Welcome to the second instalment on Copper! A quick industry summary and a review of Zijin Mining. As usual scroll to the very bottom for the short summary and a Panda Perspective.

**Important Reminder: Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

Another Reminder: New Product announcement this Sunday. Stay tuned for that.

Oh And Previews of 2025 will start dropping next week, do join us for that! Those and most detailed discussions with investing views, vast majority of the content is subscriber-only If you like this sort of thing, please subscribe, we’ll be happy to welcome you to your panda family!

This invite is extended to your friends and family too, lets not deprive them of the pleasure of diving in to a fresh PP issue!

Ok that concludes the opening remarks, on with today’s note.

Having discussed the prospects of the copper market more broadly in the previous article, it's only reasonable to offer up a palette of choice that the Chinese Market is offering us in terms of individual stocks. It used to be the case that long copper call meant going long Jiangxi Copper (358 HK). It was the best known, best understood integrated smelter. Over the years Jiangxi’s own reserves depleted, and a brand new selection of miners with world class assets are now in the forefront.

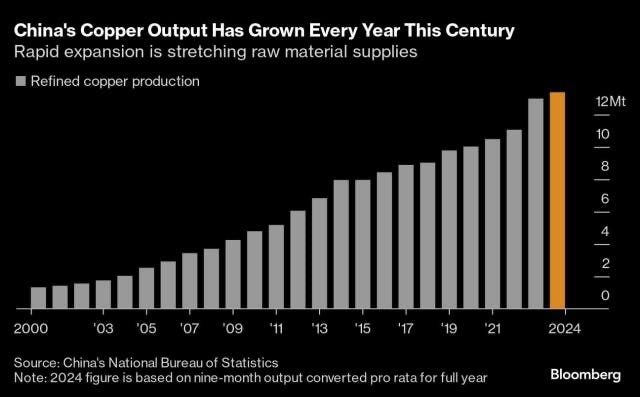

The Chinese copper industry is currently the largest globally, accounting for approximately 40% of global demand and over 20% of global production. In 2023, China’s refined copper output grew by 6% year-over-year, reaching approximately 11 million tonnes, supported by increasing investments in smelting capacity and technology upgrades. However, domestic mine output remains constrained, producing only around 1.8 million tonnes, necessitating significant imports of copper concentrates, which totaled over 25 million tonnes in 2023. The industry is undergoing structural shifts, with increasing emphasis on recycling and sustainability initiatives to reduce dependency on imports and improve environmental performance. While costs remain competitive, Chinese smelters face margin pressures due to low treatment charges and fluctuating concentrate prices.

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.