Transforming China’s Pension System for Sustainable Growth

As mentioned in yesterday’s Weekly Wrap, the Ministry of Human Resources and Social Security (MOHRSS) and the China Securities Regulatory Commission (CSRC) jointly announced the nationwide rollout of private pension schemes during a press conference in Beijing on December 17, 2024. Effective December 15, this initiative introduces tax-advantaged accounts and expands retirement investment options by adding 85 new index funds. Aimed at increasing private savings and directing long-term capital into financial markets, this program represents a pivotal step in addressing the dual challenges of China’s aging population and the need for economic modernization.

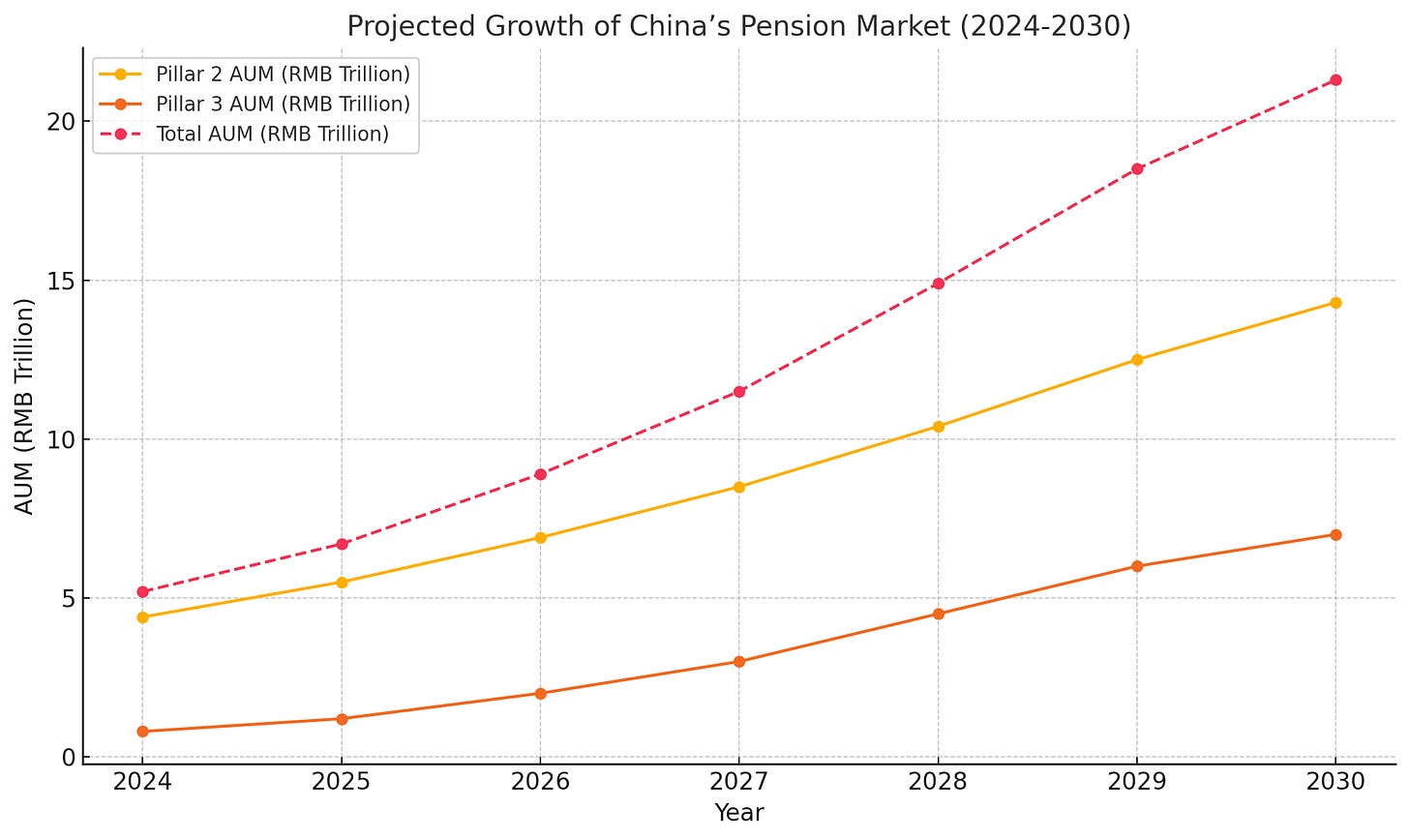

This reform underscores the government’s strategic focus on fostering a sustainable and inclusive retirement framework while unlocking significant opportunities for financial institutions, asset managers, and technology providers. With total pension assets projected to reach RMB 28 trillion by 2030, the initiative reflects a transformative shift in how retirement planning and funding are approached in the world’s second-largest economy, paving the way for long-term financial stability and growth.

The reform strategy focuses on enhancing the three-pillar pension system, encompassing basic pensions (Pillar 1), enterprise annuities (Pillar 2), and private savings (Pillar 3). Regulatory, operational, and investment frameworks are being revamped to streamline oversight, enhance transparency, and foster broader participation. Regulatory reforms aim to address the fragmented structure of pension oversight, which is currently divided among the National Council for Social Security Fund (NCSSF), the Ministry of Human Resources and Social Security (MoHRSS), and the China Securities Regulatory Commission (CSRC). By consolidating and simplifying the regulatory framework, the reforms seek to improve transparency and market accessibility. A unified licensing system will make it easier for stakeholders to navigate the market, while clearer guidelines will foster consistency and compliance.

Operational improvements target greater efficiency and broader adoption across all pillars. For Pillar 1, reforms involve allocating more pension assets to the NCSSF to enhance investment returns, which have historically underperformed global peers. Pillar 2 is set to benefit from potential mandatory enrollment for enterprise annuities, alongside the creation of centralized platforms designed to reduce administrative burdens and attract more small and medium enterprises (SMEs). Meanwhile, reforms to Pillar 3 include raising the current RMB 12,000 annual tax benefit cap and lowering the minimum age for pension savings products from 35 to 30, encouraging earlier and more consistent participation among younger contributors.

Investment reforms are unlocking growth and diversification opportunities for China’s pension system. Current caps on overseas investments, limited to below 20%, are expected to be relaxed, enabling broader global asset allocation. Pension funds will also expand into alternative asset classes, such as private equity and infrastructure, to achieve higher returns. Additionally, the introduction of a potential “Pension Connect” scheme, modeled after the successful Stock Connect, could facilitate cross-border investment opportunities, further integrating China’s pension funds into global markets. Another critical shift is the inclusion of ESG-themed investments, which align with the growing demand for sustainable and socially responsible financial products.

The growth potential of China’s pension market is immense. By 2030, Pillar 2 assets are expected to expand from RMB 4.4 trillion in 2024 to RMB 14.3 trillion, while Pillar 3 is projected to grow from RMB 800 billion to between RMB 4 and 7 trillion. These trends present significant opportunities for asset managers to design innovative, long-term products such as target-date funds and retirement-focused ETFs. Digital platforms, robo-advisors, and account management tools will be essential for enhancing user engagement and operational efficiency, while education and advisory services will play a critical role in raising awareness and driving adoption of pension products.

The transformative impact of reformed pension systems on equity markets is evident from global examples, offering a roadmap for China’s ambitions. In Japan, the Government Pension Investment Fund (GPIF), the world’s largest pension fund with over USD 1.7 trillion in assets, allocates a significant portion of its portfolio to domestic equities, providing a steady stream of patient capital that stabilizes markets and promotes corporate governance reforms. Similarly, South Korea’s National Pension Service (NPS), with USD 800 billion in assets, ensures liquidity in its domestic markets and influences better transparency and shareholder returns. In Singapore, the Central Provident Fund (CPF) channels long-term savings into domestic markets through government investment arms like GIC and Temasek, creating a stable foundation for financial market growth. Even in the United States, 401(k) plans and pension funds have fueled equity market depth, offering consistent capital that reduces volatility. Applying these lessons, China’s reformed pension system could bring similar benefits by reducing the dominance of speculative retail trading, encouraging better corporate governance, and channeling capital into innovative, high-growth sectors like technology and green energy. Such developments could reshape China’s domestic equity market into a more stable, deep, and globally attractive financial ecosystem.

Despite the promising outlook, the success of these reforms depends on overcoming several challenges. Regulatory coordination between agencies must improve to ensure cohesive implementation, while encouraging participation in Pillars 2 and 3 will require significant cultural and behavioral shifts. Technological investment will also be necessary to build robust platforms capable of handling increased demand while maintaining security and transparency. Additionally, China must address demographic challenges, balancing the needs of an aging population with efforts to attract younger generations to invest in retirement savings.

For foreign financial institutions, success in China’s evolving pension market will require a localized approach. Building strong relationships with regulators, tailoring products to Chinese consumer preferences, and leveraging global expertise will be key to navigating the market’s complexities. Institutions that invest in technology and partner with local platforms to deliver seamless, digitally enabled services will have a competitive edge. Moreover, aligning products with ESG principles and offering high-return options tailored to Chinese demographics will further differentiate market leaders.

China’s pension reforms represent a transformative step toward addressing the financial needs of its aging population while fostering economic stability and growth. These changes not only create a more robust system for future generations but also unlock substantial growth opportunities for investors and businesses. By 2030, these reforms could redefine retirement planning in China, positioning its pension market as one of the largest and most dynamic in the world. For stakeholders ready to adapt and innovate, the rewards could be transformative.