In a world where the worst is assumed when it comes other US/China relations, this letter writer believes there’s room for hope.

The relationship between the United States and China is one of the most consequential in the world, shaping global politics, economics, and security. As two superpowers with distinct political systems and strategic interests, their interactions are marked by both intense competition and necessary cooperation. Understanding the dynamics of this complex relationship is essential for anticipating the future of international affairs.

Currently, despite increased geopolitical tensions, the economic relationship remains surprisingly stable. While an open conflict over Taiwan is a concern, we believe the risk is exaggerated, with the most likely outcome being a gradual reintegration of Taiwan into the PRC, possibly with the consent of its citizens. The focus now is on mitigating risks in global supply chains, particularly for semiconductors, a process already well underway on both sides of the Pacific.

Despite the competitive nature of their relationship, recent diplomatic signals suggest a willingness from both countries to explore areas of cooperation. For example, President Xi Jinping emphasized the importance of working with the United States, noting that such collaboration benefits not only both nations but the world.

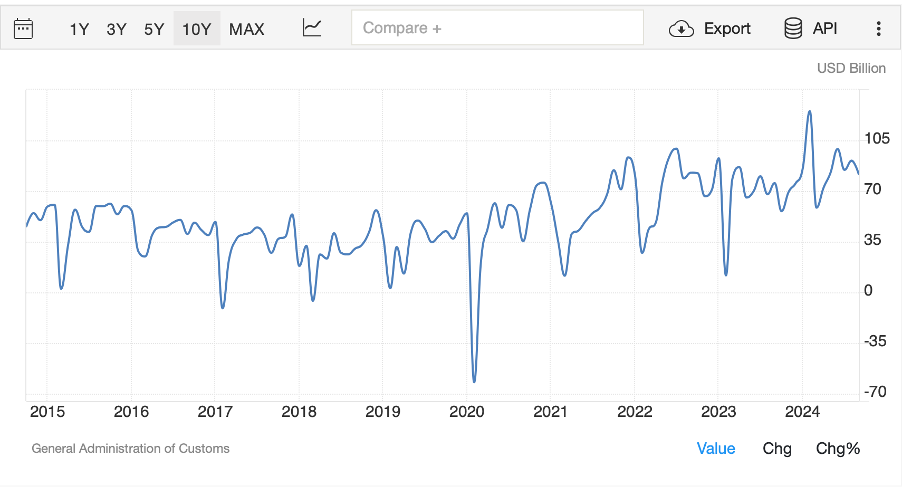

However, the economic relationship remains complex. Trade between the US and China is vast, and while tariffs introduced by President Trump have impacted imports, China’s overall trade surplus continues to grow. In fact, in the first nine months of 2024 alone, China’s trade surplus reached $689.5 billion.

This reflects the deep interconnectedness of the two economies, with China’s share of US imports declining, but the overall trade imbalance remaining high.

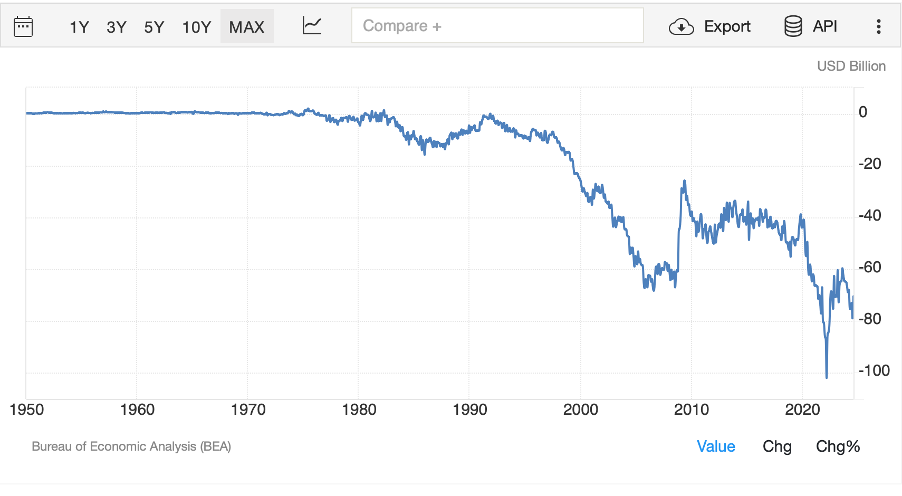

US trade deficits are still significant, topping $1 trillion in 2023 and continuing on that path in 2024. This is largely due to structural factors—China has become a manufacturing powerhouse, while the US has relied on foreign capital and treasury bonds to offset its current account deficit.

Both countries are moving toward structural shifts in their economies. China is focused on boosting domestic demand and reducing dependence on export-driven growth, while the US aims to strengthen internal industries, particularly in manufacturing and technology. The speed of these shifts may be a pivotal factor in the upcoming US elections.

Donald Trump advocates for a more aggressive decoupling from China, proposing tariffs of up to 60% on Chinese imports and pushing for a grand bargain on currency and trade. His plan includes fixing the RMB-USD exchange rate, which could make Chinese exports less competitive and boost domestic demand in China. Kamala Harris, on the other hand, supports “de-risking” without full decoupling, emphasizing domestic manufacturing and building alliances to counterbalance China’s influence.

The Trump plan conversely may sound harsher but is in fact an opportunity to do a grand bargain. A Plaza-style accord on currency, trade and industrial policy that would see China get more serious about domestic demand and the US about domestic manufacturing. Such an arrangement will be a significant about turn, but at least on the Chinese side there’s now more willingness to see demand as a strength and an asset, while the US is sold on an idea of having more manufacturing domestically. Manufacturing that cab be owned by Chinese firms, according to Trump. This is the sort of out of the box thinking that we are here for, and while this has been highlighted before we wanted to go on the record as supporters of this idea, and believe it will be very beneficial for China and the world.