China’s Recovery: A Complex Path Forward Amid Policy Adjustments and Renewed Optimism

Reflections on a recent roundtable discussion and data releases

As mentioned previously I was invited to participate in a roundtable discussion by a leading UK asset manager this past week. I have laid out my view in advance of it, based on the preparatory work i’ve done for the event. Now that it’s been about a week and i’ve had time to digest I thought it’s an excellent opportunity to reflect and also put some more recent data in to a theoretical context. All of this is baby steps to my 2025 China Equities Preview that’s already in the works and should be done for Christmas. It will of course go out in full to the premium subscribers, but there will be a much condensed version of it for the gen pop too.

I would like to note that the roundtable discussion was held under Chatham House rules. While I will not attribute specific comments to individuals who have not publicly taken these positions, I will share the general themes and debates that emerged from this unique forum. The roundtable brought together a diverse group of 20 individuals, including leaders in asset management, hedge fund CIOs, economists, journalists, civil servants, and former government advisors. This eclectic mix of backgrounds and perspectives on China sparked a stimulating exchange of ideas.

The discussions covered a broad spectrum of topics, from China’s economic trajectory to geopolitical challenges, and included robust debates on investment strategies. While the “China bears” presented familiar arguments regarding structural challenges, export struggles, and political risks, those with a more optimistic view highlighted recent signs of economic recovery and the strategic reforms undertaken by the Chinese government.

Having had some time to think about it, instead f addressing it point by point, I am going a little more meta. It is becoming clearer that China’s economic landscape is navigating a period of recalibration and recovery, with targeted government interventions, resilient consumer activity, and cautious investor optimism shaping the narrative on the bullish side. While the challenges of the Real Estate bust, covid response, and negative wealth effect and demand response continue to be a drag. The balance of perception between these factors is what drives optimism (or lack thereof) for Chinese assets on the day (or week).

Where I differ from the China Perma-Bears (yes, i’m claiming that term for the China Investing vernacular) is that the macro policy proposals by the top bras of the Xi economic team are incompatible with all the targets they are setting out. Especially the RMB rate, and keeping it from depreciating. It is my conviction that that is the misunderstanding of theorise setting mechanism of the RMB. This is a complex and nuanced topic that I will broach in the 2025 outlook, and I will not be attempting to argue it here, but sufficed to say that I am in the “Mar-A-Lago” accord camp, and as such believe that RMB will be stronger in 2025 and 2026.

Instead I want to focus on the recent policy revisions, robust retail performances, signs of recovery in real estate, and growing export strength demonstrate the country’s ability to adapt. While acknowledging the structural challenges and geopolitical uncertainties do temper the outlook, or perception thereof at the very least. This highlights the complexity of China’s recovery journey, so I would like to offer up some developments that keep me in the optimistic camp.

Revising Monetary Indicators for Clarity

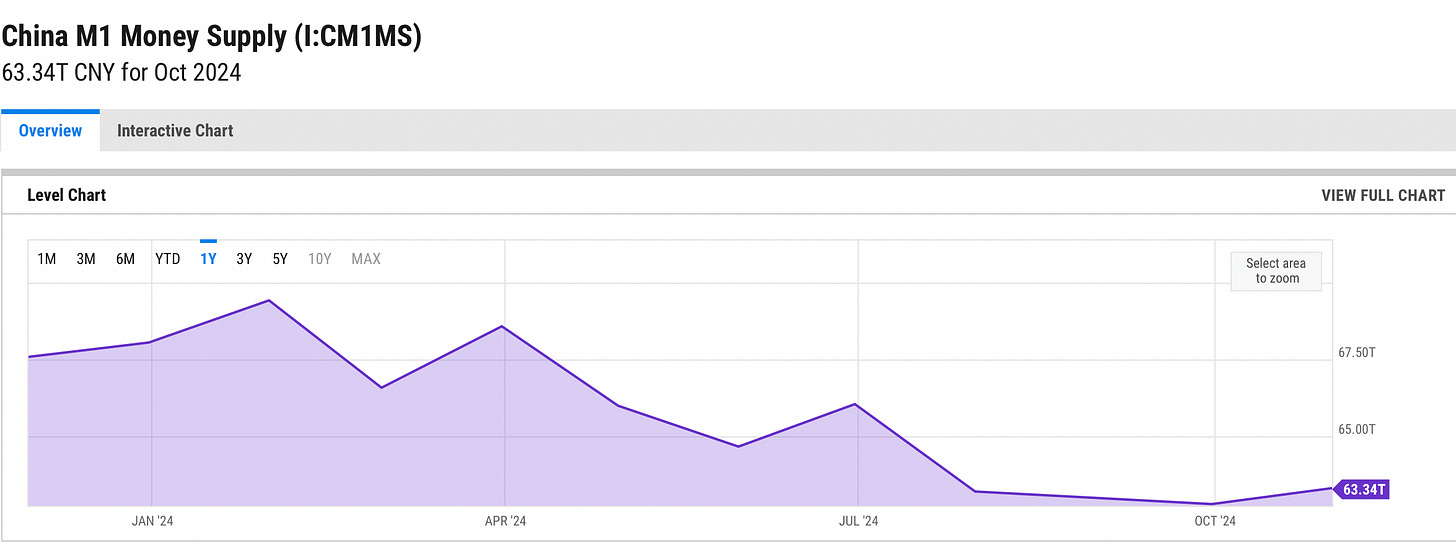

Not an obvious place to star, but I believe that Peoples Bank of China (PBOC) is in fact going through an activist phase. Recall the bazooka from earlier in the year, and now PBOC is modernising its monetary toolkit by revising the M1 money supply indicator, a move that reflects the changing dynamics of China’s economy. Traditionally, M1 includes currency in circulation and demand deposits at banks, primarily capturing highly liquid assets. The planned revision would incorporate household demand deposits and balances from nonbank payment platforms like Alipay and WeChat Pay, making it more reflective of how liquidity operates in China’s increasingly digital economy.

This change is significant for understanding M1 dynamics. As digital payments grow, nonbank platforms like Alipay and WeChat Pay have become major repositories of transactional money. By accounting for these balances, the revised M1 will offer a clearer picture of liquidity. In October 2024, China’s M1 totaled 62.82 trillion RMB. If the new components—household demand deposits (39.87 trillion RMB) and nonbank payment reserve balances (2.37 trillion RMB)—are included, the M1 contraction rate narrows from -6.1% to -2.3%. This adjustment not only reduces volatility in M1 but also aligns monetary indicators with the realities of a rapidly digitalizing financial ecosystem .

M1 growth dynamics are crucial for interpreting short-term economic trends. Historically, M1 has been closely tied to corporate liquidity and short-term business activity. The contraction in current M1 has raised concerns about weak corporate activity and subdued investments. However, the revised M1, with a smaller contraction, signals that liquidity might not be as tight as previously assumed. Analysts believe this recalibration could provide more reliable insights into economic activity, better correlating with real estate sales, corporate profits, and broader market dynamics.

This reform exemplifies how China is adapting its monetary policy to keep pace with structural changes in its financial system, enhancing its ability to gauge and manage economic trends effectively. Coupled with its willingness to do thusly, I believe that they are on the way of getting more of the excess savings to be productive and the first order of business is a realistic assessment of all the Ms and the way money is being spent and invested around the economy. This of course is crucial to asses the size and scope of any stimulus.

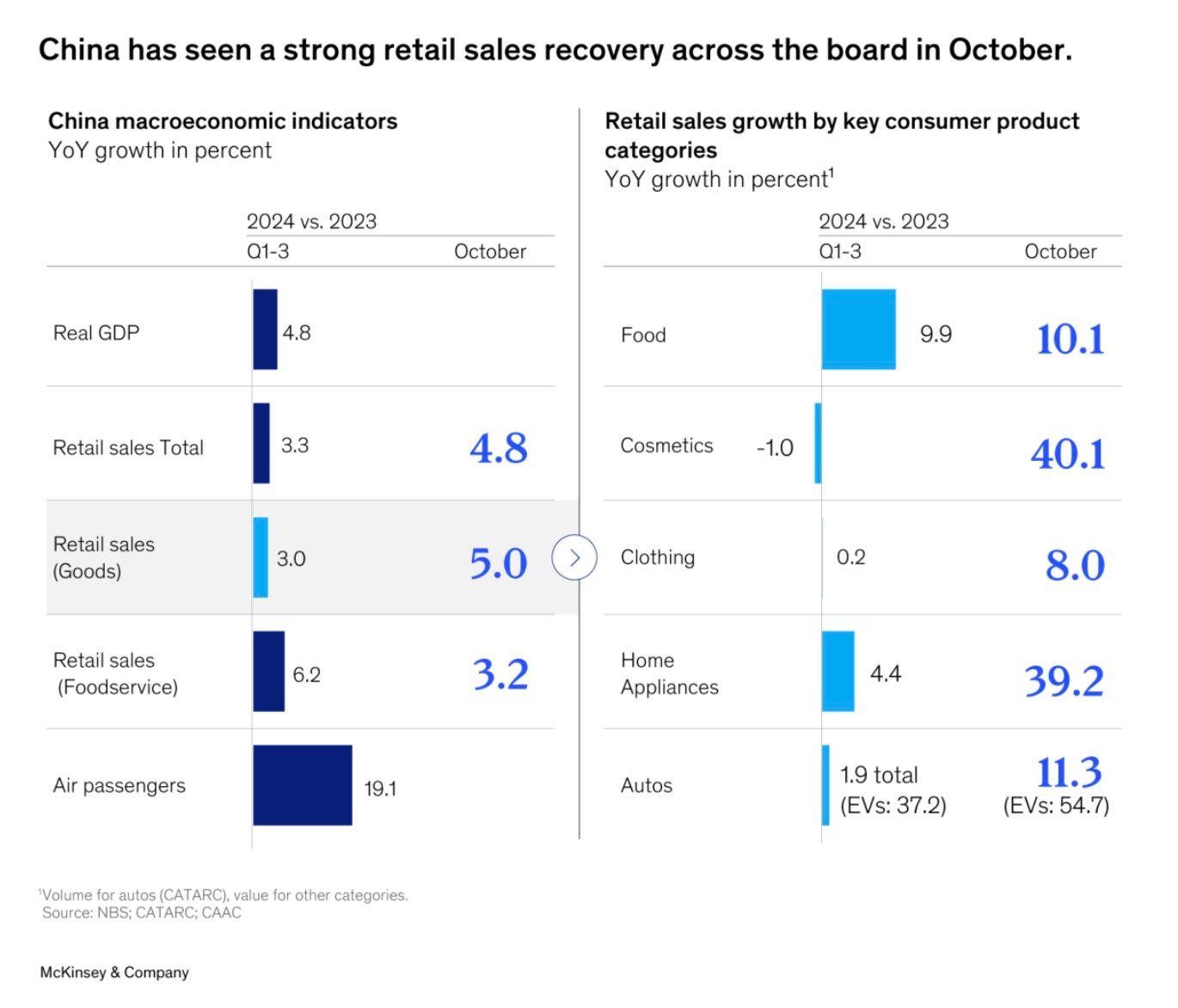

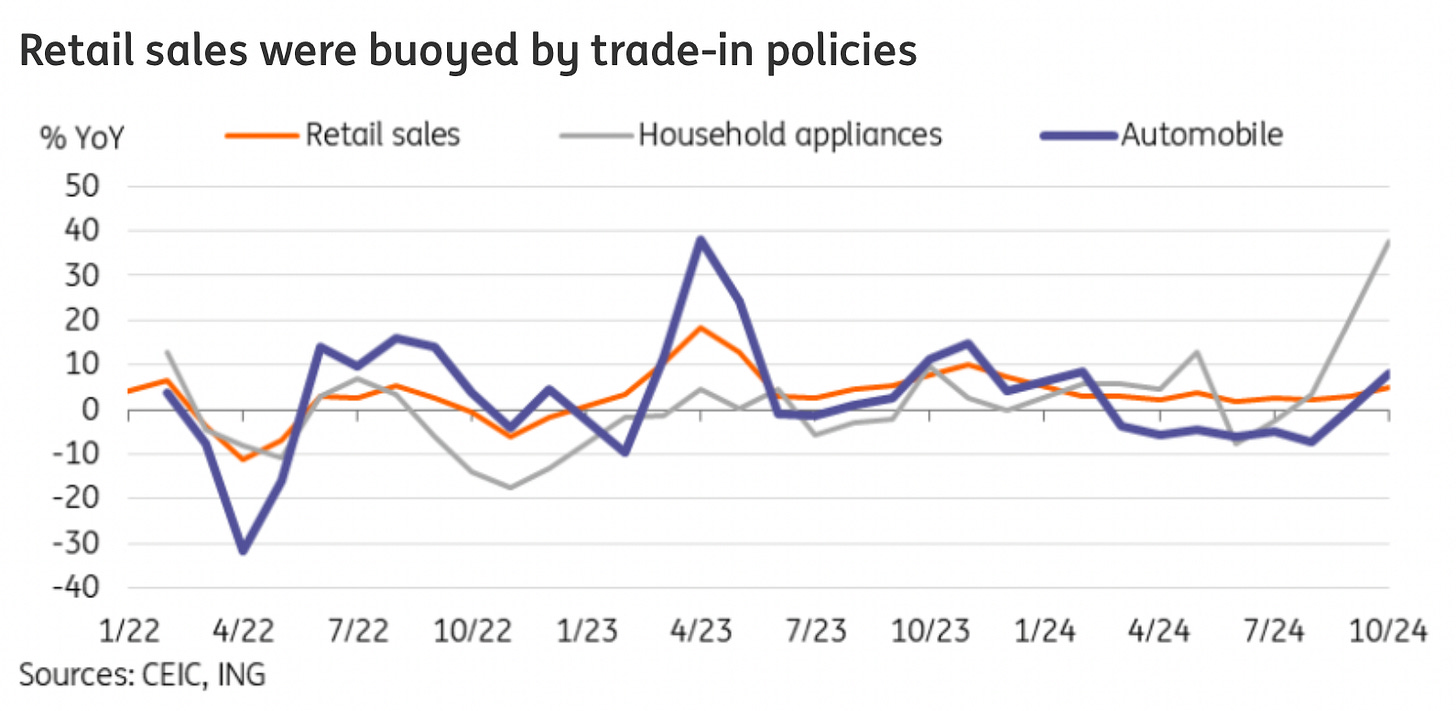

Boosting Consumption through Retail and E-Commerce

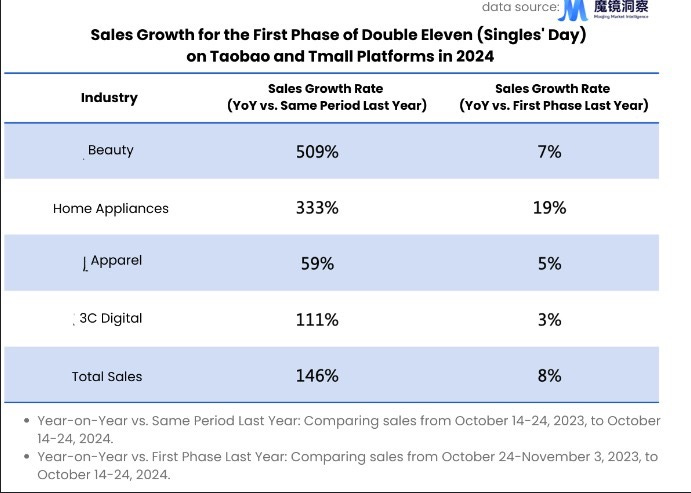

China’s “Double 11” shopping festival was a resounding success, showcasing consumer confidence and adaptability. With total sales reaching 1.44 trillion RMB—a 26.6% year-on-year increase—this year’s event underscored the strength of domestic consumption. Categories like home appliances surged by 19%, while beauty products and apparel saw 7% and 5% growth, respectively.

Platforms like Alibaba and JD.com moved beyond aggressive price wars to focus on enhancing consumer experiences, such as seamless cross-platform payments and improved logistics. These efforts align with changing consumer priorities, where quality-to-price ratios increasingly drive decision-making .

The integration of payment platforms like Alipay and WeChat Pay with major e-commerce ecosystems has also improved transaction efficiency, reflecting a broader shift towards a collaborative digital marketplace. This maturation in e-commerce signals not just recovery but transformation in China’s retail landscape.

This to me was the biggest new data point. During the roundtable discussion, one of the participants, who has visited China recently, observed how much better the mood is compared to the summer. IT was critical to see follow through and with the 11.11 data I believe we got it, on top of generally stronger data for October. I understand the argument that stronger data lessens the stimulus, but lets remember that the key is to get the economy going faster not stimulus for stimulus sake.

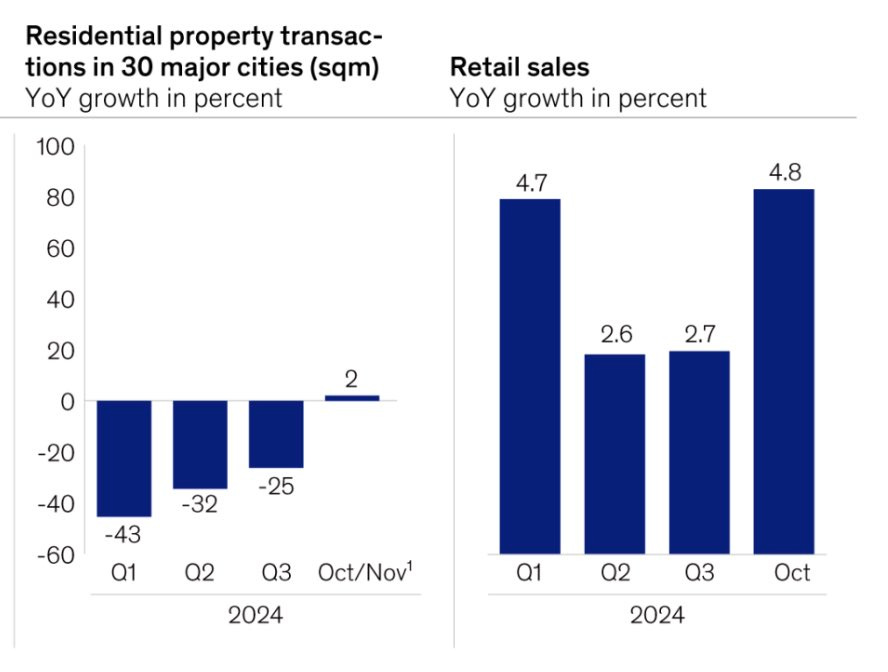

Real Estate: Green Shoots in Top-Tier Cities

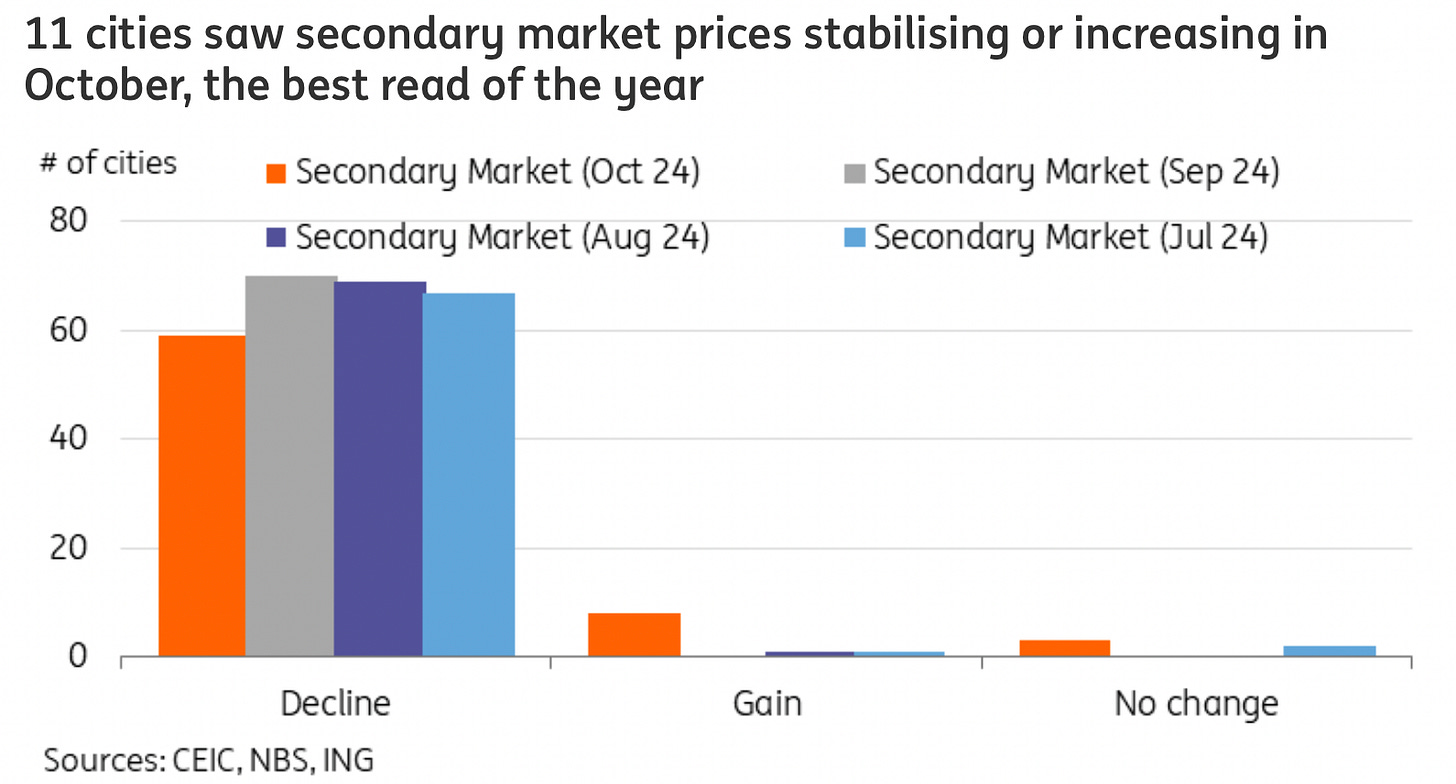

With that in mind, what is happening to the biggest drag on the economy - the Real Estate sector? It presents a mixed picture at the moment. Tier-1 cities like Beijing and Shenzhen are showing signs of stabilization, with October marking the first increase in secondary home prices after a year of declines. Transactions in these markets have improved, buoyed by government incentives and relaxed mortgage rules .

However, the recovery is uneven. Tier-2 and tier-3 cities continue to struggle, reflecting broader structural challenges such as demographic pressures and weaker income growth. Nationwide, property development investment contracted by 12.4% year-on-year in October, underscoring the sector’s fragility .

The recovery in Tier-1 markets, while promising, is not enough to lift the entire sector, but it certainly improves the feeling around the space. I would also put in the same pile the pickup in the Household Appliances sales. While not an exact proxy for Real Estate demand anymore, it is real-estate adjacent, and people’s desire to take up the various trade-in incentives (vs ignoring them) is incrementally supportive of the stronger consumer thesis.

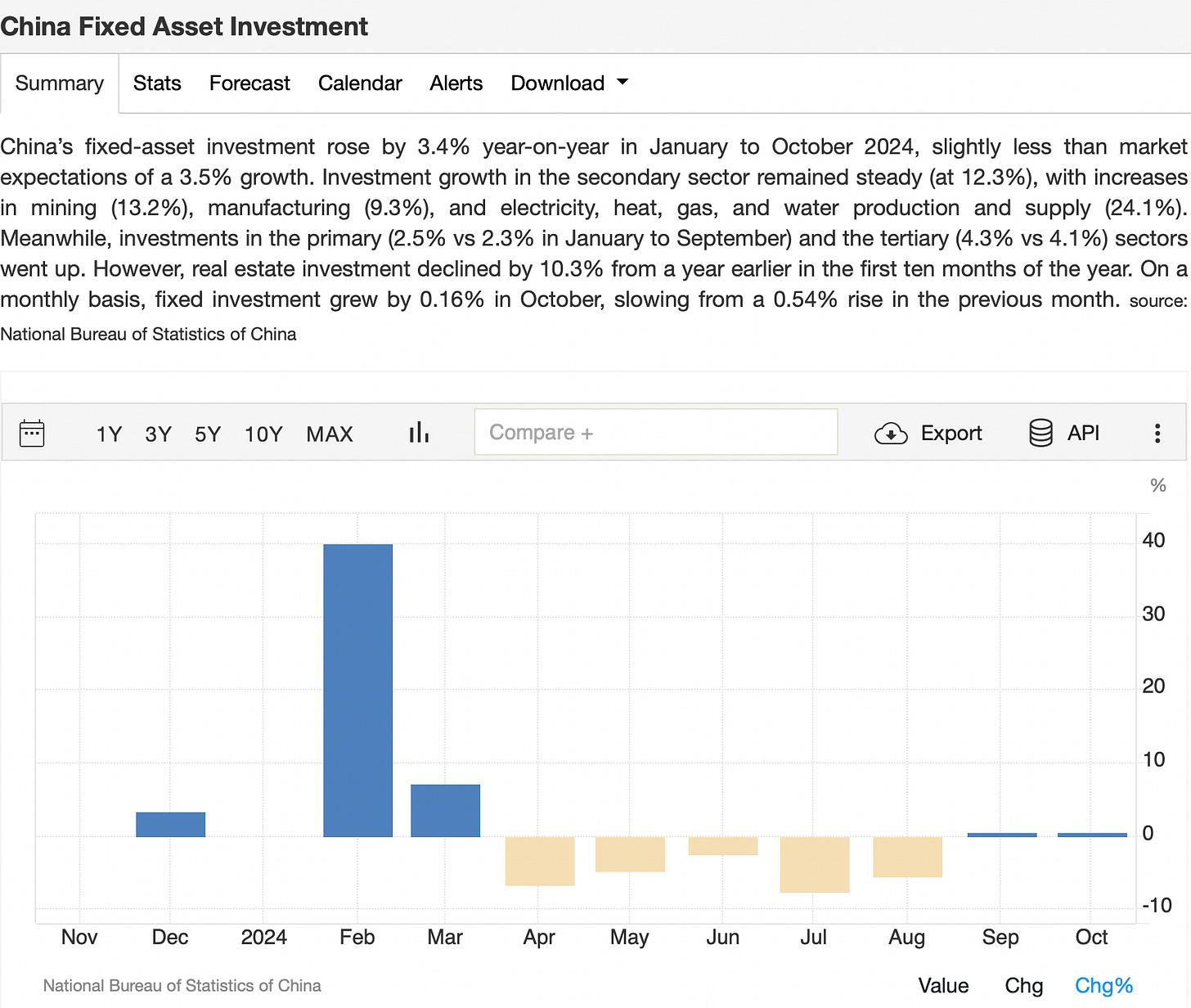

Infrastructure and Manufacturing Lead Fixed Asset Investments

Let’s not forget that our old friend, Fixed Asset Investment (FAI), has been a steadying factor in China’s economic recovery. Year-to-date, FAI grew by 3.4% as of October, with manufacturing investment rising by 10%. Robust activity in sectors like non-ferrous metals and transport equipment has driven this growth. Infrastructure investment, supported by accelerated government bond issuance, also remained, strong, growing at 10% .

Despite these gains, the contraction in property-related investments remains a drag. Policymakers are relying on infrastructure to offset weaknesses in the real estate sector, but sustaining this balance will require continuous capital flows and targeted policy support. A point to monitor, but again for me the balance is ticking over in to positive territory.

Global Impacts: Outbound Travel and Trade

This entire year we talked about the strength of China’s export sector. And with good reason - it has shown remarkable resilience, and there was more of the same in October, where exports grew by 12.7% year-on-year. Trade with key partners like Russia, the U.S., and the EU saw notable increases, contributing to a substantial $95.7 billion trade surplus. These gains reflect sustained demand for Chinese goods globally, even amid broader economic uncertainties.

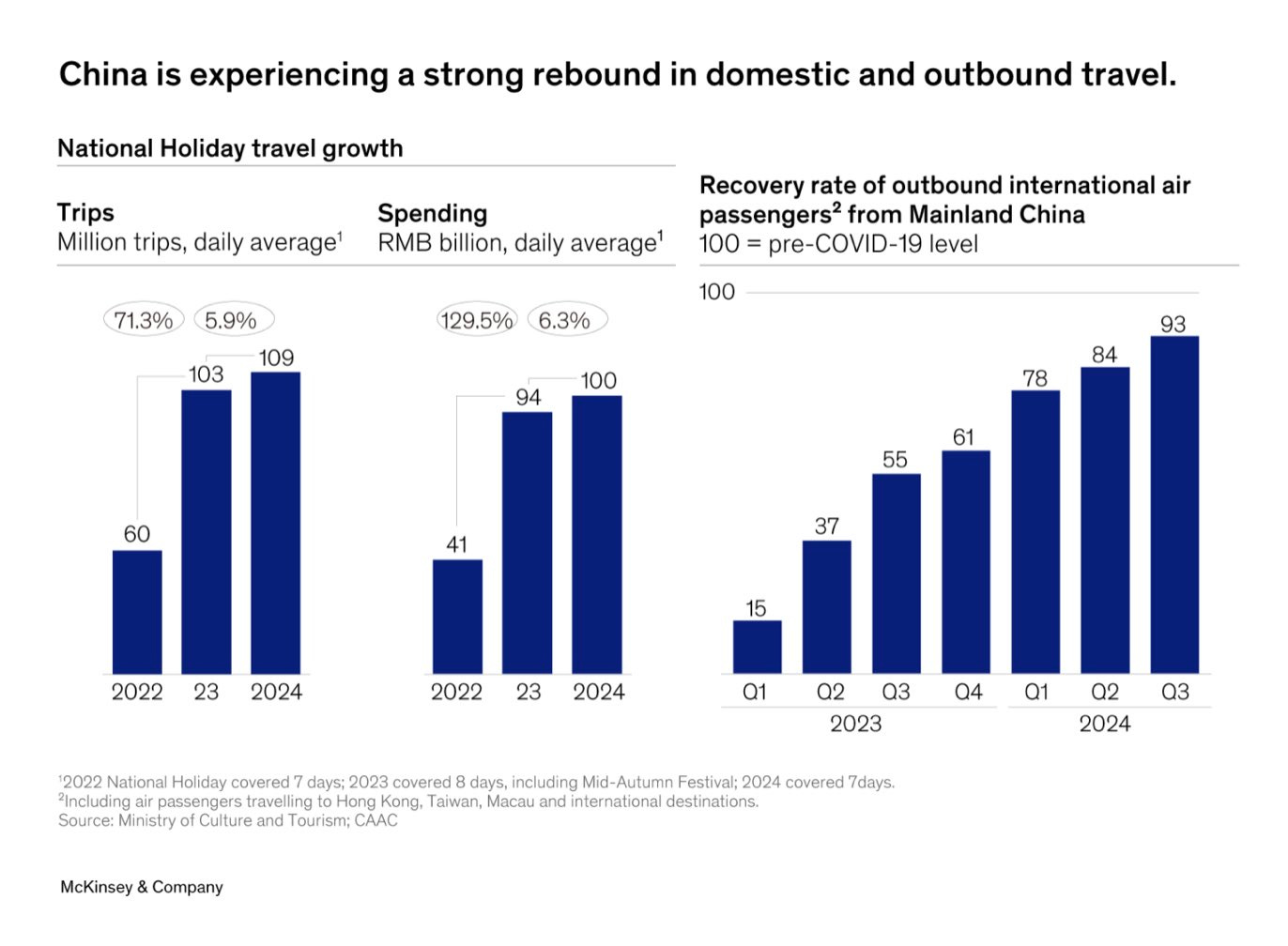

More interestingly perhaps, China’s outbound travel has shown strong signs of recovery. Popular destinations across Southeast Asia, including Thailand, Vietnam, and Malaysia, have reported a significant surge in Chinese tourist arrivals. This resurgence is contributing to regional economic growth in sectors such as hospitality, retail, and aviation. With easing travel policies and growing consumer confidence, outbound travel is expected to remain a key driver of recovery in China’s service sector and a boost for global tourism-dependent economies. Bu to me the significance is that Travel is consumption. Recall the 2022 binge of the US consumer - it started (or was manifested through) “revenge” travel. Chinese consumers took longer to recover from their *annus horribilis* but this was one of the missing dominoes, and it being in the process of falling, gives me confidence that other consumption will also pick up.

Geopolitical Ambiguity: Risks and Opportunities

A part of the discussion I am not particularly passionate about is the U.S.-China relations. Sure they remain a significant wildcard, and it was clear at the roundtable that the ambiguity of the new U.S. administration’s approach, which could range from heightened tariffs to a potential grand bargain makes it harder to read than ever. This uncertainty complicates strategic planning for businesses and policymakers alike .On the Taiwan question, opinions diverged. Some experts anticipate potential conflict by 2027, while others highlighted practical challenges that make such scenarios unlikely. Government representatives suggested that economic realities and political calculus might favour peaceful resolutions over confrontation.

My views on this are clear: i’m in the Grand Bargain camp, which I believe will include talks on currency, terms of trade and support for Taiwanese self realisation. Having thought about it, I don’t think there will be that much change on this in the near term. I would go so far as to say that conflict in the Taiwan straight is probably the most overestimated geopolitical event of the recent past and the near future. I think, the economic incentives remain more important, despite the sober rattling on both sides. But the key is that any positive development will help immensely with the perception and thus investor interest.

One hedge fund manager summarized this divergence: “Institutional ownership is at its lows, and local money is starting to get deployed—this is the beginning of the bull run.” Such sentiment reflects a broader optimism among those actively deploying capital, even as advisors remain cautious

Conclusion: Navigating a Complex Recovery

China’s recovery is far from linear, marked by a mix of promise and persistent challenges. The combination of robust consumer activity, strategic policy adjustments, and growing export strength provides a solid foundation for growth. Yet, structural issues and geopolitical uncertainties demand vigilance.

As one roundtable participant aptly noted, “The amount of bearishness out there only makes me more convinced.” With continued policy innovation and resilience, China stands poised to navigate the complexities of its recovery journey, balancing risks with opportunities for sustainable growth.