I can’t speak for every China watcher out there, but this letter writer is certainly experiencing announcement fatigue. Yesterday alone we have had 2 separate newsworthy press conferences, one big data dump and one leak that between them warrant at least 10 thousand words of detailed analysis. But I suspect the fatigue works both ways so as not to stress the Dear Reader any more than necessary and for avoidance of getting the reputation of a penny-a-liner (this august publication is at the very least an $8/month commitment, thank you very much!) here goes a very brief summary, followed by a first – a paid content bit that deals with some investment implications.

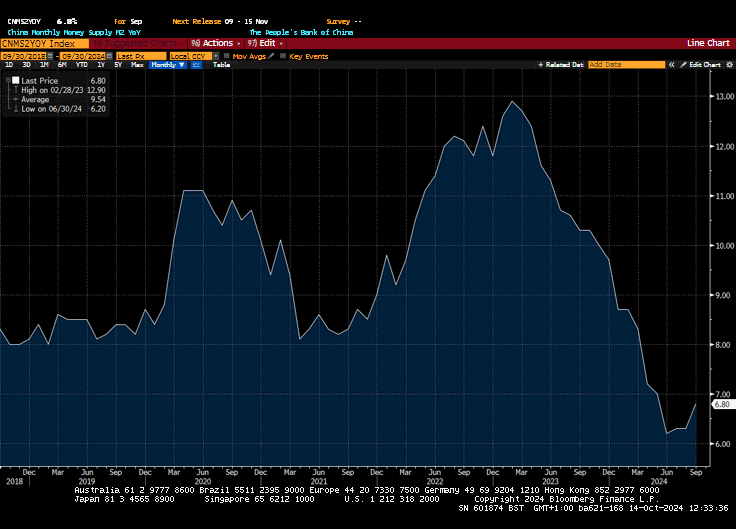

First let’s deal with the data. In September, China’s M2 money supply grew by 6.8% year-on-year, slightly exceeding the estimated 6.4%. Meanwhile, M1 money supply saw a record decline of 7.4% year-on-year, in line with the forecast of a 7.3% drop. M0 money supply increased by 11.5% year-on-year, down from the previous 12.2%. Aggregate financing reached 3.76 trillion yuan, surpassing the expected 3.73 trillion yuan. Additionally, new yuan loans amounted to 1.59 trillion yuan, significantly higher than the estimated 1.09 trillion yuan.

A picture worth a thousand words: yes the decline is big, But also yes I think we’ve bottomed.

On to the First press conference now and we are in Biejing, where In an energetic move to drive innovation and consumer spending, China’s Ministry of Industry and Information Technology (MIT) announced plans to introduce supportive measures for equipment upgrades and consumer trade-ins in Q4. The ministry is also collaborating with the Ministry of Finance to boost innovative enterprises and, with the China Securities Regulatory Commission (CSRC), to launch a third wave of regional equity markets’ “specialized, refined, distinctive, and innovative” boards. A strategic cooperation agreement with the Beijing Stock Exchange (BSE) is also on the table. With around 36,000 industrial projects already in motion, pulling in over 11 trillion yuan in expected investment, it seems MIT is taking no prisoners in ramping up domestic demand. Shock revelation: 11 Trillion is a lot of money, but details are sparse as to whose money and what will it do.

Meanwhile, not to be outdone, and still in Beijing, Ministry of Environment and the PBOC have China is rolled out its green finance strategy with a punchy 19-measure guideline designed to propel eco-friendly development. The focus? Everything from financing for green projects and boosting loan issuance to innovative green financial products and carbon market initiatives. The drive includes projects to restore ecosystems, increase forest coverage, and optimize grain production while transitioning away from fossil fuels. With plans to create a project library for key industries and initiatives, China’s financial institutions are poised to rev up their green game in both regional and national efforts to promote a beautiful, sustainable future.

And finally, TsiaShin (yes that’s how Caixin is pronounced) have dropped the bombshell that China is considering raising an additional 6 trillion yuan in treasury bonds over three years to support its slowing economy with fiscal stimulus, according to sources familiar with the matter. Part of the funds will be allocated to help local governments manage off-the-books debts. We’ve been anticipating what the number can be and 6 trillion is in the middle go the optimistic range. We also give ourselves a gold star for noting at the end of the 3rd plenum (and yes we’re still not over how little play it got at the time) – that the ultra-long bonds well be used to fund the swaps for LGFVs and other LG debt, potentially followed by LG asset transfers. We have noted back then that this is the end of worrying about Local Government financing. We also note that this is why we can actually start seeing the local governments issue and spend some of the authorised but unissued debt (see Saturday’s note for the chart).

Bottom line is, as preannounced in this very letter, CCP is very serious about the economy and it will get it going. Worry less about the size and worry more about what are the limiting factors.

Now what does this mean?

Well for the paid subscribers’ benefit here are some of my thoughts.

Keep reading with a 7-day free trial

Subscribe to Panda Perspectives to keep reading this post and get 7 days of free access to the full post archives.