Good Evening,

The first trading year is in the books - time to have a look at what happened. I suppose technically it’s the last week of last year that happened to have had some of the new year in it too, but we digress, the focus should be on how difficult it’s been on China in both equity and currency terms.

And we’ll dive right in to it right after some admin. We have been active on th substack this week publishing 2 new pieces on Oil:

Do please check those out, if you haven’t already. We will continue down the Energy path this coming week, publishing on PetroChina and Sinopec, and time permitting, HengLi Petrochemical. One way or the other subscribers will have access to a fairly definitive overview of the various parts of the Oil and Gas value chain in China by the end of the month.

As usual, Portfolio review will follow this Sunday for the premium subscribers, with a focus on US-listed China focused ETFs. Do joint us for that if that is your sort of thing, and we appreciate your custom!

A quick reminder that there’s a special offer in place until the end of Eastern Orthodox Christmas (7th January).

With all that out of the way, on to the Weekly Wrap, with an extended commentary on the Yuan (RMB) weakness.

As of January 3, 2024, here’s a summary of the weekly, month-to-date (MTD), and year-to-date (YTD) performances of major Chinese and Hong Kong stock indices that we follow.

Notes:

• Shanghai Composite Index (SHCOMP): Tracks all stocks (A and B shares) traded on the Shanghai Stock Exchange.

• CSI 300 Index (SHSZ300): Represents the top 300 stocks traded on the Shanghai and Shenzhen Stock Exchanges.

• China A50 Index (512150 CH): Comprises the top 50 A-share companies listed on the Shanghai and Shenzhen Stock Exchanges.

• ChiNext Price Index (159954 CH): Focuses on innovative and high-growth enterprises listed on the Shenzhen Stock Exchange.

• SSE STAR 50 Index (83151 HK): Represents the top 50 companies listed on the Shanghai Stock Exchange’s STAR Market, emphasising science and technology innovation.

• Hang Seng Index (HSI): Measures the performance of the largest companies listed on the Hong Kong Stock Exchange.

• Hang Seng China Enterprises Index (2828 HK): Includes major H-share companies listed in Hong Kong.

Currency Considerations:

• Chinese Indices (SSEC, CSI300, China A50, CNT, STAR50): These indices are denominated in Chinese Yuan (CNY). To present their performance in USD terms, currency exchange rate fluctuations between the CNY and USD have been considered.

• Hong Kong Indices (HSI, HSCEI): Denominated in Hong Kong Dollars (HKD). Their performance in USD terms reflects the HKD/USD exchange rate stability, as the HKD is pegged to the USD.

Weekly Relative Performance Observations:

Positive Performers:

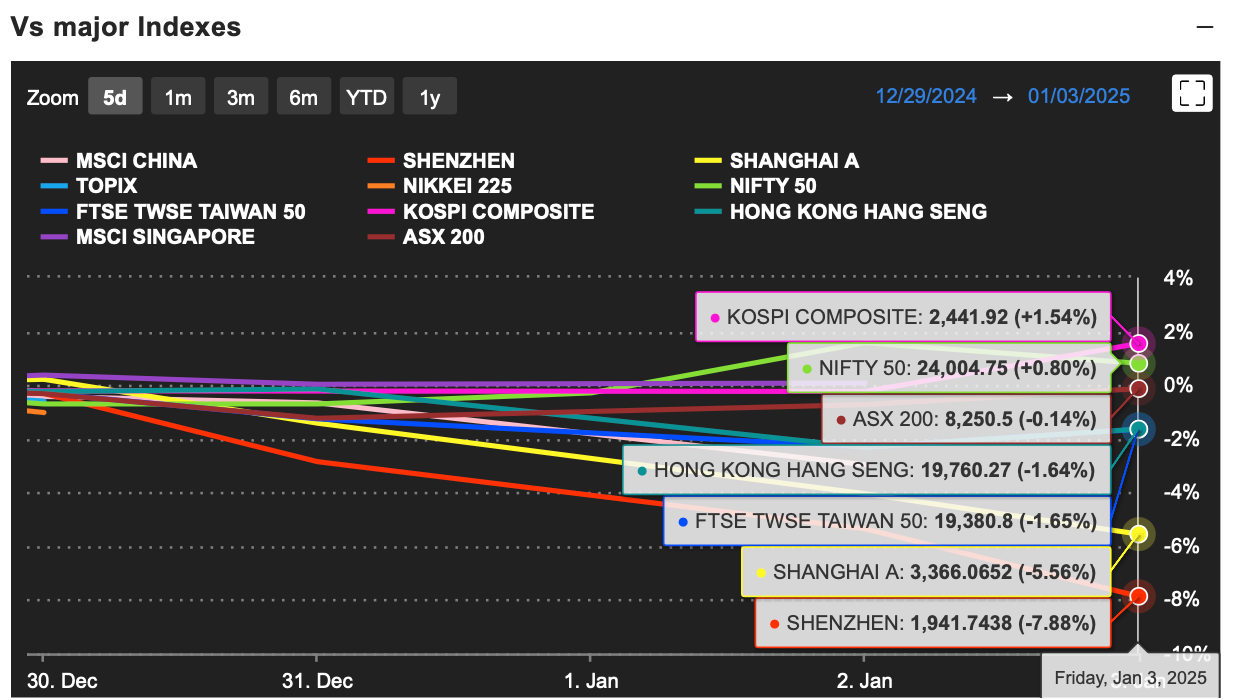

The KOSPI Composite (South Korea) was the best-performing index, closing the week with a +1.54% gain.

The NIFTY 50 (India) also showed a solid performance, gaining +0.80% over the week.

Flat/Negative Performers:

The ASX 200 (Australia) was almost flat, with a marginal decline of -0.14%.

Underperformers:

Chinese indices showed a sharp downward trend, likely reflecting localised market or macroeconomic pressures.

The Hong Kong Hang Seng and FTSE Taiwan 50 both declined, losing -1.64% and -1.65%, respectively.

The Shanghai A Index dropped significantly, with a decline of -5.56%.

The Shenzhen Index was the worst performer, falling by -7.88%.

While Chinese indices struggled, South Korea and India presented a stark contrast with stronger performance. South Korea’s inclusion in the FTSE Russell World Government Bond Index (WGBI) from November 2025 boosted foreign investor interest, supported by economic stability and strong export figures. Similarly, India’s markets thrived on robust corporate earnings in the financial and IT sectors, booming automotive sales, and its upcoming inclusion in the FTSE Russell Emerging Markets Bond Index, attracting significant foreign capital.

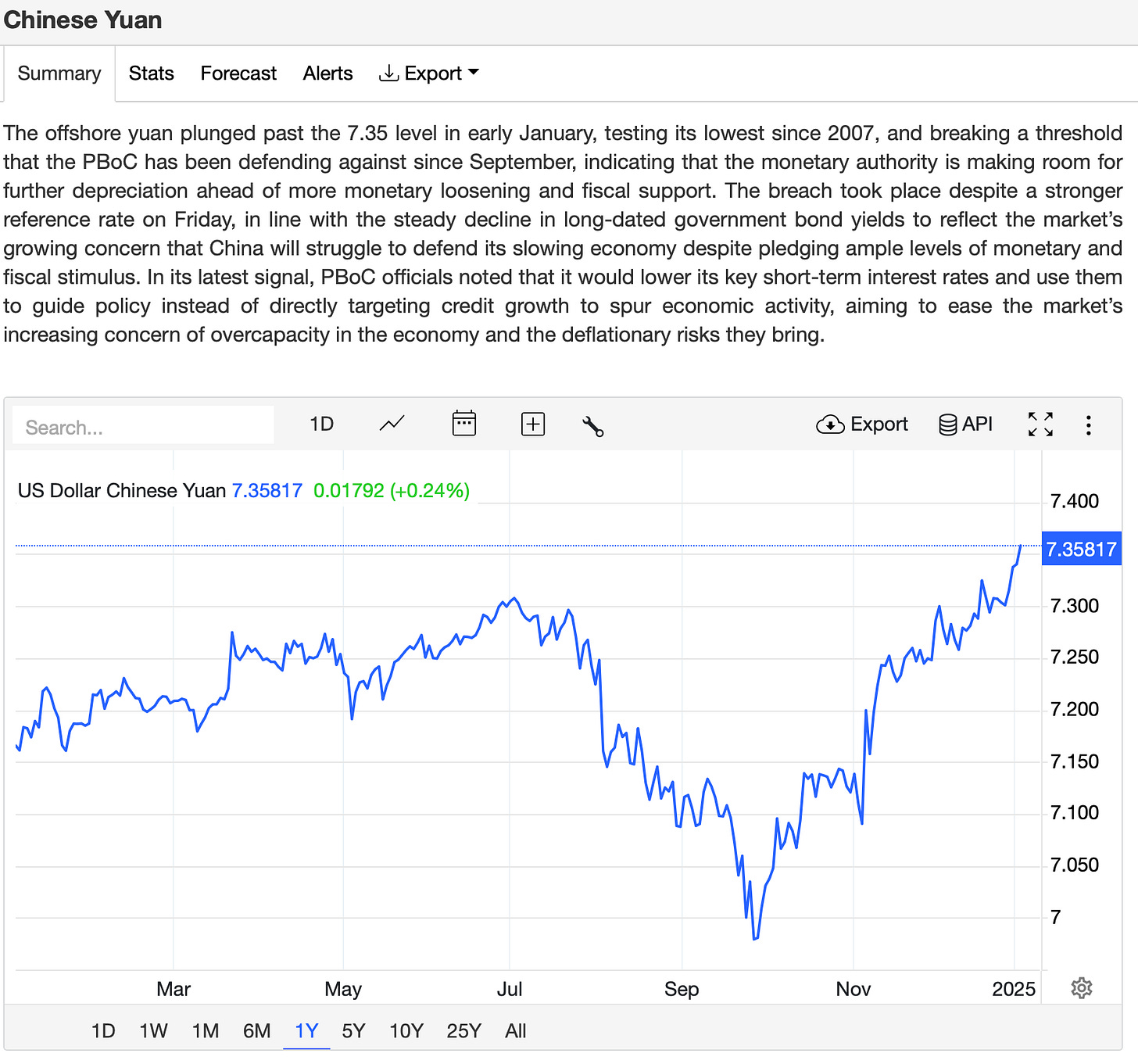

This week we have seen a major move in the currency. The RMB has depreciated to below 7.30 on Friday. China’s central bank, the People’s Bank of China (PBOC), has allowed the onshore yuan to weaken past the significant psychological barrier of 7.3 per dollar for the first time since late 2023. This marks a departure from weeks of active defense and suggests a shift toward accommodating economic pressures. The move is aimed at boosting export competitiveness amidst sluggish economic growth and a widening yield gap with U.S. bonds. However, the weakening yuan also raises concerns about capital outflows and dampened investor sentiment.

The depreciation comes as domestic government bond yields in China have dropped to record lows, further pressuring the currency. After sliding to 7.3190 per dollar, the yuan stabilized somewhat, but analysts warn that a breach of 7.3510 could see it reach its weakest level since 2007. Despite the PBOC maintaining a stronger daily reference rate, this shift indicates a willingness to tolerate a weaker currency to alleviate mounting economic challenges.

The broader market impact has been significant. The yuan’s decline has weighed on other emerging market currencies, with the Taiwan dollar hitting its lowest level since 2016 and the Korean won erasing earlier gains. At the same time, Chinese equity markets remain under pressure, with benchmark indices closing at their lowest levels since September, further reflecting poor investor sentiment.

Looking ahead, the PBOC is expected to manage the pace of the yuan’s depreciation carefully to avoid financial instability. Analysts forecast further declines, with the yuan potentially weakening to 7.45 to 7.6 per dollar by mid-2025. This development highlights Beijing’s delicate balancing act: stimulating growth while mitigating risks of excessive capital outflows and market volatility.

As you know the Panda Perspective on this is that the RMB will be stronger by year end. That said we acknowledge that the path to a higher RMB lies through the weaker RMB first. This reflects the present USD strength and the fact that the Chinese Govt is willing to consider the devaluation path at least initially as the response to Tariff Diplomacy by the US. The lower the RMB goes now, the more of a step a move back to 6.9-7.0 range will be.

To anyone calling a weaker RMB a solution on account of it being an export subsidy I hasten to remind that while that is true, it is also a levy on importers, who are mostly Households. Given the focus on increased domestic demand, it would make sense to pursue the policy of an expensive Yuan, and ultimately I belive that is what Chairman Xi wants, and will get. But certainly cant commit to it until the US position is clearer, at least from the point of view of allowing for strategic flexibility.

In the news this week:

Announced by: People’s Bank of China (PBOC)

Date: January 3, 2025

Event: Quarterly Monetary Policy Announcement

Details:

The PBOC outlined several key initiatives as part of its quarterly monetary policy update, aimed at stabilizing the financial markets and supporting economic recovery. These measures include:

Liquidity Measures: Ensuring ample liquidity by guiding financial institutions to expand credit supply to support the economy.

Interest Rate Policies: Strengthening the implementation of interest rate adjustments to reduce corporate financing costs and household credit burdens.

Capital Market Stability: Utilizing existing tools to stabilize the capital markets and ensure smooth operations.

Foreign Exchange Market Resilience: Reinforcing the stability of the yuan exchange rate and taking firm action against interference in the FX market.

Future Rate Cuts: Signaling potential reductions in the Reserve Requirement Ratio (RRR) and interest rates at appropriate times to further stimulate economic activity.

Announced by: China’s Ministry of Finance

Date: December 29, 2024

Event: Fiscal Stimulus Measures

Details:

The Ministry of Finance announced plans to significantly increase funding through special treasury bonds in 2025, aimed at spurring economic growth. The funds will be allocated to:

Infrastructure Projects: Accelerating urban development and transportation networks.

Consumer Subsidies: Boosting domestic demand through direct support for households.

Business Investments: Enhancing opportunities for private and public sector growth.

Announced by: China’s Ministry of Finance

Date: December 29, 2024

Event: Fiscal Stimulus Measures

Details:

The Ministry of Finance unveiled a comprehensive fiscal stimulus package to accelerate economic recovery and bolster domestic demand in 2025. The plan involves substantial funding through the issuance of special treasury bonds, targeting key areas for economic revitalization:

• Consumer Subsidies: Financial support will be directed to households to stimulate consumption, particularly in sectors like retail, housing, and durable goods. This measure aims to revitalize consumer spending, which has been sluggish due to broader economic challenges.

• Business Investments: Dedicated funding will encourage private sector growth through incentives for innovation, research and development, and expansion in strategic industries such as green energy, technology, and advanced manufacturing.

• Infrastructure Projects: A significant portion of the funds will be allocated to infrastructure development, including transportation networks, urban redevelopment, and renewable energy projects. These initiatives are expected to generate employment, enhance regional connectivity, and lay the groundwork for long-term economic growth.

Impact:

These measures are designed to address the structural weaknesses in the economy, mitigate the effects of slowing global trade, and foster a balanced recovery. By increasing public spending, the government aims to create a multiplier effect, boosting both private sector confidence and overall GDP growth.

This announcement reflects China’s commitment to proactive fiscal policy to navigate domestic and international economic challenges in 2025.

Announced by: China’s State Council

Date: January 3, 2025

Event: Urban Infrastructure and Renovation Policies

Details:

During a cabinet meeting chaired by Premier Li, the Chinese government unveiled a series of measures aimed at urban infrastructure improvements and economic revitalization. Key initiatives include:

Urban Renovation Projects:

• Accelerating the renovation of urban villages and old residential quarters to improve living standards and support domestic demand.

• Strengthening urban infrastructure through large-scale renewal projects, focusing on modernizing outdated facilities and creating more livable urban environments.

Private Capital Engagement:

• Encouraging private capital to participate in urban renovation efforts, fostering public-private partnerships to enhance project funding and efficiency.

Addressing Migrant Workers’ Salaries:

• Instructing local governments and state-owned enterprises (SOEs) to address overdue salaries for migrant workers and ensure timely payments going forward.

Boosting Domestic Demand:

• Emphasizing urban renewal and improving living quality as critical levers to expand domestic consumption and economic activity.

Impact:

These measures aim to improve urban living conditions, reduce income disparities, and stimulate domestic demand through large-scale infrastructure investments. By addressing overdue payments for workers and integrating private capital, the government seeks to foster a more equitable and sustainable urban development model.

This policy underscores China’s commitment to driving economic growth through urbanization and improving citizens’ quality of life.

Data Released This Week:

Announced by: People’s Bank of China (PBOC)

Date: December 30, 2024

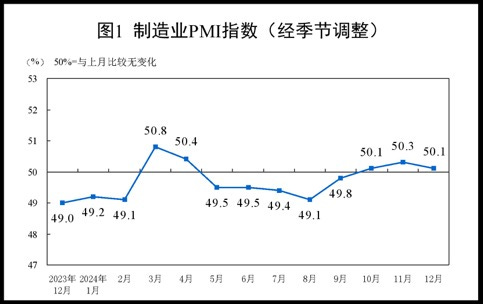

Event: December PMI Data Release

Details:

China’s December PMI data was released, revealing mixed performance across sectors:

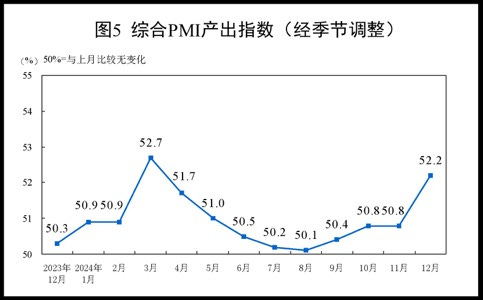

Composite PMI: Rose to 52.2 (previous: 50.8), indicating moderate expansion in overall economic activity.

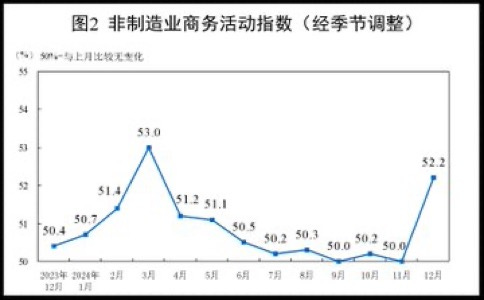

Non-Manufacturing PMI: Improved to 52.2 (previous: 50.0), reflecting growth in the services sector.

Manufacturing PMI: Declined to 50.1 (previous: 50.3), signalling a marginal slowdown in industrial activity amidst trade risks and weaker demand.

Announced by: China Academy of Information and Communications Technology (CAICT)

Date: January 3, 2025

Event: Smartphone Shipment Data Release

Details:

The CAICT published updated data on smartphone shipments, showcasing the performance of the technology and consumer electronics sector:

• 5G Smartphone Shipments (2024): Reached 241 million units, an increase of 12.0% year-on-year, driven by strong adoption of next-generation devices.

• Overall Smartphone Shipments (Jan-Nov 2024): Increased by 7.2% year-on-year, reflecting solid demand during most of the year.

• November 2024 Performance: Shipments declined by 5.1% year-on-year, highlighting recent consumer demand pressures in the market.

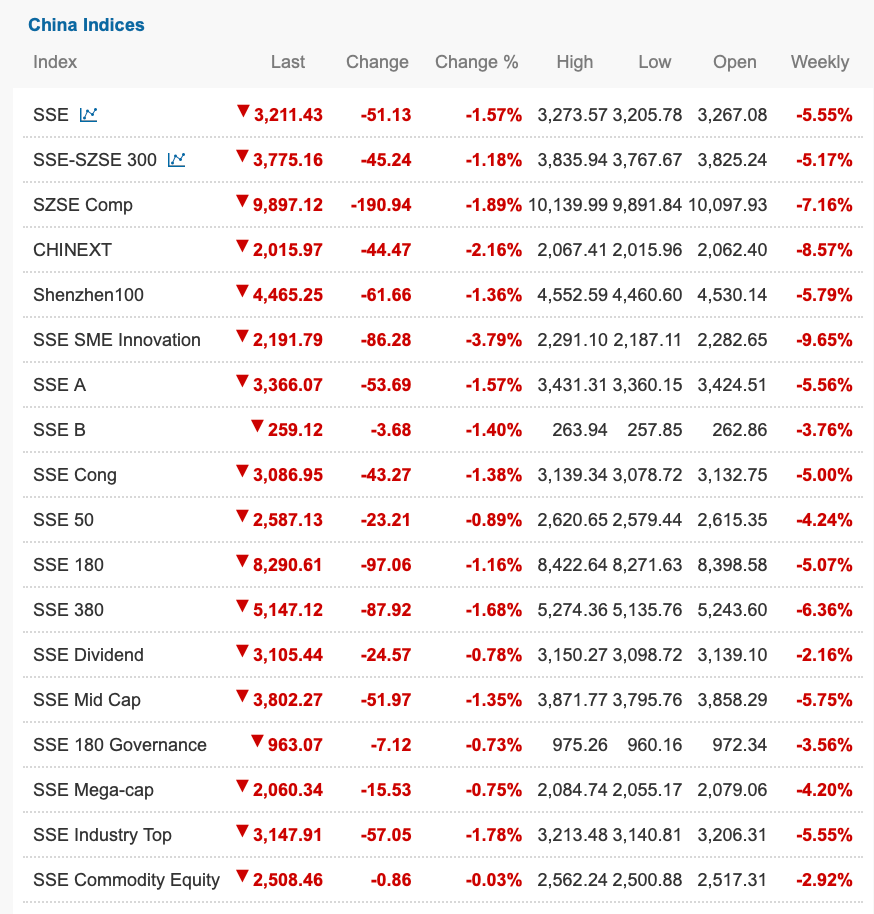

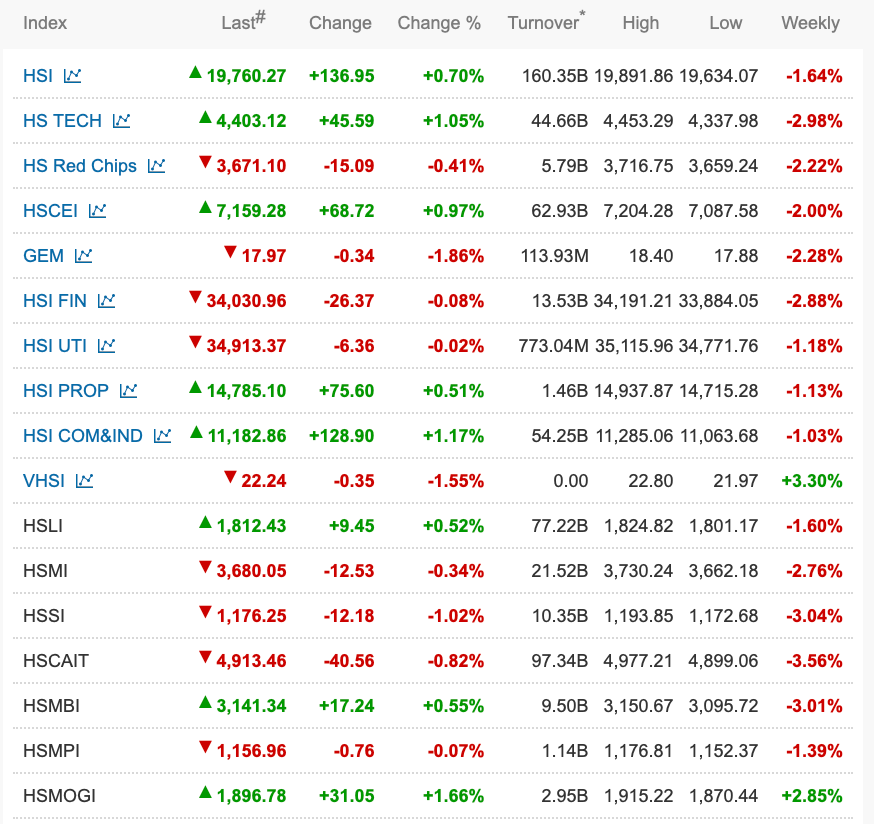

Complete Index Performance List:

for the week 30 Dec 2024 - 3 Jan 2025

Broad Declines Across Mainland Markets: The Shanghai Composite Index declined by -5.55% for the week, reflecting pervasive risk-off sentiment. The ChiNext Index saw the steepest decline of -8.57%, indicative of heightened pressures on growth-oriented and innovation-driven stocks amid a slowing economic recovery.

Mid- and Small-Cap Weakness: The SSE SME Innovation Index fell sharply by -9.65%, highlighting significant underperformance in smaller, innovation-focused companies. This suggests that these firms are more exposed to liquidity concerns and deteriorating investor sentiment.

Sector-Specific Underperformance: The SSE Commodity Equity Index was relatively resilient, declining by only -2.92%, reflecting steadier demand in resource-based sectors. However, broader equity indices such as the SSE 180 and SSE 50 dropped -5.07% and -4.24%, respectively, as blue-chip stocks faced valuation pressures.

Hong Kong Resilience in Select Areas: While the Hang Seng Index (HSI) fell by -1.64%, the Hang Seng TECH Index rose modestly by +1.05%, signaling selective optimism in the technology sector. Additionally, the HSI COM & IND segment gained +1.17%, suggesting relative strength in industrial and commercial sectors.

Volatility Reflected in Divergence: The VHSI (Hang Seng Volatility Index) rose +3.30% for the week, pointing to heightened uncertainty and investor caution. The divergence between mainland declines and pockets of relative strength in Hong Kong underscores differing investor expectations across market segments and geographies.

The week’s performance underscores persistent challenges in China’s equity markets, including economic growth concerns and liquidity issues. The disparity between mainland and Hong Kong markets, as well as sector-specific resilience in tech and industrials, suggests a selective approach to risk allocation could be prudent. Investors may need to navigate these dynamics by focusing on high-quality names with defensible market positions and sectors benefiting from structural policy support.

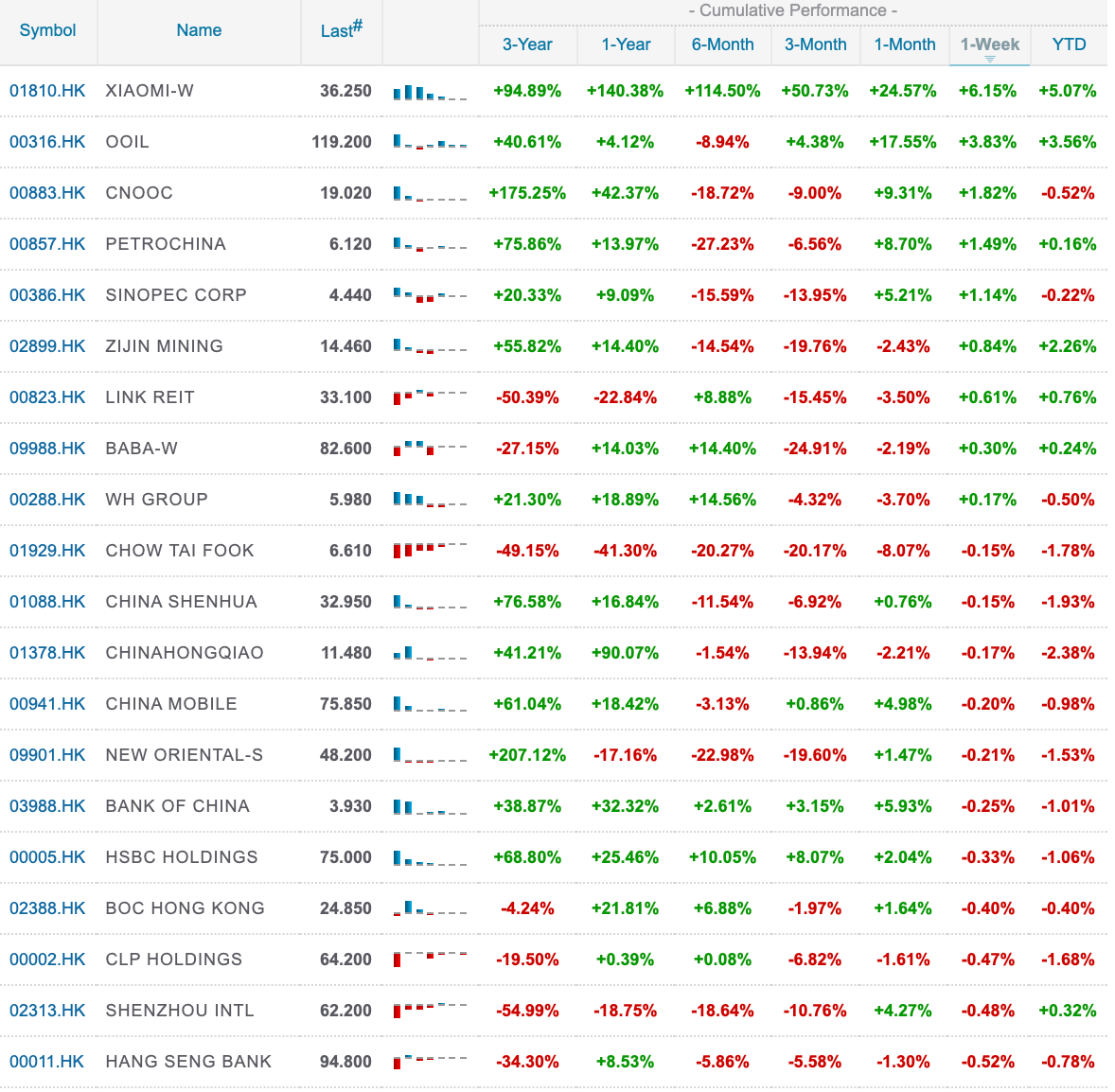

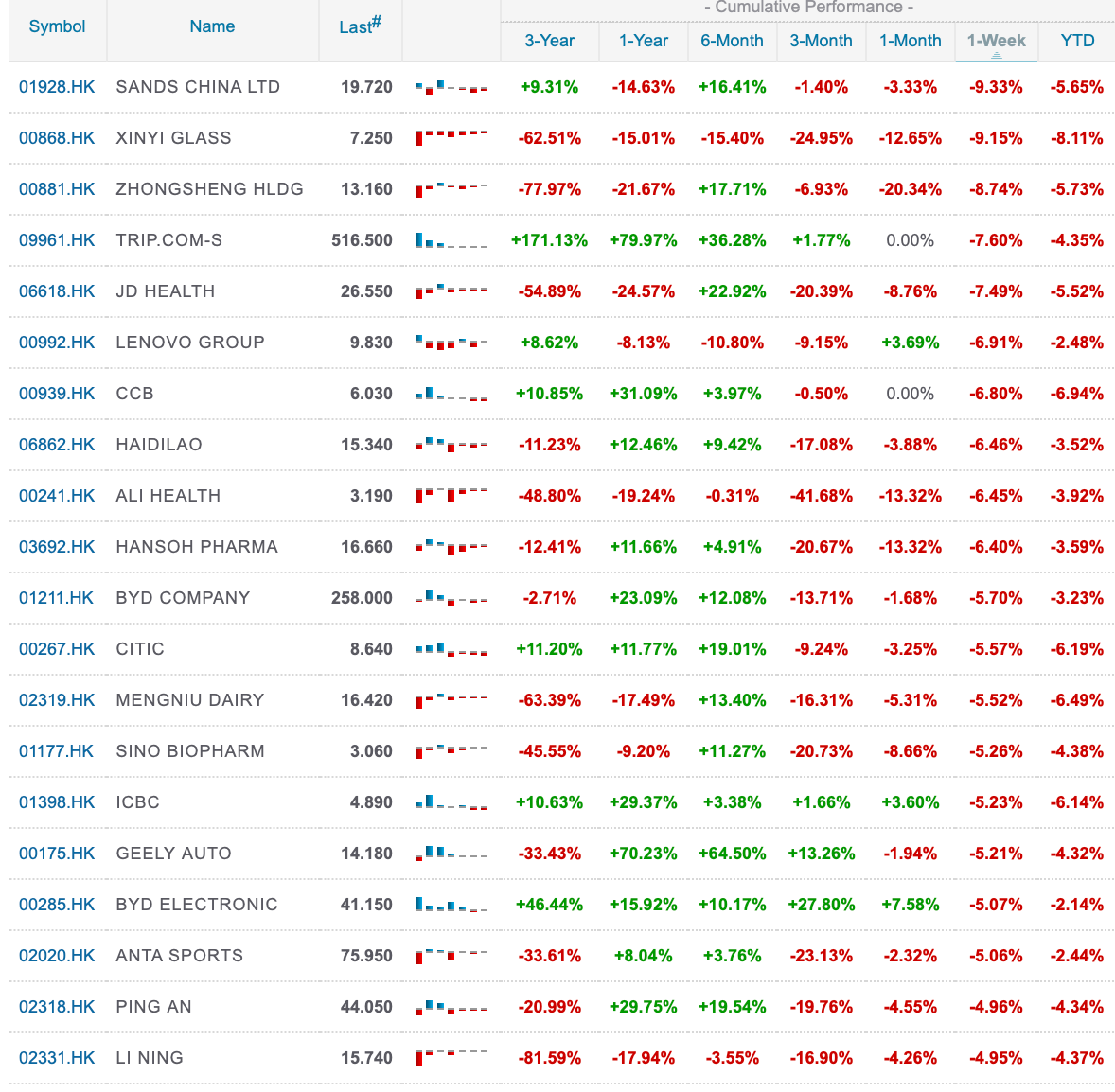

Top 20 Index Constituents:

Bottom 20 Index Constituents:

Corporate News this week:

Xiaomi’s Dynamic Expansion Across Industries

Date: Week of December 30, 2024 – January 3, 2025

Event: Major Milestones and Product Launches

Details:

Xiaomi achieved significant milestones and unveiled new initiatives, showcasing its growth and innovation across multiple industries:

Electric Vehicle (EV) Market Milestone:

• Xiaomi became the third most valuable vehicle manufacturer globally, following Tesla and Toyota, with a market capitalization of $116.9 billion.

• The company’s shares surged 6.62% to a record high of HK$36.25 on the Hong Kong Stock Exchange.

• Its first EV, the SU7 sedan, exceeded expectations with over 135,000 units sold in 2024. Building on this success, Xiaomi plans to launch its second model, the YU7 electric SUV, in mid-2025, targeting annual sales of 300,000 units.

Smart Camera Video Call Clock:

• Xiaomi introduced the Smart Camera Video Call Edition, a desktop clock with an integrated camera for video calls and security.

• Priced at 299 yuan (€35), the device features a 3.5-inch IPS display, 4MP camera with 2.5K recording, and night vision.

• The product is currently exclusive to the Chinese market, with potential plans for global release.

Strong Performance in Wearable Tech:

• The Xiaomi Smart Band 9 Pro received widespread acclaim for its premium design and comprehensive fitness tracking features, further strengthening its position in the wearables market.

Ambitions in Satellite Connectivity:

• Xiaomi announced plans to venture into satellite communications, aiming to enhance its telecommunications services and provide broader coverage in remote areas.

These developments underline Xiaomi’s strategic focus on diversifying its product portfolio and expanding its presence in high-growth industries, including EVs, consumer electronics, and satellite technology, while leveraging its strong ecosystem to maintain competitive momentum.

Tencent Completes HK$112 Billion Share Buyback

Date: January 3, 2025

Event: Share Buyback Completion

Details:

Tencent Holdings announced the successful completion of its HK$112 billion share buyback program. This move underscores Tencent’s strong financial position and its commitment to delivering shareholder returns. The buyback is expected to bolster investor confidence in the company, especially amid broader market challenges in China’s tech sector.

BYD Reports Record Year-End EV Sales

Date: January 2, 2025

Event: Sales Performance Announcement

Details:

BYD revealed record-breaking year-end electric vehicle (EV) sales, solidifying its position as a leader in China’s EV market. The company attributed the strong performance to robust consumer demand for its hybrid and fully electric models. This milestone highlights the continued growth of China’s EV industry, supported by favorable government policies and expanding charging infrastructure.

Huawei Ventures into Satellite Connectivity

Date: December 30, 2024

Event: Technology Development Announcement

Details:

Huawei announced plans to develop satellite connectivity technology, aiming to enhance its telecommunications services and compete with global players in the satellite communications industry. The initiative will focus on providing broader network coverage, especially in remote areas, aligning with China’s strategic goals to lead in next-generation communication technologies.

Nio Expands Overseas Operations

Date: January 3, 2025

Event: Global Expansion Announcement

Details:

Nio confirmed the launch of its electric vehicles in the Australian and Canadian markets, marking a significant step in its international expansion. The company plans to establish local service centers and charging infrastructure to support its operations. This move reflects Nio’s ambition to compete globally and diversify revenue streams beyond the Chinese market.

Alibaba Announces AI Investment in Retail

Date: December 31, 2024

Event: Strategic Investment Announcement

Details:

Alibaba revealed plans to invest heavily in AI-driven retail technologies, aiming to enhance its e-commerce platforms and optimize supply chain efficiency. The investment includes the development of AI tools for personalized shopping experiences and automated logistics. This initiative aligns with Alibaba’s strategy to maintain leadership in China’s highly competitive e-commerce sector.

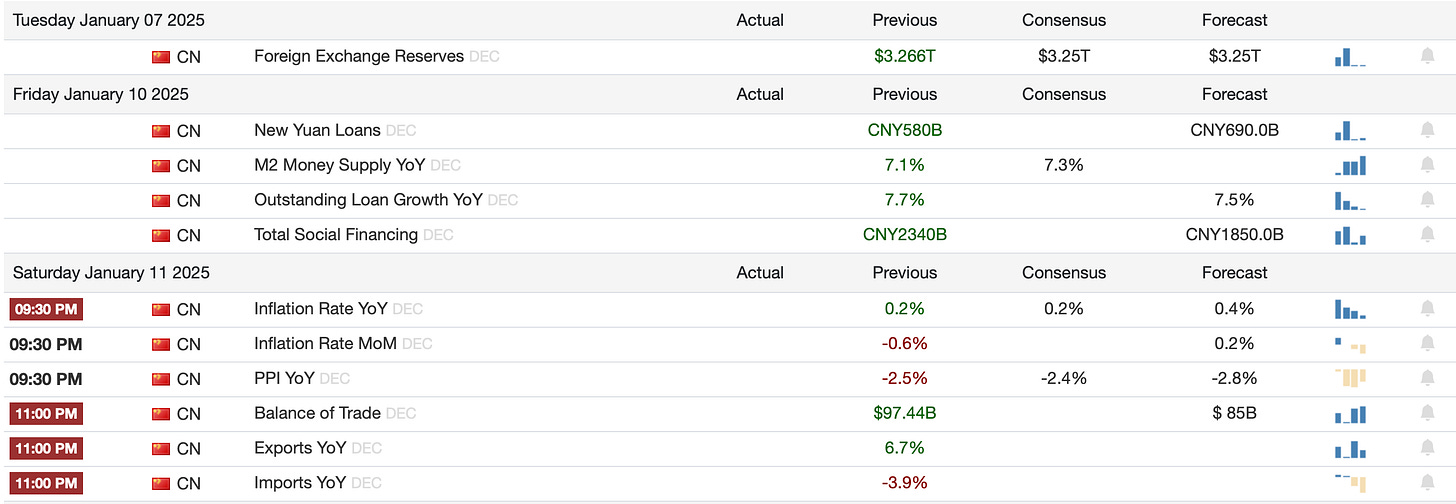

We are entering and iner-NY period - where the Western New year has already passed, but the Chinese one is far enough away where its not front of mind, but it is certainly in the air already. It’s an early one this year from Tuesday, January 28 to Tuesday, February 4, so the flow of news and data will briefly accelerate before taking a pause.

Have a lovely weekend and a great week ahead,

Leonid