The New Leap Forward

How a Nation at the Crossroads is Redefining Growth Through Resilience, Innovation, and Strategy

I’ve been invited to speak at a discussion “which bring together leading figures from politics, finance, industry, academia, the security and foreign policy establishment and so on to debate some of the big questions facing markets and global political economy to encourage some cross-pollination of ideas”. I will certainly share the details after the event, but sufficed to say it’s un by a well-respected UK money manager and I am looking forward to it. So much so, that I actually did a serious amount of preparatory work, in order to help me structure my thoughts.

The weirdest thing is that I think that while none of it is new takes/information, it came together rather coherently in what I would call a program article. I am posting it here, as I think it’s a pretty definitive summary of my macro view of China, and challenges and opportunities therein.

A programming note: there will only be one in-depth paid article this week as i’m busy with the event and follow ups Monday and Tuesday. There are 3 pieces still outstanding in the EV-verse schedule:

BYD (the biggest and the most complex of the industry participants)

Yutong Bus (a niche player, but what a niche! maker of the new double deckers among other buses)

Summary data review (an in-depth look at valuations and what they mean across the autos space).

They are all coming in the next 2 weeks. Surprisingly the summary piece is the furthest along, and I suspect that it will be the first one to be published. I do think it should be worthwhile , as it should put a bow on the EV space and put it in to a numerical context. I am certainly very excited about it. I think its ok to do it before reviewing BYD as it’s so well covered I doubt I can add too much to that particular conversation.

As usual I would love to have you join the conversation over on the paid side of things.

The New Leap Forward

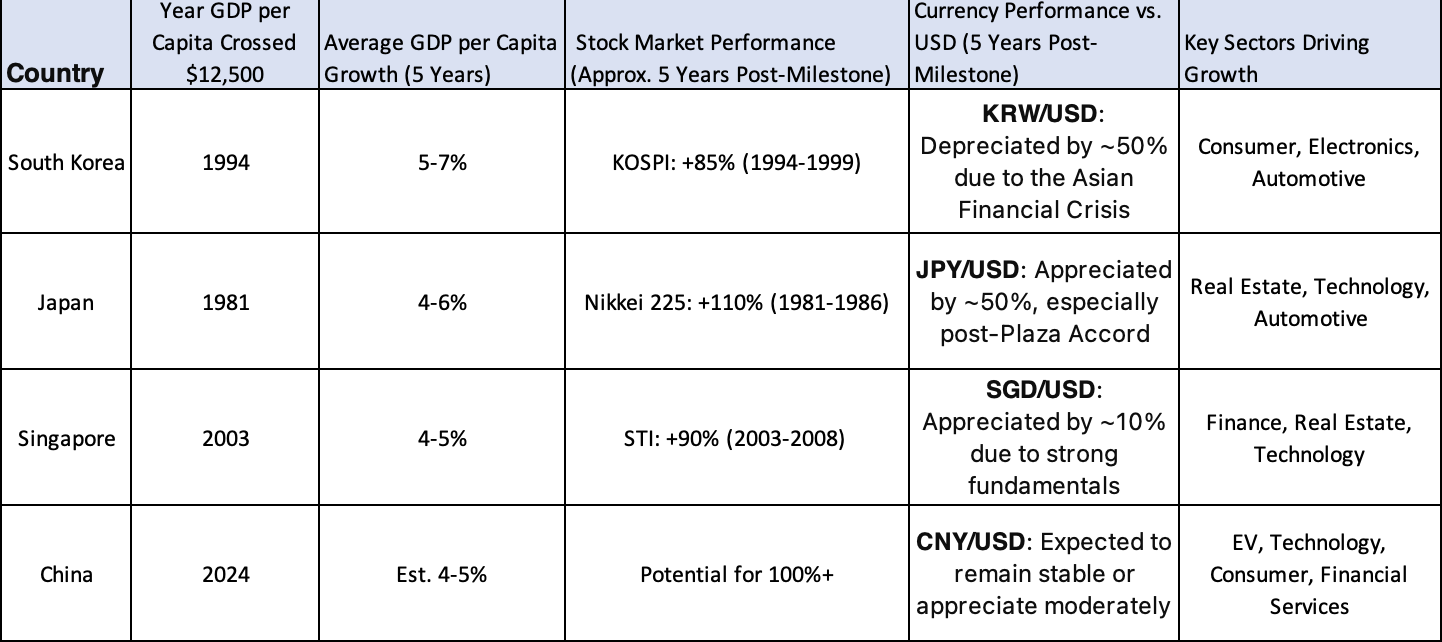

13,000 GDP per capita threshold. Historically, this milestone has signaled profound transformations for economies, as seen in Japan and South Korea, where rising middle-class prosperity fueled consumption-driven growth and sectoral innovation. For instance, Japan experienced a 110% surge in its Nikkei 225 index between 1981 and 1986, while South Korea’s mid-1990s transition was marked by robust advances in consumer goods and electronics. China’s current position reflects similar opportunities, with its GDP per capita reaching approximately $12,700 in 2024.

This economic shift is already visible in key indicators. Retail sales grew by 4.5% year-on-year in October, with automobile purchases, in particular, rising by 8.6%, driven by improving consumer sentiment and targeted subsidies. The property sector, often a bellwether for China’s economic health, has also shown signs of recovery after 2 years of falling sales and prices. Sales by the top 100 developers rose by 7.1% year-on-year in October, marking the first positive growth in over a year. These developments have been supported by fiscal and monetary policies, including the People’s Bank of China’s interest rate and reserve ratio cuts, and a 2 trillion yuan allocation for property inventory buyouts. These measures, combined with a 6 trillion yuan program to address local government debt over the next three years, highlight the government’s commitment to stabilizing the economy while addressing structural challenges.

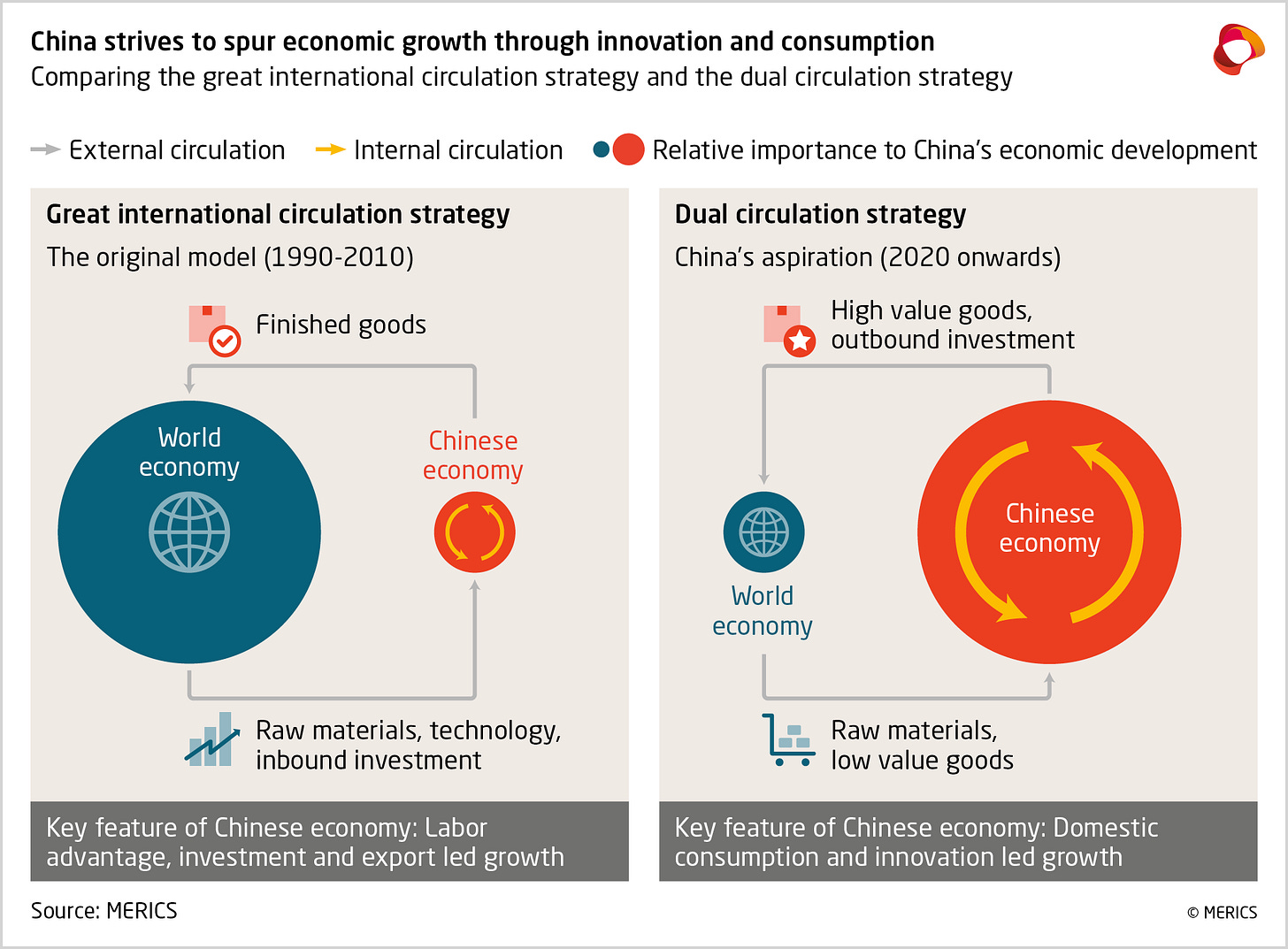

Central to this economic transformation is China’s Dual Circulation Strategy, which seeks to balance internal consumption with external trade engagement. Introduced in 2020, the strategy emphasizes reducing reliance on exports by fostering domestic demand, innovation, and self-reliance in critical industries, while maintaining China’s role as a key player in global trade. The strategy has already delivered tangible results. Despite global challenges, China’s exports rebounded with a 7% year-on-year growth in October, bolstered by diversification efforts that have reduced its dependency on the US market. Meanwhile, domestic initiatives, such as subsidies for multi-child families and rural welfare programs, are enhancing household purchasing power, further supporting the shift toward a consumption-driven economy.

Currency dynamics play an integral role in the Dual Circulation Strategy. A stable yuan supports household consumption by preserving purchasing power, while a weaker yuan enhances export competitiveness. China has historically managed this balance effectively, allowing modest depreciation during periods of trade tensions, such as the 2018-2019 tariff hikes, to cushion exporters without triggering sharp capital outflows. Today, the yuan remains stable, reinforcing investor confidence and supporting the strategy’s dual objectives.

The property sector, long a cornerstone of China’s economy, still has a role to play in this transition. Fiscal interventions, including urban renewal projects and targeted buyouts, are stabilizing the market. While challenges remain, particularly in tier-2 and tier-3 cities, these measures are expected to create a foundation for recovery by the second half of 2025. A stable property market not only secures jobs and household wealth but also underpins broader economic stability.

China’s approach to external pressures, particularly geopolitical tensions with the US, further reflects its adaptability. The potential for a renewed trade war under a Trump 2.0 administration could impose significant tariffs on Chinese exports, with estimates suggesting GDP growth could drop by up to three percentage points annually in a worst-case scenario. Yet, China has demonstrated its capacity to navigate such challenges by strengthening trade ties with ASEAN, Africa, and Latin America, while bolstering domestic demand to mitigate external shocks. These efforts align with the Belt and Road Initiative, which continues to enhance China’s influence in emerging markets.

We are seeing the government being very aggressive with stimulus. While critics argue that the 12 trillion yuan package, amounting to 10% of GDP, is insufficient or narrowly focused on debt replacement. This misunderstands the broader scope of the measures, which include tax cuts, property market support, and social welfare enhancements. These initiatives not only stabilize the economy in the short term but also lay the groundwork for long-term growth. Given how many government bodies have come out with their own part of the stimulative measures, its clear that the government is united over the direction of policy, and its only the pace thats being figured out in the process.

China’s current trajectory echoes the transformative periods experienced by Japan and South Korea, where shifts to consumption-driven growth models unlocked decades of sustained prosperity. As it navigates challenges and opportunities, China’s comprehensive approach—balancing fiscal stabilization, structural reform, and global engagement—positions it as a resilient and innovative economic powerhouse. With strategic policies in place and a clear vision for the future, the country is well-equipped to enter a new era of growth and influence.