuations. Third, stocks with improving shareholder returns and governance metrics could see multiple expansion.

The valuation dispersion across China's core industries reveals a fascinating story about market expectations and sectoral dynamics. Traditional infrastructure and utility sectors like Telecommunications (40.3x) and Electric Utilities (27.1x) command premium valuations, reflecting their stable cash flows and policy support. Growth sectors like Semiconductors (20.5x) and E-commerce (22.9x) trade at above-average multiples, suggesting market confidence in China's technological advancement. However, traditional consumer and financial sectors show much more modest valuations, with Banks at 9.6x and Retail at 5.3x, potentially indicating concerns about economic growth and consumer spending. Most notably, Airlines (1.7x) and Energy sectors (Oil & Gas at 3.8x, Solar at 3.0x) trade at deep discounts, reflecting both cyclical pressures and structural challenges. This valuation landscape suggests investors are placing a premium on policy-supported sectors while remaining cautious on consumer and cyclical industries.

Valuations represent both opportunity and challenge in 2025. While aggregate market valuations appear undemanding, success will require careful sector and stock selection, focusing on areas where fundamentals support multiple expansion, which is where thematic breakdown comes in.

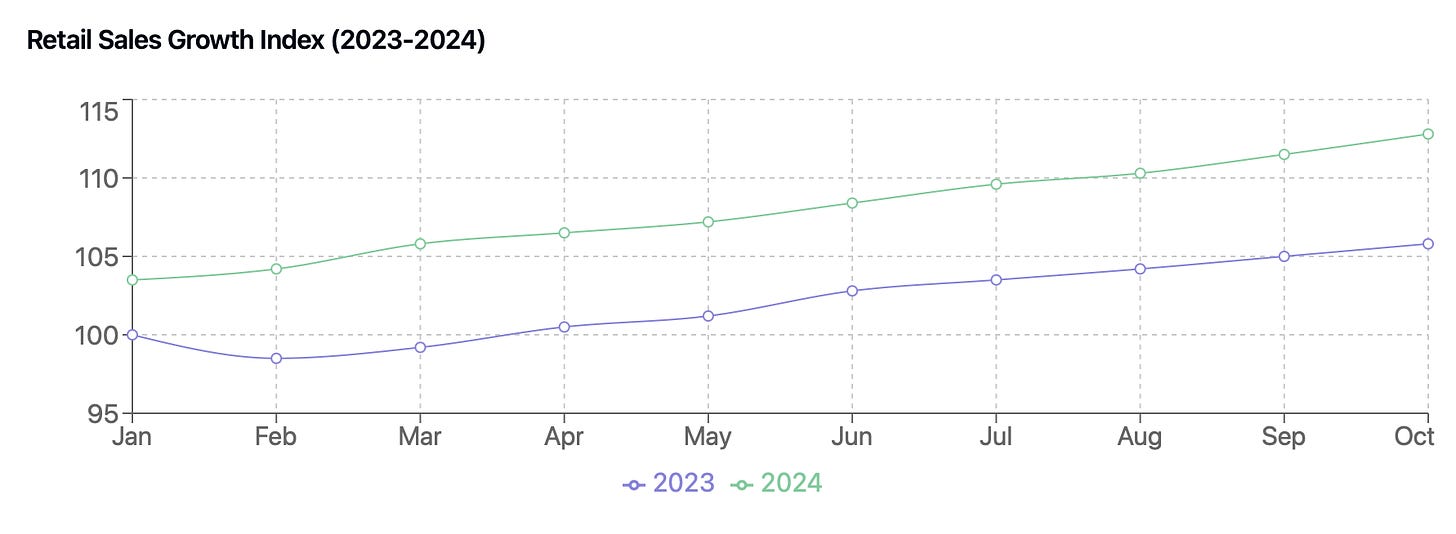

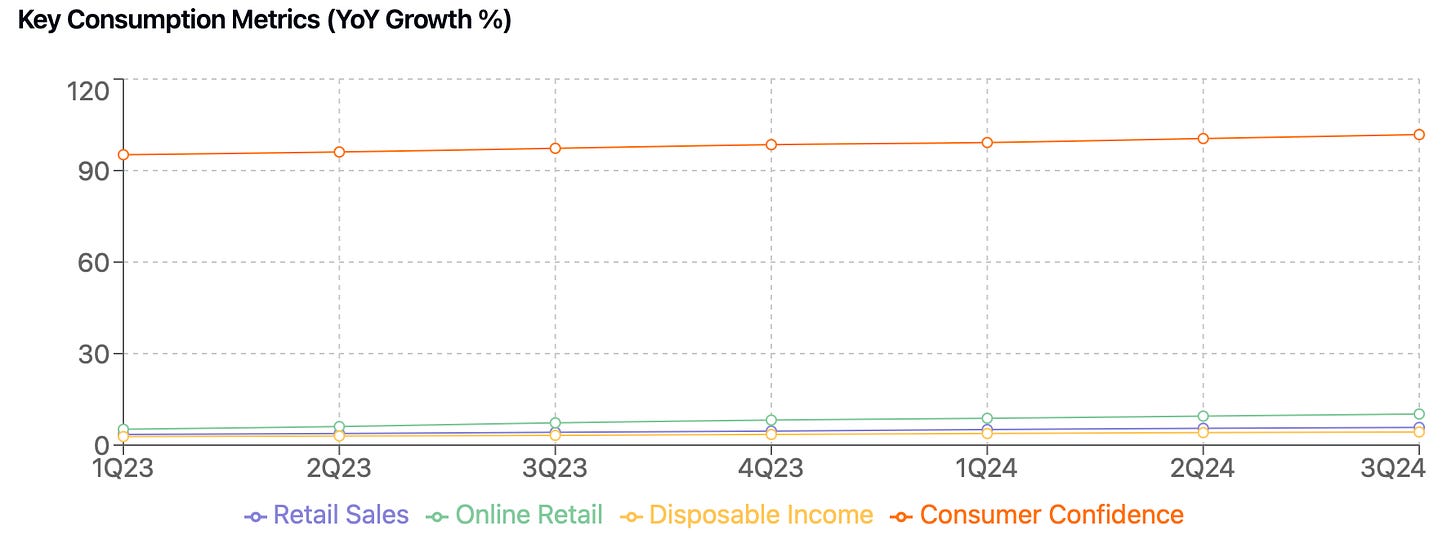

Theme 1. China's Domestic Consumption Revival

In a year where global markets face mounting uncertainties, China's domestic economy is showing clear signs of acceleration. The data tells a compelling story: retail sales have climbed steadily from 5.1% year-over-year growth in Q1 2024 to 5.8% in Q3, while online retail growth has surged even more impressively to 10.2%. This isn't just a cyclical bounce – the numbers point to a structural shift in China's economic model. While November data was somewhat disappointing, overall annual trends remain much better than the narrative would suggest.

Total retail sales reached RMB44.7 trillion in the first ten months of 2024, with online penetration hitting 28.2% – up 2.1 percentage points year-over-year. More importantly, this growth is built on solid fundamentals: urban disposable income is up 4.3% year-over-year, while rural incomes have grown 4.1%. The consumer confidence index has reached 101.8, its highest level since 2021.

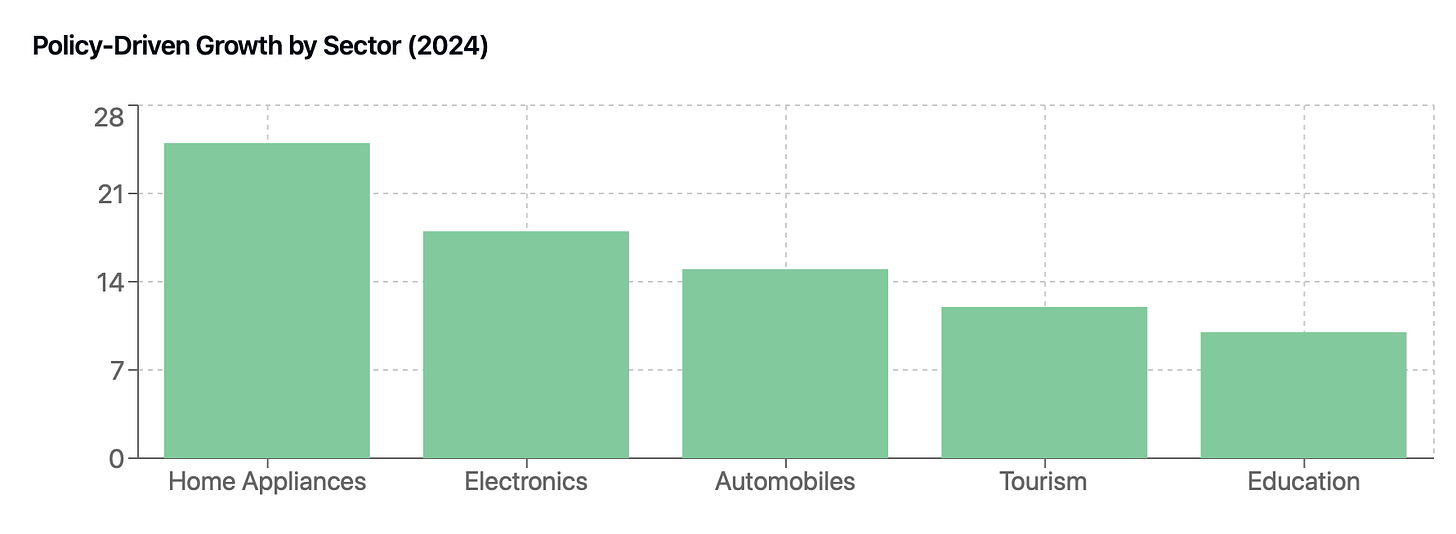

What's driving this revival? Beijing's policy playbook has evolved significantly. The government has deployed RMB150 billion in special bonds specifically for trade-in programs, and the results are striking. Home appliance sales have jumped 25% year-over-year, automobile sales are up 18%, and consumer electronics have grown 15%. These aren't just headline numbers – the subsidy transmission is remarkably efficient, with a 68% trade-in conversion rate in the automotive sector for example.

The standout story is in home appliances, where subsidies averaging 15% of purchase prices have driven an 8 percentage point increase in market penetration. Average ticket sizes are up 22% year-over-year, suggesting consumers aren't just buying – they're upgrading.

In the automotive sector, the narrative is equally compelling. New Energy Vehicle (NEV) penetration has reached 35.8% as of Q3 2024. Perhaps more telling is the 24% growth in Tier 3-4 city sales, indicating the consumption revival is broadening beyond wealthy coastal regions.

Behind the consumption story lies an equally important trend: China's push for technological self-sufficiency is bearing fruit. Robot density has increased to 322 per 10,000 workers, up from 296 in 2023. Domestic brands now command 41.5% of the industrial automation market, a 5.2 percentage point jump year-over-year. Industrial software revenue has hit RMB2.85 trillion, growing at 16.8%.

The semiconductor sector tells a similar story. Domestic chip production is up 32% year-over-year, with the equipment localization rate reaching 28%. R&D investment in the sector has surged to RMB89.5 billion, a 25% increase from the previous year.

The property-adjacent consumption recovery is equally noteworthy. Home improvement spending is up 8.2%, furniture sales have grown 12%, and the home appliance replacement cycle has shortened to 5.2 years from 6.1 years.

The recovery isn't uniform across China. Tier-1 cities are leading with 7.2% retail sales growth and 12.5% growth in service consumption. Their per capita disposable income has reached RMB78,500. Lower-tier cities are growing more modestly at 4.8%, but show strong policy subsidy utilization at 82%.

Forward-looking indicators suggest this momentum could accelerate. The purchase intention index stands at 105.2, up 3.8 points year-over-year. Manufacturing capital expenditure is growing at 15.2%, while R&D spending is up 18.5%. Most tellingly, inventory restocking cycles have shortened to 3.2 months from 4.1 in 2023, suggesting businesses are preparing for sustained demand growth.

Theme 2. Building China's Future: The Infrastructure Investment Theme for 2025

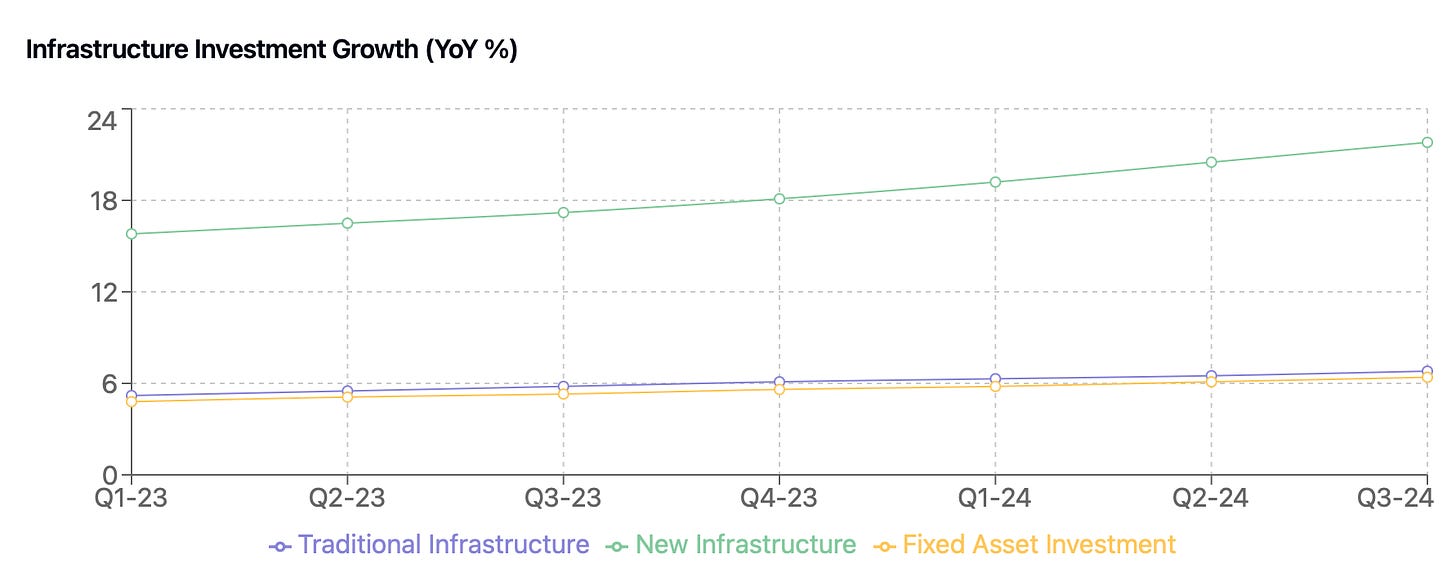

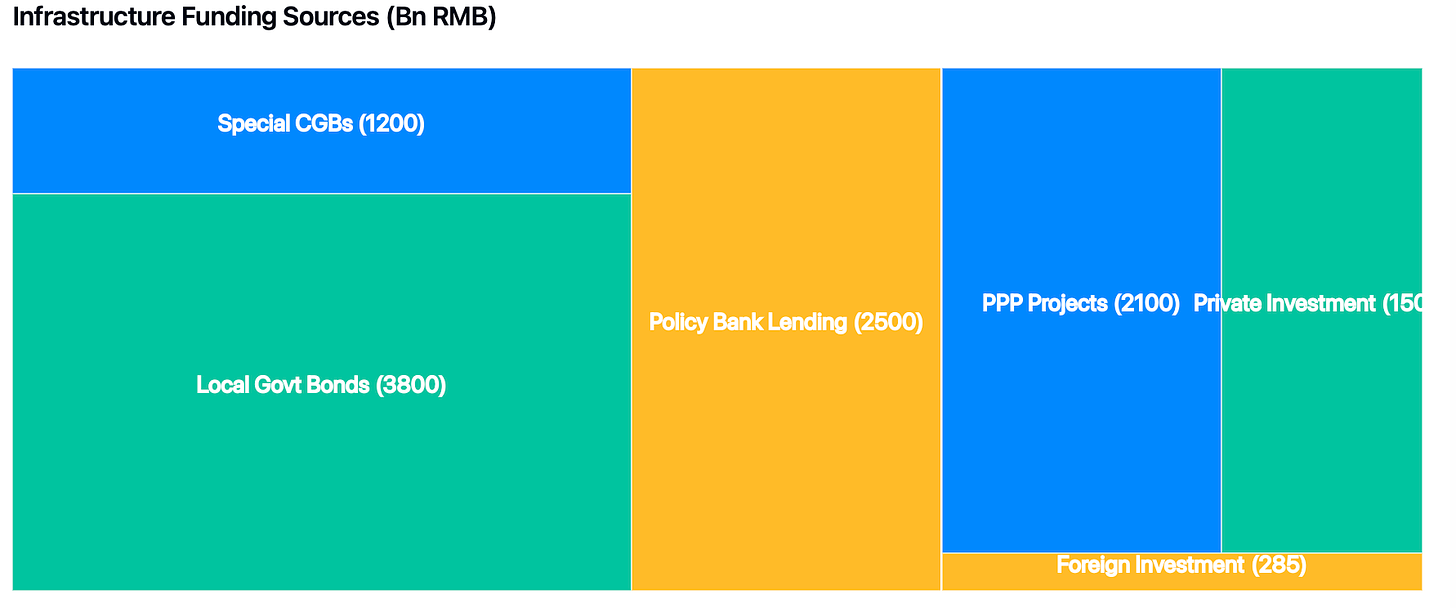

As China's markets enter 2025, one investment theme stands out with remarkable clarity: infrastructure spending is accelerating at its fastest pace since 2020. With new infrastructure investment growing at 21.8% year-over-year in Q3 2024, backed by a massive RMB1.2 trillion special CGB allocation, this isn't just another construction cycle – it's a fundamental reshaping of China's economic backbone.

Why Infrastructure Matters Now

The numbers tell a compelling story of acceleration. Traditional infrastructure investment, running at a steady 6.8% growth, is being dwarfed by new infrastructure spending. Digital economy investments have surged to RMB385 billion, with computing power expanding at a 32.5% CAGR. This twin-track approach – maintaining traditional infrastructure while aggressively building new – creates multiple investment opportunities.

But here's what makes this cycle different: completion rates have jumped to 82%, up from 76% in 2023. Higher execution rates mean faster returns on investment and more efficient capital allocation. For investors, this efficiency translates into more predictable earnings streams for infrastructure-related companies.

The ASEAN Angle: Beyond Borders

China's infrastructure story isn't confined to its borders. ASEAN markets are providing significant growth opportunities:

Indonesia's $28.5 billion infrastructure budget and $35 billion new capital city project

Vietnam's ambitious 3,000km highway target and $12.5 billion power project pipeline

Philippines' commitment to spend 5.5% of GDP on infrastructure

Chinese construction equipment manufacturers are particularly well-positioned here, with export growth to ASEAN markets exceeding 22% year-over-year.

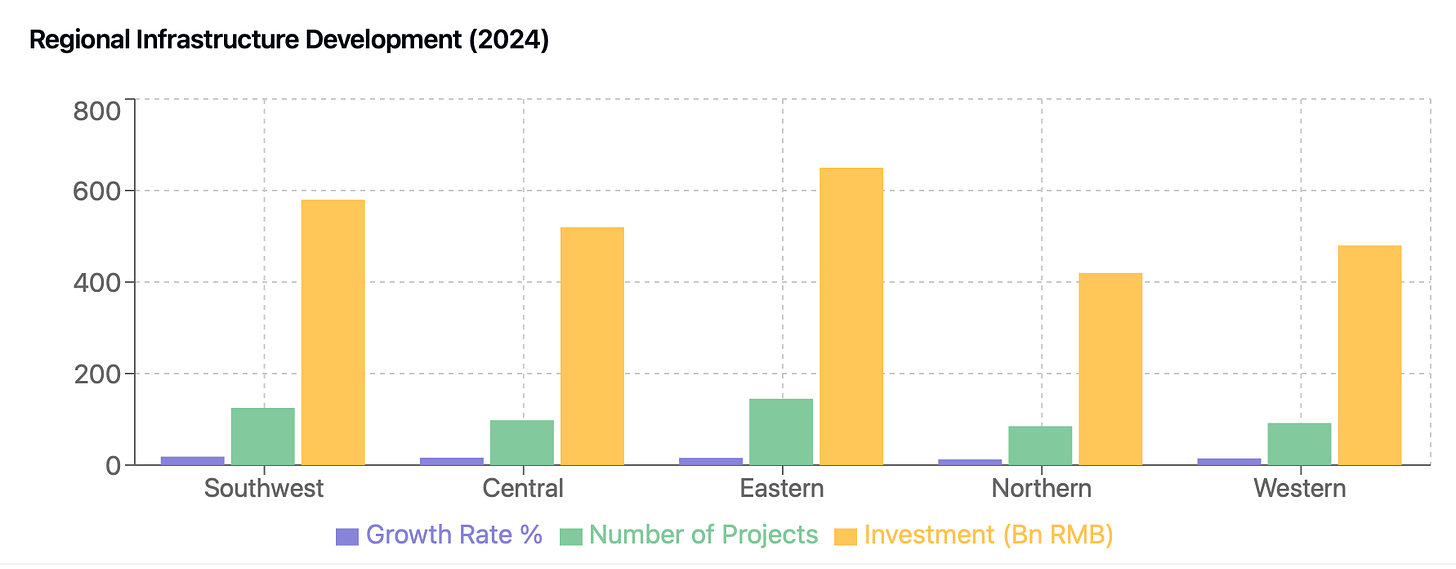

Despite strong growth prospects for infrastructure development in China in 2025, several risks warrant investor attention. Regional variations in execution efficiency could pose challenges, with the Southwest region showing high growth of 18.5% but experiencing significant project delays of 15%, while the Central region reports 16.2% growth alongside 9% cost overruns. In contrast, the Eastern region is the most efficient, with only 5% cost overruns. Funding risks also remain a key concern, including elevated local government debt levels, varying rates of private capital participation, and uncertainties surrounding the availability of international funding. These factors underscore the importance of careful regional and project-specific analysis for infrastructure investments.

The infrastructure investment theme shows strong momentum into 2025, supported by:

RMB7.5 trillion in government funding

32% year-over-year growth in new project approvals

85% implementation rate

78% equipment utilization rates

For investors, the key is identifying companies that can capitalize on both domestic and ASEAN opportunities while maintaining cost discipline and execution efficiency. The combination of traditional and new infrastructure spending creates a robust opportunity set, particularly for companies positioned at the intersection of digital transformation and physical infrastructure.

What makes this theme particularly attractive is its relative independence from global market volatility, anchored instead in domestic policy priorities and regional development needs. With clear policy support, improving execution metrics, and expanding regional opportunities, infrastructure remains one of the most compelling China investment themes for 2025.

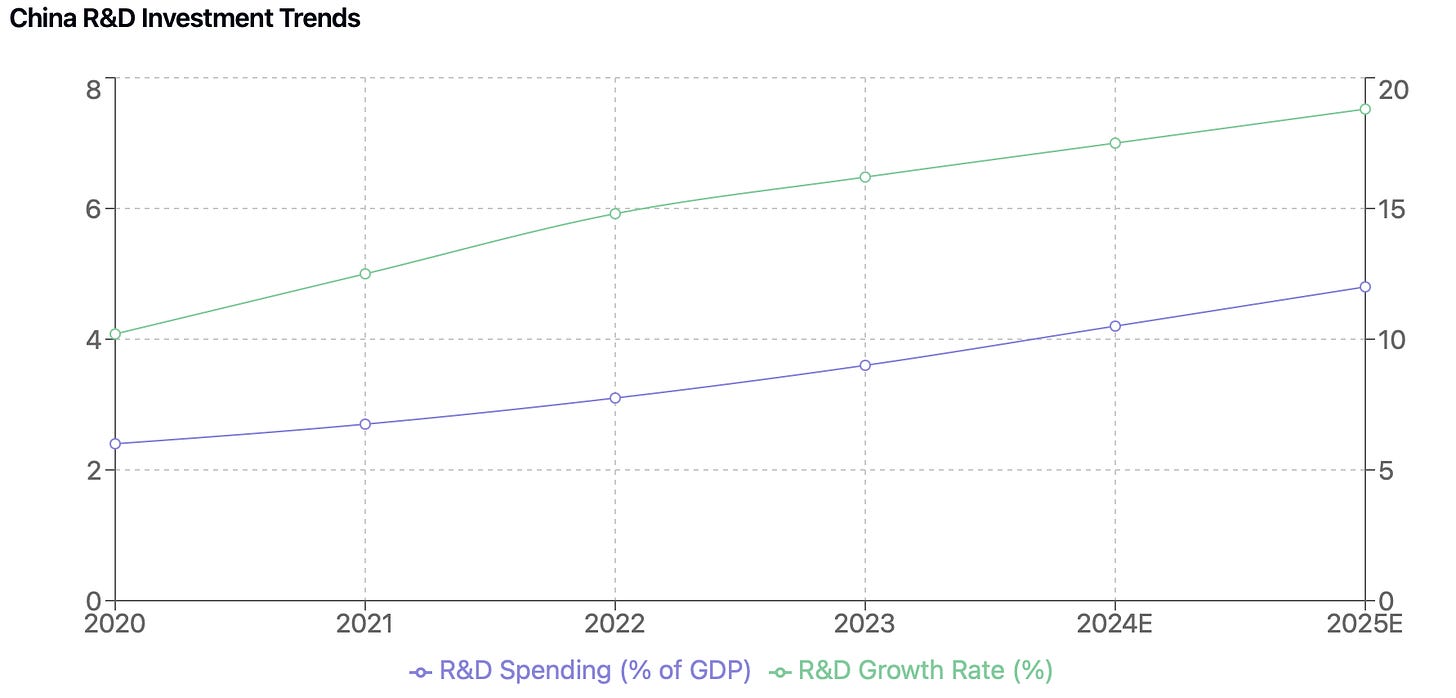

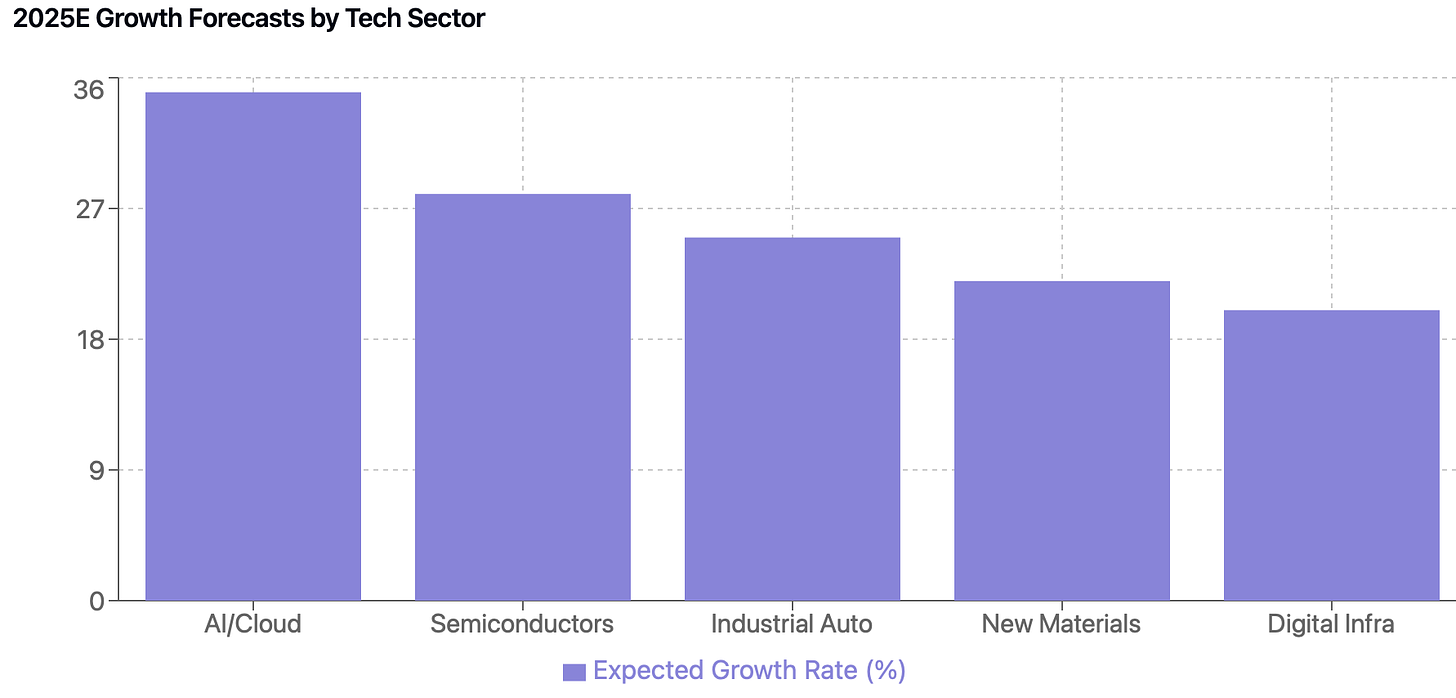

Theme 3. Technology Innovation & Self-Reliance: Strategic Priority Driving Investment Opportunities

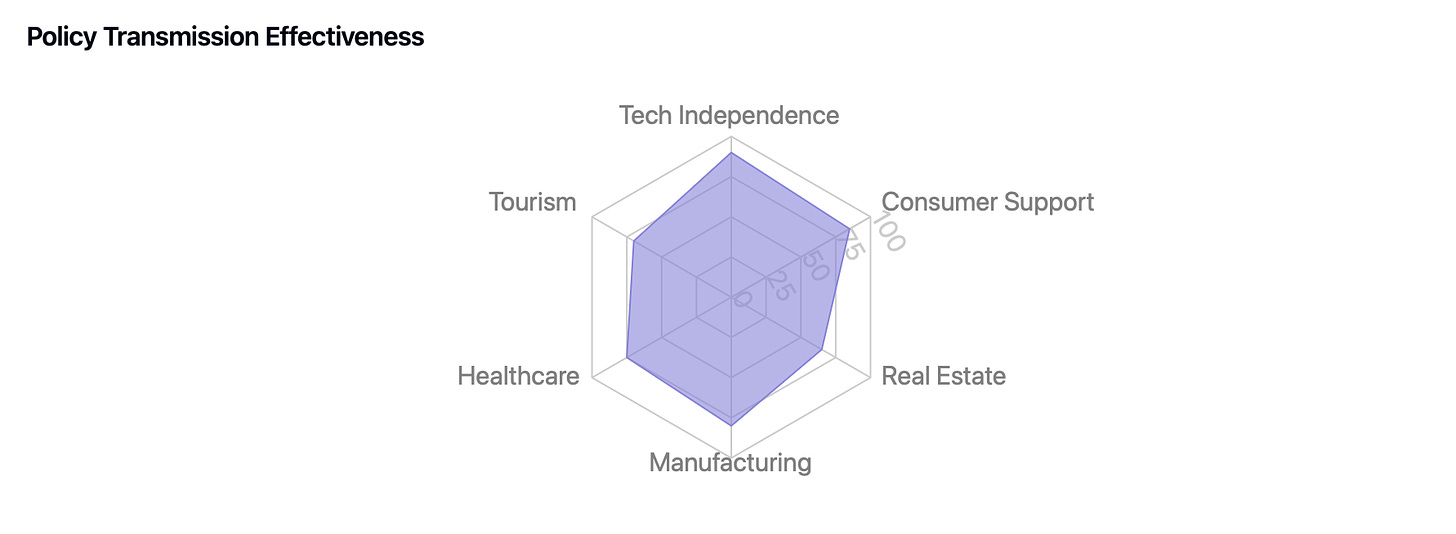

Technology innovation and self-reliance have emerged as central themes shaping China's economic and investment landscape in 2025. With growing geopolitical uncertainties and the need for supply chain resilience, this strategic push is creating significant investment opportunities across multiple sectors. The government's emphasis on technological independence extends beyond rhetoric to concrete policy support, including strengthening foundational industries subject to overseas restrictions, increased R&D investment with greater private sector participation, and focus on core technology breakthroughs in strategic sectors.

In the advanced manufacturing space, we see particularly compelling opportunities. Companies focusing on industrial automation, robotics, and high-precision machine tools are positioned to benefit from the equipment upgrading and renewal programs. The push for smart manufacturing solutions and advanced manufacturing processes, including 3D printing, is driving demand for domestic technology solutions. This trend is further amplified by the government's emphasis on import substitution in key technological areas.

The semiconductor sector represents another critical investment opportunity. As China seeks to reduce dependence on foreign technology, domestic semiconductor equipment manufacturers, materials providers, and chip design firms with proprietary IP are gaining strategic importance. The focus extends beyond basic chip manufacturing to include the entire semiconductor ecosystem, from design and manufacturing to testing and packaging. Government support and increasing private sector investment are accelerating the development of domestic capabilities.

Digital economy infrastructure presents a third major investment avenue. The rapid growth in data center demand, coupled with the push for high-performance computing solutions, is creating opportunities for equipment providers and operators. Cloud service providers with AI capabilities are particularly well-positioned as businesses accelerate their digital transformation. The integration of AI across industries is driving demand for specialized hardware and software solutions.

The new materials sector is emerging as a foundational element of technological self-reliance. Companies developing advanced composites, novel semiconductor materials, and specialty chemicals for tech applications are seeing increased demand. This sector is crucial for both traditional manufacturing upgrade and emerging technology development, particularly in areas like renewable energy and advanced electronics.

However, investors need to be mindful of several risks. Execution risk in technology development, potential overcapacity in certain sectors, and ongoing geopolitical tensions affecting supply chains are key concerns. Competition intensity in strategic sectors and policy implementation uncertainties also require careful consideration.

The intersection of policy support and market demand in this theme provides a more sustainable investment case compared to purely policy-driven sectors. Success will likely accrue to companies that combine genuine technological capabilities with strong market positions and alignment with national strategic priorities.

Technology Innovation and Self-Reliance: Driving China’s 2025 Growth Agenda

As China navigates a rapidly evolving geopolitical landscape, technology innovation and self-reliance have emerged as core priorities for its economic and industrial strategy in 2025. Recognising the critical importance of reducing dependence on foreign supply chains and fostering homegrown innovation, the Chinese government is placing technology at the centre of its development plans. This approach not only addresses current external pressures but also lays the foundation for sustainable growth and global competitiveness in key industries.

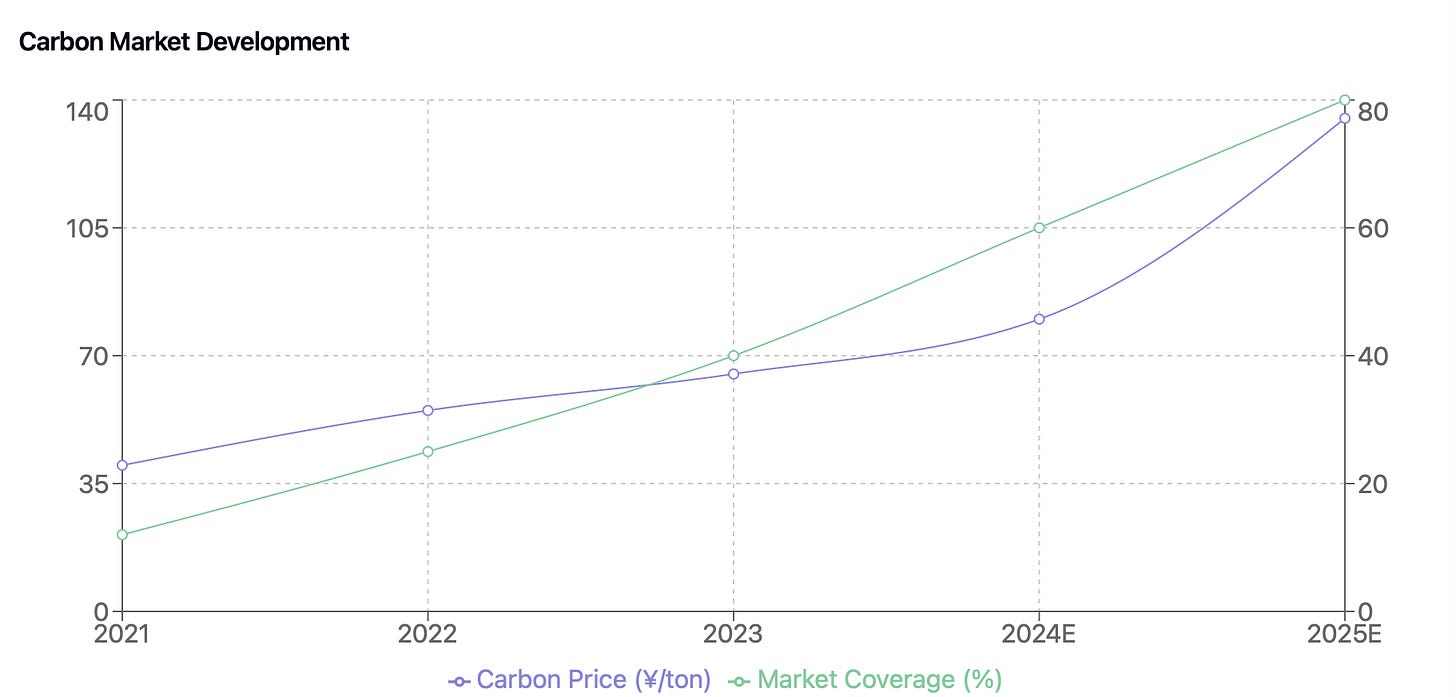

Theme 4. Energy Transition: Capitalising on China's Green Revolution

China's commitment to energy transition has moved from aspiration to action, with 2025 marking a crucial year in this transformation. The implementation of the new Energy Law, combined with expanding carbon markets and ambitious renewable energy targets, creates compelling investment opportunities across multiple sectors. Our analysis suggests this theme will be a key driver of both policy and capital allocation throughout 2025.

The renewable energy sector is experiencing unprecedented growth, with installed capacity expected to reach new highs in 2025. Solar installations are projected to exceed 180GW in 2025, up from 150GW in 2024, while wind power installations are forecast to reach 75GW. This expansion is supported by technological advancement, with N-type TOPCon technology rapidly gaining market share in the solar sector and expected to reach 65% of new installations by year-end 2025.

Carbon markets represent another significant opportunity, as China expands its Emissions Trading System (ETS) to include more sectors. The market is projected to cover 80% of the country's total greenhouse gas emissions by end-2025, up from 40% in 2024, as cement, steel, and aluminum sectors join the scheme. Carbon prices are expected to rise from current levels of RMB80/ton to RMB120-150/ton by end-2025, creating meaningful incentives for industrial decarbonization.

The nuclear sector is emerging as a crucial component of the energy transition, particularly given its role in supporting high-energy-demand technologies like AI. With approximately 10 new nuclear units approved annually and construction times averaging 5-6 years, we expect the nuclear fleet to grow significantly. The sector's importance is underscored by tech companies' growing interest in nuclear power for data centers, with several major firms already announcing nuclear-powered facility plans.

Energy storage and hydrogen technologies are poised for substantial growth. Grid-scale storage capacity is forecast to double in 2025, reaching 100GWh, while the hydrogen industry is expected to see investment of RMB400 billion throughout the year. These developments are crucial for grid stability and industrial decarbonization, particularly in hard-to-abate sectors.

ESG considerations are increasingly influencing capital allocation. Green bond issuance is projected to reach RMB1.5 trillion in 2025, up 40% year-over-year, while ESG-labeled funds are expected to grow to RMB800 billion in assets under management. The implementation of mandatory ESG reporting requirements for large companies starting in 2025 will further accelerate this trend.

However, investors must navigate several risks. Overcapacity concerns in sectors like solar and power batteries require careful stock selection, focusing on technology leaders rather than pure capacity plays. Policy implementation risk, particularly around the new Energy Law and carbon market expansion, could create near-term volatility. International factors, including the EU's Carbon Border Adjustment Mechanism (CBAM), may affect export-oriented companies in carbon-intensive sectors.

The energy transition and ESG theme represents a structural shift in China's development model, supported by both policy imperatives and market forces. While challenges exist, particularly around overcapacity and policy implementation, we believe this theme offers compelling long-term investment opportunities for discerning investors.

Theme 5. Geopolitical Hedging: Navigating Trade Tensions and Global Realignment

Geopolitical tensions have emerged as a defining investment theme for 2025, with US-China trade relations at a critical juncture. The anticipated increase in US tariffs, potentially rising to 60% by year-end 2025, combined with broader global protectionist measures, is reshaping trade flows and creating both risks and opportunities across sectors, requiring careful portfolio positioning. We have tried to model the “bad case” of trade tensions and lack of deal between US and China, or even progress towards a deal. This is not our base case, but the motto of this section is “Prepared!”

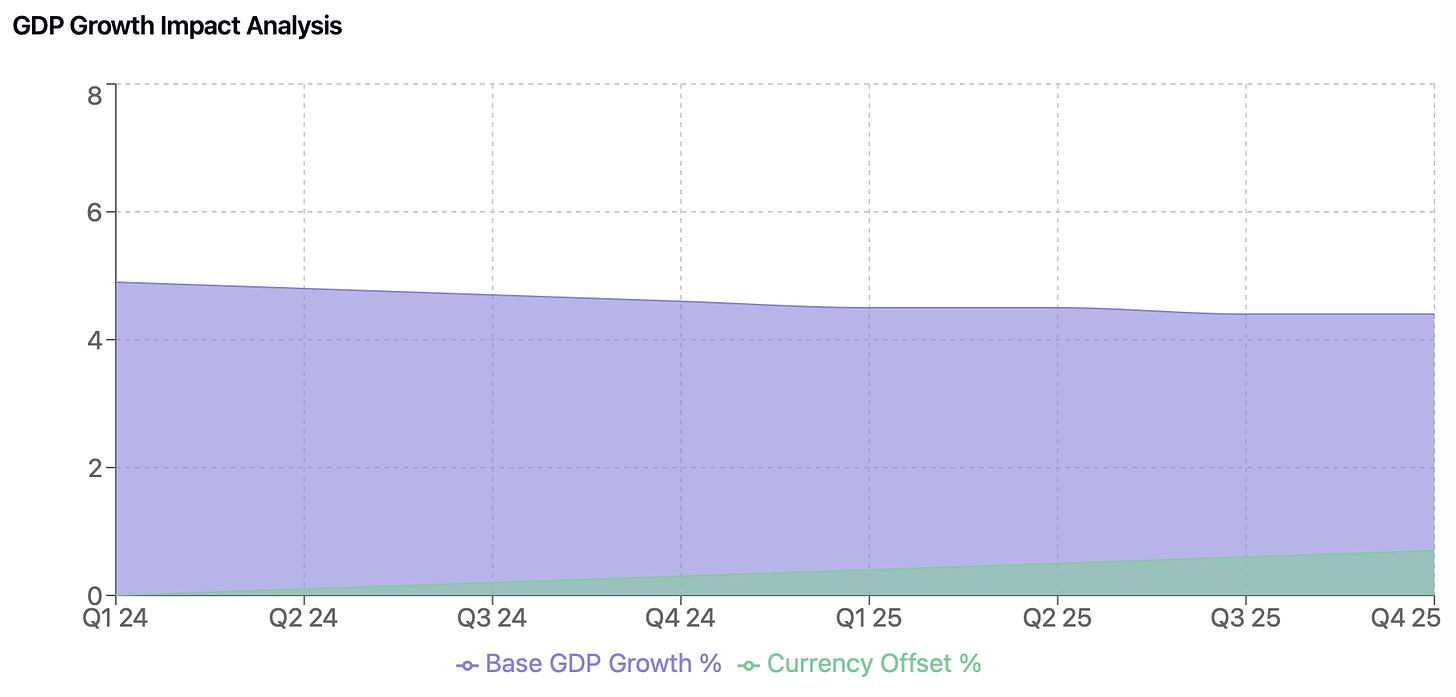

The impact of increased tariffs is expected to be substantial, with our analysis indicating a potential 0.7-1.0 percentage point reduction in China's GDP growth for 2025. This effect will be particularly pronounced in export-oriented sectors, where we project a decline in export growth to -0.9% in 2025 from 6.6% in 2024. The manufacturing sector, especially in intermediate and capital goods, faces the greatest exposure to these headwinds.

Currency dynamics will play a crucial role in offsetting these pressures. The CNY is expected to depreciate to 7.50 against the USD by end-2025, providing some cushion for exporters. Historical data shows that every 1% depreciation in the CNY typically offsets approximately 0.3-0.4% of tariff impact on corporate margins. This relationship suggests that the projected 3-4% currency depreciation could mitigate roughly one-third of the tariff effects.

Trade diversification efforts are accelerating, with China's trade with Belt and Road Initiative (BRI) countries projected to grow 15% in 2025, compared to 8% growth in overall trade. This shift is particularly evident in sectors like electronics and machinery, where BRI countries' share of China's exports is expected to reach 35% by end-2025, up from 28% in 2024.

Supply chain reconfiguration is another key trend, with the "China +1" strategy gaining momentum. Our analysis shows that 45% of surveyed multinational companies plan to diversify their supply chains away from China by 2025, with Vietnam, India, and Mexico as primary beneficiaries. However, this shift is gradual, with only 15-20% of affected production capacity expected to move in 2025.

However, investors must navigate several risks. The timing and extent of US trade actions remain uncertain, with potential for broader protectionist measures affecting multiple trading partners. Policy response effectiveness, particularly the balance between currency depreciation and domestic stimulus, could create market volatility. Additionally, second-order effects on global supply chains might create unexpected winners and losers.

The importance of this theme extends beyond 2025, as it represents a structural shift in global trade patterns. While near-term volatility is likely, companies that successfully adapt to this new environment by diversifying markets and strengthening domestic positions should emerge stronger.

Theme 6. Capital Market Evolution: The Great Institutionalisation

China's capital markets are undergoing a profound transformation in 2025, driven by accelerating institutionalization and policy support. The shift from retail-dominated to institutional-led markets, combined with reforms to attract long-term capital, represents a structural change in market dynamics. Our analysis suggests this evolution will be a key driver of both market stability and investment opportunities throughout 2025.

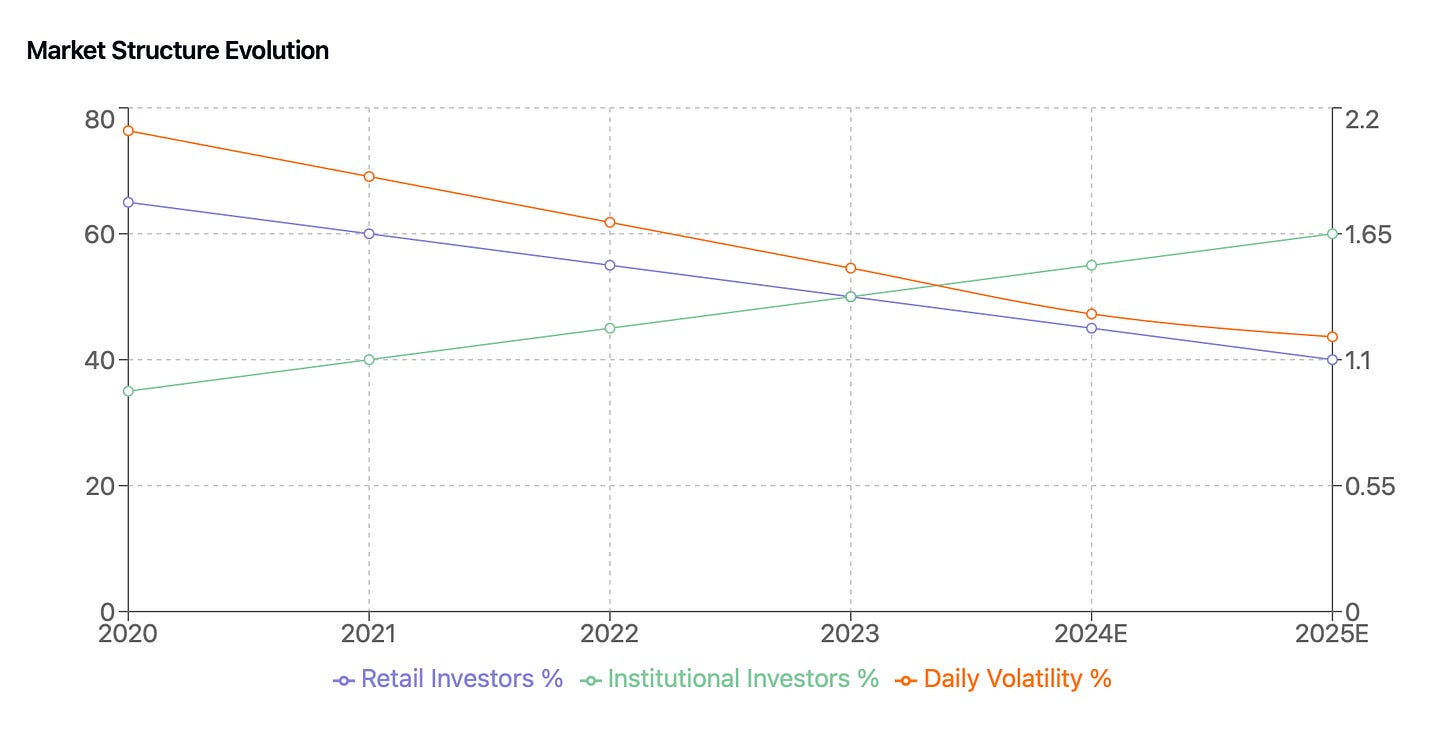

The institutionalisation trend is gaining momentum, with institutional investors expected to account for 60% of market activity by end-2025, up from 45% in 2023. This shift is particularly evident in the A-share market, where daily trading volatility has declined to 1.2% in 2024 from a historical average of 1.8%. The growing presence of long-term investors is fundamentally changing market behavior and pricing mechanisms.

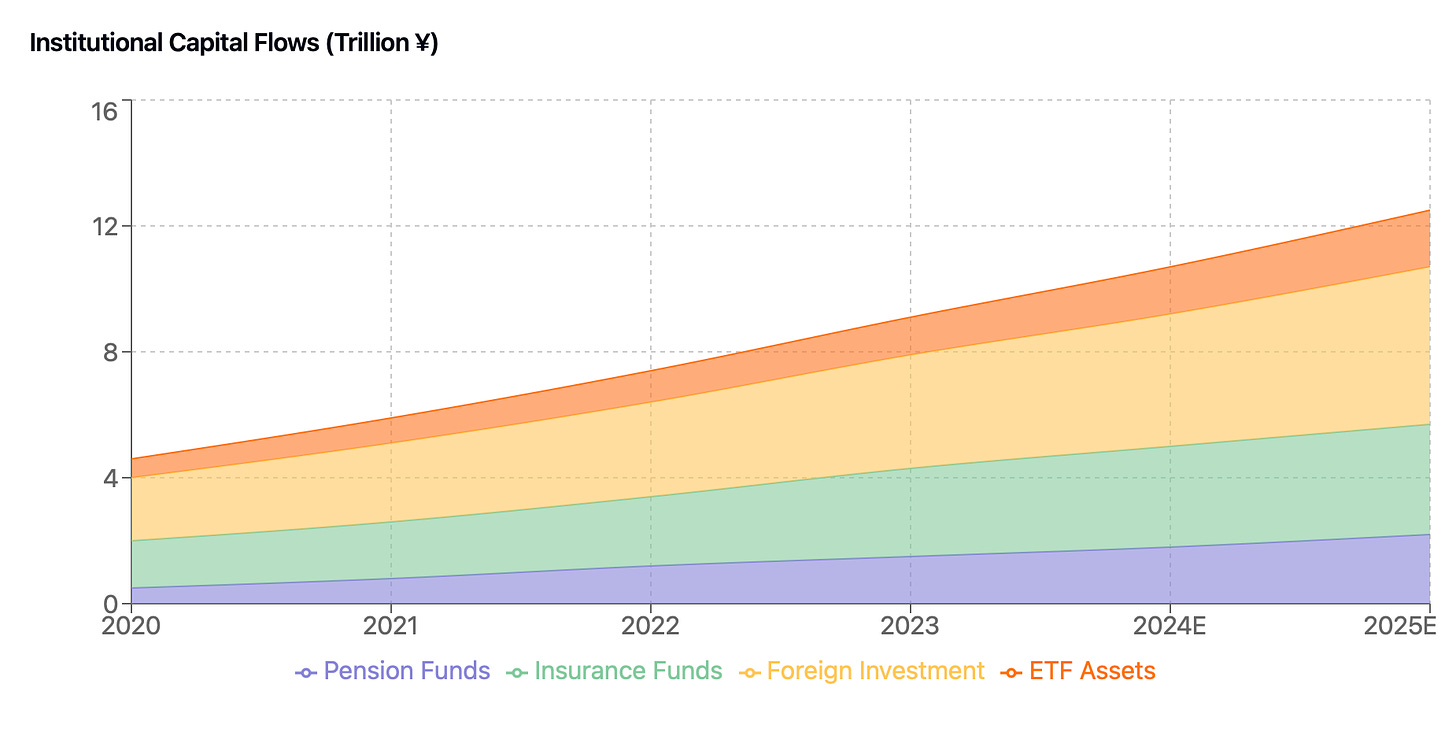

Capital flows are increasingly dominated by professional investors. Insurance funds' equity allocation is projected to reach RMB3.5 trillion by end-2025, representing a 40% increase year-over-year. ETF assets under management are expected to grow to RMB1.8 trillion, up from RMB1.2 trillion in 2024, reflecting both retail and institutional demand for passive investment vehicles.

Policy support has become more direct and innovative. The PBoC's securities, funds, and insurance companies swap facility (SFISF) and the share buyback lending facility represent unprecedented central bank involvement in capital markets. These facilities are expected to channel over RMB1 trillion of incremental funds into the stock market in 2025, providing crucial support for market stability.

Shareholder returns are improving significantly. Share buybacks reached RMB70 billion in 2024 and are projected to double in 2025, supported by policy initiatives and improved corporate governance. Dividend payout ratios for A-share companies are expected to reach 35% in 2025, up from 30% in 2024, bringing them closer to global standards.

The pension system reform is emerging as a crucial driver of market institutionalization. Private pension contributions are forecast to reach RMB2 trillion annually by 2025, with approximately 30% allocated to equity markets. This represents a significant source of long-term, stable capital that should help reduce market volatility.

We have done a separate review of the pension reform:

Cross-border flows are also evolving. Southbound Stock Connect flows averaged RMB2.9 billion daily in 2024 and are expected to grow further in 2025. Foreign ownership of A-shares is projected to increase to RMB5 trillion by end-2025, reflecting growing international confidence in China's market reforms.

However, investors should be mindful of risks. The transition from retail to institutional dominance could create near-term volatility in certain sectors. Policy implementation effectiveness, particularly around pension reform and market access, remains uncertain. Additionally, the pace of foreign investor participation could be affected by global geopolitical factors.

The capital market evolution theme represents a fundamental shift in China's financial system. While the transition may create some volatility, the long-term impact of institutionalization should be positive for market stability and investment returns.

Theme 7. Corporate Governance Evolution: From SOE Reform to Shareholder Value

Corporate governance reform has emerged as a defining theme for Chinese equities in 2025, driven by SASAC's landmark introduction of stock price performance as a KPI for SOE management. This shift, affecting RMB28 trillion in market value across 409 mainland-listed SOEs, represents a fundamental change in how Chinese companies approach shareholder value creation and market accountability.

The impact of these reforms is already visible in quantitative metrics. SOE dividend payout ratios are projected to reach 40% by end-2025, up from 32% in 2024, bringing them closer to global averages. Share buybacks among SOEs reached RMB35 billion in 2024 and are expected to double in 2025, supported by dedicated central bank facilities and management incentives. Return on Equity (ROE) for SOEs is forecast to improve to 11.5% in 2025 from 9.8% in 2024, driven by improved operational efficiency and capital allocation.

The reform extends beyond traditional financial metrics. Board independence at SOEs is expected to reach 45% by end-2025, up from 35% in 2024. ESG disclosure compliance is projected to hit 85% among large SOEs, compared to 60% in 2024. These improvements in governance structure and transparency are critical for attracting international capital and aligning with global standards.

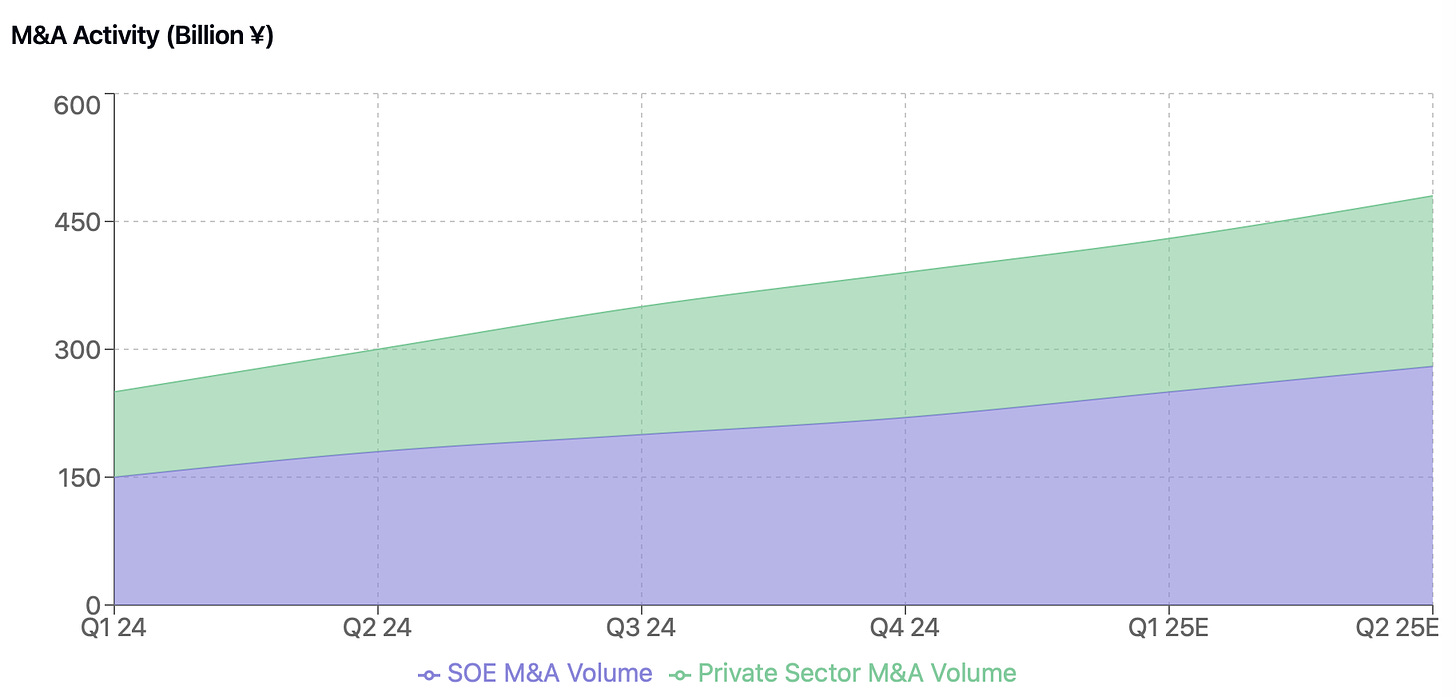

M&A activity is accelerating as a tool for value creation. SOE-led M&A volume is forecast to reach RMB800 billion in 2025, a 50% increase from 2024, focusing on strategic consolidation in key sectors like energy, telecommunications, and financial services. This consolidation is expected to improve sector profitability and create stronger national champions.

Private sector companies are responding to these changes. The average dividend payout ratio for private sector leaders is projected to reach 35% in 2025, up from 28% in 2024, as they compete for institutional capital. Corporate governance scores for private companies, as measured by major index providers, show continuous improvement, with the average score expected to reach 75 out of 100 by end-2025.

However, investors should consider several risks. Implementation of reforms may vary across regions and sectors, creating potential execution risk. The pace of improvement in shareholder returns could be affected by broader economic conditions. Additionally, increased M&A activity might not always create immediate shareholder value.

The governance reform theme represents a structural shift in China's corporate landscape. While implementation challenges exist, we believe this transformation will be a key driver of value creation and market performance in 2025 and beyond.

Theme 8. Bond Yields and Equity Appeal: The Great Asset Rotation

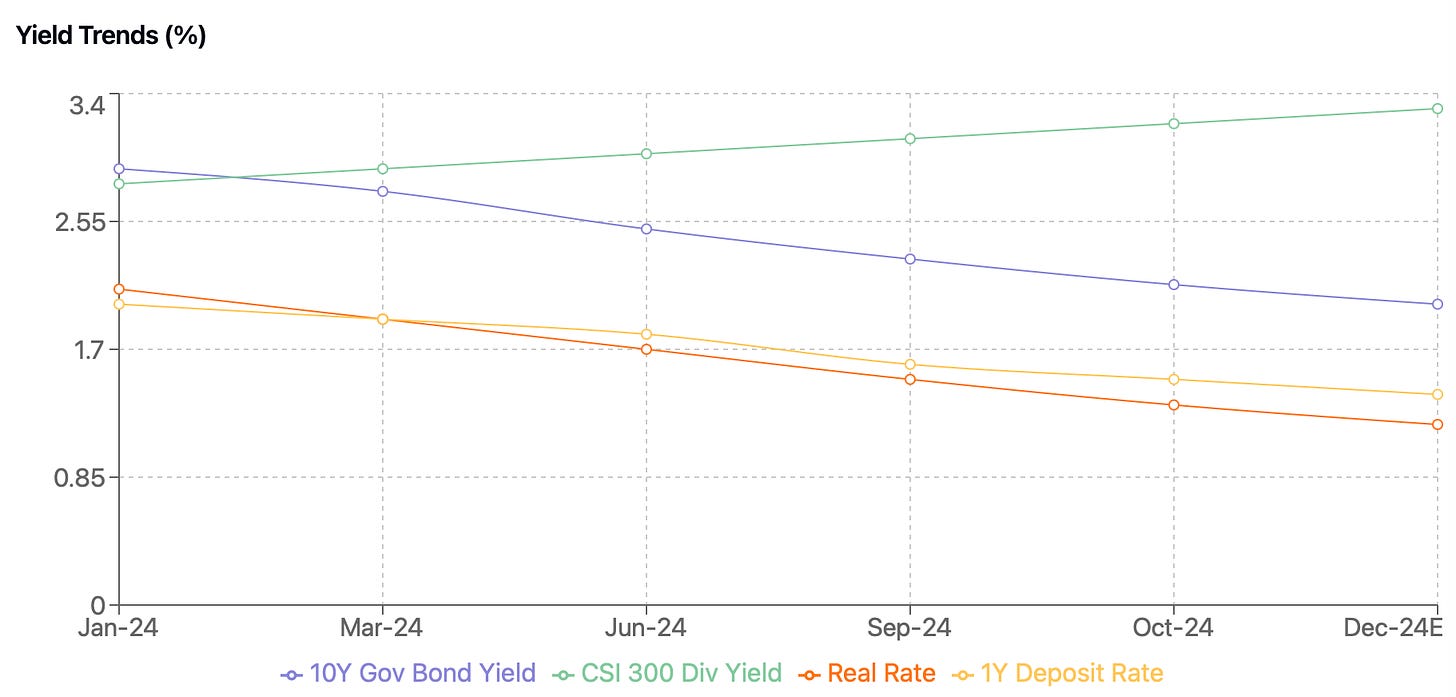

The declining trend in Chinese bond yields is creating a compelling case for equity investments in 2025. With the 10-year government bond yield falling to 2.13% by late 2024, and further monetary easing expected, the relative attractiveness of equities has strengthened significantly. This shift in yield dynamics is driving a fundamental reallocation of capital across asset classes.

The equity-bond yield gap has reached historically attractive levels. The average dividend yield for the CSI 300 stands at 3.2%, representing a positive spread of over 100 basis points compared to 10-year government bonds. This spread widens even further in sectors like utilities and financials, where dividend yields exceed 5%. High-quality SOEs are offering dividend yields of 4-7%, significantly outperforming bond returns and providing attractive risk-adjusted income opportunities.

Real rates have moved decisively into negative territory. With CPI at 0.8% and the 10-year yield at 2.13%, the real yield has declined to 1.33%, down from 2.1% in early 2024. This environment traditionally supports equity valuations, particularly for growth sectors where the present value of future earnings becomes more attractive in a low-rate environment.

Asset allocation shifts are becoming more pronounced. Insurance companies, with over RMB25 trillion in assets under management, are increasing their equity allocations from current levels of 12% toward their regulatory limit of 30%. Pension funds are similarly boosting equity exposure, with the National Social Security Fund targeting a 40% allocation to domestic equities by end-2025, up from 32% in 2024.

Corporate bond yields have also compressed significantly, with AAA-rated issuers now yielding below 3.5%. This compression is pushing investors up the risk spectrum and making equity investments, particularly in stable dividend-paying sectors, more attractive on a relative basis. The white goods sector, for example, offers a 5.3% dividend yield with potential for further increases in payout ratios.

However, investors should consider several risks. Further monetary easing might not materialize as expected, which could impact the relative attractiveness of equities. Global interest rate dynamics, particularly U.S. Federal Reserve policy, could influence domestic yields. Additionally, company-specific factors might affect dividend sustainability.

The yield environment represents a structural support for equity markets in 2025. While risks exist, we believe the combination of attractive yield spreads, negative real rates, and institutional flows creates a favorable backdrop for equity investments.

We hope these 8 themes have clarified the Chinese market’s 2025 prospects. For actionable recommendations, subscribe to the full Panda Experience. Gain access to in-depth insights, industry and trend updates, detailed company reports, and our exclusive Best Ideas Portfolio—your guide to navigating China’s evolving market opportunities.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**