The Coal Conundrum: Still Burning Bright in the Age of Renewables

A look at the Coal Market and associated equities

Good Morning, hope you had a lovely weekend!

Happy Chinese/Lunar new Year to those celebrating. Kung Hen Fat Choi/Gong Xi Fa Cai, as it were.

This is a short week for this in HK and mostly a week off in the main land, but this does not stop us from continuing to build up our coverage/archive. Today we’ll talk King Coal. It’s been long in the making, as we’ve been working on it on and off for over 4 weeks now. What with Macro breaks and various trips and everything, but we’re finally here - and I do believe that the last week of Energy Month will yield some very fine articles.

It may seem like an odd choice of timing, given that many investors are worrying about the DeepSeek impact on the market. While it certainly has set the cat among the pidgeons in the AI race, and the NASDAQ is likely to have a challenging day, we dont think that we’re dealing with a massive shift in outlook economically speaking, and we are certainly well prepared for a shift in investor attitudes towards china. Let’s be honest, it’s unlikely to get worse, and if this is the kick that western investors have needed to return their sights on China, so be it. We are prepared for that. But this does not mean we’ll change the plan in terms of coverage - we’re highlighting companies that are earning a significant yield already, and will continue to power the shift to greater power intensity of life whether it comes through GenAI or any other technology. This is what energy month has been about, and this is what we’ll focus on this week.

We’re kicking off with Coal but do remember that the renewables and coal are intertwined in China (Extra Extra, read all about it, literally slightly later in this very note!). We’ll move on to Solar and Wind. As usual - the market outline will be available to all subscribers, the investment implications only to the premium ones.

Do join us if this is something that is of interest to you, we’d love to have you on board!

Fear not though, Tech focus is just around the corner - Hard Tech will be the focus for February, and I believe we’ll cover some very exciting trends, and again we’ll focus on companies that actually are real and make money for their investors. And certainly, once the dust settles, we’ll see what’s happening in the software space, but thats’ for another day.

A reminder:

**Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.**

This week the only real impact the holidays will have is that the Weekly wrap will be much curtailed, and the Portfolio review will focus on the review and rebalancing (if any) on the month end (January 2025) so there won’t be any additional more recent performance analysis.

With that said, on with today’s piece:

The State of Coal in 2025 A Balancing Act Amid Renewable Growth

Despite global efforts to transition to renewable energy, coal continues to play a crucial role in the energy mix, particularly as a stabilizer for grids increasingly reliant on intermittent renewable sources like wind and solar. This paradox—coal usage growing alongside renewable energy expansion—reveals the complexities of the energy transition. In this post, we explore why coal remains indispensable in key markets, analyze regional dynamics in China, India, and the broader Asia-Pacific region, and project how these trends may evolve. We delve into coal’s role in ensuring energy security, stabilizing power grids, and addressing the challenges of renewable intermittency, offering a comprehensive look at the factors driving coal’s continued relevance in a greener energy landscape.

The Global Coal Landscape in 2025

Coal remains a pivotal component of the global energy mix in 2025, with its production, pricing, and role in the energy transition continuing to shape markets worldwide. Despite a global push toward decarbonisation, coal’s dual role as a provider of baseload power and a stabiliser for intermittent renewable energy ensures its ongoing relevance, particularly in major economies like China and India.

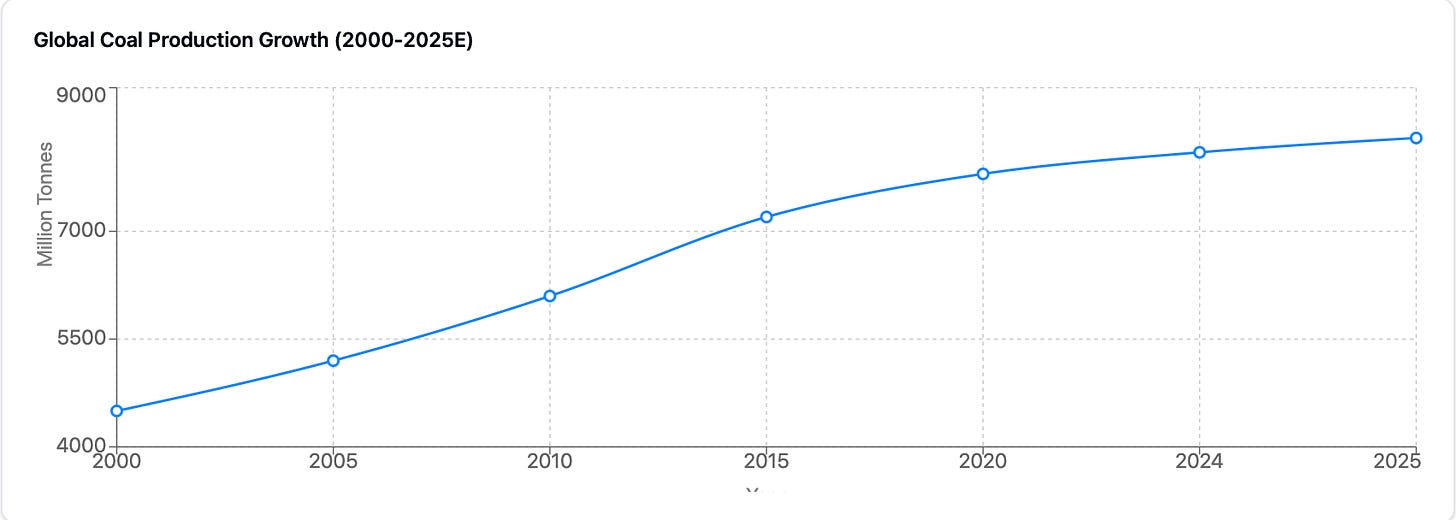

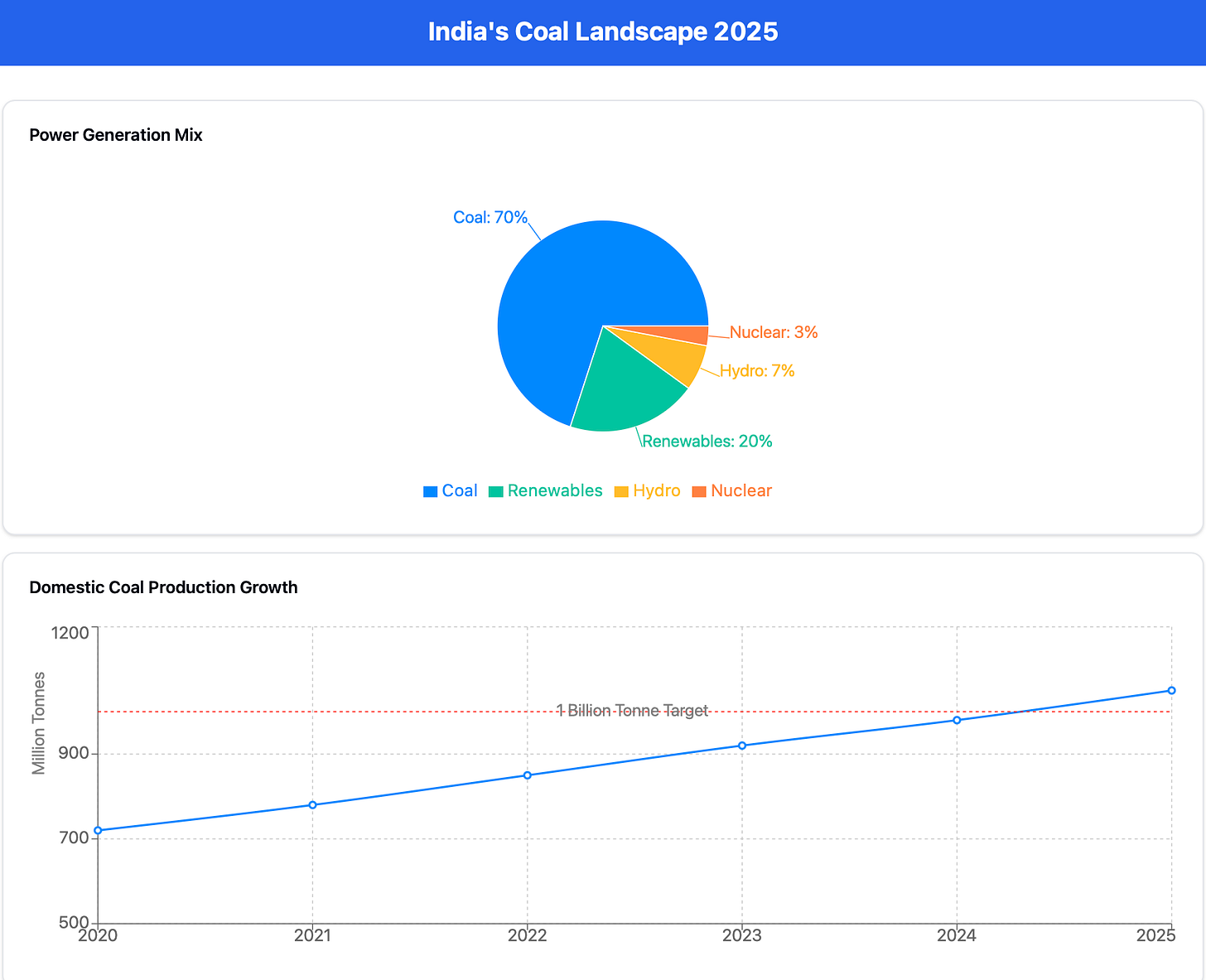

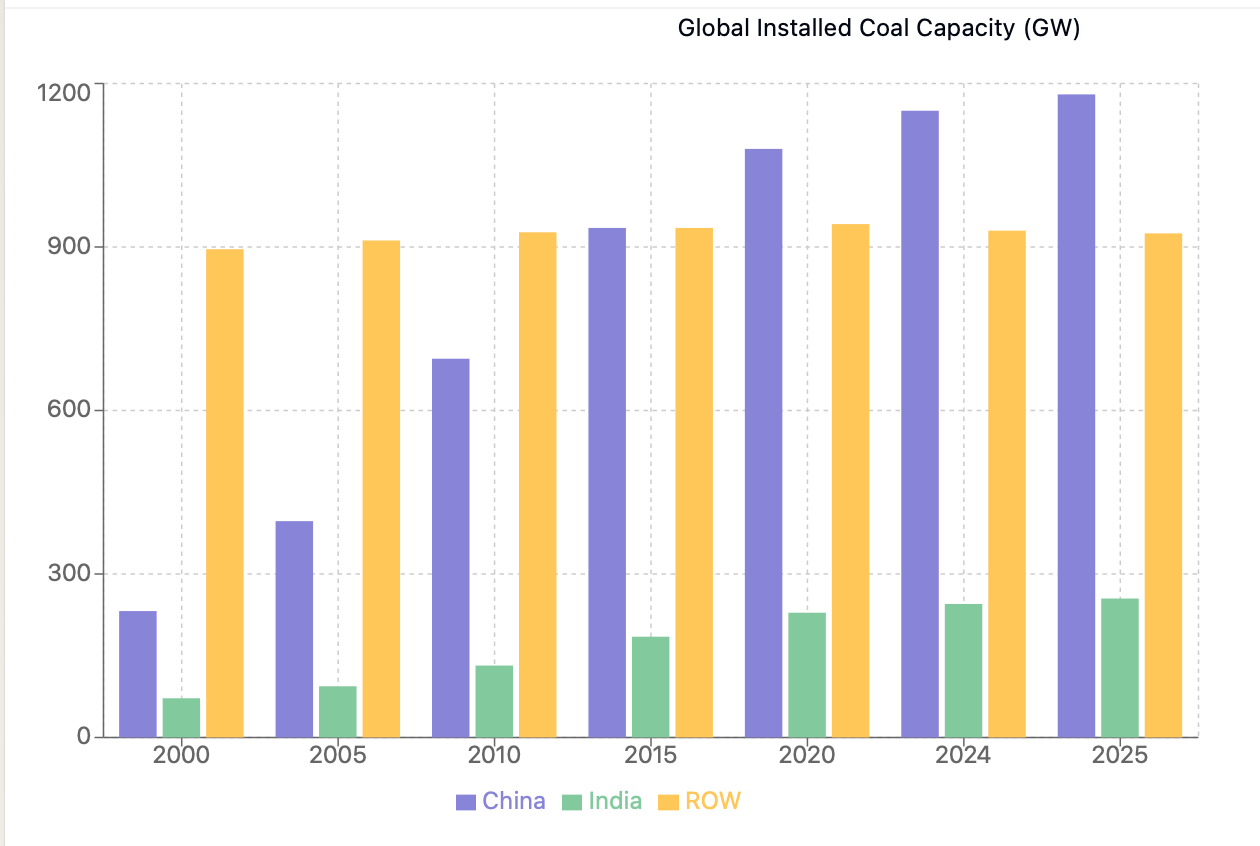

Global coal production is expected to grow modestly in 2025, driven primarily by increases in China, India, and Indonesia. China, the world’s largest coal producer, is forecasted to exceed 4.5 billion tonnes of production, fueled by capacity expansions in Shanxi, Xinjiang, and Inner Mongolia. Similarly, India’s annual coal production is projected to surpass 1 billion tonnes as the country prioritises domestic output to meet surging demand and reduce import dependency.

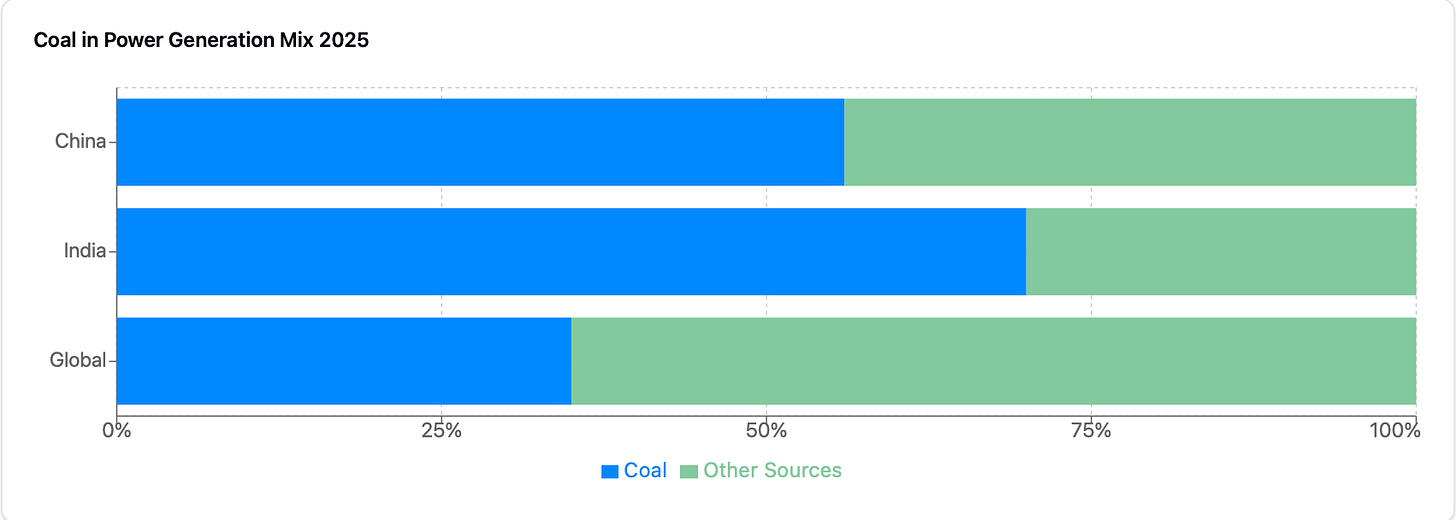

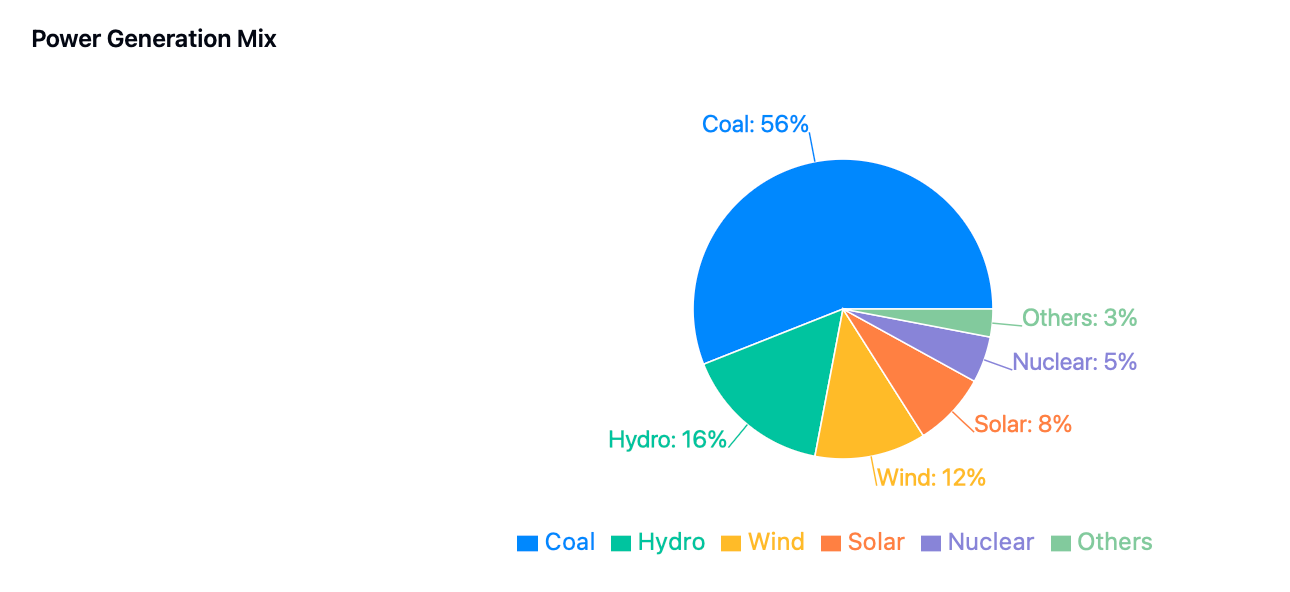

In terms of electricity generation, coal continues to dominate the energy mix in both China and India. In China, coal accounts for 56% of electricity generation, underlining its indispensable role even as the country expands its renewable energy capacity. India, on the other hand, remains even more reliant on coal, which powers 70% of its electricity generation. With India’s electricity demand growing by an estimated 6-8% annually, coal will continue to be the backbone of its energy infrastructure. Globally, coal still supplies over 35% of electricity, emphasizing its critical role in meeting the world’s energy needs.

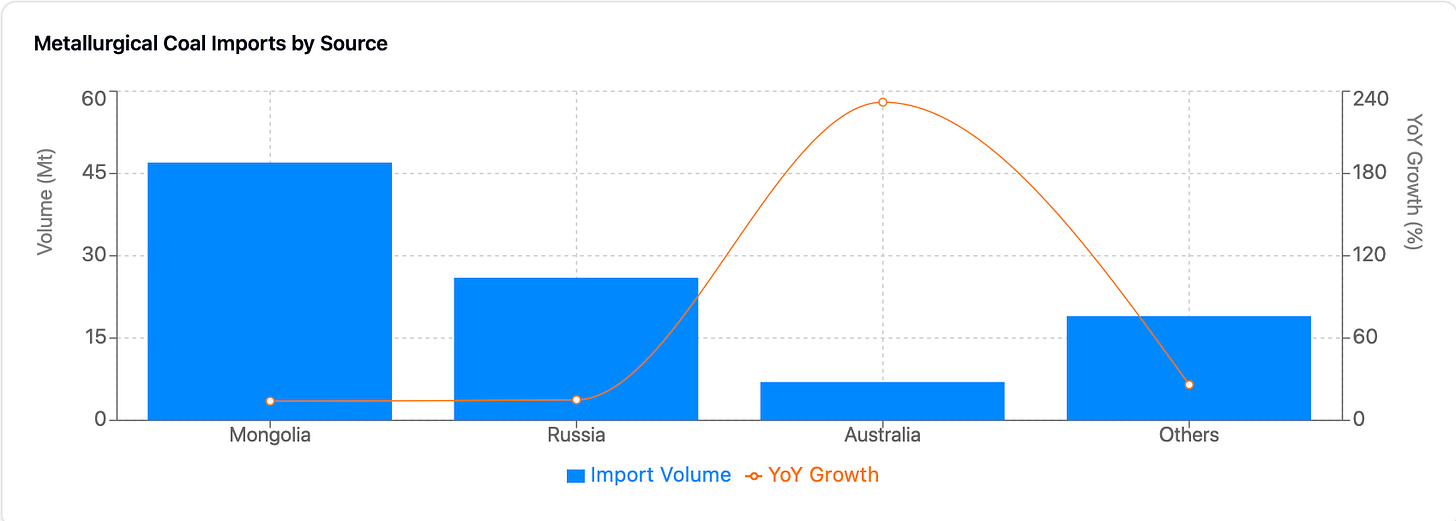

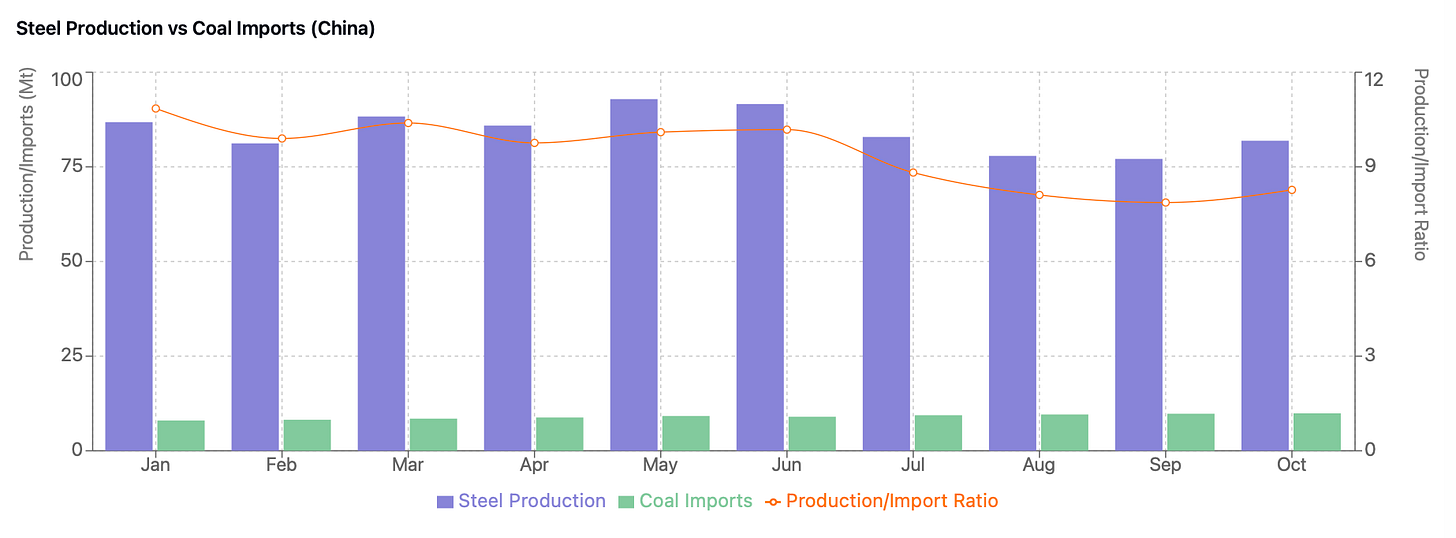

Thermal coal prices are trading at $130-$140/t, with modest declines forecasted in 2025 as production rises globally and demand stabilizes in certain regions. However, robust demand from China and India, coupled with occasional supply disruptions, is expected to provide a price floor near $120/t. In the metallurgical coal market, prices remain near cost-support levels of ~$200/t, buoyed by tight supply dynamics and resilient demand from steel production in Asia. China’s metallurgical coal imports have increased 22% YoY, with key supplies coming from Mongolia, Russia, and Australia. Meanwhile, India, despite increasing its domestic coking coal output, continues to rely on high-grade imports for its growing steel industry.

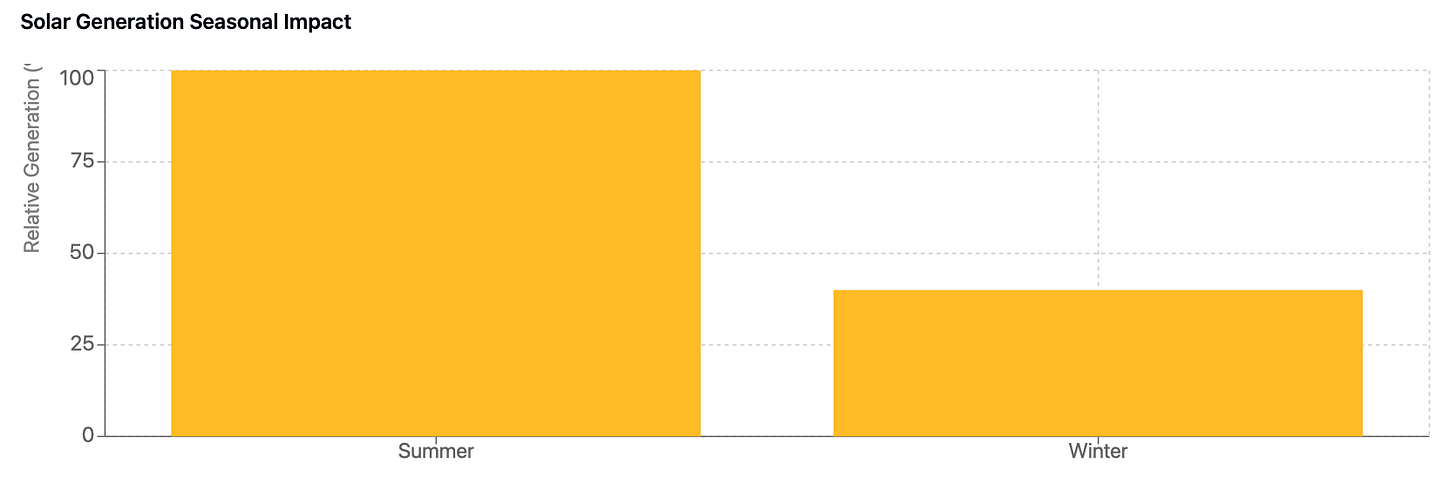

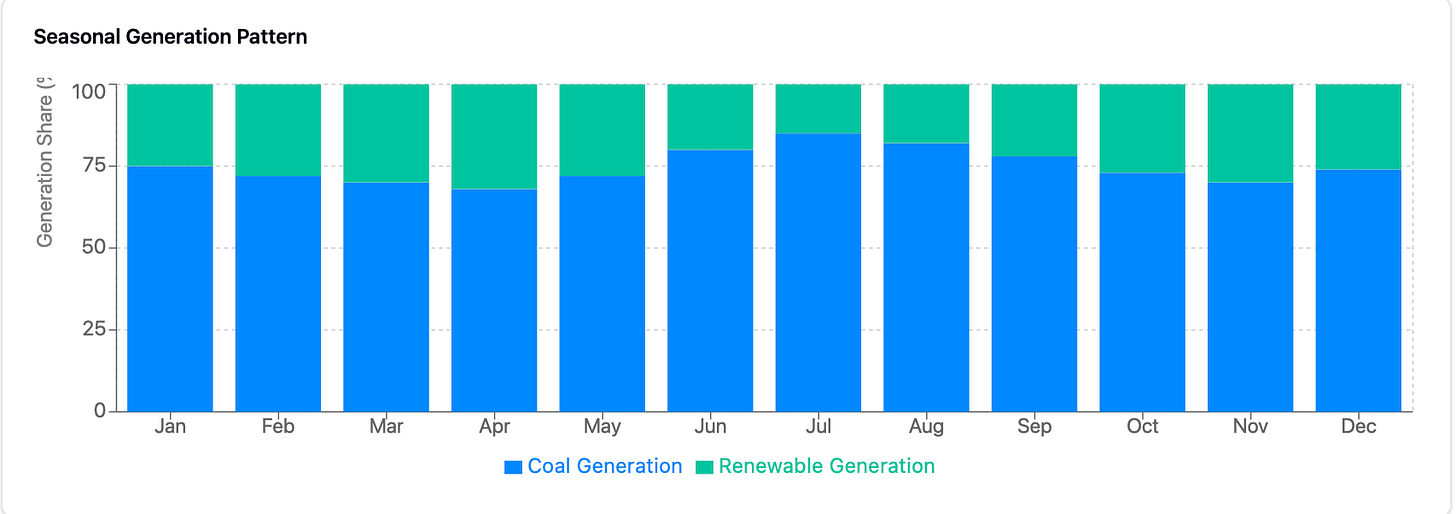

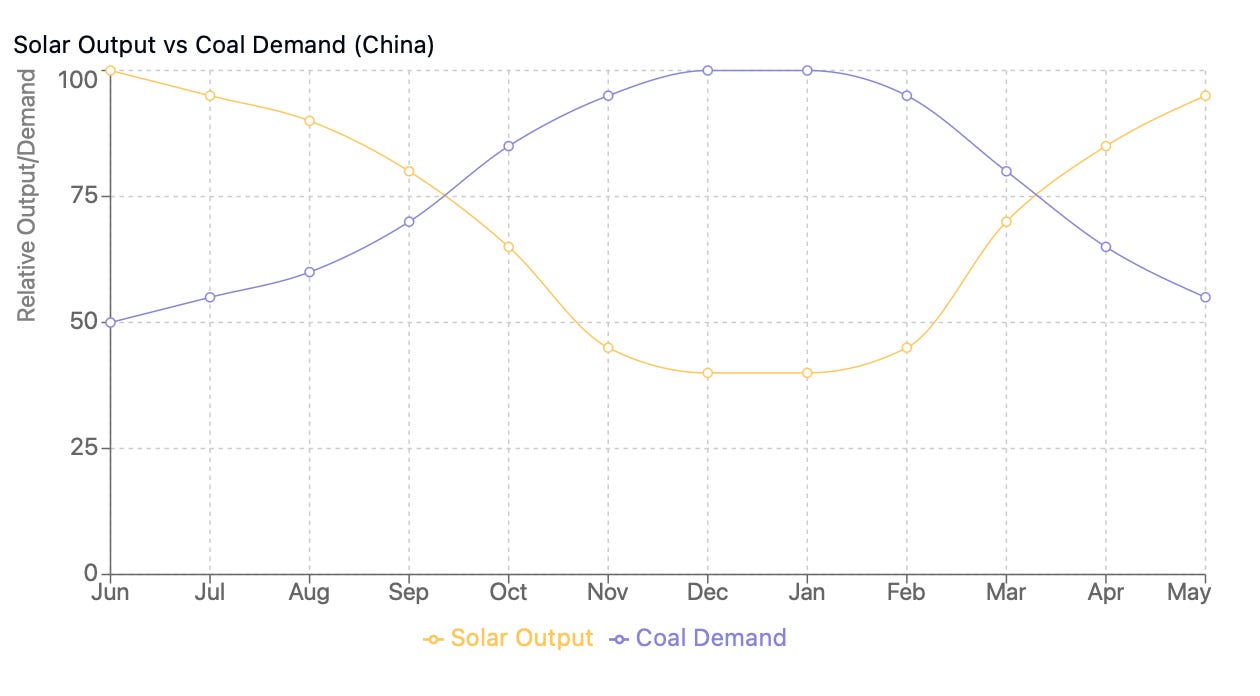

Coal continues to play a dual role in the energy transition, serving as both a provider of baseload power and a stabilizer for renewable energy systems. In China, coal-fired power plants are critical during periods of low renewable output, particularly in winter when solar energy generation drops by as much as 60% compared to summer levels. Similarly, in India, coal plants ramp up during the monsoon season, when solar and wind output decrease due to adverse weather conditions. This flexibility ensures grid stability in both countries as renewable energy adoption accelerates.

Beyond stabilization, coal remains vital for energy security, particularly in Asia. China has prioritized stockpiling coal as part of its national energy security strategy, resulting in record-high inventories to guard against potential disruptions. India is similarly expanding its domestic coal mining infrastructure to reduce its reliance on imports, ensuring a stable supply for its rapidly growing economy.

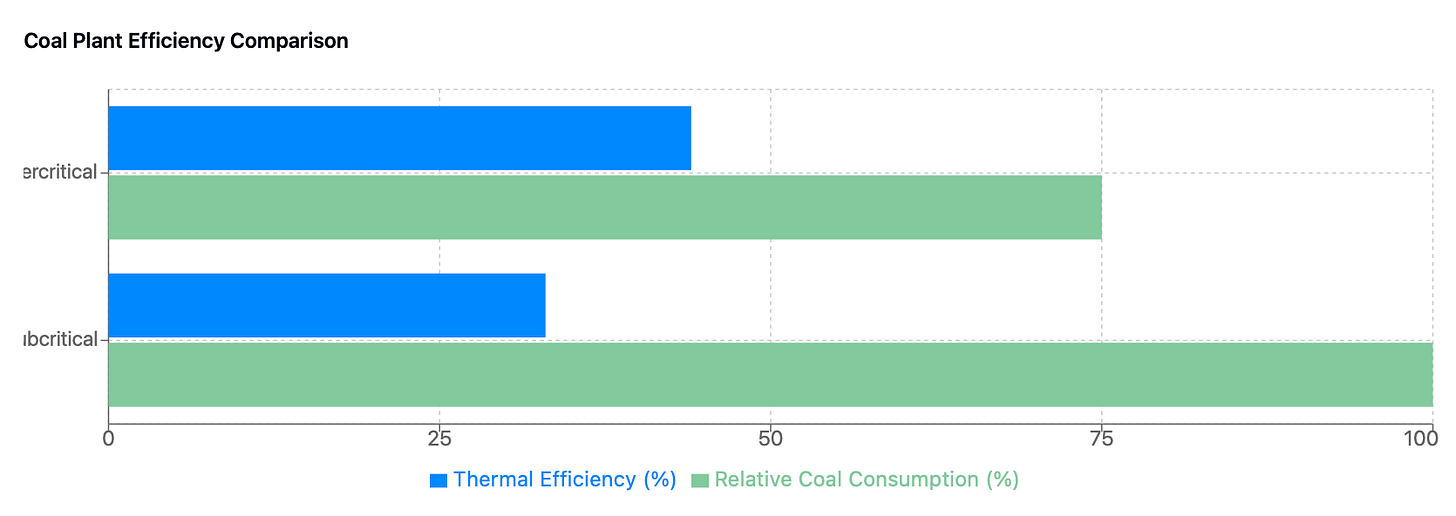

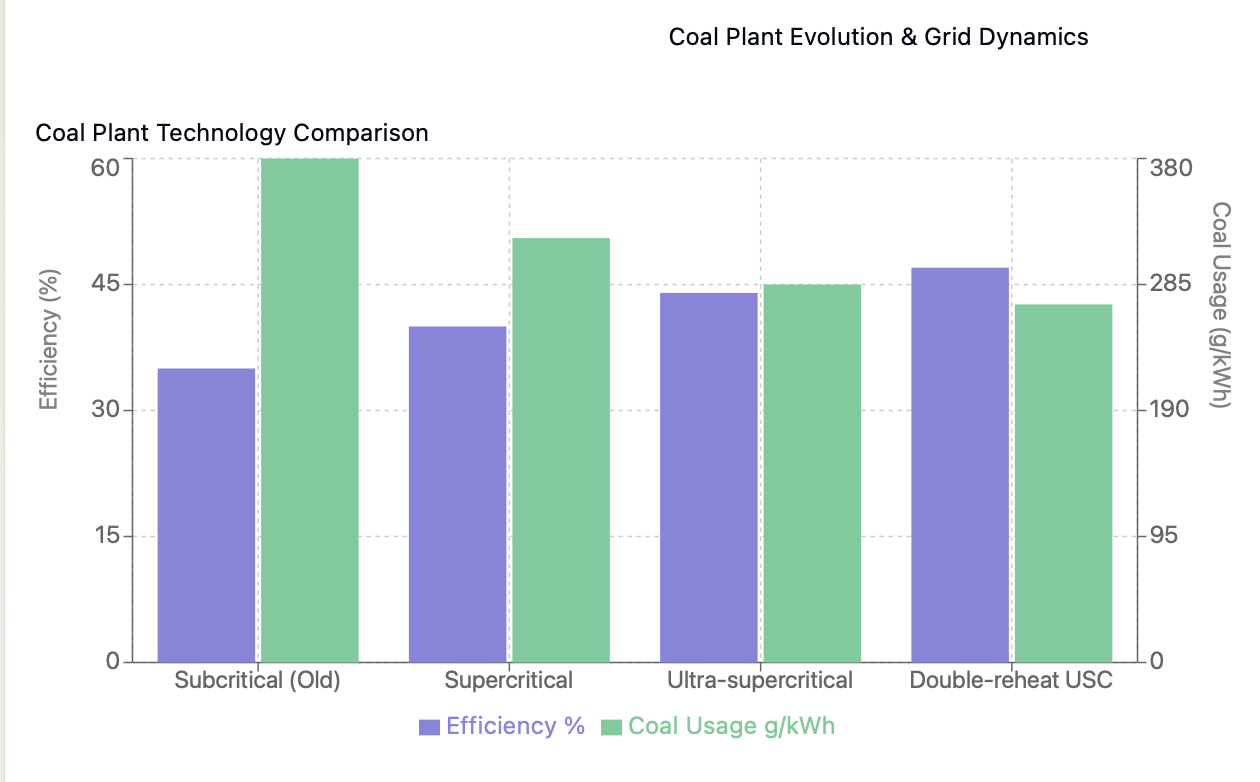

In 2025, coal-fired power plants in both China and India increasingly leverage ultra-supercritical technology, achieving thermal efficiencies of 42-45% compared to older subcritical plants at ~33%. This technological advancement reduces coal consumption and emissions per unit of electricity by 20-25%, underscoring the drive toward cleaner coal use.

Coal remains a cornerstone of energy systems worldwide in 2025, particularly in emerging markets where energy demand continues to rise. While thermal coal prices may soften slightly, strong demand from power generation and steelmaking will sustain its importance. As the energy transition accelerates, coal’s role as a stabilizer and reliable energy source underscores its necessity, even as governments and industries pursue cleaner alternatives. However, the long-term sustainability of this reliance will depend on advancements in grid technology, energy storage, and alternative fuels like green hydrogen.

China’s Coal Strategy: Balancing Growth and Stability

In 2025, coal remains the backbone of China’s energy strategy, balancing economic growth, energy security, and the challenges of renewable energy intermittency. As the world’s largest coal producer and consumer, China plays a pivotal role in shaping global coal markets, with its policies and investments driving both domestic and international trends.

China’s coal production is forecasted to exceed 4.5 billion tonnes in 2025, supported by capacity expansions in key regions such as Shanxi, Xinjiang, and Inner Mongolia. Despite the rapid growth of renewable energy, coal continues to fuel approximately 56% of China’s electricity generation, highlighting its indispensable role in powering the world’s second-largest economy. This dependency stems not only from coal’s reliability as a baseload energy source but also from its critical role in stabilizing grids that increasingly rely on intermittent renewables like wind and solar.

China’s ultra-supercritical (USC) coal-fired power plants represent a significant leap in efficiency, achieving thermal efficiencies of 42-45% compared to older subcritical plants at ~33%. These advanced plants consume ~20-25% less coal per unit of electricity and emit significantly lower CO₂, SO₂, and NOx levels. The deployment of such technology underscores China’s commitment to modernising its coal fleet, even as it faces global pressure to decarbonise.

Price trends in the coal market also reflect China’s dual priorities of securing supply and managing costs. Thermal coal prices, benchmarked at $130-$140/t, are expected to stabilize due to rising domestic production and high stockpile levels. In the metallurgical coal market, prices remain near $200/t, driven by strong demand for steel production and tight global supplies. China’s metallurgical coal imports have increased 22% YoY, with Mongolia, Russia, and Australia serving as key suppliers.

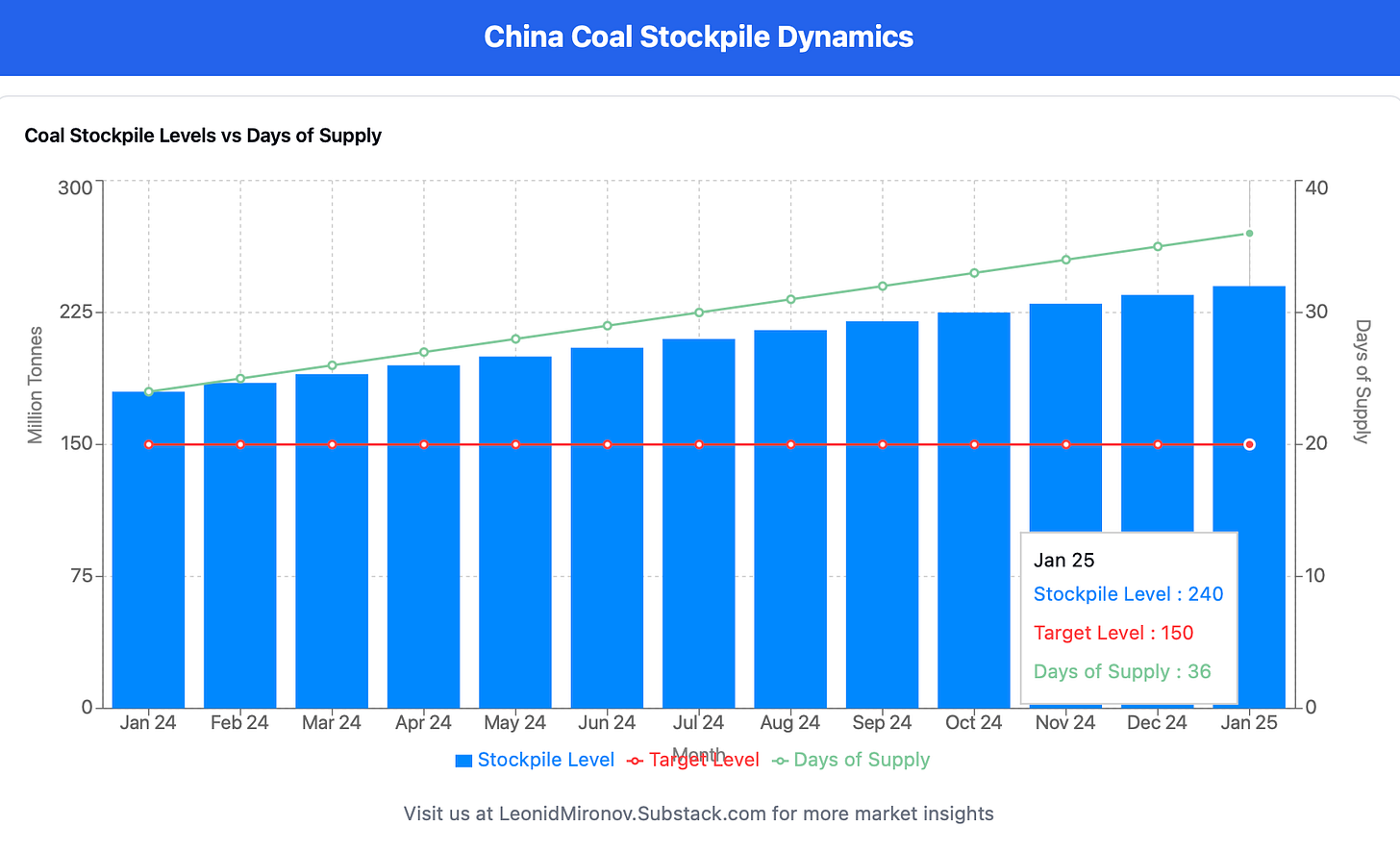

Beyond energy production, coal plays a vital role in China’s energy security strategy. The country has aggressively stockpiled coal to buffer against potential supply disruptions, achieving record-high inventory levels. This stockpiling reflects a broader national priority to ensure energy resilience amid geopolitical tensions and fluctuating global markets.

At the same time, coal remains a critical stabilizer for renewable energy integration. During the winter months, when solar generation can drop by as much as 60%, coal-fired plants provide the necessary backup to meet demand. This flexibility enables China to continue its ambitious renewable energy expansion without compromising grid reliability.

China’s coal strategy in 2025 demonstrates a complex balancing act. While the country is investing heavily in renewables and advanced grid technologies, coal remains essential for maintaining energy security, supporting industrial growth, and managing the challenges of a transitioning energy system. The long-term challenge will be navigating this reliance while pursuing deeper decarbonization to align with its 2060 carbon neutrality target.

India’s Coal Dependency Amidst Renewable Expansion

India’s energy landscape in 2025 is characterized by a growing reliance on coal, even as the country rapidly expands its renewable energy capacity. As one of the world’s largest coal consumers, India faces the dual challenge of meeting rising electricity demand while transitioning to cleaner energy sources. Coal remains indispensable to India’s power generation and industrial sectors, playing a key role in ensuring energy security and supporting economic growth.

Coal demand in India is driven by two main sectors: power generation and steel production. Coal fuels approximately 70% of India’s electricity generation, making it the backbone of the country’s energy system. As electricity demand continues to rise by an estimated 6-8% annually, coal-fired plants are essential for meeting the needs of a growing population and industrial expansion. Additionally, India’s steel industry, which is experiencing strong growth fueled by infrastructure and manufacturing projects, heavily relies on coking coal for blast furnace operations.

India’s dependence on coal is particularly evident during periods of renewable intermittency. Seasonal factors like the monsoon significantly reduce solar and wind power output, requiring coal-fired plants to ramp up production to stabilize the grid. This flexibility is critical for ensuring consistent electricity supply during renewable energy dips, highlighting coal’s ongoing importance as a stabilizer in India’s energy transition.

On the supply side, domestic coal production is rising steadily, with annual output projected to exceed 1 billion tonnesin 2025. This growth reflects a strategic push by the Indian government to reduce reliance on costly imports and strengthen energy security. Domestic coal now meets a larger share of India’s power generation needs, particularly for thermal power plants. However, India remains dependent on imports of high-grade coking coal for steelmaking, even as coking coal imports declined by 8% YoY in 2024 due to increased domestic production and inventory optimization.

India’s reliance on coal also presents challenges and opportunities. The seasonal impacts of the monsoon disrupt renewable energy generation, underscoring the need for robust grid infrastructure and backup capacity. At the same time, the government is implementing policies to reduce the environmental impact of coal use, such as promoting cleaner coal technologies and incentivizing energy efficiency improvements. Initiatives to deploy ultra-supercritical power plants, which achieve thermal efficiencies of 42-45%, are gradually reducing emissions intensity while improving fuel efficiency.

Despite its efforts to expand renewable energy—targeting 500 GW of installed capacity by 2030—India’s coal dependency will remain significant in the medium term. As the country seeks to balance energy security with its climate commitments, coal will continue to play a central role in meeting demand and stabilizing the grid. However, long-term sustainability will depend on investments in renewable energy, battery storage, and cleaner industrial processes, which could gradually reduce the need for coal in India’s energy mix.

Southeast Asia and Australia: Export Dynamics and Market Shifts

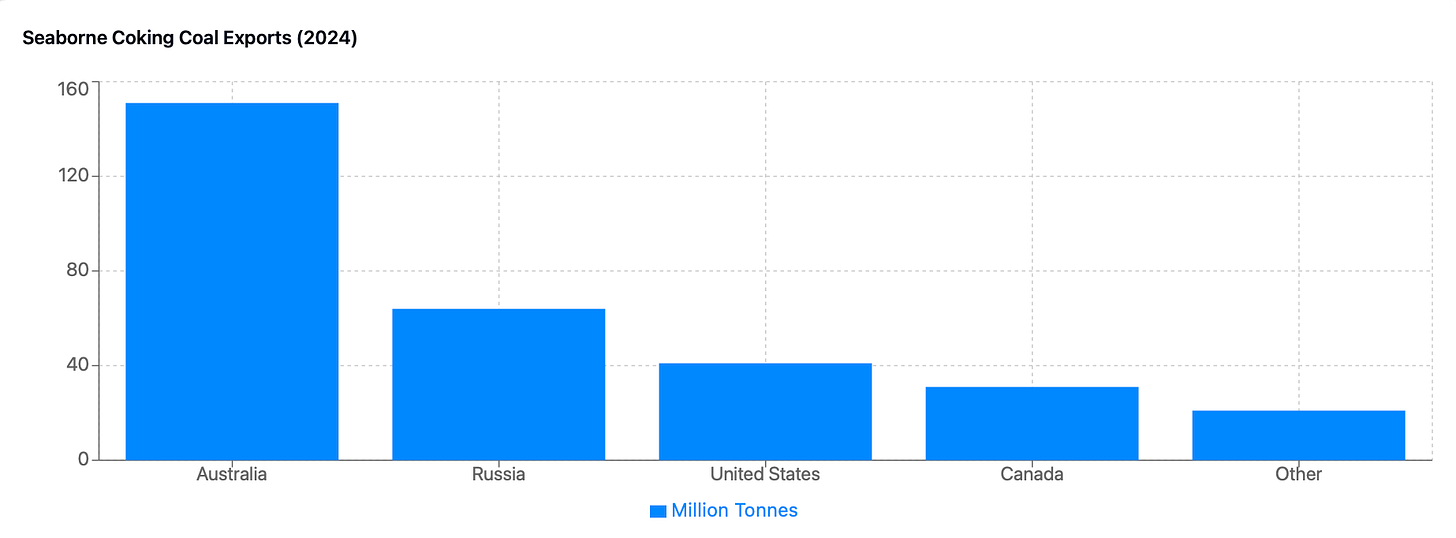

Coal markets in Southeast Asia and Australia are undergoing significant shifts in 2025, shaped by rising demand from key importers like China and India, intense competition among exporters, and evolving geopolitical dynamics. Both regions play pivotal roles in the global coal trade, with Indonesia leading in thermal coal exports and Australia dominating metallurgical coal markets.

Indonesia, the world’s largest exporter of thermal coal, continues to expand its production and export capacity, meeting strong demand from China and India, its two largest customers. Stable weather conditions and the development of new mining projects have enabled Indonesia to increase coal shipments, cementing its position as a key supplier of thermal coal to Asia. However, Indonesian exporters face mounting competition from Australia and Russia, which are vying for market share in China and India. Despite this, the proximity of Indonesian ports to major Asian markets gives it a competitive logistical advantage, helping maintain robust trade volumes.

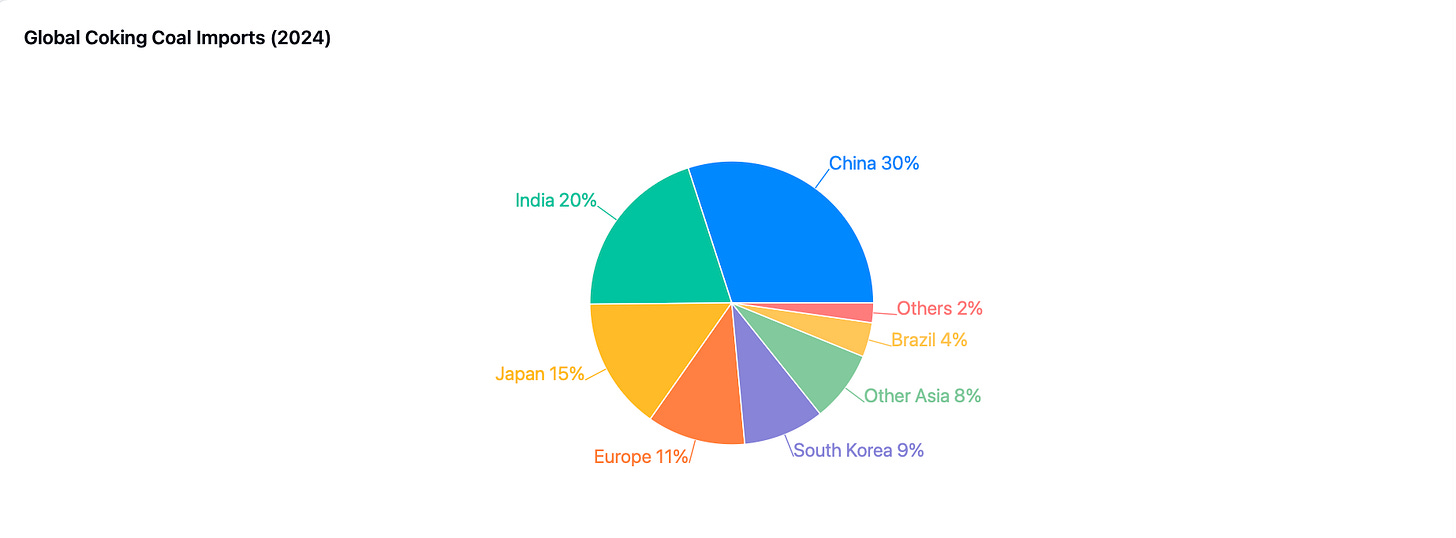

Australia, on the other hand, is witnessing a recovery in coal exports to China following the lifting of trade restrictions that had been in place since 2020. Australian coal exports to China have surged by over 200% YoY, driven by rising demand for high-quality metallurgical coal needed for steel production. Australia remains the dominant global supplier of metallurgical coal, accounting for nearly 50% of global seaborne trade, with key markets in China, India, Japan, and South Korea. High-grade Australian coking coal continues to be a critical input for Asia’s blast furnace steelmaking processes, underscoring its importance in regional industrial supply chains.

However, both Indonesia and Australia face market pressures and risks that could impact their coal industries. Increasing competition from Russian coal, particularly in Asia, is exerting downward pressure on prices. Russia’s lower-cost coal has gained significant traction in China and India, with its exports to China increasing by 15% YoY. This has forced Indonesian and Australian producers to adjust pricing strategies to remain competitive. Additionally, geopolitical tensions in the Asia-Pacific region, coupled with logistical challenges like port congestion and trade route disruptions, add uncertainty to coal export markets.

The broader global push toward decarbonization also looms over coal exporters in Southeast Asia and Australia. While demand remains strong in the short term, especially for high-grade metallurgical coal, long-term trends toward renewable energy, hydrogen-based steel production, and energy efficiency improvements could reduce dependence on coal. As such, exporters in the region must navigate both near-term opportunities and long-term structural challenges in a rapidly evolving energy landscape.

Steel Demand and Its Impact on Metallurgical Coal

Global steel production is projected to grow modestly in 2025, driven by strong demand from the infrastructure, construction, and automotive sectors, particularly in emerging markets. China, the world’s largest steel producer, which accounts for approximately 50% of global output, is expected to stabilize production at around 1.02 billion tonnes in 2025. This marks a recovery following a challenging 2024, with a slight improvement in steel exports as domestic and international demand picks up. India, on the other hand, is set to become a significant growth driver, with steel production expected to increase by 8-9% YoY to support its rapidly expanding infrastructure projects. Similarly, emerging economies in Southeast Asia are ramping up steel production to fuel urbanization and industrial growth.

Metallurgical (met) coal, an essential input for blast furnace-based steelmaking, will see demand growth in line with rising steel production. Blast furnaces, which dominate global steelmaking, require approximately 0.6–0.8 tonnes of coking coal per tonne of steel produced. In 2025, met coal demand is expected to grow by 2-3%, driven by several factors:

• China’s stabilization of steel exports and domestic manufacturing needs.

• India’s infrastructure boom, requiring higher steel output.

• Southeast Asia’s industrial expansion, particularly in countries like Vietnam and Indonesia, which are increasing their reliance on blast furnace steelmaking.

Regional dynamics highlight variations in met coal consumption patterns. China, despite slower industrial growth, remains a key consumer. Stabilization of steel exports and continued domestic demand are expected to keep met coal imports strong. As of 2024, China’s met coal imports have increased by 22% YoY, with Mongolia and Russia emerging as major suppliers. India, while growing its domestic steel production, is reducing its reliance on imports for basic-grade coal but will continue to import high-quality coking coal from Australia and Russia for blast furnace operations. Meanwhile, Southeast Asia is becoming a growth hotspot, with nations like Vietnam and Indonesia heavily dependent on imported met coal to fuel their expanding steel industries.

Metallurgical coal prices are hovering around $200/t, which is close to cost-support levels for marginal producers. Prices at this level ensure a balance between supply and demand, as any significant drop would force high-cost producers to scale back operations, thereby reducing supply and stabilizing the market. Australian and Russian met coal exporters are competing fiercely for market share in Asia, with Russia gaining traction due to its lower production costs, while Australian coal remains favored for its higher quality.

Looking ahead, the met coal market faces both risks and opportunities. Risks include potential economic slowdowns in China or Europe, which could suppress steel demand and, consequently, met coal consumption. Additionally, the global push for greener steel production, such as electric arc furnaces (EAFs) using scrap steel, could reduce the long-term reliance on met coal. However, opportunities remain robust in emerging markets like India and Southeast Asia, which continue to rely heavily on traditional blast furnace steelmaking. These regions offer significant growth potential for met coal exporters from Australia, Russia, and Mongolia, positioning them to capitalize on sustained demand in the medium term.

The Paradox of Coal Growth with Renewable Expansion

As renewable energy scales rapidly across the globe, coal consumption continues to grow in certain markets, driven by its critical role in stabilising power grids that rely heavily on intermittent sources like wind and solar. This paradox underscores a major challenge in the energy transition: renewables’ variability demands a reliable backup, and coal remains the most accessible and scalable option.

Renewable energy sources, such as wind and solar, are inherently intermittent, depending on weather conditions and daylight. In China, coal plants are crucial during winter months, when solar power generation can drop by as much as 60% compared to summer levels. Similarly, wind power in China often declines during calm weather, requiring coal plants to ramp up to stabilize the grid. In 2024, coal generation accounted for 56% of China’s electricity, with coal-fired plants regularly increasing output during renewable energy dips . In India, the monsoon season significantly impacts solar and wind power output, as heavy cloud cover and low wind speeds reduce generation capacity. For example, during the 2024 monsoon, India’s coal-fired power output increased by 15% YoY, ensuring uninterrupted electricity supply during a period of low renewable performance .

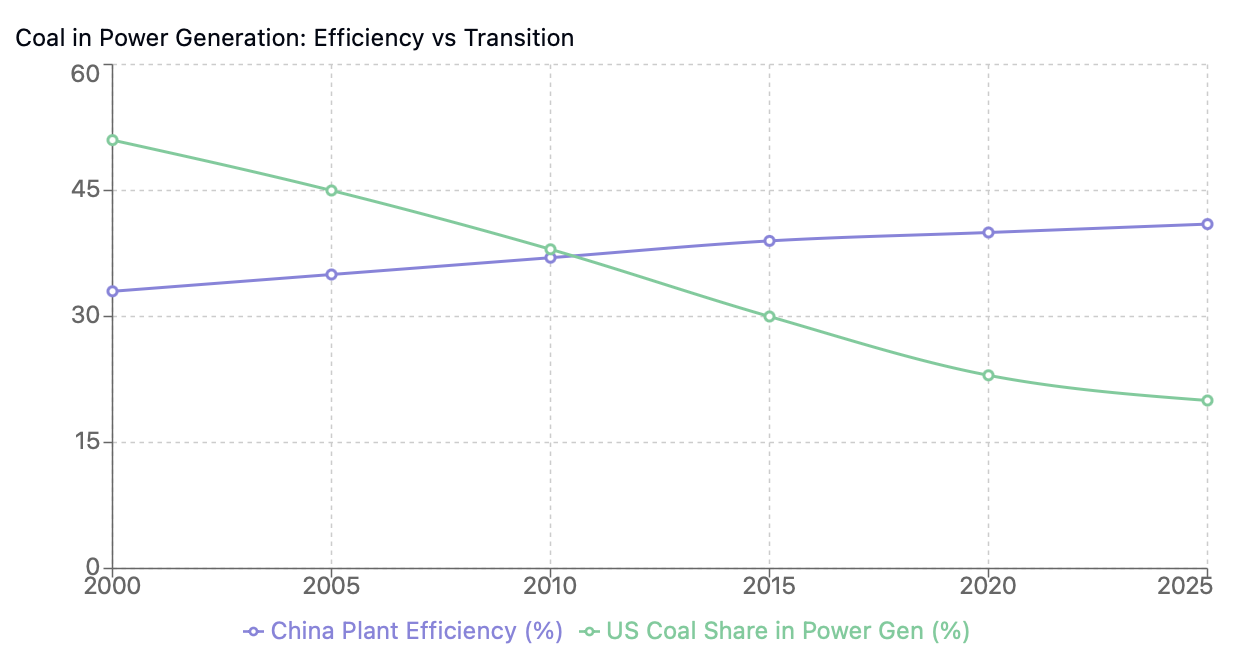

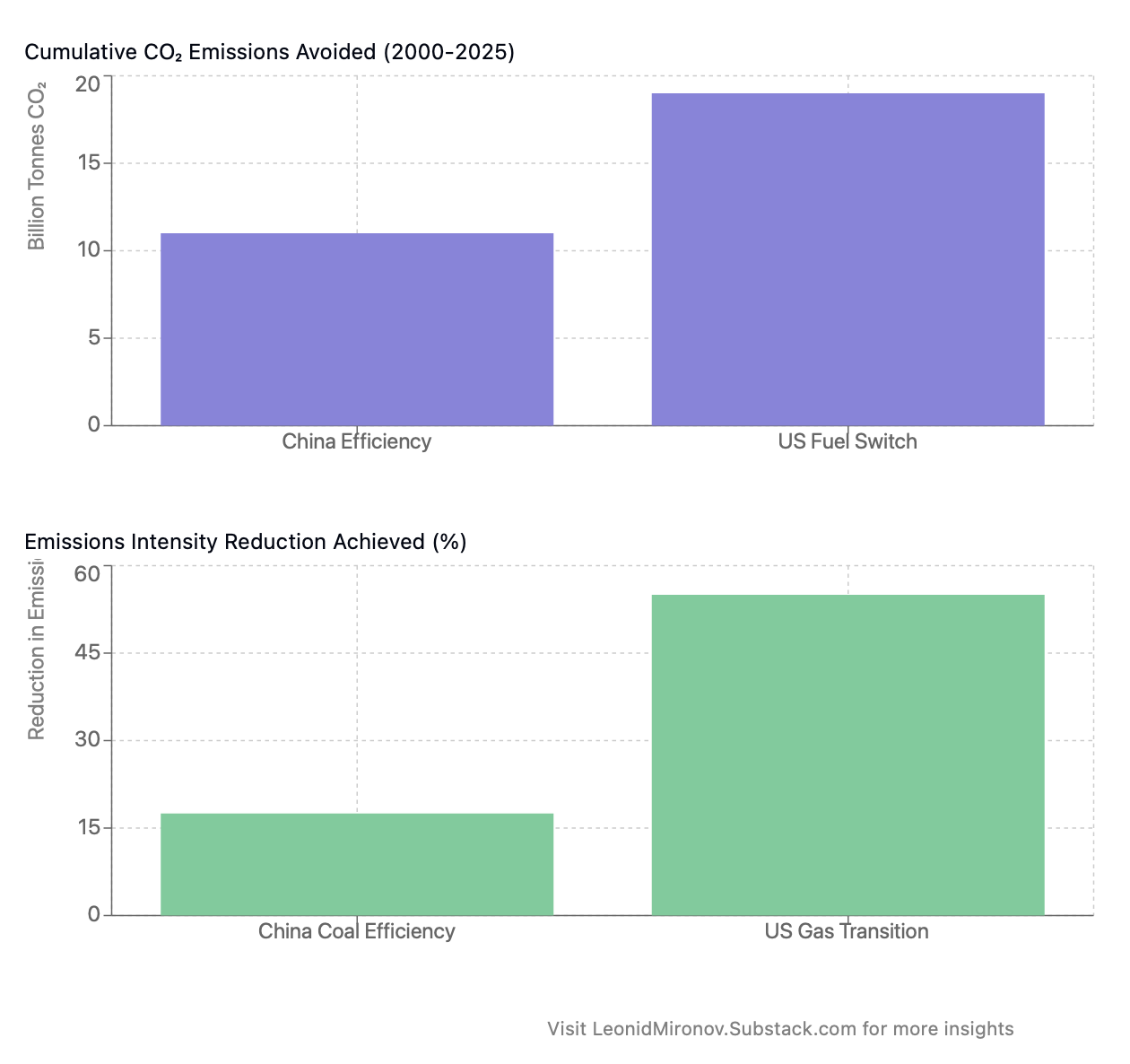

Coal’s continued relevance is bolstered by advancements in the efficiency of coal-fired power plants. In the early 2000s, most coal plants in China and India operated with subcritical technology, achieving thermal efficiencies of only 33-37%, consuming ~380 grams of coal per kWh of electricity generated. Modern ultra-supercritical (USC) plants, which dominate recent capacity additions, operate at much higher efficiencies of 42-45%, consuming just ~285 grams of coal per kWh. These advanced plants have also reduced CO₂ emissions by 20-25% per unit of electricity compared to older plants .

China has been at the forefront of deploying cutting-edge coal technologies, including double-reheat ultra-supercritical plants, which can achieve efficiencies of up to 47%, among the highest globally. For example, the Guodian Taizhou Power Plant and other flagship projects represent a significant leap in efficiency and emissions reduction. By 2025, China’s fleet-wide coal plant efficiency is expected to average ~41%, a notable improvement from the early 2000s .

In comparison, many coal-fired plants in the United States and Europe operate with subcritical or supercritical technology, with average efficiencies ranging from 33-40%. Western nations have largely stopped building new coal plants, focusing instead on phasing out older ones. However, China’s newer plants emit 15-25% less CO₂ per MWh than legacy plants in the West, underscoring how modernization efforts can mitigate environmental impacts even within a coal-dominated energy mix .

Despite these improvements, coal-fired plants remain a high-carbon energy source, emitting ~750–800 kg of CO₂ per MWh, compared to natural gas (~400 kg/MWh) or renewables (near-zero). Yet, the ability of ultra-supercritical plants to adjust their output flexibly makes them indispensable for balancing renewable energy supply. During 2024’s peak winter demand in China, coal-fired plants provided over 70% of incremental electricity supply during periods of low wind and solar generation, demonstrating their critical role in maintaining grid reliability .

Technological gaps in energy storage further reinforce coal’s short-term necessity. While lithium-ion batteries and pumped hydro are growing in capacity, their scalability and cost-effectiveness remain limited. As of 2025, global battery storage capacity is expected to reach ~150 GW, insufficient to handle the large-scale variability of renewables in major markets like China and India. Until storage technologies become widely affordable and accessible, coal will continue to bridge the gap during renewable shortfalls .

Panda Perspective:

Coal’s ability to provide reliable and flexible power underscores its ongoing role in stabilizing grids, particularly in emerging markets. However, the long-term viability of coal as a stabilizer depends on advancements in low-carbon technologies, including grid-scale storage, hydrogen, and accelerated investments in renewables. Until these solutions reach maturity, coal will remain a key component of the global energy transition.

In the short term, coal will remain an integral part of global energy systems, particularly in emerging markets where its reliability and affordability make it indispensable. In China, coal accounts for 56% of electricity generation, with production exceeding 4.5 billion tonnes annually. Similarly, India, where coal powers 70% of electricity, is projected to surpass 1 billion tonnes of domestic coal production in 2025. This reliance stems from coal’s unique ability to stabilize grids during renewable intermittency, such as China’s winter solar dips (up to 60% lower output) and India’s monsoon season when solar and wind generation falter. Coal demand for power generation is expected to grow modestly by 2-3% annually in these regions, with prices supported by cost floors near $130-140/t for thermal coal and $200/t for metallurgical coal, ensuring viability for producers .

Strategic stockpiling will further bolster coal demand. China, for example, has achieved record-high inventories to safeguard against supply disruptions, while India is ramping up domestic coal infrastructure to minimize import dependency. Globally, coal remains essential in industries like steelmaking, where blast furnaces require 0.6-0.8 tonnes of coking coal per tonne of steel. With global steel production projected to rise 2-3% YoY, metallurgical coal demand is expected to remain resilient .

However, the long-term trajectory for coal is clear: demand will decline as technological and policy changes reshape energy systems. Advances in battery storage (projected to reach ~150 GW of global capacity by 2025) and grid modernization will gradually reduce the need for coal-fired plants as stabilizers. Additionally, policy-driven decarbonization is accelerating renewable adoption, with nations like India targeting 500 GW of renewable capacity by 2030 and China aiming for carbon neutrality by 2060. Emerging technologies such as green hydrogen for steelmaking and scalable long-duration energy storage promise to further disrupt coal’s dominance in both power generation and industry .

Despite these headwinds, coal remains a cornerstone of energy security in the near term. Its affordability and scalability ensure continued relevance, especially in developing economies. For instance, Indonesia, the world’s largest thermal coal exporter, has increased exports by 6% YoY, supplying growing markets in China and India. At the same time, Russia, leveraging its low production costs, has gained significant market share in Asia, with coal exports to China rising by 15% YoY .

For investors, the coal sector offers opportunities, particularly in companies with flexible operations and exposure to key markets. Australian coal producers, for instance, dominate the metallurgical coal market, supplying over 50% of global seaborne trade, while Indonesian producers benefit from logistical proximity to major Asian buyers. However, risks are mounting: global coal consumption faces long-term structural declines due to policy shifts, environmental concerns, and competition from renewables. Geopolitical disruptions, such as trade tensions and conflicts, could also impact supply chains and pricing stability.

Coal’s future lies at a critical juncture. In the short term, its role as a stabilizer for renewable grids and a backbone for industrial processes remains vital. Yet, as clean energy technologies advance and climate goals intensify, the long-term sustainability of coal faces significant challenges. Investors and policymakers alike must balance immediate energy security needs with the imperative to transition toward a low-carbon future.

Investment implications.

Cost Curves and Economic Implications

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.