Welcome to the first article on Copper! Just reviewing supply/demand dynamics in the industry today and on to the Chinese industry overview for the rest of the week. As usual scroll to the very bottom for the short summary and a Panda Perspective.

In Substack news, this Sunday I shall also be announcing a new product, which I think will be very exciting, so stay tuned for that. Announced and structured this weekend, first instalment will come out last week of the year.

Next week is exciting as it will be the week of Predictions. I will put out a China Macro 2025 preview and a China Equities 2025 preview. If it goes well, potentially a Rest of Asia outlook too, given the size and scope of the first two I can’t commit to the third just yet, but I would really, really love to do it.

Much like this piece, and most detailed discussions with investing views, vast majority of the content is subscriber-only If you like this sort of thing, please subscribe, we’ll be happy to welcome you to your panda family!

Alternatively please consider forcefully inviting your nearest and dearest by getting them a gift of panda knowledge.

That takes care of all housekeeping, so on to the main bit!

Copper is at the heart of the green energy revolution and advanced technologies, promising robust demand growth over the next decade. However, the supply landscape is fraught with challenges, from declining ore grades to insufficient exploration investment. Strategic investment in efficient projects, recycling, and technological innovations will be pivotal in meeting future demand. Stakeholders must navigate a volatile macroeconomic environment while preparing for the structural shift toward a copper-intensive future.

Copper prices over the past five years have been shaped by a complex interplay of economic, industrial, and geopolitical factors. These forces have driven significant price fluctuations and underscored copper’s critical role in the global economy. Three primary categories of influence stand out: global demand growth, supply challenges, and macroeconomic pressures.

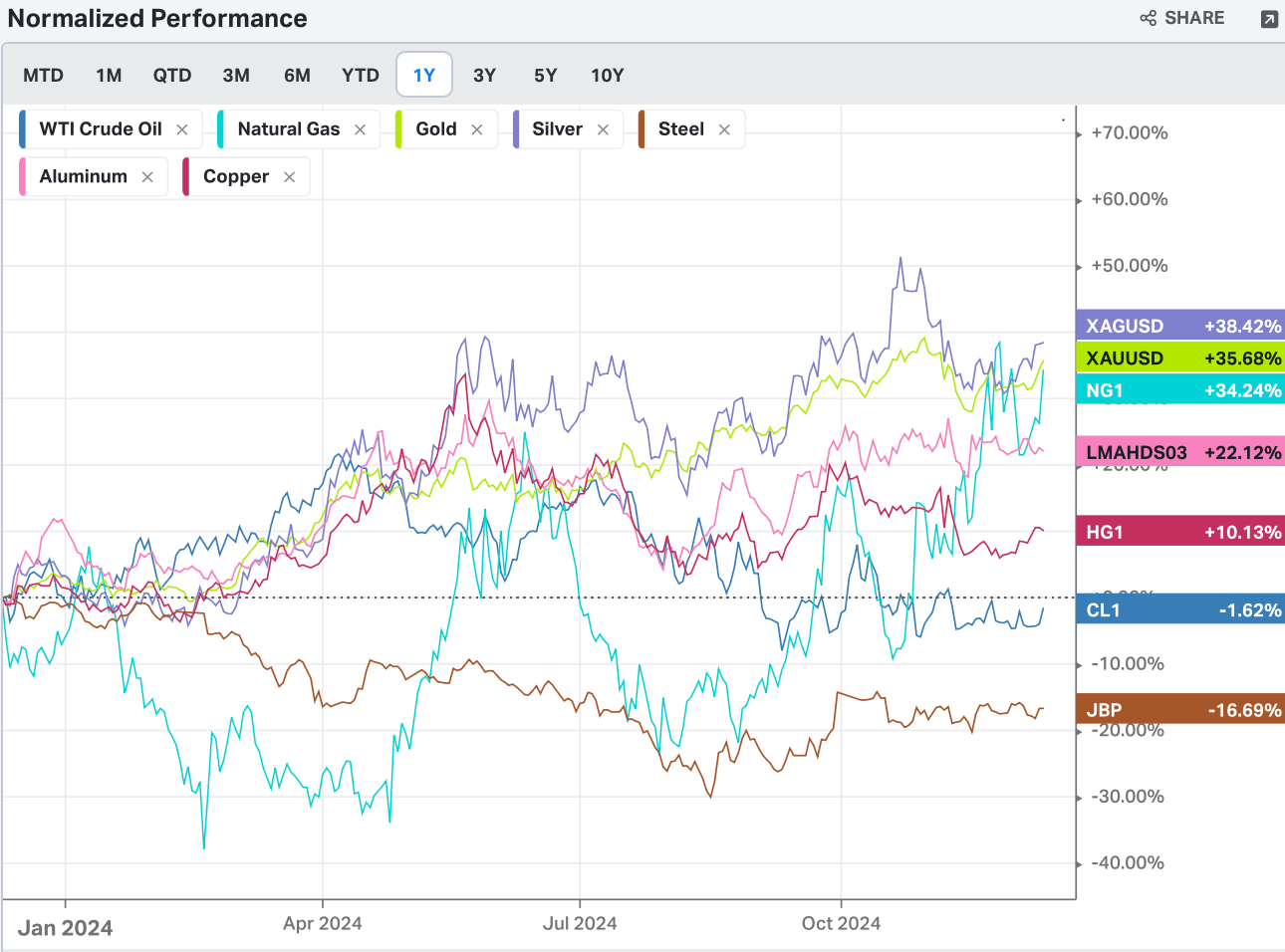

In 2024, copper prices experienced significant volatility, reflecting shifts in macroeconomic conditions and investor sentiment. In May, copper reached an all-time high of $5.20 per pound (~$11,450 per metric ton), driven by tight supply conditions, speculative flows, and optimism about global economic recovery. This rally was supported by robust demand growth in key sectors such as electric vehicles (EVs) and renewable energy .

However, by November 2024, prices had declined to approximately $4.12 per pound (~$9,080 per metric ton), marking a drop of nearly 20% from the peak. This downturn was attributed to multiple factors:

Global demand concerns: A strengthening US dollar and fears of recession in developed markets weighed on industrial metal prices .

Inventory builds: Copper inventories on global exchanges (LME, SHFE, and COMEX) rose during mid-year, further pressuring prices. However, visible stocks decreased later in the year, indicating gradual improvement in market fundamentals .

Despite the late-year correction, market analysts remain optimistic about the medium-term copper price outlook. Expectations of a structural supply deficit, driven by limited new mining projects and robust demand growth from electrification and green energy transitions, could push prices back toward $5 per pound ($11,000/ton) or higher by 2026.

This dynamic underscores the metal’s sensitivity to macroeconomic shifts and its critical role in global energy transformation

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.