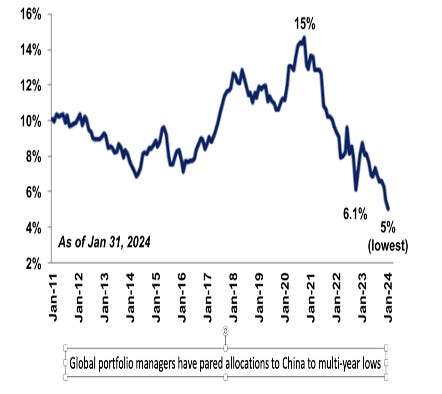

Why we believe that China represents a unique opportunity for equity investors this year and beyond.

Investing in China in the 2020s has been anything but plain sailing. With its share of exhilarating heights of the late 2020 and 2021 to the 2023 lows it has truly been a wild ride.

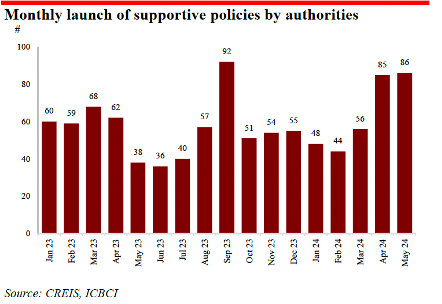

However, the second half of 2024 should awaken the broader investing world to a material improvement in China’s economic prospects going forward. A combination of the 3rd Plenum, Politburo meeting and a Conference on Economic Work all happening before December this year gives ample opportunity for Chinese policy makers to publicise the progress made in addressing the key weaknesses of the Chinese growth model and implement new policies, that will benefit Chinese consumers and corporates, and by implication investors in the long term.

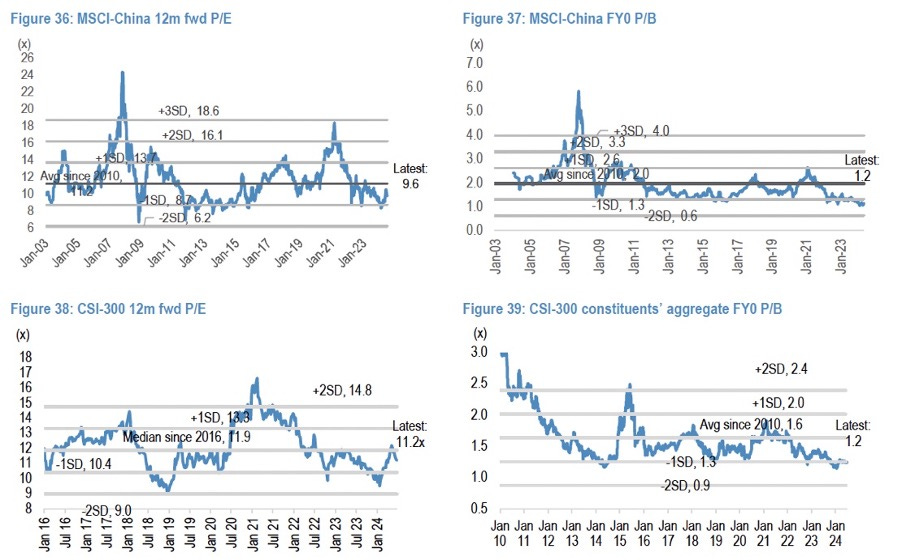

Equity valuations have gotten cheap with CSI 300 NTM P/E over 1 standard deviation below long-term average at 11x, and MSCI China at only 9.6x. Similar dynamic can be observed on the P/B multiples. Critically, positive dynamics have returned to sales and earnings of Chinese companies since the end of 2023. If as we expect, the government can deliver on sensible economic stewardship, we believe that corporate earnings growth will become more sustainable and visible. The resulting valuation uplift in this scenario provides investors a compelling risk/reward profile in the China equity space.

Traditionally, the venue for announcing big economic policy measures has been the third plenary session of the CPC. Accordingly, we believe that the next set of policies that are likely to be announced at the coming Third Plenum of the 20th Central Party Committee of the Communist Party of China will focus on addressing the needs of the people. Rather than focusing on specific policy details, we would like to take this opportunity to convey our vision of why we believe the economic challenges of the late 2010s and early 2020s have been identified and are being dealt with already, and that there is now a foundation for decades of high-quality growth for the entire economy.

The Issues: Real Estate difficulties dragged down demand

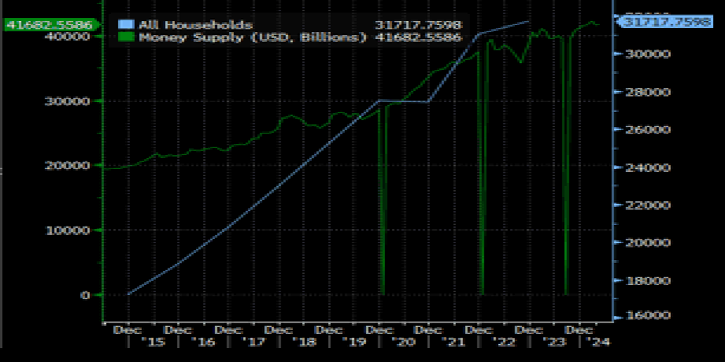

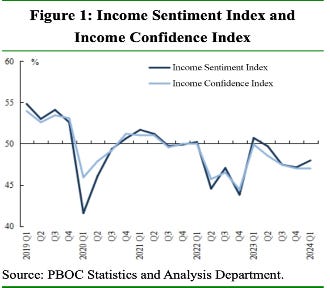

First, we need to acknowledge that the environment has been challenging, especially for consumers. While it is certainly true that China rebounded more slowly than original expectations of 2023, and in a distinctly different manner to the US and Europe, it is important to note that this happened largely because of the lack of the stimulus payments that western governments used. Coming out of COVID, Chinese households did not have the same desire for “make-up” consumption than their Western counterparts because the experience was dramatically different. They have instead re-focused on the lack of safety nets especially for the elderly and the very young. Consumption thus continued to grow at a lacklustre pace, barely keeping up with money supply since 2020.

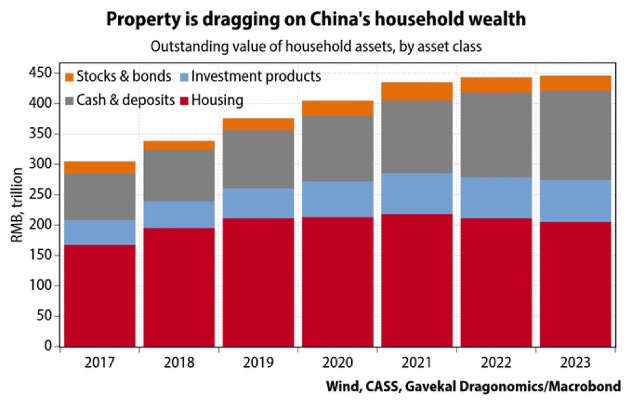

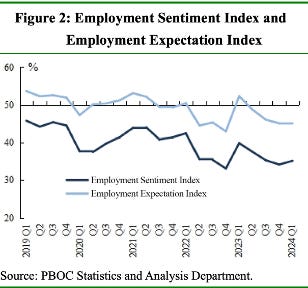

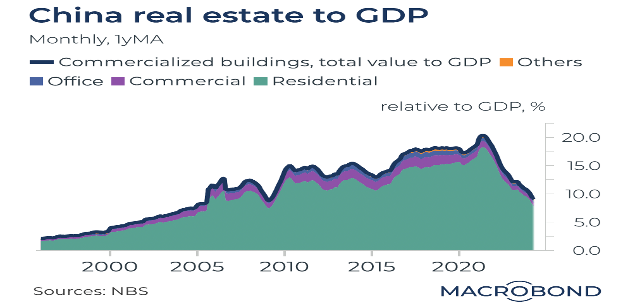

Compounding that was a slowdown in real estate. While a lot has been said about the RE slowdown, and the high-profile bankruptcies of big developers like Evergrande continue, we would like to focus on the pure economic outcomes of the decline in property values, and the most obvious ones: the reduction in both the household wealth and in employment opportunities.

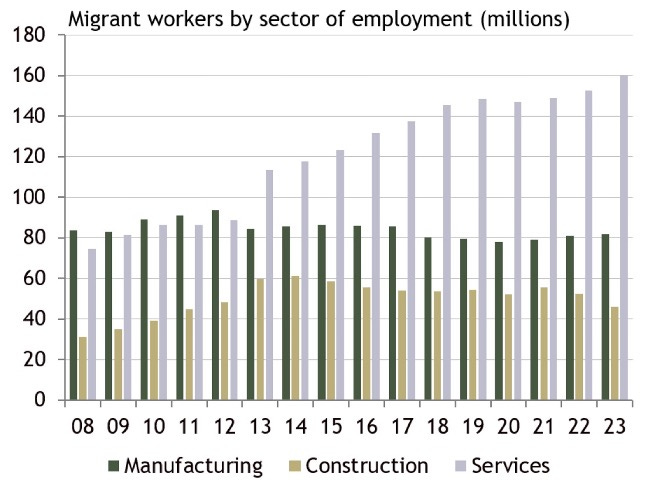

The Sector as a whole has shed over 6.5m (predominantly migrant) jobs in 2023. This in turn was reflected in almost no salary growth over 3 years for those who kept their jobs, as competition intensified.

While the overall trend started in 2014, it’s the decline since 2021 that’s most telling as overall the construction sector has lost over 15m jobs since the introduction of the 3 red lines policies.

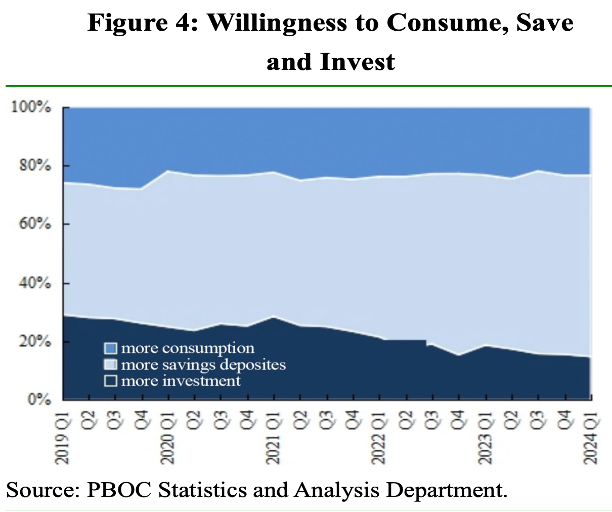

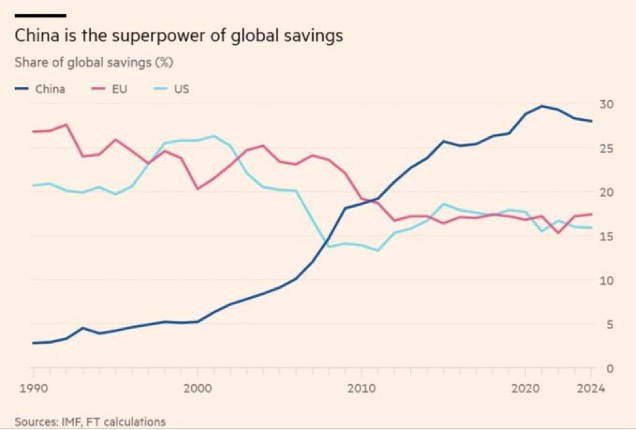

Another post-COVID reality has been the highlighting of the lack of a social safety net. Since most residents of the big urban centers in China weren’t born there, they don’t qualify for free government services like healthcare and early education, and more crucially, elderly care. In our view, having to provide for one’s parents and one’s own retirement is the key reason for the high savings rate in China. If the government reassures citizens that they will be provided for, they can finally put more money to work rather than just save. In the meantime though, the focus is squarely on savings.

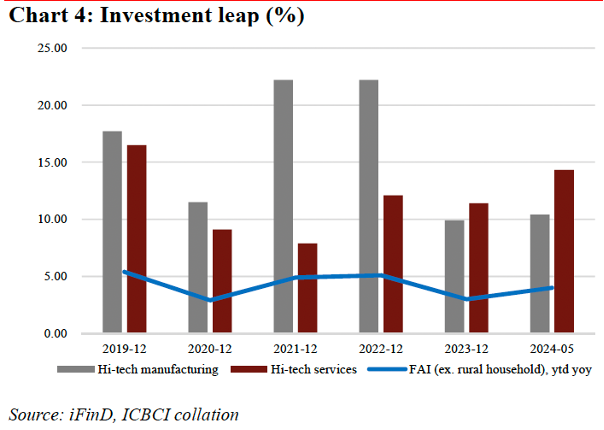

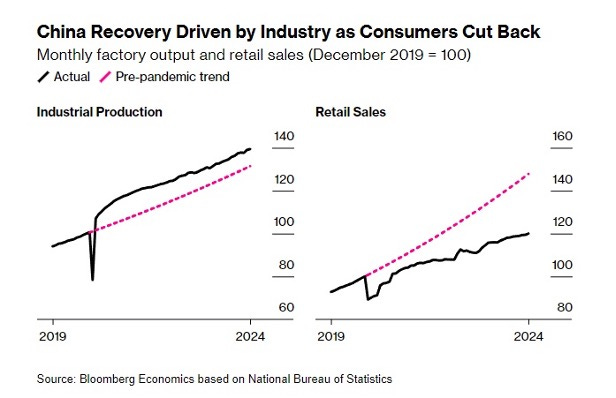

Finally, an issue that keeps re-emerging in various forms is the lack of efficacy, from the household point of view, of the stimulus that was actually deployed. The support went to the manufacturing industries. A traditional supply-side response, that has been the main focus of China’s stimulus since the late 80s. The most recent iteration thereof is the focus on New Productive Forces – focusing on high tech manufacturing and promoting technology independence. Understandable in the context of the US chip policy, but that’s not making it easier on the Chinese consumers in need of a boost.

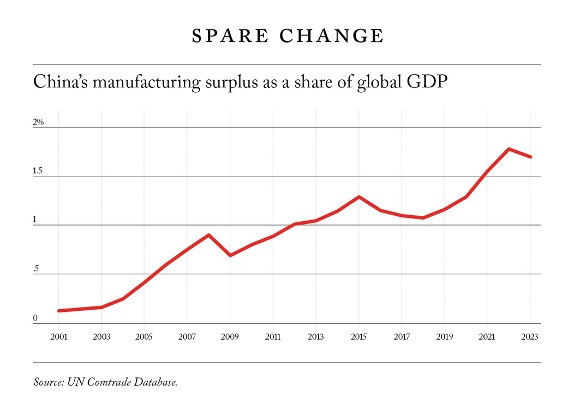

The issue with this approach now though is that there isn’t much runway left on that path. China’s manufactured goods surplus now approaches 2% of global GDP. It is possible this is the highest number in history for any economy, certainly since the industrial revolution. The practical constraint though now is that the Chinese companies have become so efficient at producing high quality goods, that they are competing successfully with European and US producers both globally and in their domestic markets.

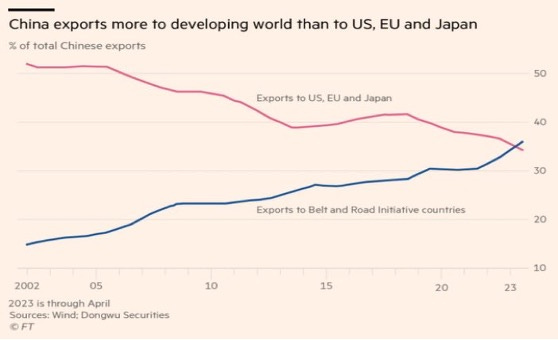

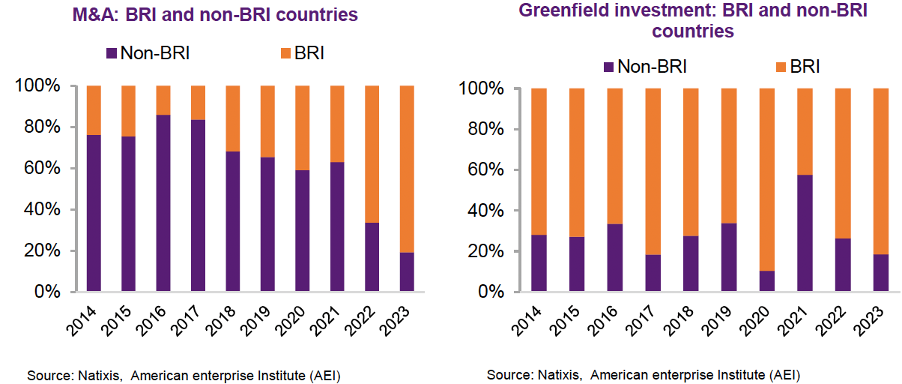

That in itself is not necessarily a problem, as long as alternative markets can be secured. Already China’s share of trade with the participants in the Belt and Road Initiative (the BRI, a Chinese policy of providing loans and infrastructure solutions to developing nations) exceeds that of Japan, EU and US put together.

But the BRI nations do not have an infinite propensity for allowing Chinese imports without taxing those eventually. Already we’re seeing Indonesia propose introducing 200% tariffs on some Chinese goods. The ability of Chinese corporates to acquire local companies or provide the trade partners with FDI helps in the short to medium term, especially in cases where they do not have domestic high-end industry to protect, but it’s not a limitless market either.

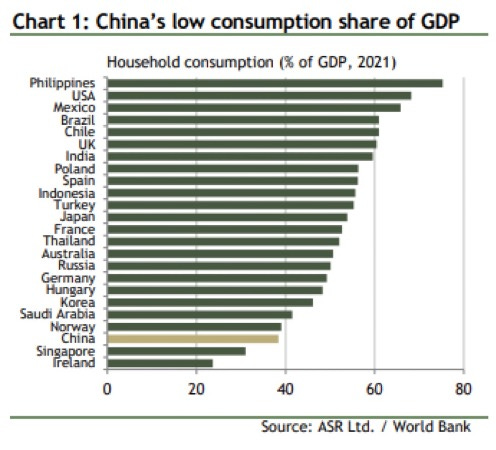

As a result, China in July 2024 is facing a consumer sector that’s weak and is back at sub 40% of GDP and a manufacturing sector that is likely bumping up against limits to how much more incremental exports the global market can take from China.

The Solution: Consumption Stimulation and Domestic Market Focus

The situation outlined above seems quite dire and explains the investor apathy to Chinese equities that we described at the very top. However, thinking though those challenges, solutions begin to emerge, and we will argue that the government is both understanding of the issues and is openminded about the exact mix of the solutions, but is focused on getting it right. We believe that a good policy response will deal both with current issues and imbalance as well as build a foundation for future growth. Broadly speaking current issues need to be resolved with stimulus while future issues are dealt with via “reform and opening up”.

To us, the most important fact is that President Xi has been consistent in acknowledging these struggles, and he has had his focus on broadening the recovery. In fact, in December 2023, he mentioned “发展是硬道理” loosely meaning economic development is the priority, mirroring the famous Deng line form the 1980s. He then further pivoted earlier in the year to emphasizing “prosperity” in Common Prosperity. That is to say – focus on making sure that ordinary Chinese workers feel the quality-of-life improvement through rising incomes. This is very different from talking away from billionaires and punishing them for getting too powerful.

Xi further committed to this in his speech in Jinan City, Shandong Province at the “symposium of enterprises and experts” on May 23 this year. This was a meeting of President Xi with the business leaders and key economists. There he highlighted that the CPC

“Some reform measures that are urgent for the people's livelihood and the people's hearts should be done to do more practical things that benefit the people's livelihood, warm the people's hearts and obey the people's will, so that the reform can give the people more sense of gain, happiness and security”.

This is exactly what we are talking about. The CPC understands the issues plaguing the Chinese consumer and will address them.

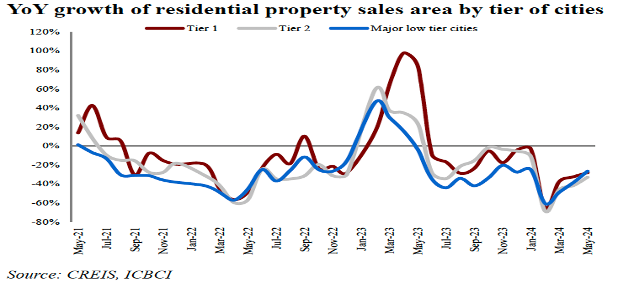

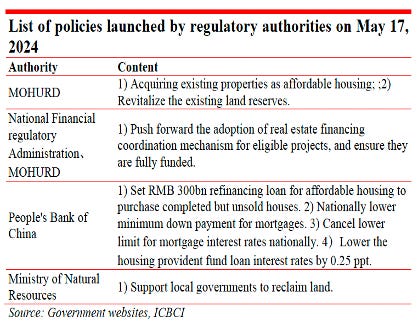

Secondly, the damage that the real estate sector readjustment has had has clearly been severe, but we would argue that we have gone through the worst of it. Some of the policies that have been put in place have already started to have an effect on sentiment.

And beyond that, Real Estate’s industry contribution to GDP has been cut in half from the peak, and thus its propensity to do more damage to the recovery has been dramatically reduced.

The housing starts and pries have not recovered yet, but it does appear to us that they are basing. we believe the broad approach of creating a “bad bank” of property that can purchase large projects from developers directly, coupled with creating regional funds that can be administered locally for greatest local effect will the job of stabilizing the market.

In-line with the mantra of “Real estate is for living, not speculating on” we do not need these policies to start a new bull market in policy prices, but rather arrest the decline, and stabilize construction volumes at these new levels. The real estate acquired can then be used to help the slum dwellers and needy families. We note that the currently announced size of these programs (c.1trn RMB) is not fixed and can be increased if needed. These measures should stop the deterioration of consumers’ balance sheets and create an environment more conducive to spending.

We think that it is also important to acknowledge that the deflation of the real estate market has not caused a breakdown in the economy, that one might expect given that the sector was over 25% of GDP at its peak, and GDP, measured in US Dollars, has not grown on trend over the past 3 years. The fact that growth continued at all is a remarkable indicator of the success of the New Productive Forces.

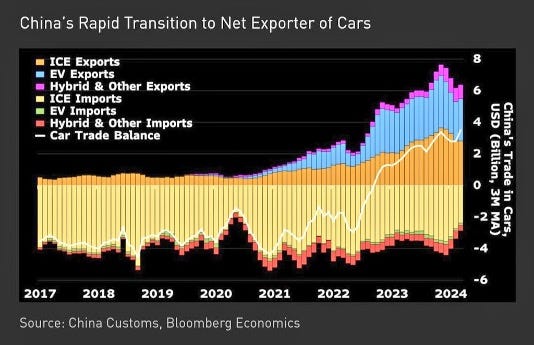

Electric Vehicles are a great example of that China’s ability to seize upon a trend for cleaner vehicles, get good at making them and become a net exporter from a net importer in a short space of time. Through proactive industrial policy, incentivizing production and a strong competitive domestic market, Chinese producers have evolved from also-rans as early as 2019 to global leaders in EV technology. Their export success in the case be used as a yardstick for acknowledging how far they’ve come.

And to be clear it is not just the EVs; the entire Solar and Wind power value chains are both concentrated in China, as is a lot of high-precision manufacturing. In fact, China’s share of global manufacturing value added has been rising significantly since 2000 and it now represents over 30% of total.

These successes are due in no small part to the strength of private enterprise and a large supply of highly educated engineers and researchers. Chinese private companies are no longer copying western technology but are surpassing their western counterparts due to R&D as well as product and manufacturing innovations.

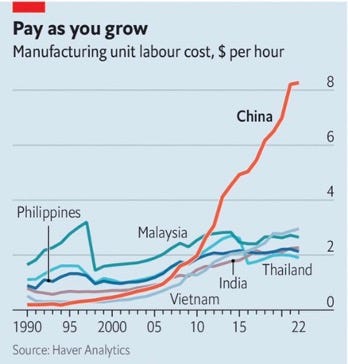

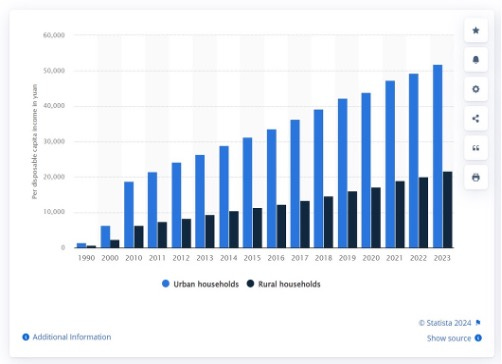

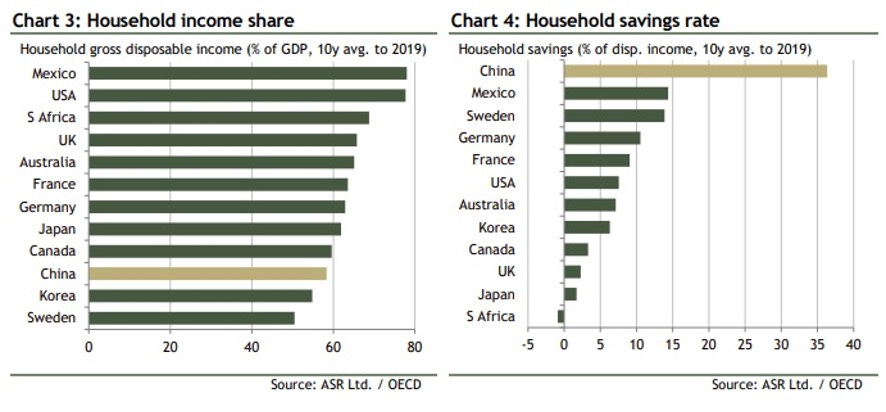

The issue is though, as per the original David Riccardo theory, the trade needs a balance, as participants in global trade need to let their counterparty specialize in something they require to ensure that the flow of money is circular, rather than being stuck in one country’s reserves. So, while Chinese firms will likely get better at manufacturing high value-added goods over time, their ability to export a significant portion thereof to the EU and the US may be under pressure. Thus, the real solution is stronger domestic demand. We note that while we have outlined the challenges that consumption growth has faced in recent years, we must remember that China has done a stellar job of raising incomes. Both salaries (as measured by unit labor costs) and incomes, rural and urban, have grown, and Income’s share of GDP remains high.

So much so that the income share of Chinese households is much closer to OECD average than the share of consumption s. And thus, the lower consumption is a function of high savings, rather than a lack of income per se.

As the Chinese domestic market grows and matures, it becomes a demand center for innovative Chinese products and services. It also becomes an end market for goods produced elsewhere, evening the trade imbalances.

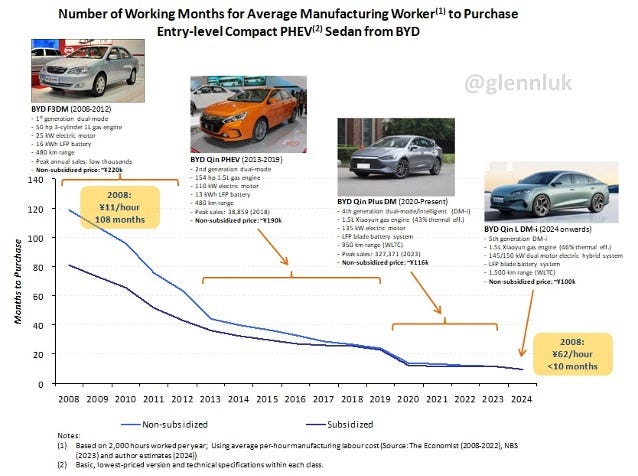

We are already seeing this happen on the overlap of the new industries and rising salaries. Consider the affordability of new EVs to the workers of EV makers, using BYD as an example.

The workers’ pay has gone up nearly 600% over the past 14 years while the quality of the car also improved substantially, it’s now a world-leading Hybrid engine, while the price has declined by over 55% in absolute terms! This means affordability has gone up rather significantly, enabling more money to be spent on other pursuits.

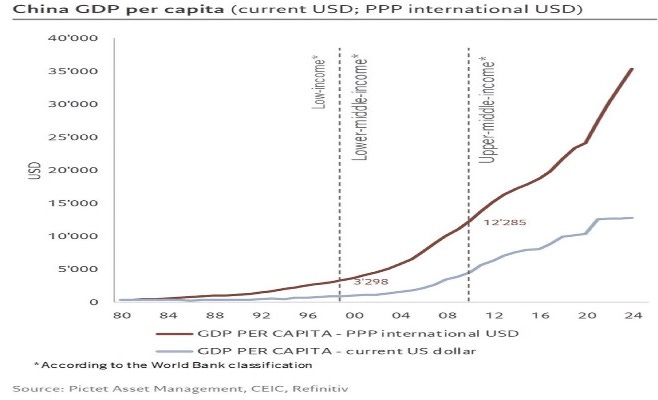

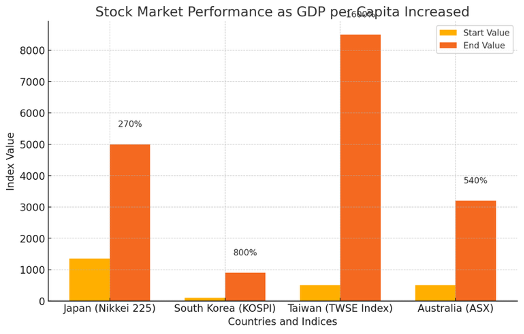

This is exactly what we have observed in other Asia-Pacific success stories. The initial run up was driven largely by a coherent industrial policy, enabled by a successful land reform (except Australia where it was a mining and population growth story). Nevertheless, it is after achieving the US$12,500 of per capita GDP level that domestic consumers tend to become driver of the economy. The markets tend to follow.

Those numbers are quite impressive. Japan achieved the GDP per capita of $12,500 in the early 1960s and $25,000 by the mid-70s. The Nikkei 225 was up approximately 270% during this period. South Korea did so between early 80s and mid 90s with KOSPI being up over 800% for the corresponding period. Taiwan was even more spectacular – it achieved the GDP levels at a similar timeframe to Korea but in that time TWSE Index was up close to 1,600%. Even Australia followed a similar path. The All-Ordinaries Index was up approximately 540% from late 1970s to early 2000s, when they achieved the above-mentioned GDP levels. This is exactly the path that we envisage for China and its equities. Interestingly, Japan was the most expensive market at the point where it embarked on this transformation at around 20x TTM P/E while the others averaged 10 with Korea being the lowest at 4.

We view the Long-Range Objectives Through the Year 2035 stated plan of doubling the GDP per capita as a signal to achieve what is being described in this paper. But that plan does not put forth details on how to get there. We believe it’s time to reverse flow of support away from the industry and local governments and towards the household sector. By removing stress factors, the government will have encouraged greater individual spending, and broader based consumption will put China well on the way to doubling GDP per capita by 2035, and possibly sooner.

This will also have positive spillover effects to foreign policy. Clearly being beholden to overseas sources of demand for goods has highlighted the value of demand as an equal market force to supply. Higher share of domestic consumption makes foreign sanctions less relevant. And a stronger import economy makes trading partners keener to minimize trade friction with China.

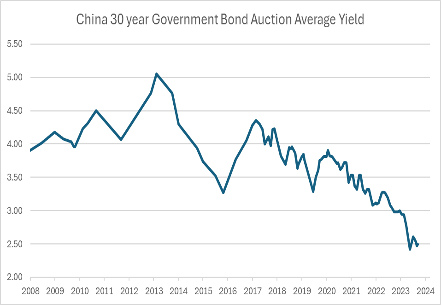

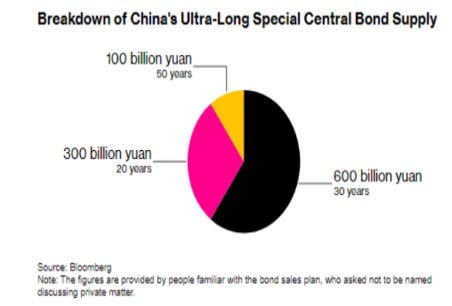

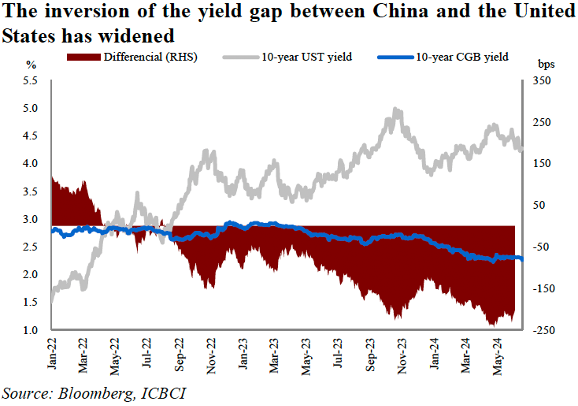

Paying for these policies should not be difficult. China has already embarked on a policy of long-term bond issuance. Over RMB 1Trn in 22 batches of 20, 30, and 50-year notes will have been issued in 2024. What’s more, the issuances are oversubscribed and perform well in the aftermarket.

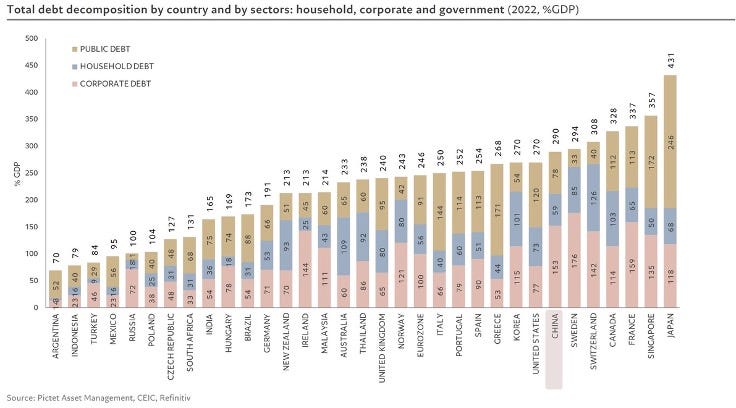

This is a strong a signal as one can find that the government is encouraged to borrow very long to sort out the immediate issues, especially given how Chinese debt to GDP will stand at 61.3% at the end of 2024 according to Fitch, and this is taking in account the current pace of bond issuance, which of course compares favorably to the OECD average of 83% and countries like the UK ore the US at over 100% or Japan at 250%.

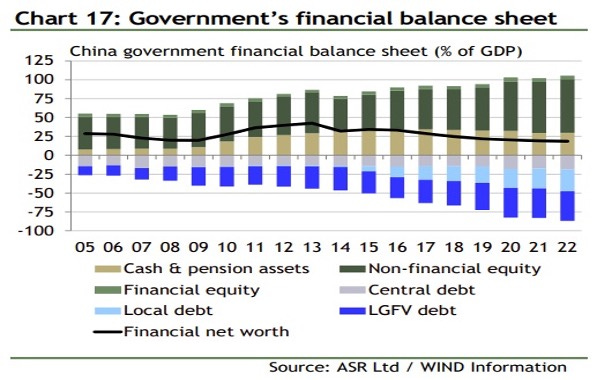

Clearly Chinese corporates and local governments are in a slightly sticker situation debt-wise. However, the Central government’s overall net worth is still above the level required to cover all those debts, giving them the opportunity to clear up those balance sheets and centralize the loans and cashflows. If the central government chooses to do so, they would end up with better control over policy implementation within the provinces themselves.

It is thus not surprising that the yield gap between US and China government bonds has flipped negative in May of 2022 and has expanded since, suggesting that there’s capacity for China to follow in the footsteps of the G7 nations and borrow more to address current needs.

In order to stimulate domestic consumption beyond that, in our well-publicized opinion, the most important building block is the Hukou reform. The ball is already rolling: many tier 3 and 4 cities have basically removed hukou requirements for its residents, most notably Shenyang, the London-sized capital of Liaoning province, being the highest profile example to date. We believe a genuine policy acknowledgement from the plenum will expedite this process and provide consumers with confidence.

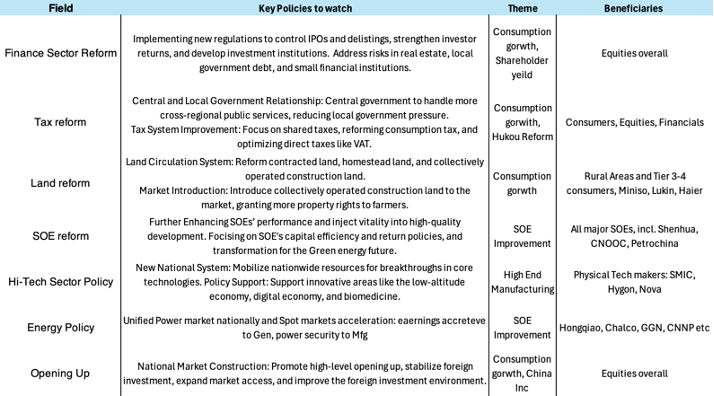

The Outlook: Policy Proposal Analysis and a better A-share Market in the long run

Following the logic of the proposals discussed above we have a thematic approach to picking stocks that will benefit in 2024 and beyond. Broadly, we are optimistic that the current shift in policy will benefit all equities, and we will see the P/E for the market trade up to above-average driven by the better-than average cash generation and distribution, market infrastructure and greater stability. We also anticipate earnings expansion as the stimulus measures help and Real Estate stops being a drag on the economy. More specifically we see 5 major structural bullish themes in Chinese equities:

- Domestic consumption growth. Domestic players, especially ones seen offering value over flashiness should benefit as first consumption RMB are likely to be quite price sensitive. This will pivot to broader consumption eventually, but we see companies like MiniSo and Luckin Coffee benefiting first before higher-end higher price bracket competitors do.

- High-end manufacturing. The proactive industrial policy and localization of technology will have beneficiaries, especially coupled with robust domestic demand. US sanctions may hamper initial progress, but China will catch up eventually and, in the process build out a robust domestic semiconductor industry. This will in turn bolster the high-tech manufacturing companies, like the EV makers than can rely on and incorporate the products of that industry. We’re considering companies like Hygon, SMIC, TSMC and EV makers to be prime examples.

- State-owned enterprises undergoing improvement. The 20th CPC has been very clear on making SOEs more efficient, and they have introduced targets for ROE as well as encouraging higher dividend payouts. Already this year the SOE-heavy HSCEI is outperforming the rest of the indices by 600bps, we anticipate this to continue, with high yielding oil and gas and coal names leading the way.

- Shareholder yield. Building on the SOE improvements in efficiency, disclosures and shareholder focus, some private enterprises are in an even better position to capitalize on the trends. More aggressive buybacks, whether opportunistic like PAX global or policy-driven like Alibaba or Tencent put a bid in the market, whereas aggressive dividend policy like the Energy companies, coal miners or even DoYu – private companies can follow in the footsteps in SOEs and benefit from the market looking for quality improvement and higher yield.

- Resource Names. The stimulus and reform we believe will arrest the decline in residential construction, which should stop being an anvil around the industrial metals. At the same time Chinese miners have accumulated some of the best assets around the world, especially in copper. Given the SOE improvement overall, these are the most interesting subset with Zijin and MMG as standout candidates, as well as Chalco.

What also adds to our overall bullishness is that there’s a renewed focus by the government on the financial markets, and their stability and quality. China's State Council has issued a new guideline aimed at enhancing the regulation and quality of the nation's capital markets. This is the third such document in two decades, following those released in 2004 and 2014. The guideline outlines a vision for a secure, transparent, and resilient capital market that supports high-quality development and serves the broader goal of Chinese modernization. In other words, a capital market fit for use by the world-class companies that China continues to develop – so that they don’t have to list in the US to raise capital. Interestingly the two prior “9 Measure” market evolutions have seen significant market appreciation within a year from the introduction.

This is important as the China market has the liquidity but lacks structure. 2023 has been a bad year for Chinese equities, yet despite that, the A-share average Daily Value traded has stayed above USD0.8trn with peak turnover days reaching over 1.3trn average daily value traded. China’s issue is not liquidity, its term. Most investors do not put money to work in the equity markets and when they do, it tends to be in the momentum-focused strategies, and the holding periods tend to be short (measured in weeks). Creating an industry of long-term capital collection and allocation, with the Super funds in Australia or 401(k) funds in the US as examples we believe will be the cherry on the cake for the Chinese equity markets to continue their evolution to a world-class centres of capital allocation.

Finally, we understand that this paper goes into the theoretical aspect of policy modification in China, and we also understand the need to answer the most obvious question – when? When will all these changes take place? As we have noted above, many policies have already been approved and are being rolled out such as the hukou -related policies and some of the real estate measures. But there is always possibility for more, and what’s more we need to monitor, and as such we are offering a quick checklist for the progress that we may have.

We are eagerly anticipating the developments on these fronts and are monitoring the progress on all avenues outlined. We are happy to host calls to discuss investment ideas discussed here and go through our thought process in more detail.

Great insight for investors focusing on China!

Nice first post!