Good Morning! Christmas cheer is all around us, but we’re not loosing focus. China market rolls on with no breaks (well maybe a quick one for some sweet dumplings on Winter solstice) and we continue watching it.

A busy week for us here, as we published 2 major pieces this week:

Final piece on copper, covering MMG and CMOC

China 2025 Economic Outlook.

Outlook was the first in a series of 3, with the detailed Equity thematic piece for 2025 to follow around Christmas time and a Pan-Asian overview for New Years.

Tomorrow we’re doing the first instalment of the portfolio review- that series is evolving so if you have comments/suggestions as to what ti include in the review, do let me know. As a reminder the portfolio launch note is here.

All the best bits are for subscribers, so do please join in!

Similarly if you know someone who deserves teh gift of joining the Panda family - this next button is for you. Give the gift of Panda this holiday season!

Without further ado, the Weekly Wrap follows

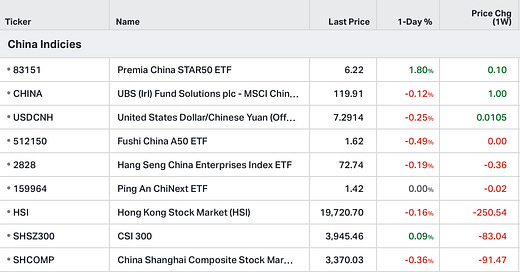

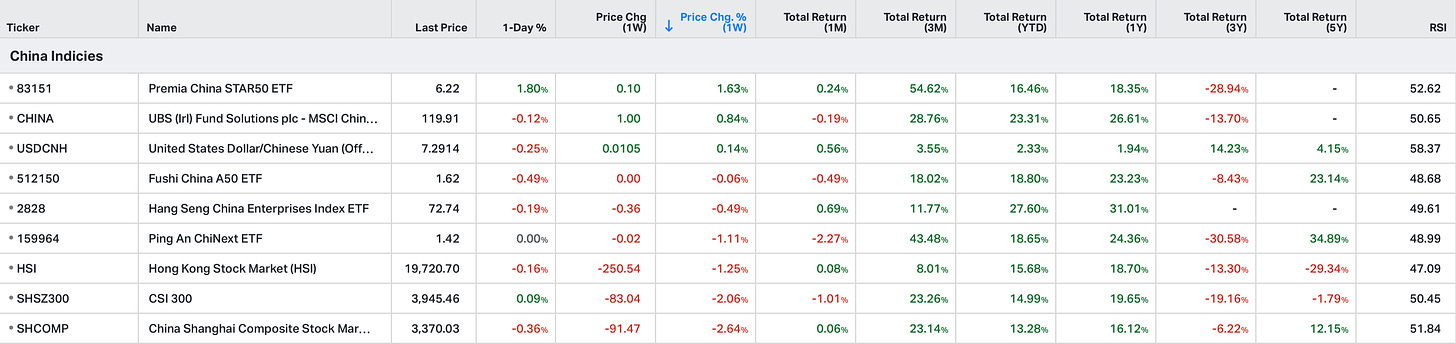

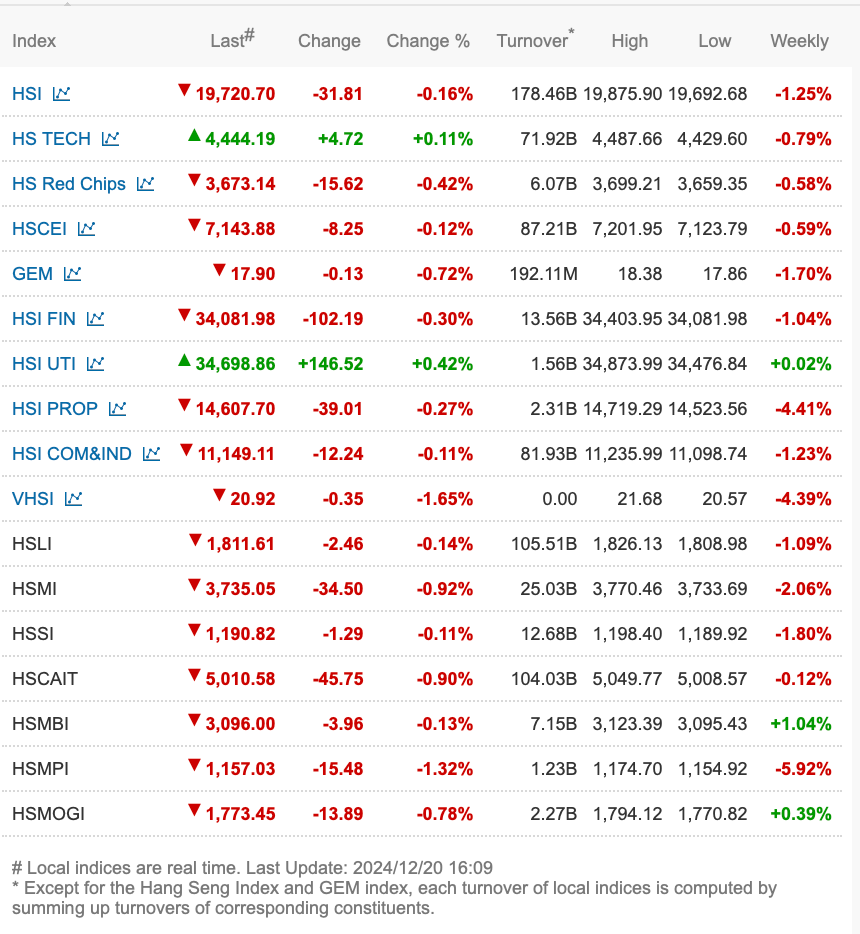

As of December 20, 2024, here’s a summary of the weekly, month-to-date (MTD), and year-to-date (YTD) performances of major Chinese and Hong Kong stock indices that we follow.

Notes:

• Shanghai Composite Index (SHCOMP): Tracks all stocks (A and B shares) traded on the Shanghai Stock Exchange.

• CSI 300 Index (SHSZ300): Represents the top 300 stocks traded on the Shanghai and Shenzhen Stock Exchanges.

• China A50 Index (512150 CH): Comprises the top 50 A-share companies listed on the Shanghai and Shenzhen Stock Exchanges.

• ChiNext Price Index (159954 CH): Focuses on innovative and high-growth enterprises listed on the Shenzhen Stock Exchange.

• SSE STAR 50 Index (83151 HK): Represents the top 50 companies listed on the Shanghai Stock Exchange’s STAR Market, emphasising science and technology innovation.

• Hang Seng Index (HSI): Measures the performance of the largest companies listed on the Hong Kong Stock Exchange.

• Hang Seng China Enterprises Index (2828 HK): Includes major H-share companies listed in Hong Kong.

Currency Considerations:

• Chinese Indices (SSEC, CSI300, China A50, CNT, STAR50): These indices are denominated in Chinese Yuan (CNY). To present their performance in USD terms, currency exchange rate fluctuations between the CNY and USD have been considered.

• Hong Kong Indices (HSI, HSCEI): Denominated in Hong Kong Dollars (HKD). Their performance in USD terms reflects the HKD/USD exchange rate stability, as the HKD is pegged to the USD.

Weekly Relative Performance Observations:

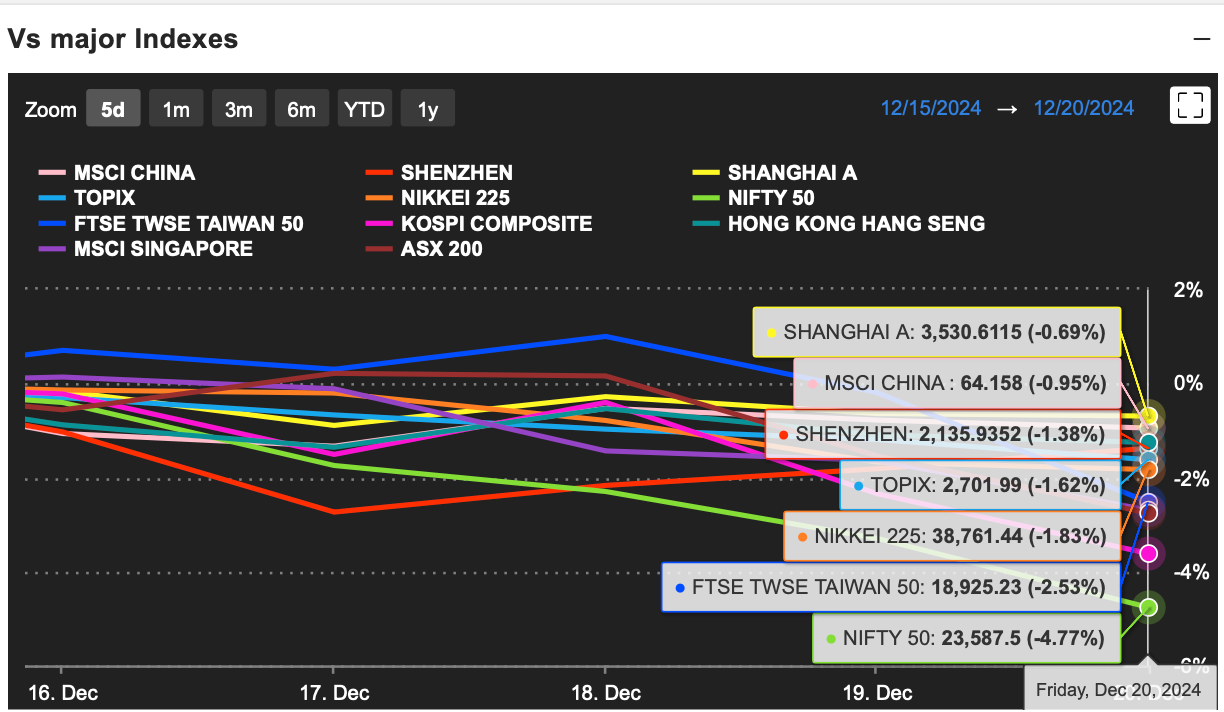

Chinese equities have shown resilience compared to their global counterparts, the overall market remains influenced by macroeconomic and global headwinds. Investors might see this as an opportunity to build positions in undervalued or policy-supported sectors within China.

Chinese Markets Show Relative Resilience:

Among the major global indices, Chinese equities, particularly the Shanghai A Index (-0.69%) and MSCI China (-0.95%), demonstrated relatively better resilience compared to other regional markets like Taiwan (-2.53%) or India’s NIFTY 50 (-4.77%). This suggests that investor sentiment in China has been more stable despite the broader downturn.

Shenzhen Performance:

The Shenzhen Composite fell by -1.38%, slightly underperforming the Shanghai A Index but still faring better than many global peers. This indicates a mixed performance within Chinese equities, with smaller-cap or tech-heavy stocks potentially facing more pressure.

Regional Outperformance:

Chinese markets outperformed other key Asian indices such as TOPIX (-1.62%), Nikkei 225 (-1.83%), and the FTSE Taiwan 50 (-2.53%). This relative strength might reflect investor optimism around China’s policy support, economic recovery, or undervaluation of Chinese equities.

Global Sentiment Still a Drag. With the US tanking in the post-Powel window, it would be hard for any part of the world to stage a sustained rally.

In the news this week:

Shift in Monetary Policy – Reinforcement of “Moderately Loose” Stance

Announced by: The People’s Bank of China (PBoC)

Date: December 18, 2024

Event: PBoC’s Quarterly Monetary Policy Report and Press Briefing

Details:

• The PBoC reiterated its commitment to a “moderately loose” monetary policy announced earlier in the month and confirmed plans to lower interest rates and inject liquidity into the financial system.

• Key measures included reducing the medium-term lending facility (MLF) rate and cutting the reserve requirement ratio (RRR) for banks to stimulate credit growth.

• This was aimed at countering weak domestic demand and deflationary pressures, while ensuring financial stability in light of global uncertainty.

Nationwide Rollout of Private Pension Schemes

Announced by: Ministry of Human Resources and Social Security (MOHRSS) and China Securities Regulatory Commission (CSRC)

Date: December 17, 2024

Event: Joint Press Conference in Beijing

Details:

• The MOHRSS and CSRC officially launched the expanded nationwide private pension scheme, effective December 15, which had been previewed the week before.

• This rollout introduced tax-advantaged accounts and added 85 index funds for retirement investment, designed to boost savings rates and support capital markets.

• Officials highlighted this initiative as a key step to address China’s aging population and enhance the financial well-being of retirees.

*This is an important development and I will certainly dive in to it upon the completion of the outlooks, for now though lets just acknowledge that more institutionalised flows are coming to China*

Agricultural Modernisation and Grain Security

Announced by: Ministry of Agriculture and Rural Affairs (MARA)

Date: December 19, 2024

Event: National Agricultural Development Forum

Details: MARA outlined a comprehensive plan to modernise China’s agricultural sector, with a focus on grain security. This included:

• Accelerating the adoption of smart farming technologies.

• Building a stronger rural logistics and supply chain infrastructure.

• Ensuring stable grain output at over 650 million metric tons annually, amid global supply uncertainties.

• This policy aligns with broader efforts to reduce dependency on imported agricultural products and improve rural incomes.

Fiscal Measures to Boost Consumption

Announced by: Ministry of Finance (MOF)

Date: December 20, 2024

Event: State Council Meeting

Details: The MOF announced an additional fiscal stimulus package aimed at directly supporting households to boost domestic consumption. Key measures included:

• Direct Fiscal Support: China plans to enhance household income growth and domestic demand in 2025 through increased fiscal support and improved social security measures. This includes boosting job creation, wage growth, higher pensions, and improved medical insurance.

• Special Bonds: The government will issue ultra-long special bonds to significantly increase funds supporting industrial upgrades and consumer goods trade-ins. In the current year, 150 billion yuan supported trade-ins for appliances like fridges and TVs, generating over 1 trillion yuan in sales.

• Economic Growth Target: The government aims for an economic growth rate of around 5% in 2025, with efforts to stabilize the housing market ongoing.

*I note that I expect a 5-5.2% growth in 2025, and actually improved momentum in to 2026, which makes me very optimistic, but within range of consensus*

Enhanced Regulatory Oversight for Real Estate Sector

Announced by: Ministry of Housing and Urban-Rural Development (MOHURD)

Date: December 20, 2024

Event: Real Estate Stabilization Policy Briefing

Details:

• The MOHURD introduced new regulatory measures to stabilize the struggling real estate sector, including:

• Loosening restrictions on home purchases in key cities to stimulate demand.

• Providing tax incentives for property developers to accelerate project completions.

• Offering lower interest rates for first-time homebuyers and affordable housing projects.

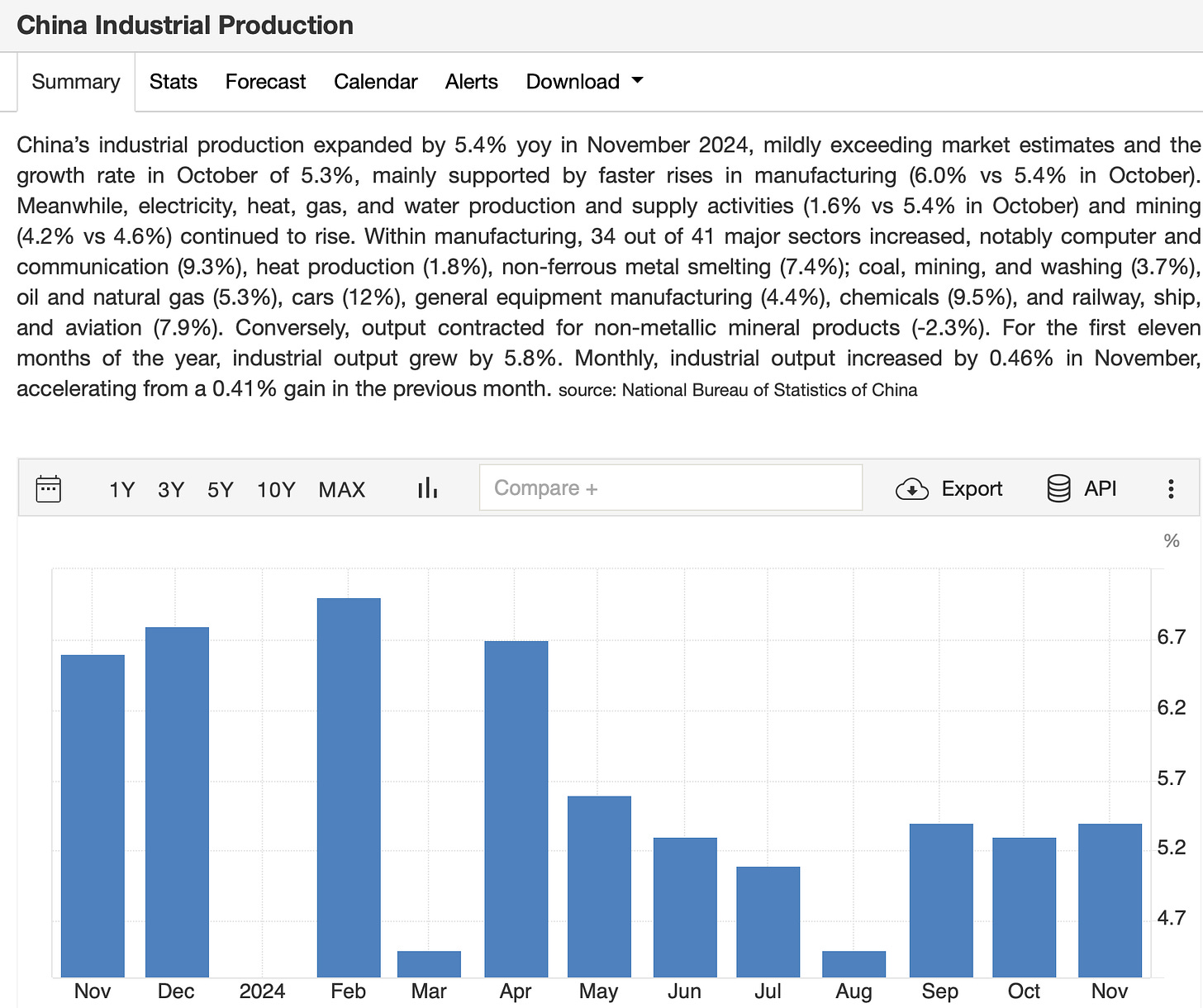

We also had some interesting data releases this week:

The latest data releases reveal a mixed outlook for the Chinese economy. Industrial production remains a relative bright spot, with high-tech manufacturing and the EV sector continuing to drive growth, presenting opportunities for investors focused on innovation and technology. However, the sharp deceleration in retail sales underscores persistent consumer weakness, highlighting structural challenges in rebuilding confidence and boosting discretionary spending. Fixed Asset Investment (FAI) growth, led by robust infrastructure spending, points to clear beneficiaries in sectors tied to government-funded projects. Meanwhile, the real estate sector continues to weigh on the broader economy, though targeted stabilization policies may unlock medium-term opportunities.

Industrial Production

Growth Rate: 5.4% year-on-year in November, slightly above October’s growth of 5.3% and exceeding analysts’ expectations of 5.2%.

Sector Highlights:

High-tech manufacturing: Continued to drive growth with a double-digit increase (specific breakdown not released this week but historically 12-15%).

Automotive sector: Strong recovery as electric vehicle production surged, supported by government incentives.

Energy production: A notable uptick in coal and renewable energy output to meet winter energy demand.

Implications: This growth indicates the manufacturing sector remains a key stabilizer amid broader economic uncertainties, benefiting from targeted policy support.

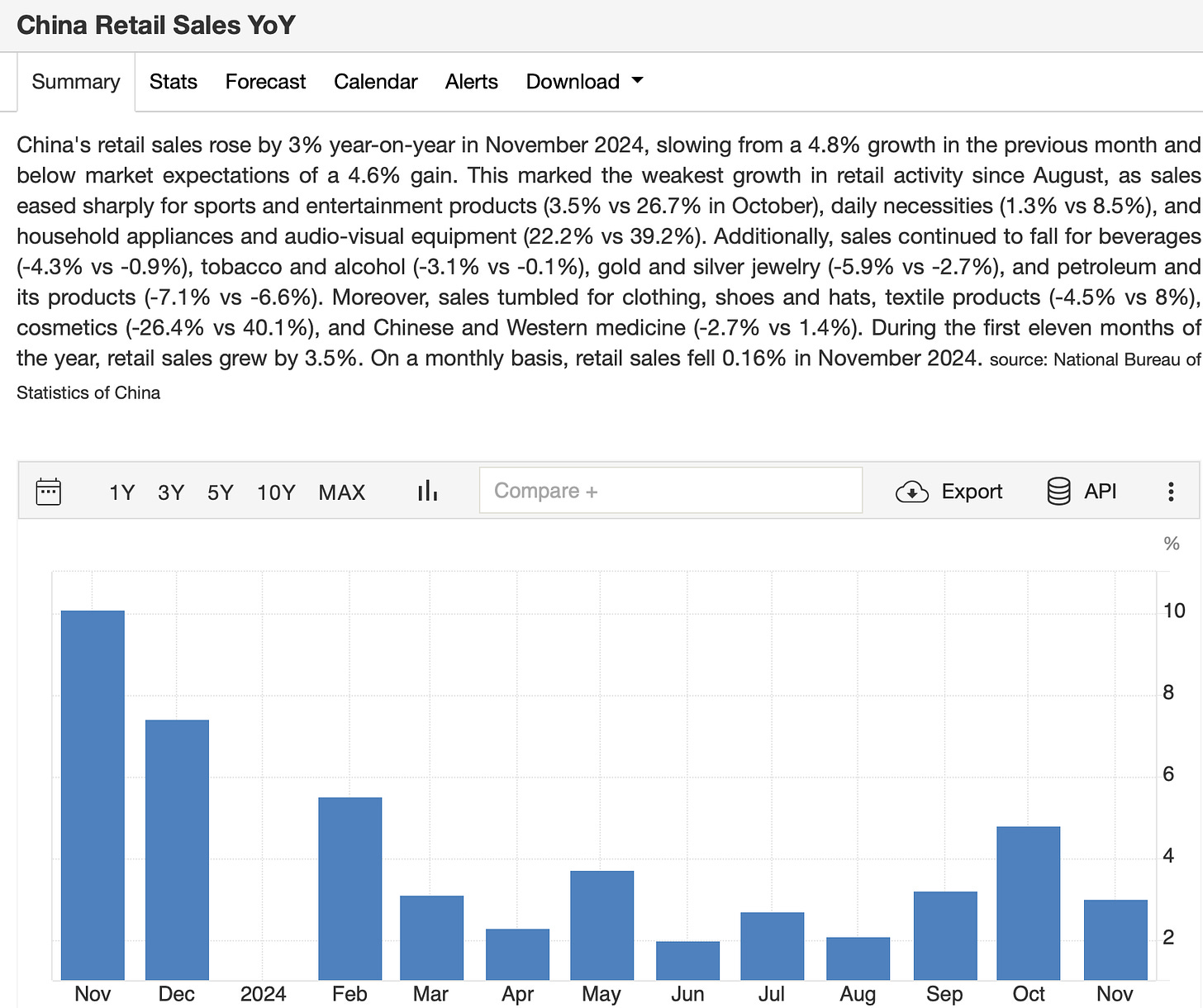

Retail Sales

Growth Rate: 3.0% year-on-year in November, significantly down from 4.8% in October and missing expectations of 4.6%.

Breakdown by Segment:

Online retail sales: Grew by 7.5%, outperforming physical retail, driven by Singles’ Day promotions.

Discretionary spending: Categories like apparel and electronics weakened, reflecting cautious consumer sentiment.

Automobile sales: A bright spot, with 4% growth, buoyed by EV subsidies and trade-in programs.

Analysis: The sharp slowdown reflects ongoing fragility in consumer confidence, impacted by weak income growth, though the online trends are interesting.

Fixed Asset Investment (FAI)

Growth Rate: 3.3% from January to November, slightly lower than the 3.4% growth from January to October. This is normal as FAI tends to get front loaded in to the NPC in March.

Sector-Specific Data:

Infrastructure investment: Increased by 6.8%, supported by government-led projects in transport, energy, and water conservation.

Real estate investment: Declined by 8.1%, reflecting ongoing challenges in the property sector.

Private investment: Grew by a modest 2.2%, showing hesitancy among private firms due to economic uncertainty.

Implications: Infrastructure spending remains the primary driver of FAI growth, offsetting weakness in real estate and private investment. This is a big part of the 2025 Outlook, so please see that for a detailed discussion.

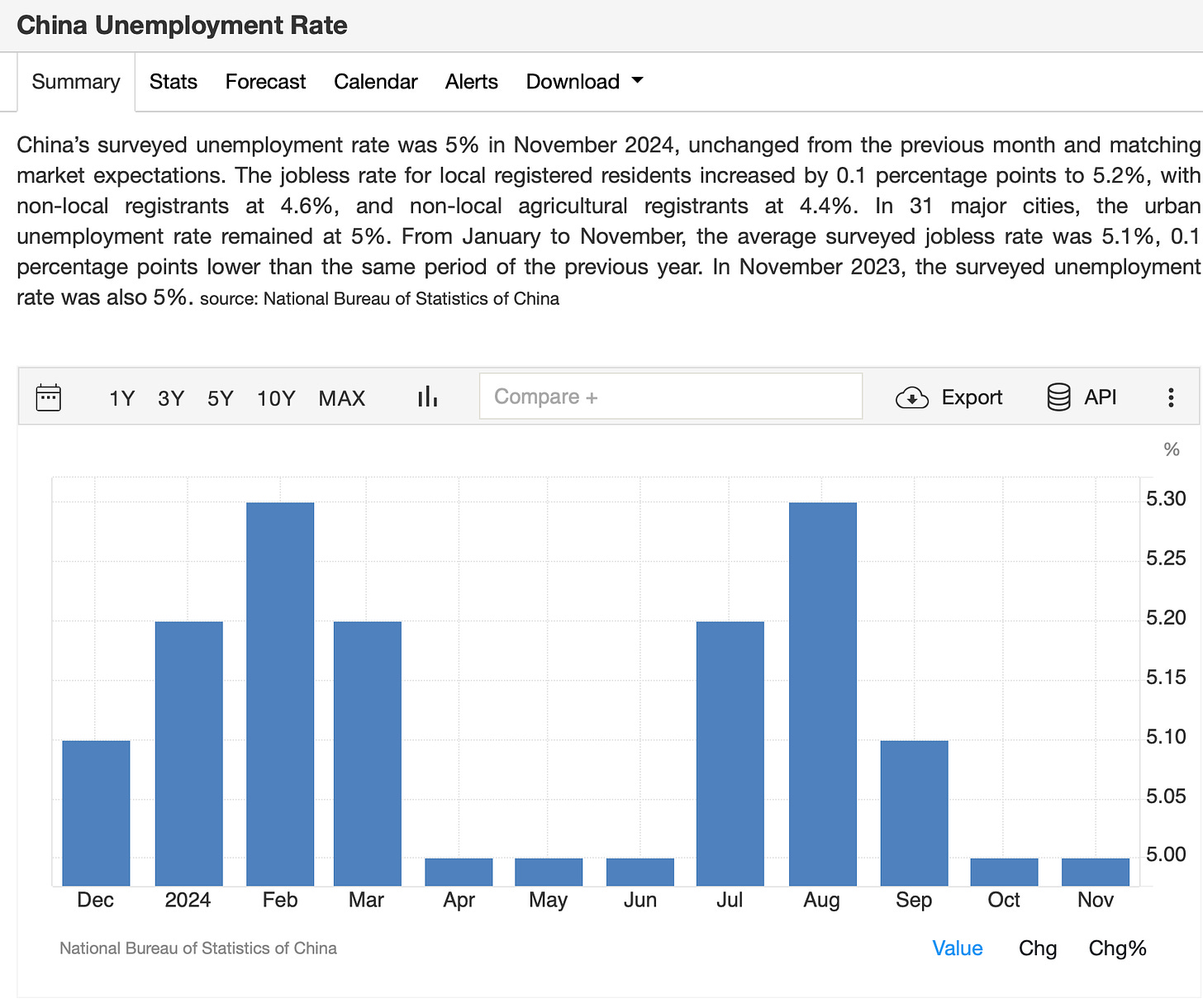

Unemployment Rate

Overall Unemployment: Steady at 5.0% in November.

Youth Unemployment (16–24 years): Decreased to 16.1%, down from 17.1% in October, marking the third consecutive monthly decline.

Regional Trends:

Urban employment improved slightly in tier-1 cities, while smaller cities faced challenges due to factory closures and layoffs.

Policy Support: The government’s job creation initiatives, particularly in the digital economy and green energy sectors, are helping to ease youth unemployment.

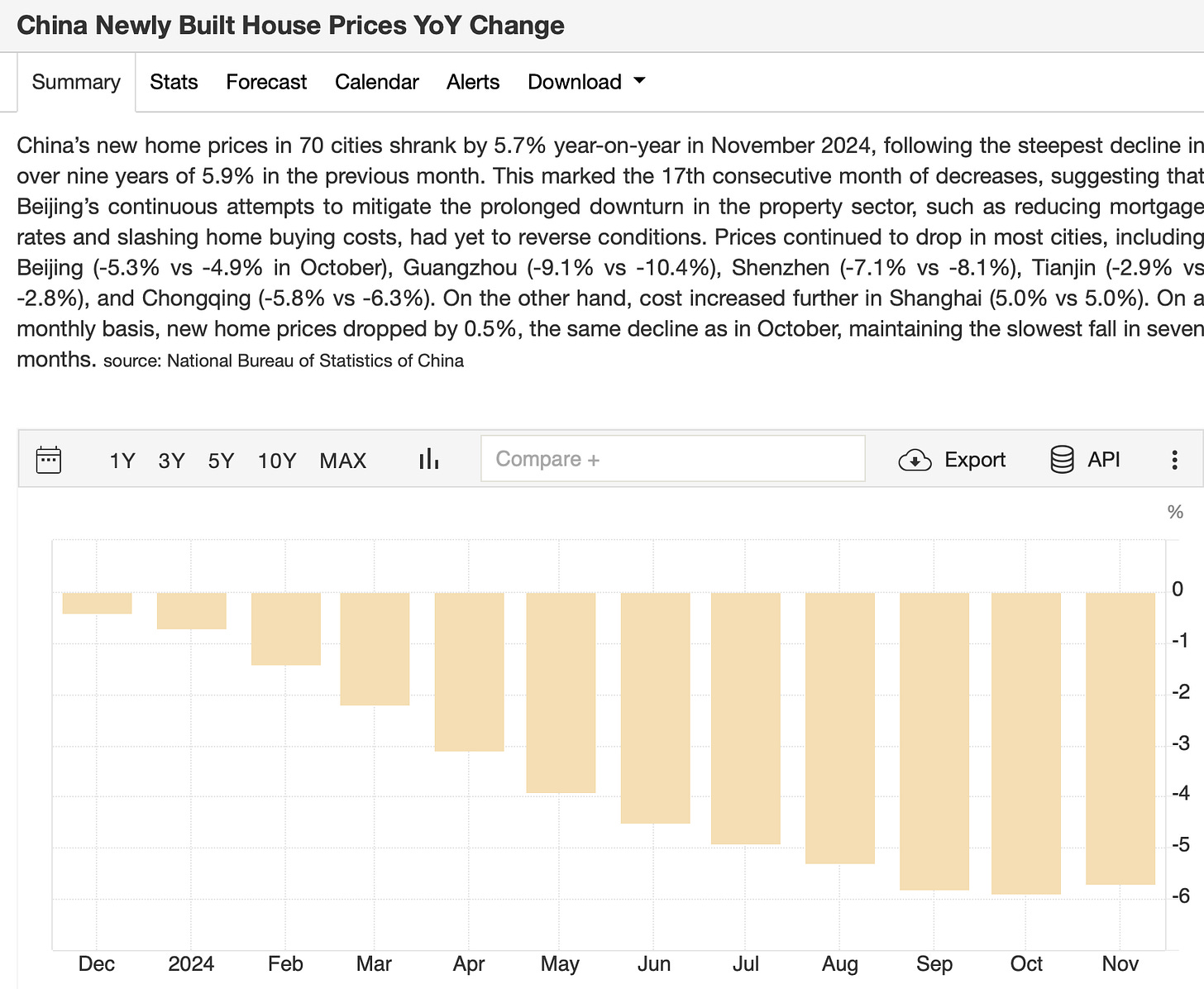

Housing Market

Home Prices: Nationwide average home prices fell by 1.1% year-on-year in November, continuing a decline for the eighth consecutive month. Prices in tier-1 cities (e.g., Beijing, Shanghai) dropped by 0.4%, while tier-3 and tier-4 cities saw steeper declines of 1.8%-2.2%.

Sales Volume: Housing transactions fell by 10.5% year-on-year, despite some easing measures for first-time buyers.

Implications: The persistent weakness underscores the need for further targeted interventions to stabilize the property market, particularly in lower-tier cities.

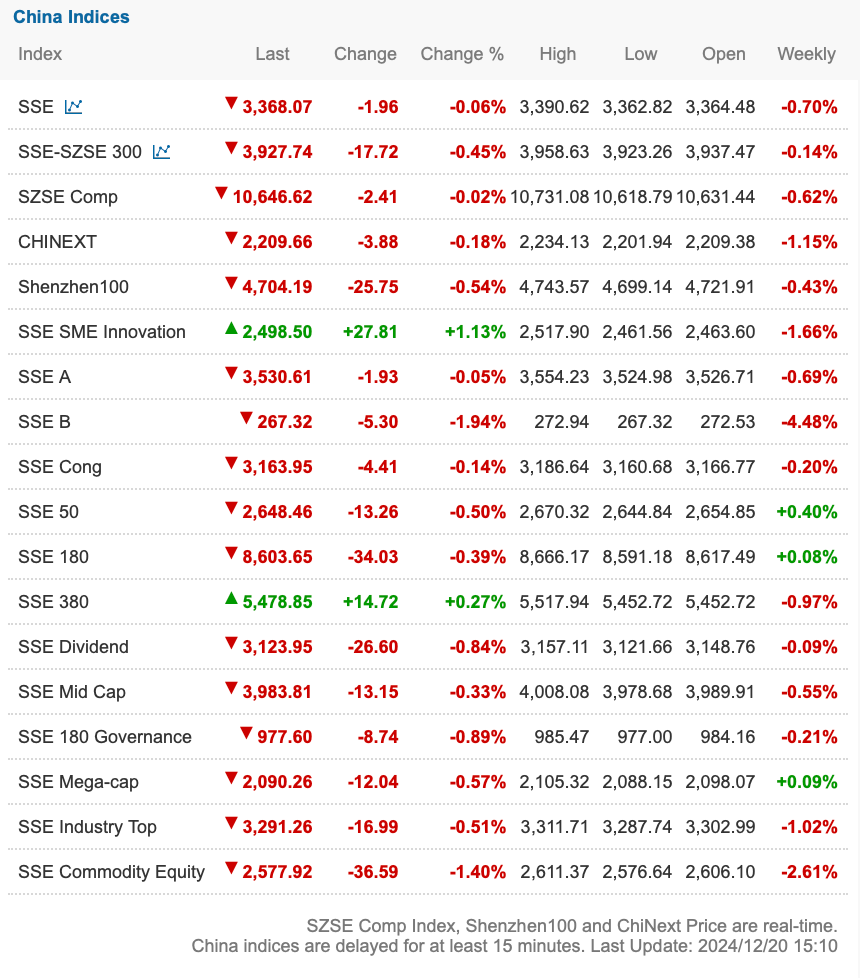

Complete Index Performance List:

5 Observations:

1. Strong Performance in Small and Innovative Sectors:

The SSE SME Innovation Index was a notable outperformer with a weekly gain of +1.13%, suggesting resilience in small and medium enterprises, particularly in innovation-driven sectors. This aligns with the broader government focus on promoting innovation and supporting SMEs as a growth engine.

2. Mixed Performance Across Broader Market Indices:

Major indices like the Shanghai Composite (SSE) and Shenzhen 100 showed slight weekly declines of -0.70% and -0.43%, respectively. These modest losses reflect a lack of strong bullish sentiment, possibly due to mixed macroeconomic data and cautious market outlook.

3. Continued Weakness in Property and Commodity Sectors:

Real estate-linked indices, such as the HSI Property Index (-4.41%), experienced significant declines, emphasizing the ongoing struggles in the real estate sector. Similarly, the SSE Commodity Equity Index dropped -2.61%, indicating weak performance in resource-based companies amidst global commodity price volatility.

4. Divergence in Hong Kong vs. Mainland Markets:

The Hang Seng Tech Index posted a minor weekly loss of -0.79%, but some tech-related sectors showed resilience, such as utilities with a small weekly gain (+0.42%). Mainland China’s SME and mid-cap-focused indices performed relatively better, reflecting localized investor optimism in policy-driven sectors.

5. Sectoral Bright Spots in Utilities and Mid-Caps:

The HSI Utilities Index gained +0.42% for the week, suggesting a preference for defensive sectors amidst broader market uncertainty. Mid-cap indices like the SSE 380 Index also recorded positive performance (+0.27%), highlighting investor interest in mid-sized companies poised for growth.

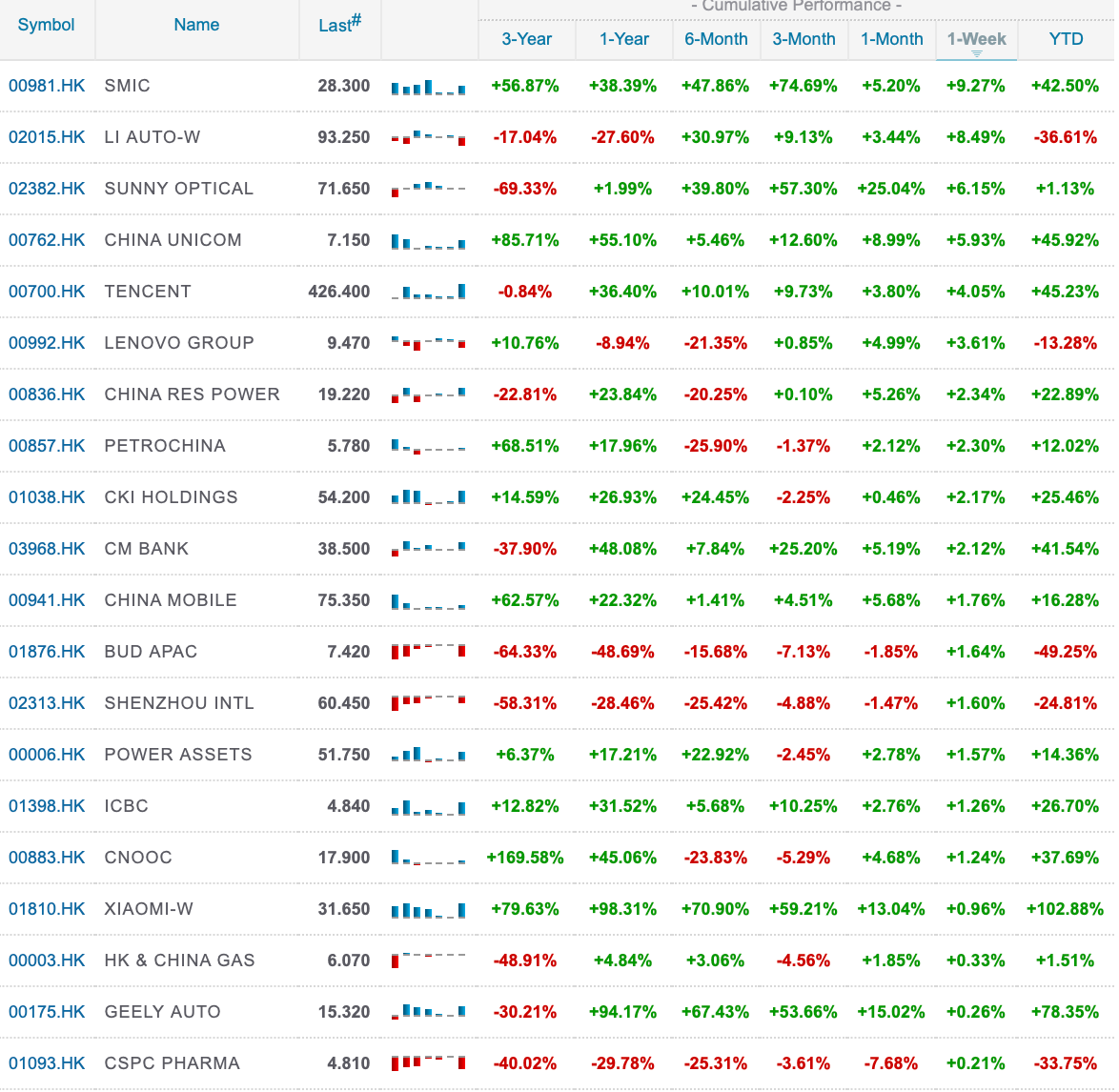

Top 20 Index Consituents:

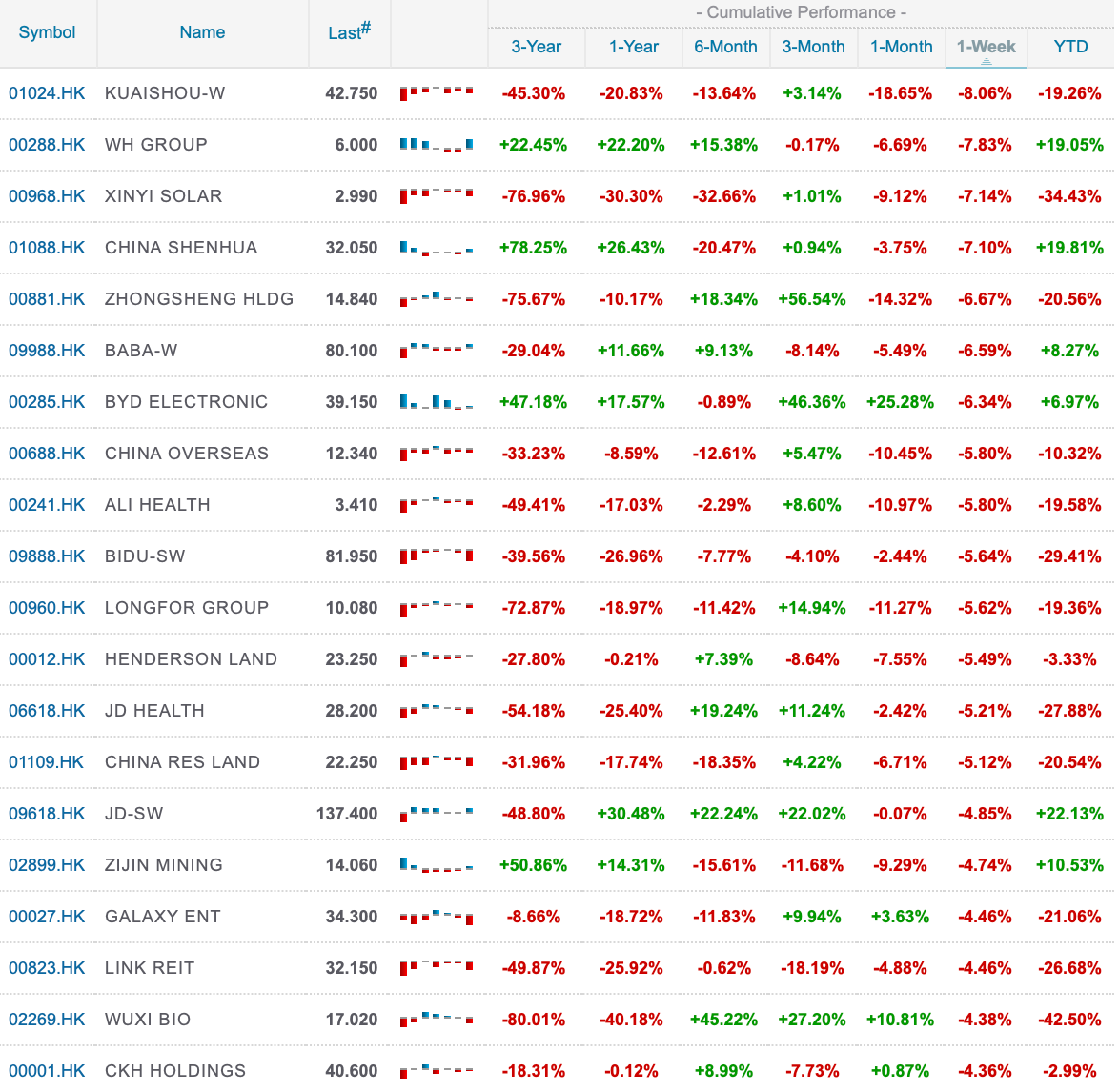

Bottom 20 Index Consituents:

Corporate News this week:

1. Huawei Expands into Electric Vehicles (EVs)

Details: Huawei announced plans to deepen its involvement in the EV market by integrating its HarmonyOS into vehicles manufactured by partners such as Changan Automobile and Seres. The company is targeting 1 million EVs running HarmonyOS by 2025.

As you know my thesis for EV makers is “the race for 1m” in order to win longer term. Clearly Huawei have taken a bit of a shortcut, but good on them for elbowing in to a very competitive space.

Huawei’s Smart Car BU (Business Unit) generated CNY 6.8 billion (~$930 million) in revenue in the first three quarters of 2024, marking a 30% year-on-year increase.

2. Tencent Collaborates with Apple on AI Features

Details: Apple and Tencent are reportedly working together to roll out localized AI-driven features for iOS users in China. This includes advancements in Siri’s Chinese language processing and enhanced recommendations for WeChat.

Tencent invested CNY 8 billion (~$1.1 billion) into AI research in 2024, focusing on generative AI and large language models.

Tencent’s stock rose by 1.2% during the week, reflecting investor optimism about its AI initiatives. This of course is at the expense of Baidu (BIDU US) who seemingly has the apple partnership sewn up. The deal is non-exclusive though, so let’s see which provider wins out (if any!).

3. Semiconductor Industry Expansion

Details: SMIC (Semiconductor Manufacturing International Corporation) announced a $7 billion investment in a new fabrication facility in Beijing. At the same time Hua Hong Semiconductor raised CNY 15 billion (~$2.2 billion) via a bond issuance to expand its foundry capacity.

These investments aim to bolster China’s self-sufficiency in chipmaking, with an emphasis on mature node processes (28nm and above) that are less affected by export controls.

4. Guowang Internet Satellite Launch

China launched the first 10 satellites for its Guowang Internet constellation aboard a Long March 6 rocket. The Guowang constellation aims to deploy 13,000 satellites by 2030, rivaling SpaceX’s Starlink system. Each satellite costs an estimated $8–10 million to produce, putting the total project cost at $130 billion over the next decade.

This marks a significant step toward China’s goal of achieving global satellite-based internet coverage, particularly for underserved regions.

This is a repose to SpaceX, though how successful it will be commercially remains other than be seen.

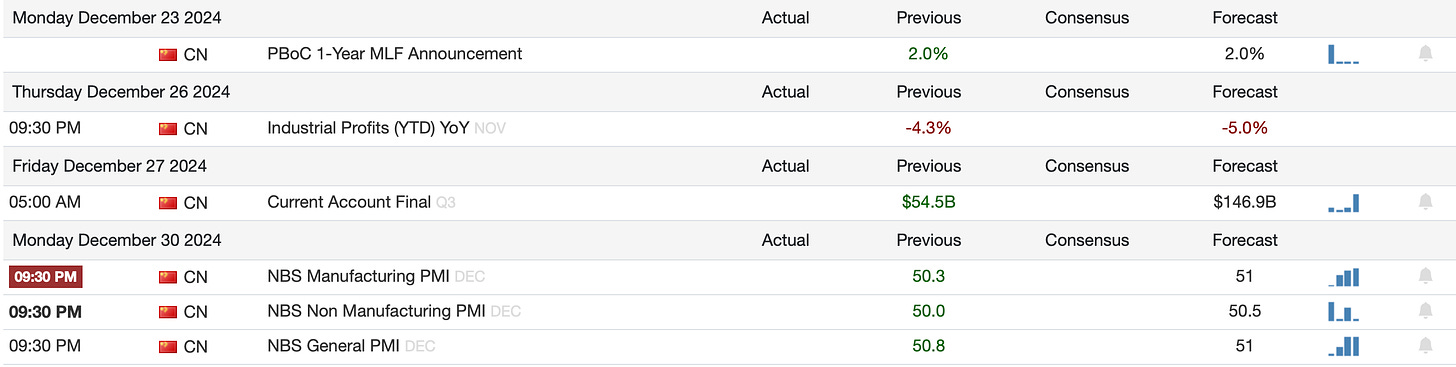

Not a very busy week in terms of data over Christmas:

Have a Merry Christmas week and Happy Holidays if you are celebrating any!