“If you like Panda Perspectives, you’ll love a Panda Portfolio…” Panda Marketing Manager (if we had one).

I have always been somewhat sceptical of giving advice to people without understanding their situation. And indeed I continue to believe that. There isn’t 1 size fits all in investing, to some volatility is death, to others its opportunity. To some underperformance is a price they are happy to pay to avoid drawdowns, some others will ride a stock like NVDA both up and down and be happy about it. There are also more practical limitations on what people can and cant buy, what the brokers will let them do and what instruments they would be allowed to buy. So when being asked a very simple question - what should I buy in China I struggle. There are plenty of great companies, and if anything, im guilting of getting carried away and espousing their virtues, as opposed to focusing of actually picking the stocks.

Believe me when I say that this comes for the fact that Panda Perspectives is a passion project. I love talking about Chines stocks, and I do enough picking in my Day Job. We Run both long only and long/short strategies at PACAT, so I am all to aware of benchmark pressures, relative performance stress so having a space to just focus on talking about companies, industries their fundamentals and an bit of Macro thrown in here and there is a welcome reprieve.

Nevertheless the questions keep coming. What should I buy? what should I hold? why? And I get it, Asia’s been off the map for over 10 years, there’s not that much competent advice available (though of course there is some!) So I was thinking, what is the best way of actually helping people. I came to a conclusion - there is an easy fix that probably addresses 50% of issues - create a public portfolio using the “Best Ideas” approach. Basically focus on things I like and relative size in the portfolio then also suggest ranking. And there is a proper fix - sit down with people, go over their Asia/China Exposure and help them do better with it.

So I am happy to announce that i’ve done part one, form today, the Panda Portfolio is live! Paid subscribers will receive a separate note detailing the portfolio, its construction and thinking behind it, shortly after this one. But I did want to explain my thinking publicly so as to explain what we’re trying to do here.

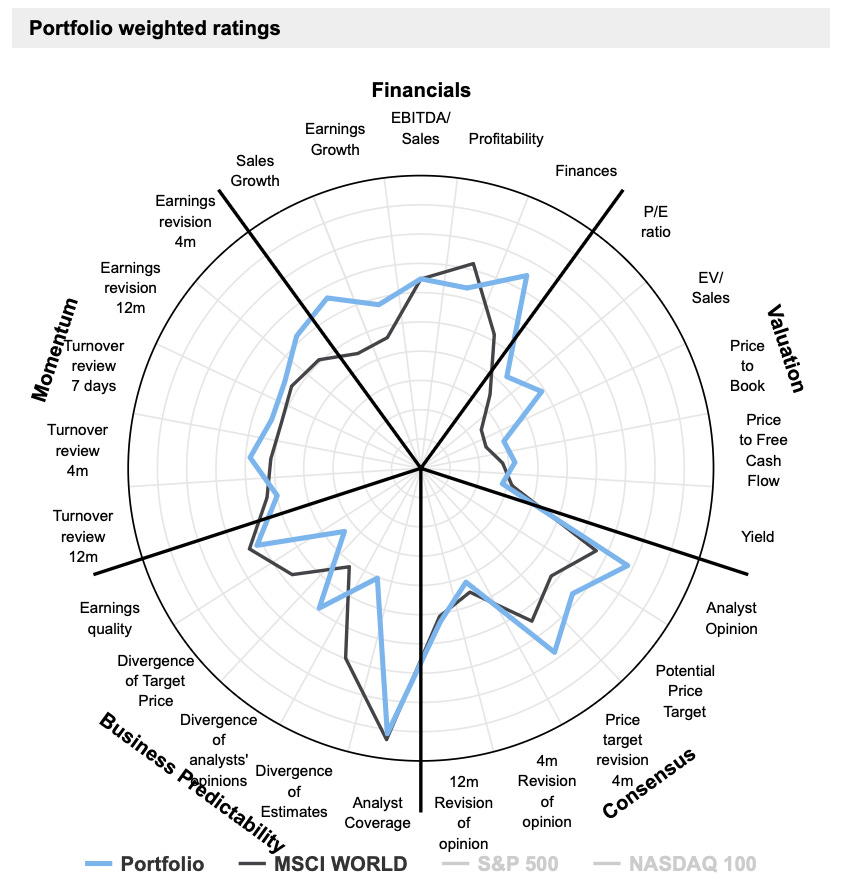

Overall, the Panda Portfolio is different, in terms of stronger earnings growth, more reasonable valuations, and better momentum than the World portfolio. The current death of optimism for China allows us to create a portfolio that is high quality of earrings, decent growth, at cheap(-er) valuations. It’s not always possible to guarantee that that will be the case, but this is the opportunity in front of us at the moment. I belive in trying to got capture that opportunity is a responsible way, that is in a way that will let people sleep well at night.

If you are interested in something like this, now’s the time to act - subscribe to get the updates on the portfolio, available to all paid subscribers!

But wait, there’s more!

I am fully cognisant of the limitations of this approach though. ITs a “Best Ideas” portfolio, and while it’s pretty diversified, it isnt focused on diversification. It doesnt have fixed income, it is currently China-only. But again, the idea is to pursue opportunities where they are.

I would like to formally state that this is not the portfolio that we run at PACAT, as we are limited by benchmarks and risk preferences, as well as there being more cooks in the kitchen. Cannot emphasise this enough - this is just a selection of my best ideas, that happens to exhibit decent portfolio characteristics, not entirely by accident.

Then there’s the fact that while it helps people, it isn’t personalised. If it is personalised portfolio review/creation you’re after that is also something I am happy to do. Clearly this won’t be free (or included) as it takes time to prepare for a review in order to do it well, so for the people interested, get in touch and we can try to work something out.

I am very exited for this, and the new schedule includes a weekly Portfolio Review post alongside the Weekly Wrap every weekend. I hope this will be as well received as the research posts have been.