China Weekly Wrap (featuring StoneX conference impressions)

a week that was 5 January - 10 January 2025

Good Evening,

We are well and truly back with a pretty exciting week in the markets. Most of the action was in the US what with the surprises in the data and continued Trump news flow, but China had its fair share of excitement too. Over and above the usual features, we are also including a summary of the StoneX Natural Resources Day conference, though mostly from a China angle.

But first, some admin. We have been active on th substack this week publishing 2 new pieces on Oil:

A piece on Refining (focusing on Sinopec) We are really quite proud of how this one turned out.

Another piece on x-China refining (focusing on Thai Oil)

We also recorded a pre-trip Pod on the implications of the CATL and Tencent inclusion in the US DoD list of entities, working on behalf of the PLA

Do please check those out, if you haven’t already. We will continue to explore Energy in China and Asia this week with a look at HengLi Petrochemical and the chemicals landscape as a whole, as well as starting to look a coal. There will also be another episode of the Perpercticast dropping on Sunday evening.

As usual, Portfolio review will follow this Sunday for the premium subscribers, with a second instalment of the review of US-listed China focused ETFs and the indices they follow. Do join us for that if that is your sort of thing, and we always appreciate your custom!

With that, please enjoy the Weekly Wrap!

As of January 3, 2024, here’s a summary of the weekly, month-to-date (MTD), and year-to-date (YTD) performances of major Chinese and Hong Kong stock indices that we follow.

Notes:

• Shanghai Composite Index (SHCOMP): Tracks all stocks (A and B shares) traded on the Shanghai Stock Exchange.

• CSI 300 Index (SHSZ300): Represents the top 300 stocks traded on the Shanghai and Shenzhen Stock Exchanges.

• China A50 Index (512150 CH): Comprises the top 50 A-share companies listed on the Shanghai and Shenzhen Stock Exchanges.

• ChiNext Price Index (159954 CH): Focuses on innovative and high-growth enterprises listed on the Shenzhen Stock Exchange.

• SSE STAR 50 Index (83151 HK): Represents the top 50 companies listed on the Shanghai Stock Exchange’s STAR Market, emphasising science and technology innovation.

• Hang Seng Index (HSI): Measures the performance of the largest companies listed on the Hong Kong Stock Exchange.

• Hang Seng China Enterprises Index (2828 HK): Includes major H-share companies listed in Hong Kong.

Currency Considerations:

• Chinese Indices (SSEC, CSI300, China A50, CNT, STAR50): These indices are denominated in Chinese Yuan (CNY). To present their performance in USD terms, currency exchange rate fluctuations between the CNY and USD have been considered.

• Hong Kong Indices (HSI, HSCEI): Denominated in Hong Kong Dollars (HKD). Their performance in USD terms reflects the HKD/USD exchange rate stability, as the HKD is pegged to the USD.

Weekly Relative Performance Observations:

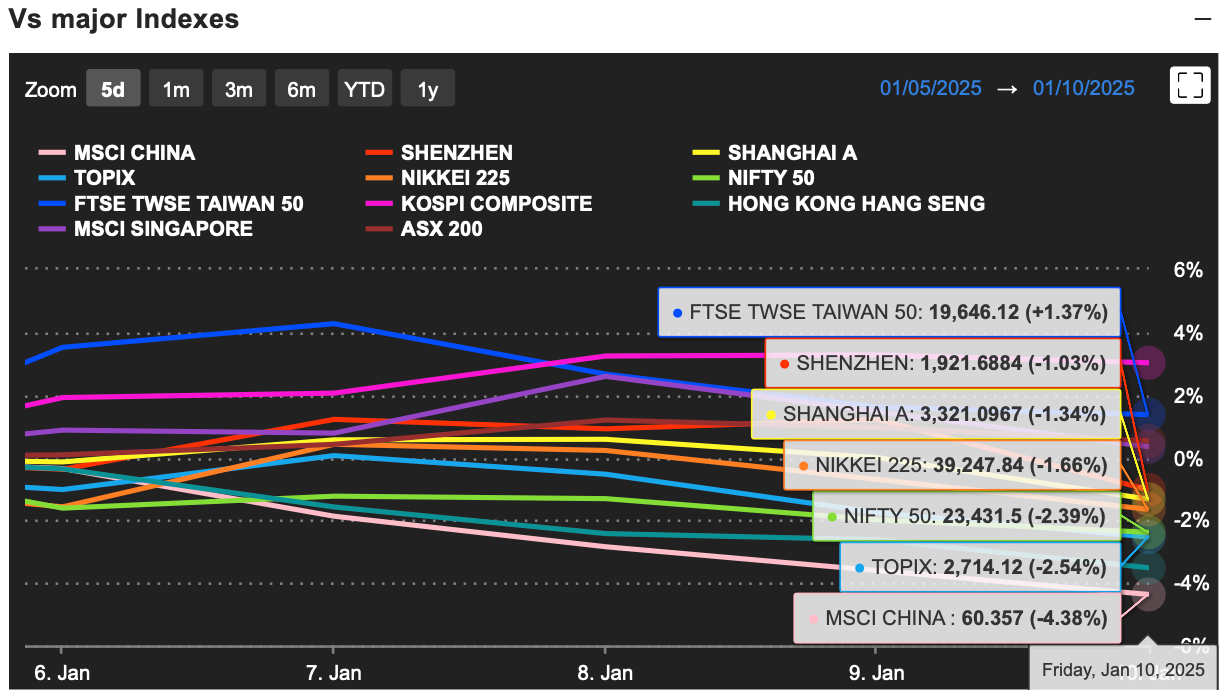

Weak Performance in Chinese Markets:

The MSCI China Index declined by -4.38%, marking the largest drop among the indices, indicating a bearish sentiment towards Chinese equities during this period.

Other key Chinese benchmarks, such as Shenzhen (-1.03%) and Shanghai A (-1.34%), also showed negative returns, reflecting broad-based underperformance within China.

Regional Comparison:

Chinese indices underperformed compared to regional peers like FTSE Taiwan 50 (+1.37%), which showed strong gains, and Nikkei 225 (-1.66%), which declined less sharply. This divergence suggests that investors may be rotating out of Chinese equities in favor of other Asian markets.

Possible Factors:

Sentiment in Chinese equities may have been dampened by concerns about economic recovery, policy uncertainty, or weaker-than-expected corporate earnings.

Broader market volatility and global macroeconomic factors, such as interest rate expectations and geopolitical risks, could have disproportionately affected Chinese stocks.

For investors in Chinese equities, the recent underperformance may present a tactical buying opportunity if valuations become more attractive, especially for sectors tied to long-term growth drivers like EVs and renewables.

Conference notes.

We have been invited to be on the China panel of the StoneX Natural Resources Day 3.0, held on January 9, 2025. It was a truly great event, focusing on the broader Natural Resources landscape where China, as the largest consumer was one of the more important topics of conversation. We would like to thank the Team at StoneX and Mike Cuoco personally for organising and inviting us to it, it really was great.

The event brought together industry leaders and experts to discuss key trends shaping global markets. It featured panels on macroeconomic outlooks, commodity markets, and the energy transition.

Highlights included discussions on copper’s rising demand driven by AI and urbanization, challenges in permitting and production, and bullish outlooks on silver despite supply risks. The energy transition panel emphasized China’s EV dominance, the feasibility of carbon capture and storage (CCS), and infrastructure gaps hindering progress.

Overall, the event provided actionable insights into market dynamics, investment opportunities, and the evolving role of technology and sustainability in natural resources. Commodities-wise the outlook was pretty bullish, while we didn’t discsuss energy, more or less every other trend was positive form base to precious metals including steel.

To us thought the key takeaway was that no one is seriously looking at Chinese assets. Now we could have told you that in advance, by just looking at foreign holdings of chinese equities and by how stocks have traded over the past few years. But there’s always a question of when will the interest return? what stage of the interest cycle are we in?

It is interesting to me that while Chinese impact on commodities, and even trade and geopolitics is still front of mind. As is the impact of any proposed tariffs in the US on China. All of this was discussed at length on the main panel and came up a few times in the specialist ones. But that mindshare did not, as yet, converted in to a change in interest in the actual stocks among the professional investor community.

As best we could gather the trigger for a return would be all the things we’re talking about, the consumption stimulus, the reforms and the continued peace in the strait. I do wonder though, do those waiting for this to consider going back in, that once it plays out like that, the Chinese market would have 2x by then. We continue to advocate that the pockets of opportunity in the Chinese Equities space are such that its time to have those positions and add to them and expand after the market starts moving as the CCP delivers on key reforms, ad we start seeing the results of reforms already passed.

In the meantime, we proceed.

In the news this week:

Announced by: China’s Vice Finance Minister

Date: January 5, 2025

Event: Proactive Fiscal Policy in 2025

Details:

China’s Vice Finance Minister emphasized the government’s intention to adopt a highly proactive fiscal policy in 2025 to address both domestic and external economic challenges. With significant room to expand debt and deficits, the government plans to use fiscal tools to stabilize the economy. The measures include targeted infrastructure spending, subsidies to boost consumption, and support for high-growth sectors such as green energy and advanced manufacturing. The policy focus will also prioritize maintaining efficiency and timing to ensure funds are allocated effectively. This comes as China navigates slower-than-expected global recovery and deflationary risks in its domestic market.

Announced by: People’s Bank of China (PBOC)

Date: January 10, 2025

Event: Suspension of Government Bond Purchases

Details:

The PBOC announced it would suspend government bond purchases starting January 2025 in an effort to stabilize the yuan and manage market imbalances. This move follows growing speculation of aggressive monetary easing, driven by a sluggish economy, weak property markets, and soft consumption. By halting bond purchases, the PBOC seeks to reduce excessive liquidity that could weaken the currency further, especially amidst a widening interest rate gap with the U.S. Bond yields surged following the announcement, reflecting concerns over liquidity in financial markets. Analysts believe this policy highlights the balancing act China faces in sustaining growth while managing inflationary pressures and financial stability risks.

Announced by: Shanghai and Shenzhen Stock Exchanges

Date: January 9, 2025

Event: Meetings with Foreign Institutional Investors

Details:

Both stock exchanges held meetings with foreign institutional investors to address concerns and improve market confidence. Discussions included efforts to deepen the external opening of China’s capital markets, such as enhancements to the Qualified Foreign Institutional Investor (QFII) scheme and improving connect measures with Hong Kong’s financial markets. These initiatives aim to streamline foreign capital inflows and ensure greater accessibility for global investors. Officials also emphasized China’s commitment to strengthening market transparency and predictability, particularly in the A-share market, as part of broader reforms to attract long-term investments.

Announced by: China’s Foreign Ministry

Date: January 11, 2025

Event: 11th China-UK Economic and Financial Dialogue

Details:

Scheduled to take place in Beijing, the dialogue will focus on deepening bilateral economic cooperation between China and the UK. Co-chaired by Vice Premier He Lifeng and UK Chancellor Rachel Reeves, the meeting will explore avenues for trade expansion, financial collaboration, and mutual investment in key sectors like green energy, fintech, and advanced manufacturing. This marks a significant diplomatic and economic engagement amidst global geopolitical uncertainties. The dialogue aims to strengthen ties and create opportunities for both nations to navigate global economic headwinds collaboratively.

Data Released This Week:

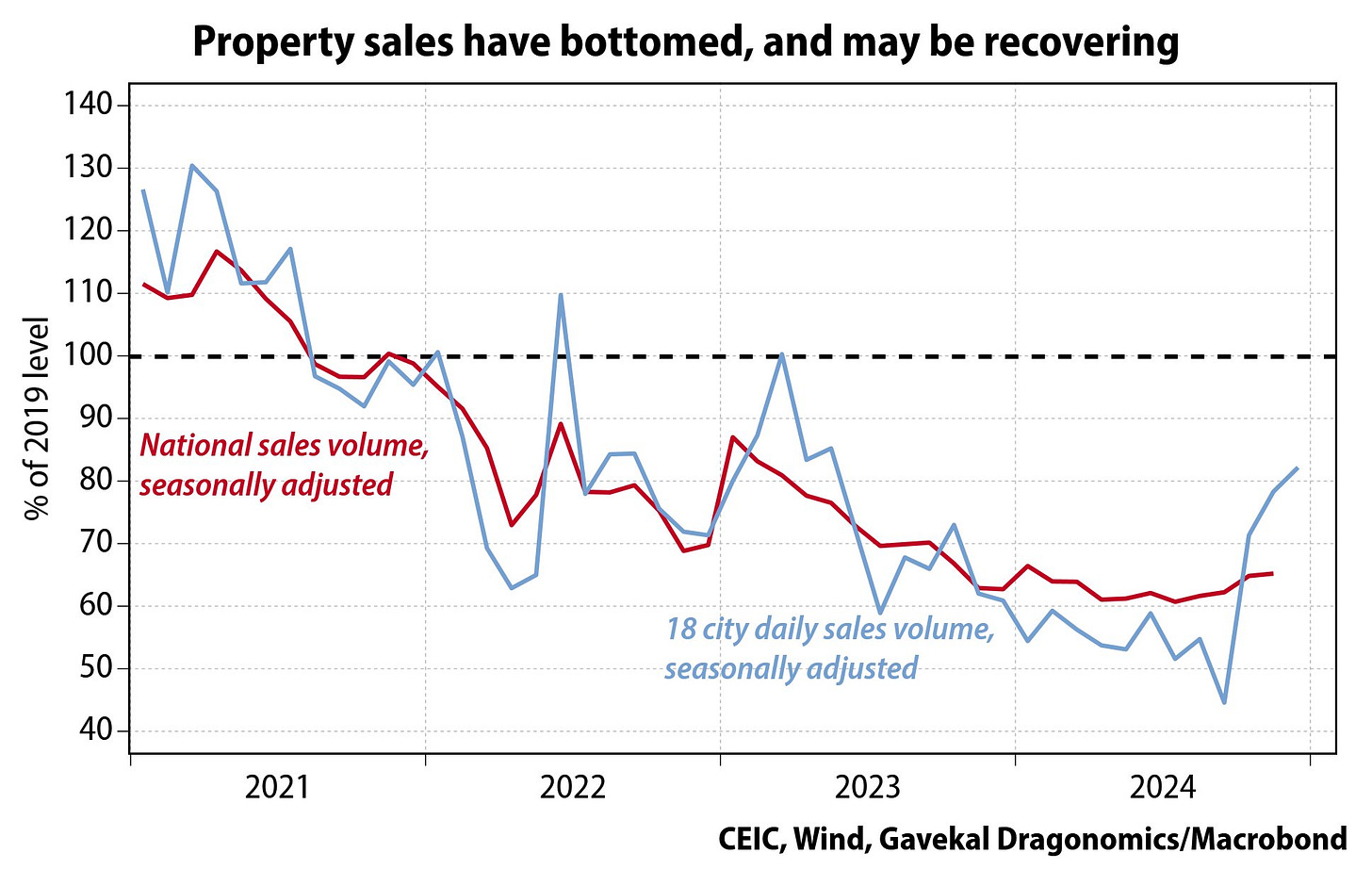

Announced by: China Index Academy

Date: January 8, 2025

Event: Property Market Stabilization

Details:

The China Index Academy reported sustained recovery in China’s property market, with a 20% rise in both new and pre-owned home transactions in December 2024 across 30 key cities. The recovery reflects the success of property rescue measures implemented in 2024, including eased mortgage restrictions, lower down payments, and direct support to distressed developers. The housing market has been in decline since 2021, with over-leveraged developers and slowing urbanization weighing heavily on growth. Academy Director Cao Jingjing highlighted that these policies have arrested the multi-year slump and brought stability to the market, with potential for further growth in 2025 as confidence returns.

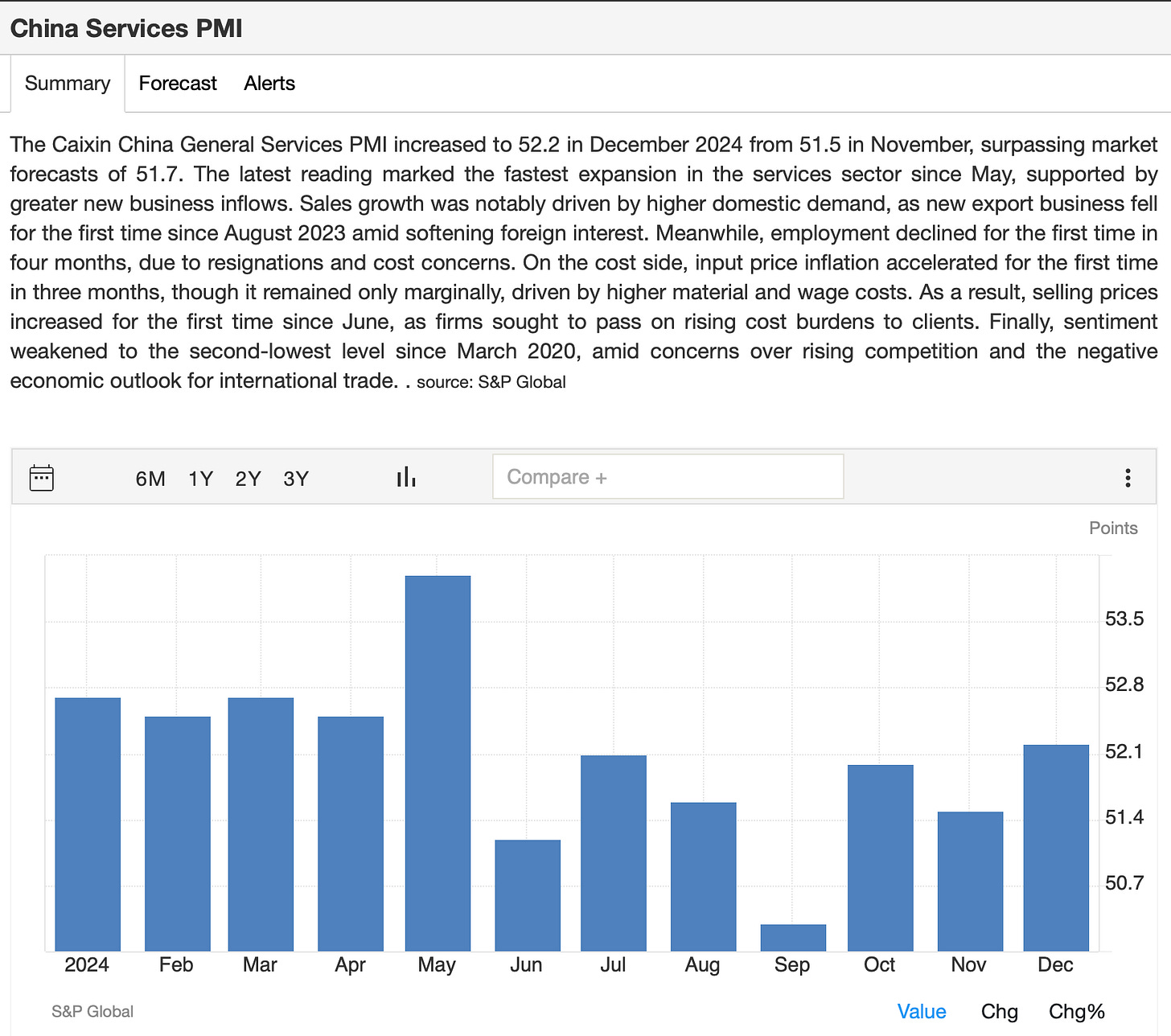

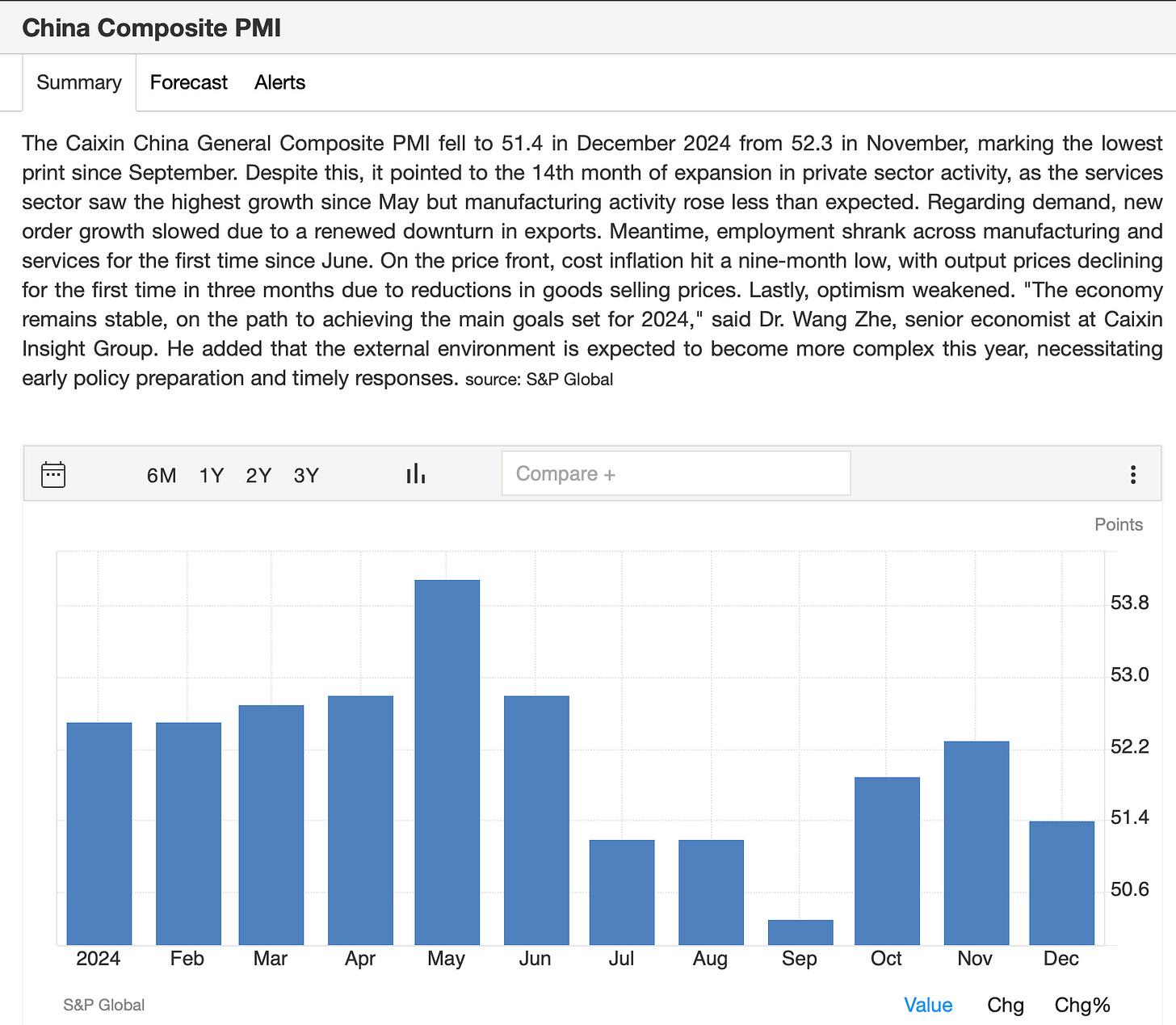

Announced by: Caixin Insight Group

Date: January 5, 2025

Event: December Caixin Services and Composite PMI

Details:

The Caixin Services PMI rose to 52.2 from 51.5 in November, exceeding the forecast of 51.1. This marks continued expansion in the services sector, driven by higher business activity and new orders.

The Caixin Composite PMI fell slightly to 51.4, down from 52.3 in the previous month, reflecting weaker performance in manufacturing compared to services. Both indices remain above the 50-point threshold, signaling overall economic growth.

Announced by: State Administration of Foreign Exchange

Date: January 7, 2025

Event: December Foreign Exchange Reserves

Details:

China’s foreign exchange reserves declined to $3.202 trillion from $3.266 trillion in November, below the consensus forecast of $3.25 trillion. The drop is attributed to valuation effects due to a stronger U.S. dollar and adjustments in asset holdings amid increased market volatility.

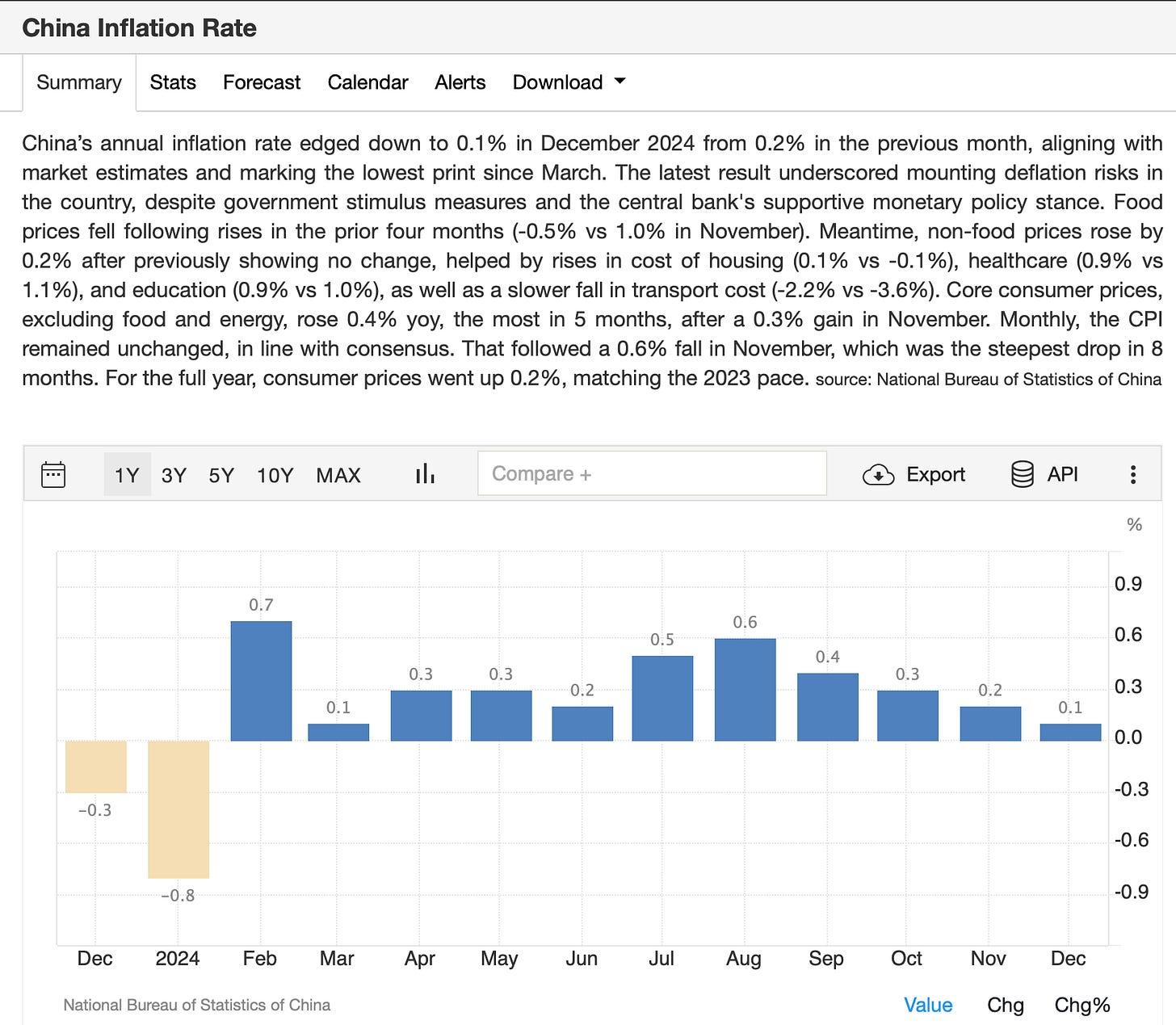

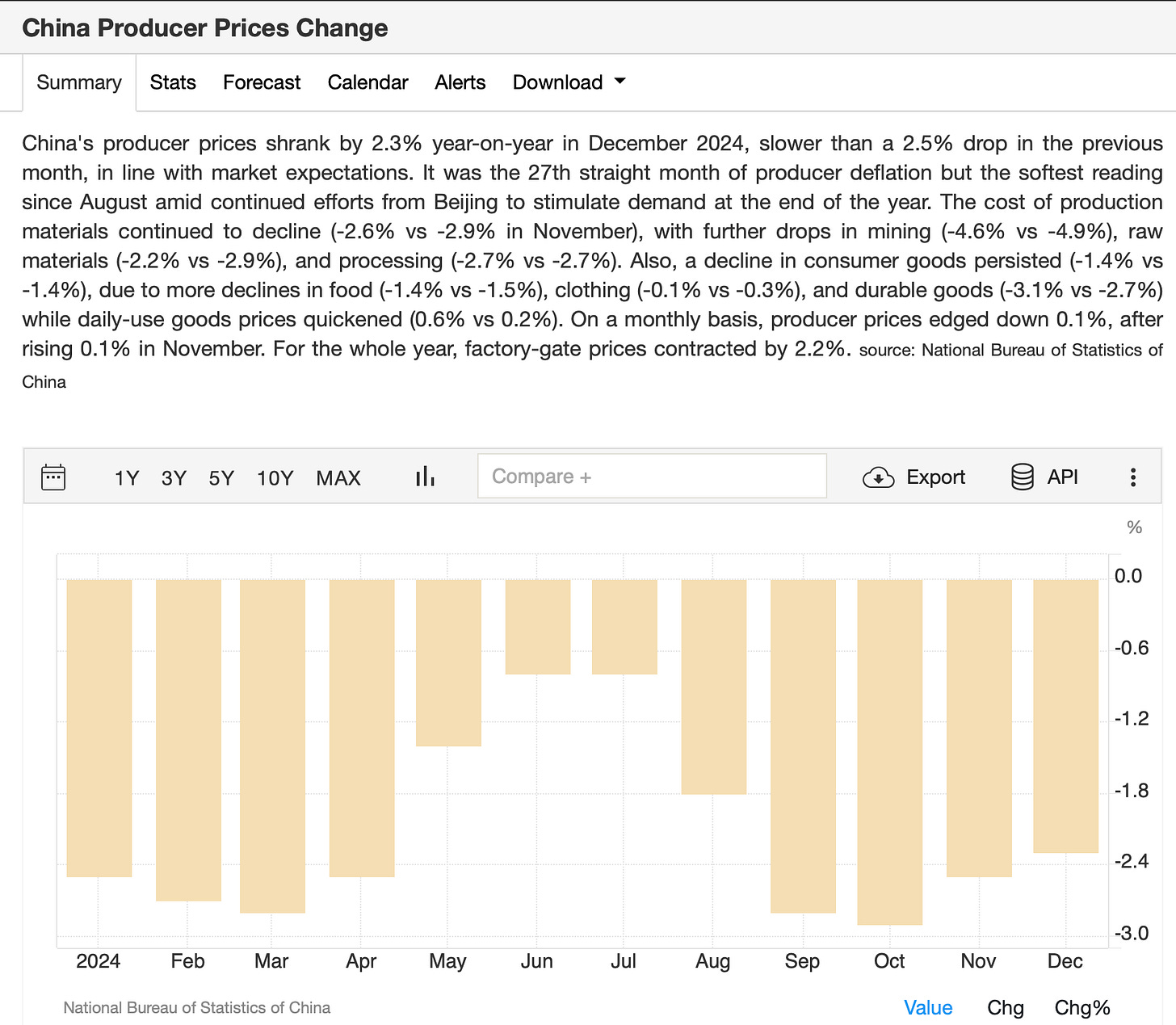

Announced by: National Bureau of Statistics of China

Date: January 8, 2025

Event: December Inflation Data (CPI and PPI)

Details:

Consumer Price Index (CPI): Year-over-year growth slowed to 0.1%, matching expectations but lower than the previous 0.2%. Month-over-month CPI growth was 0.0%, reflecting ongoing weak domestic demand.

Producer Price Index (PPI): Declined by -2.3% year-over-year, aligning with expectations but slightly better than the previous month’s decline of -2.5%. The persistent deflation in producer prices highlights challenges in the industrial sector, with weak global demand and overcapacity weighing on prices.

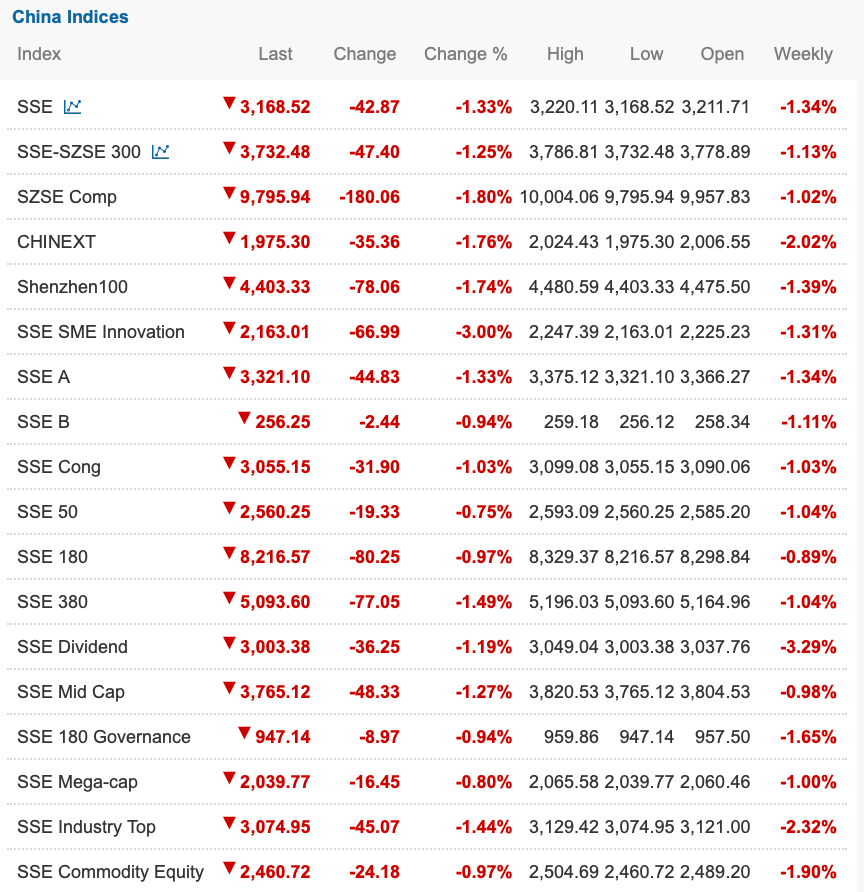

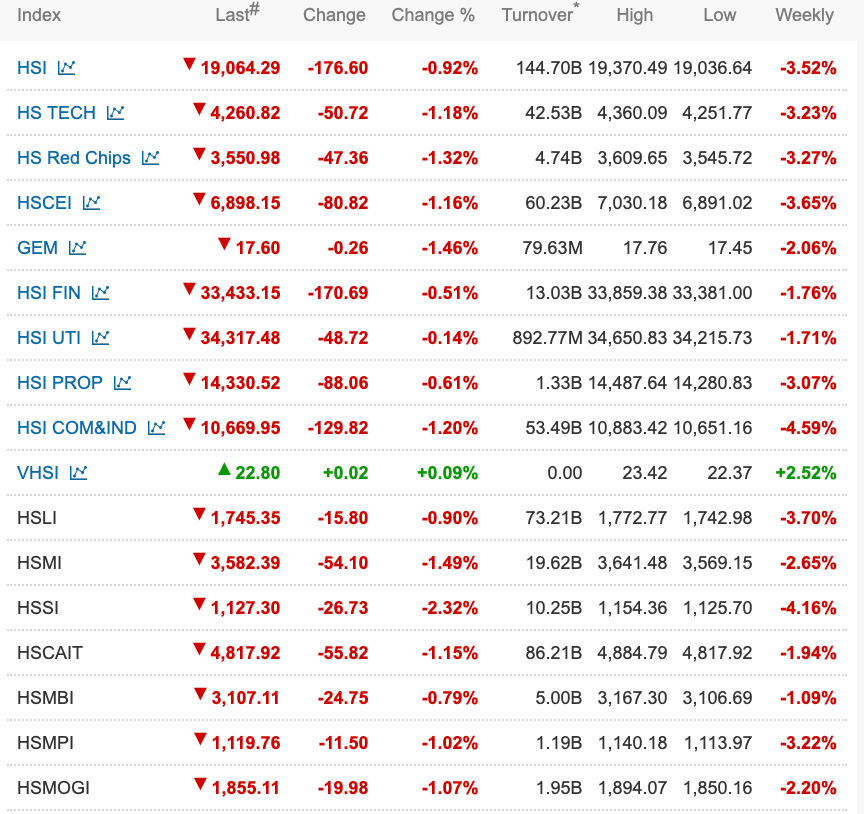

Complete Index Performance List:

China’s markets are reflecting a combination of structural weaknesses and investor caution. Large caps and commodity-related stocks showed relative resilience, while growth and SME sectors faced sharper declines. The overall market sentiment remains bearish amid ongoing macroeconomic and policy uncertainties. Further clarity on fiscal stimulus and monetary easing measures will be key in determining near-term market direction.

General Trends

Broad Weakness Across Markets: Most Chinese indices registered declines during the week, reflecting continued investor concerns about economic growth, deflation, and weak domestic demand. The SSE Composite Index declined 1.80%, closing at 3,168.52, while the Shenzhen Component Index dropped 1.74%, underperforming slightly.

Relative Underperformance:

The SSE SME Innovation Index experienced the largest drop at -3.00%, suggesting increased pressure on smaller and innovative companies, which often struggle more during economic uncertainty.

The SSE Dividend Index also posted a significant decline of -3.29%, potentially due to worries about the sustainability of corporate earnings in a challenging macroeconomic environment.

Sector-Specific Dynamics:

Commodity Equity: The SSE Commodity Equity Index fell 0.97%, indicating relative resilience compared to the broader market, reflecting potential stabilization in raw material-related stocks.

Technology-Related Indices: The Chinext Index, focused on growth and tech stocks, dropped by 1.76%, reflecting cautious sentiment towards high-growth sectors.

Mid-to-Large Cap vs. Smaller Indices:

Large-cap indices like the SSE Mega Cap Index declined only -0.80%, demonstrating relative strength compared to broader markets. Investors may be seeking safety in larger, more stable companies.

Mid-cap and SME-focused indices, such as the SSE SME Innovation Index (-3.00%) and SSE Mid Cap Index (-1.27%), underperformed significantly, as smaller companies are more vulnerable to liquidity and growth concerns.

Key Takeaways in Context

Investor Sentiment Remains Weak: The broad declines align with the deflationary pressures highlighted earlier, with China’s CPI at only +0.1% YoY and the PPI showing a persistent decline of -2.3% YoY. Concerns over weak domestic demand are reflected in the underperformance of consumer-driven and SME-focused indices.

Commodity Resilience: Despite economic challenges, the relatively lower decline in commodity-related equities suggests that this sector may be supported by global demand stabilization or anticipated policy measures in infrastructure investment, as highlighted by the proactive fiscal policy announcements.

Growth Sectors Under Pressure: The technology-focused Chinext and SME indices have been hit harder, reflecting skepticism about growth sectors in a subdued economic environment. Investors are possibly wary of high valuations and speculative growth plays.

Preference for Stability: The smaller declines in large-cap indices, such as the SSE Mega Cap Index, suggest a flight to quality as investors favor more established companies with stronger balance sheets.

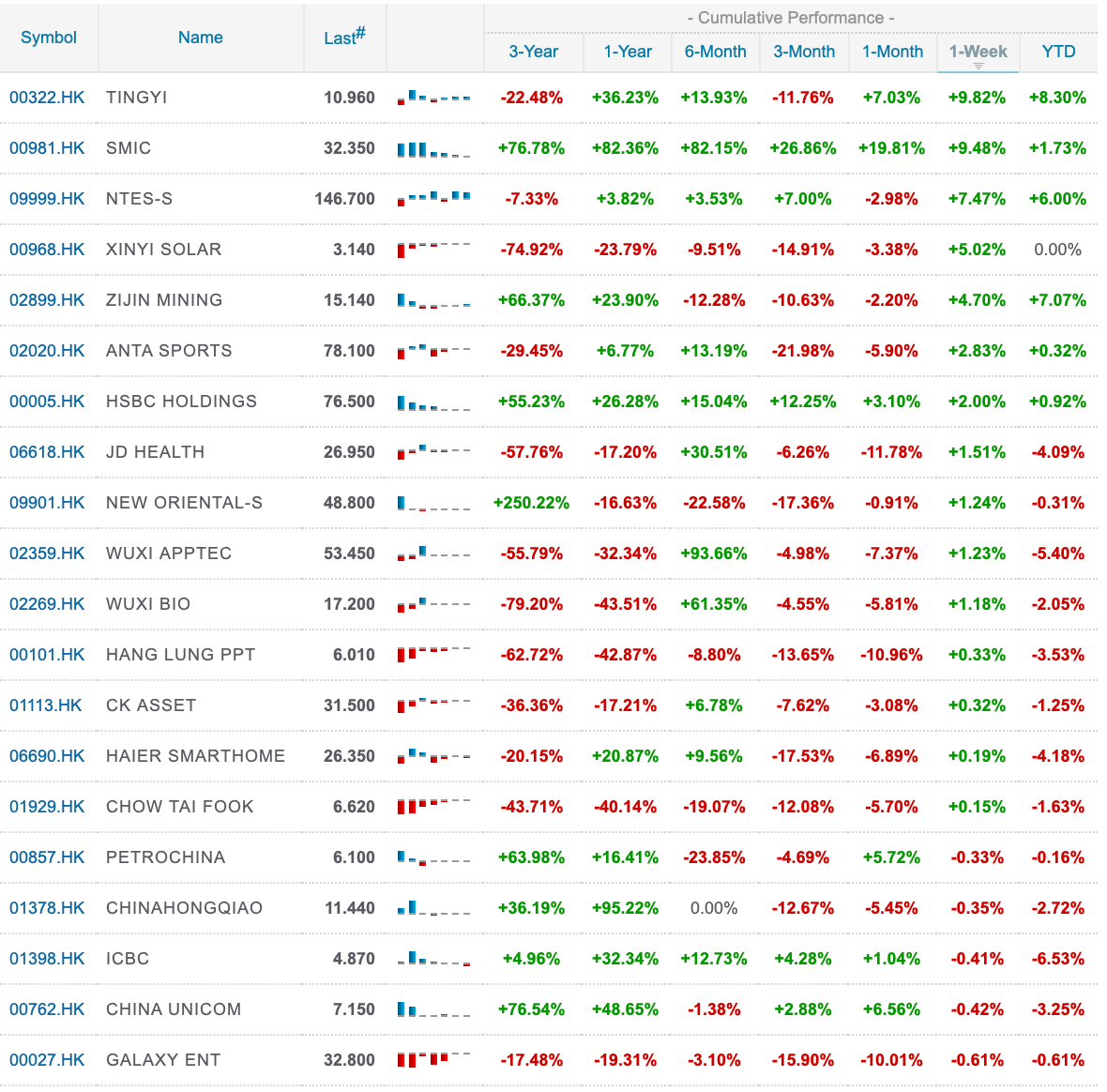

Top 20 Index Constituents:

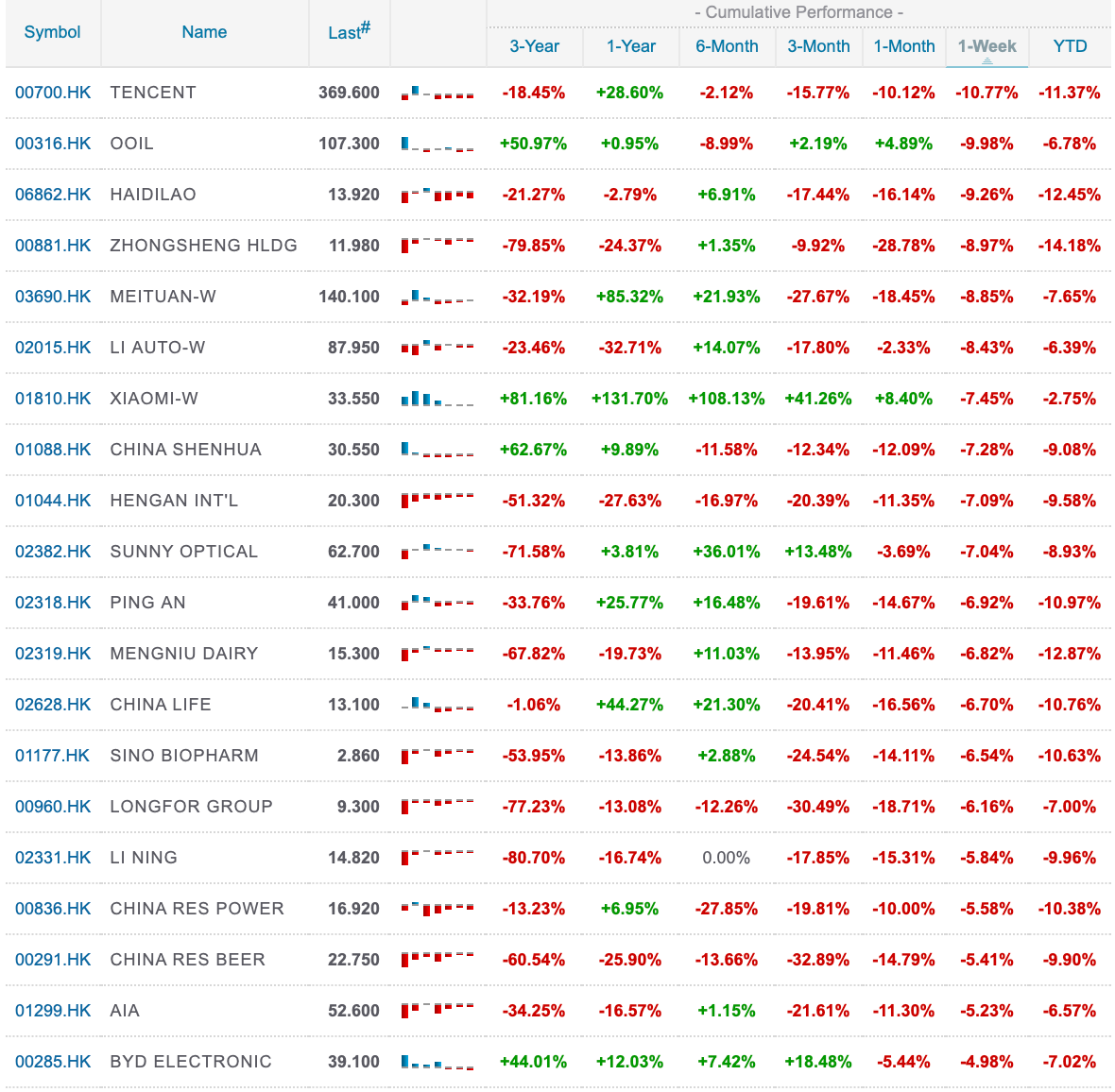

Bottom 20 Index Constituents:

Corporate News this week:

CATL’s $5 Billion Hong Kong Listing

Event: Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest battery manufacturer, announced plans for a $5 billion listing in Hong Kong.

Details: The funds are intended to support CATL’s overseas expansion, including a $7.6 billion plant in Hungary, a joint venture in Spain, a partnership in Indonesia, and a new R&D hub in Hong Kong. This move aims to bolster CATL’s financial position against global currency fluctuations and facilitate new product development, such as an integrated car chassis. Approval from the China Securities Regulatory Commission is pending.

U.S. Defense Department Blacklists Chinese Firms

Event: The U.S. Department of Defense added several Chinese companies, including Tencent Holdings and CATL, to a list of entities identified as “military in nature.”

Details: This designation reflects U.S. concerns over China’s integration of commercial and military technologies, particularly in areas like AI and quantum computing. Both Tencent and CATL have denied any military affiliations and are considering legal action. The listing has impacted stock performances, with Tencent’s shares dropping by 7%. While the designation doesn’t impose immediate sanctions, it serves as a warning of national security risks, potentially deterring investments and collaborations. Check out the Perspecticast episode for an expanded take on this.

Sunac China’s Debt Restructuring Progress

Event: Sunac China, a major property developer, secured support from holders of an onshore bond for its debt restructuring plan.

Details: The company has now obtained backing from holders of eight out of its ten bonds, aiming to reduce its onshore debt by over half. Sunac plans to be the first Chinese developer to restructure onshore bond debt through a company-led initiative, potentially setting a precedent for the sector. Approval from all ten onshore bondholders, totaling 15.4 billion yuan ($2.11 billion), is required to proceed. Meetings with investors are scheduled to finalise the restructuring plan.

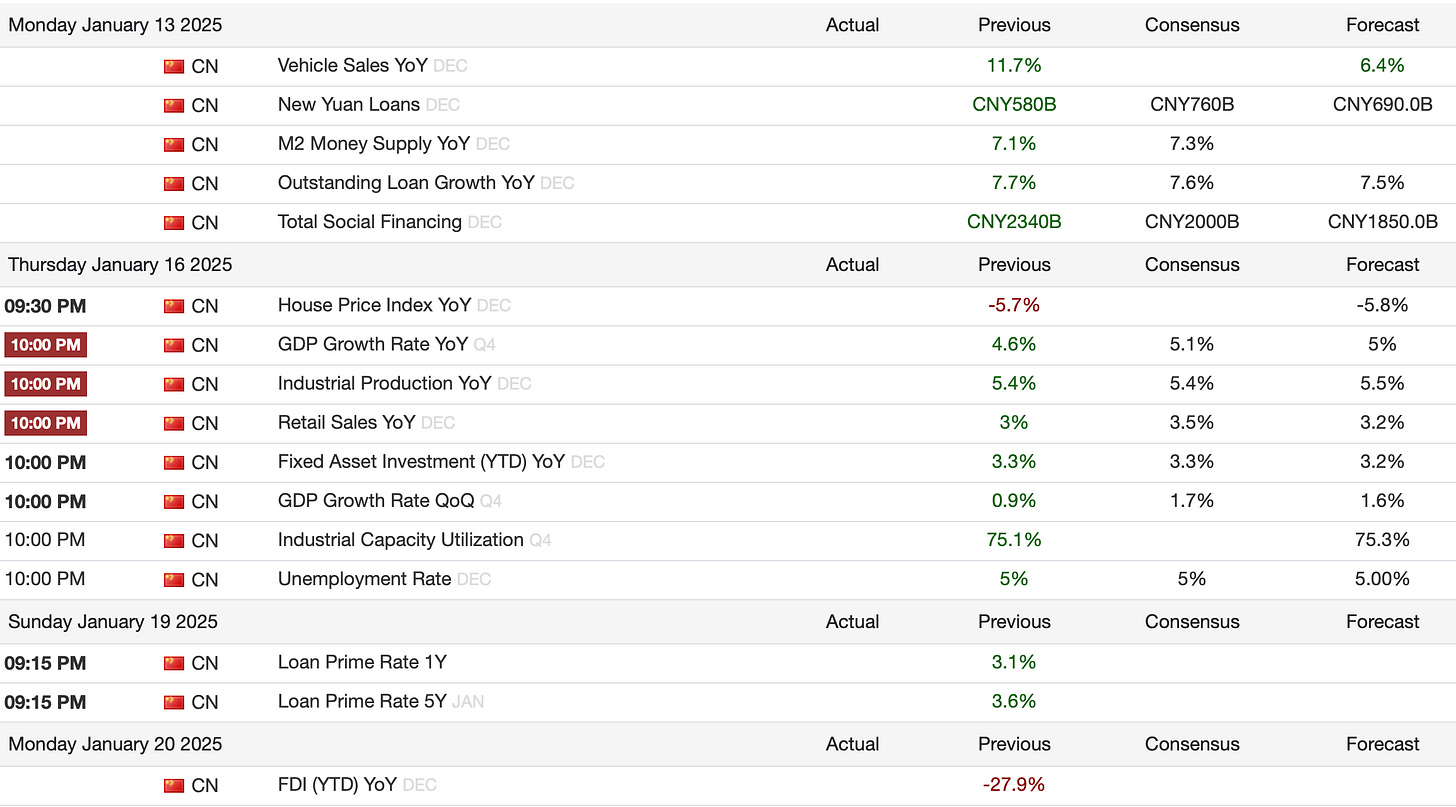

As we finish up the western holiday season, all of a sudden we’re staring at the Chinese New Year festivities shutting China down for just over a week at the end of January. While the legislative window is probably closed, and we won’t get much in the way of policy until well after the CNY, the data releases are going to pick up in the mean time.

Have a great weekend,

Leonid