Macro Minute: Two Sessions Preview

National Peoples Congress and National Committee of the Chinese People's Political Consultative Conference: the two plenary sessions rolled in to 1

Good Evening,

We are finally here! The 2 sessions week is upon us. The NPC and CPPCC are both happening this week, and we firmly believe this will be an important stepping stone for the development of our thesis that Chinese domestic demand growth will be the most important economic development, and will for the most part, be more impactful than all the tariff talks coming out of Washington.

This our preview of what to focus on and what to expect from this week. It’s a generally available publication coming out in the “Macro Minute” section of the Substack. We hope you find it useful!

Over the course of the week we will continue with our China Internet review and we will publish on JD and PDD. We will of course release a review of the 2 sessions after the fact, most likely as a section in the Portfolio Review product, as we’ll focus on the market impact, and as such it will be paywalled. Do join in if you are interested in those.

For now though, do enjoy the report!

The annual “Two Sessions” of China’s political calendar—the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC)—offer a unique window into the evolution and inner workings of China’s state and party apparatus. Emerging from the revolutionary era and the early years of the People’s Republic, these institutions now embody the dual nature of China’s political system: a formal legislative authority in the NPC and an expansive consultative platform in the CPPCC. This research explores their historical trajectory, evolving roles, and interrelated functions within the framework of “socialist consultative democracy.”

Established in the early years of the PRC and institutionalized with the 1954 constitution, the NPC serves as the highest organ of state power, charged with enacting laws, amending the constitution, and ratifying major state policies. In contrast, the CPPCC traces its roots to the united front strategies of revolutionary China and functions as a broad-based advisory body. It gathers insights from non-Communist political entities, intellectuals, and social organizations, symbolizing a consultative process that integrates diverse perspectives even within a one-party dominant framework.

The synchronized convening of the NPC and CPPCC is not merely an administrative decision; it is a deliberate mechanism for policy signaling and political coordination. By holding these meetings concurrently, the government underscores that its policy formulation is both top-down and inclusive. This unified platform enhances the credibility of key policy announcements—such as the reaffirmation of the 5% GDP growth target and various fiscal and monetary measures—by demonstrating that decisions are made through a deliberate process that blends authoritative directives with broad-based advisory input.

The consultative role of the CPPCC is crucial. Although it lacks formal legislative power, its recommendations allow a multitude of voices to be heard, enabling the leadership to adjust policies dynamically based on real-time feedback. This process not only softens the inherently top-down decision-making model but also fosters collective ownership over national priorities, thereby reducing public dissent and promoting social harmony. In a system where competitive elections are limited, the Two Sessions serve as a vital institutional practice that reinforces legitimacy and resilience by visibly integrating consultative feedback with decisive policymaking.

Economic Growth and Stability

Growth Target and Provincial Outlook

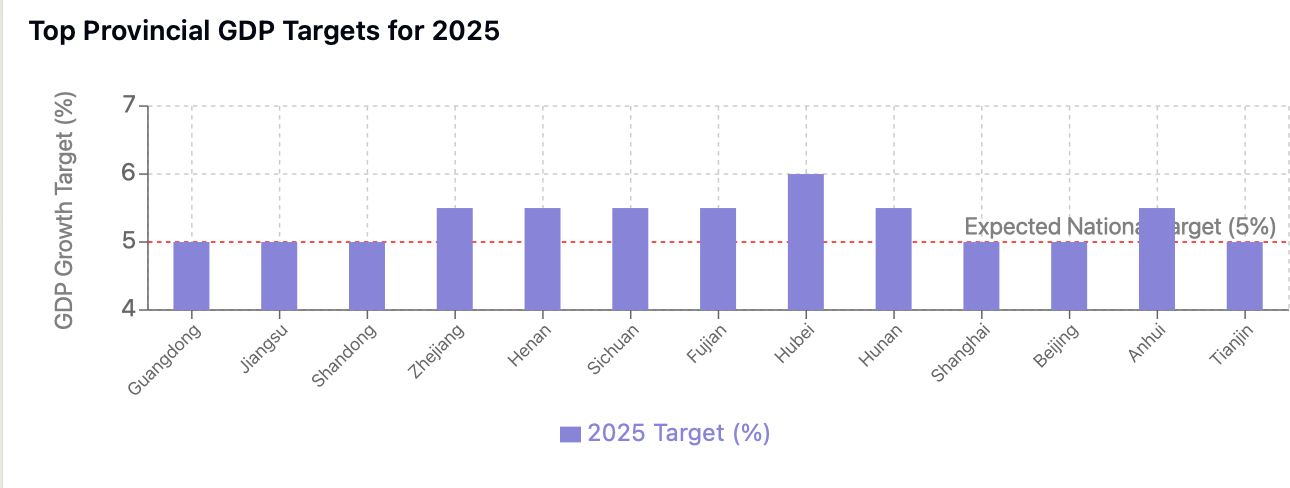

A central pillar of the Two Sessions agenda is the expectation that China’s GDP target will remain around 5% for 2025. This figure is supported by the Top Provincial GDP Targets for 2025 chart, which shows most provinces aiming for targets near or slightly above 5%. The weighted average of these provincial goals—around 5.26%—highlights the government’s collective commitment to maintaining steady growth despite trade tensions, global supply chain disruptions, and slowing investment in certain traditional sectors.

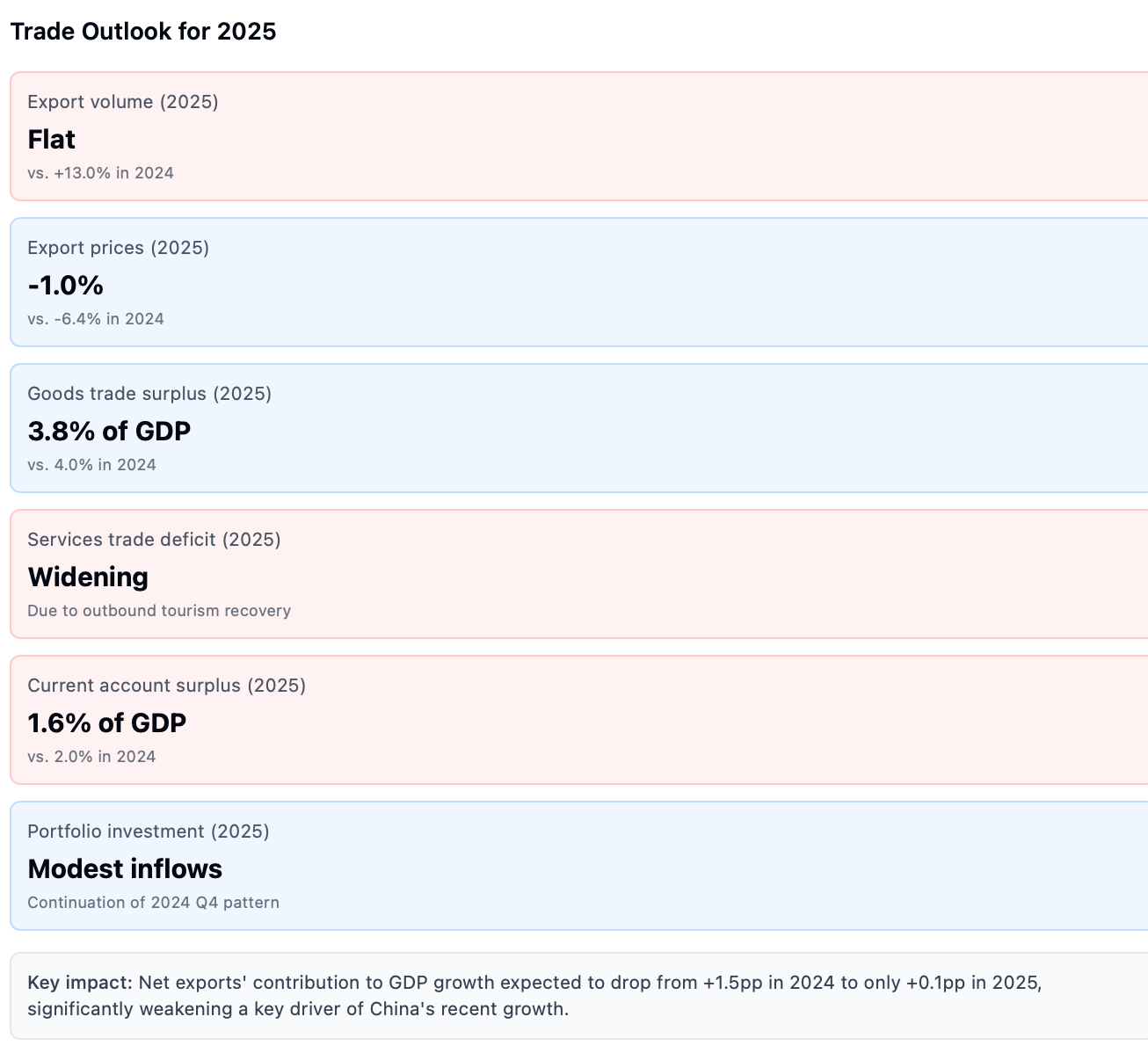

Recent data also indicate that the gap between projected growth rates and actual performance is narrowing. In 2023/2024, this difference was only about 0.41 percentage points, suggesting improved alignment between policy expectations and economic outcomes. As shown in the Trade Outlook for 2025 visualization, net exports’ contribution to GDP growth is expected to decline from +1.5 percentage points in 2024 to roughly +0.1 percentage points in 2025, underscoring the increasing importance of domestic demand in driving overall economic performance.

Balancing Short-Term and Long-Term Goals

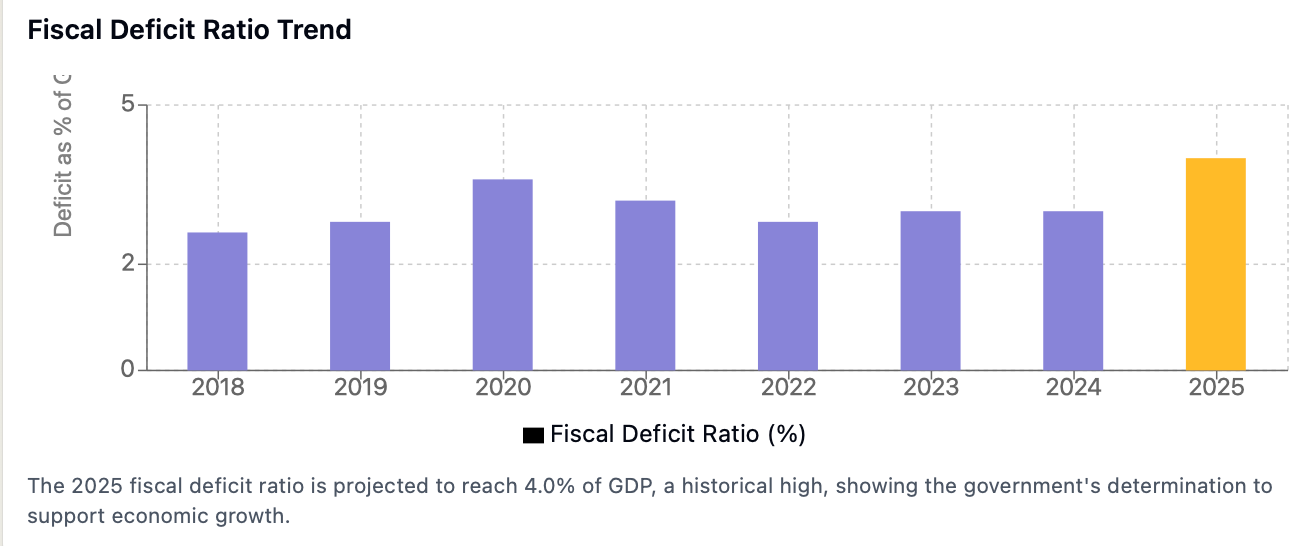

Policymakers are deploying a range of fiscal and monetary tools to manage current uncertainties. For instance, the Fiscal Deficit Ratio Trend chart projects the deficit to reach 4.0% of GDP, a historical high that reflects the government’s intention to provide sufficient economic support. Simultaneously, a series of structural reforms aims to transition the economy toward domestic consumption and innovation-driven sectors, thus reducing reliance on external demand.

Domestic Demand and Consumption

Shift to Domestic Consumption

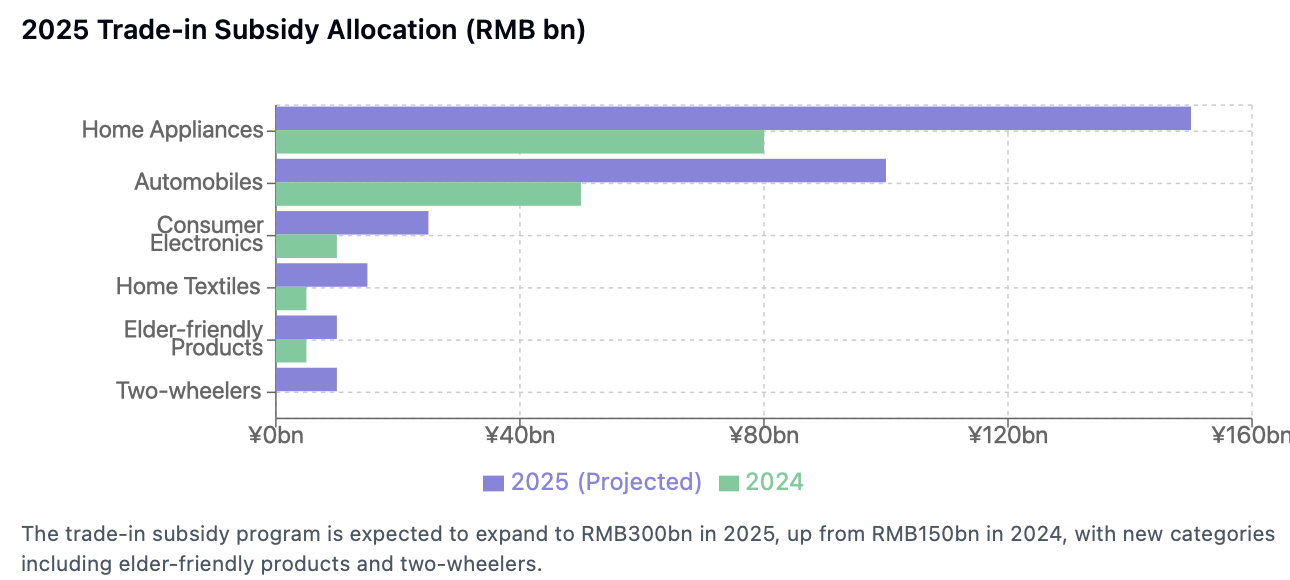

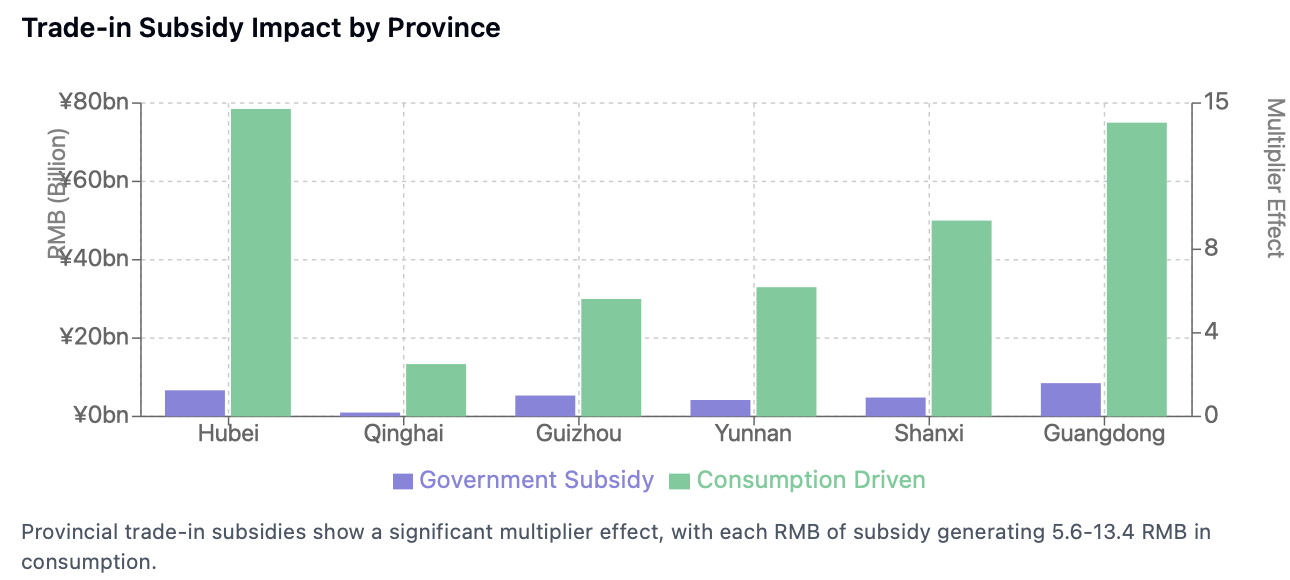

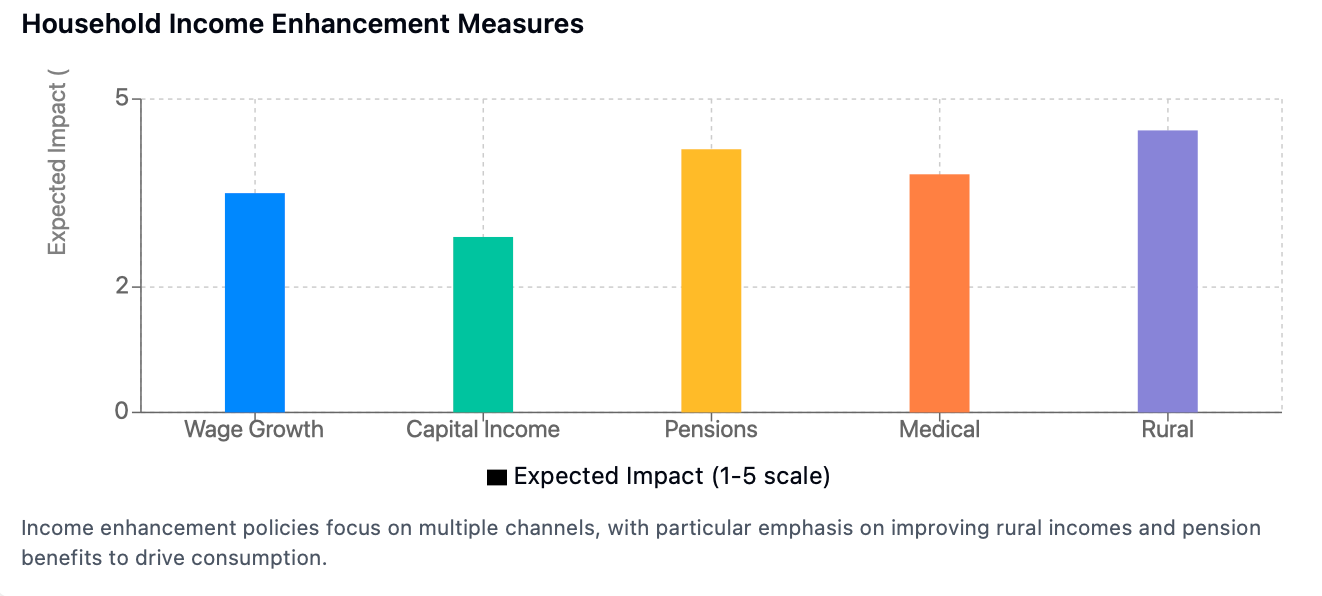

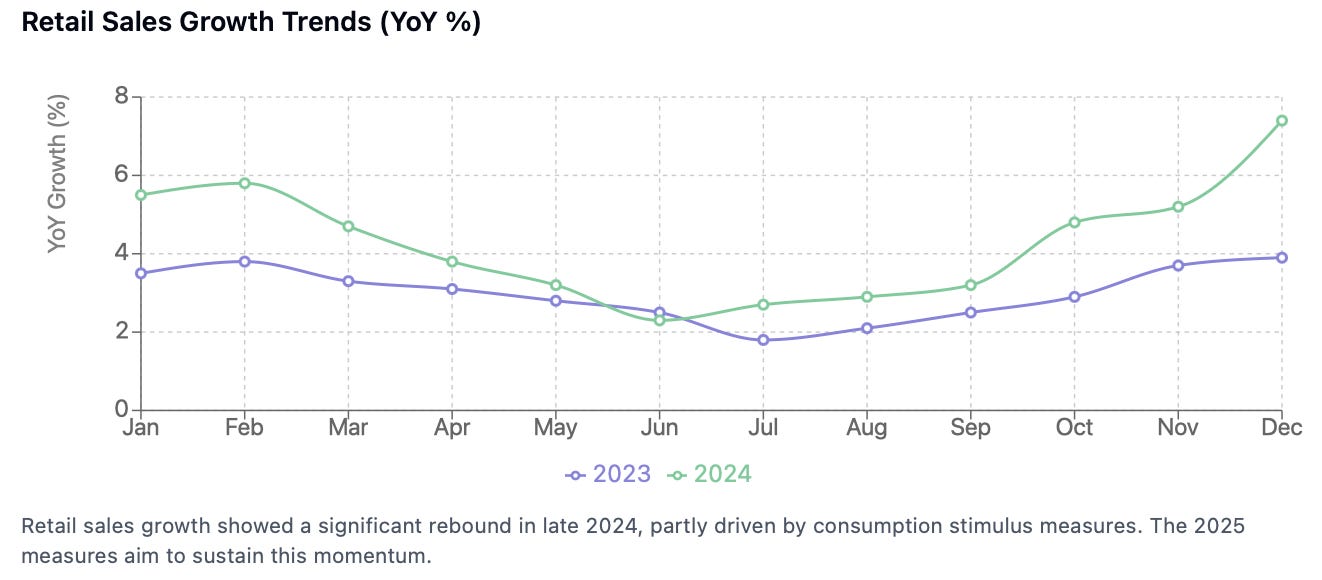

China’s transition from an export-led model to one driven by domestic demand is evident in both policy statements and recent data. According to the Trade-in Subsidy Impact by Province chart, trade-in subsidies have a significant multiplier effect on consumption, with each RMB of subsidy generating between 5.6 and 13.4 RMB in spending. This approach is part of a broader plan to boost household consumption, reflected in a rise in retail sales of about 3.7% year-over-year in December and an approximate 5.6% annual increase in per capita disposable income.

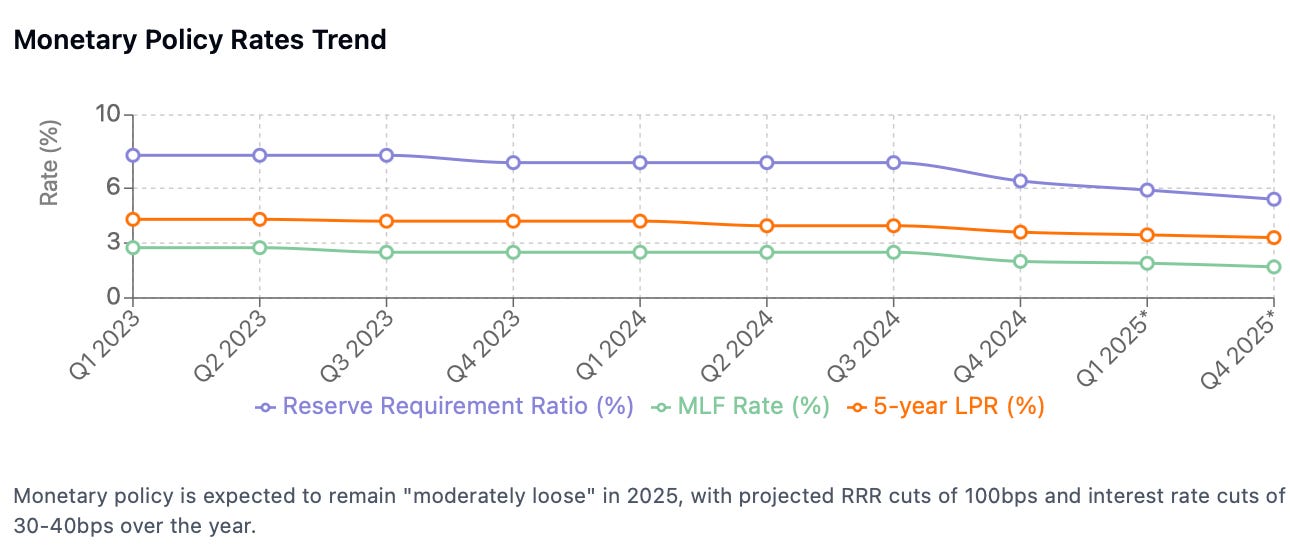

Long-Term Investment in Capital Markets

To further stimulate domestic demand, policymakers are encouraging long-term investments in A-shares and other financial instruments. Public funds are directed to increase their holdings in domestic equities by at least 10% annually, while state-owned insurers must allocate up to 30% of new premium inflows to domestic equities. As the Monetary Policy Rates Trend chart suggests, the central bank’s “moderately loose” stance, featuring projected rate cuts of 30–40 basis points, also supports these long-term investment strategies by keeping borrowing costs manageable.

Fiscal Policy and Government Spending

Increased Fiscal Stimulus

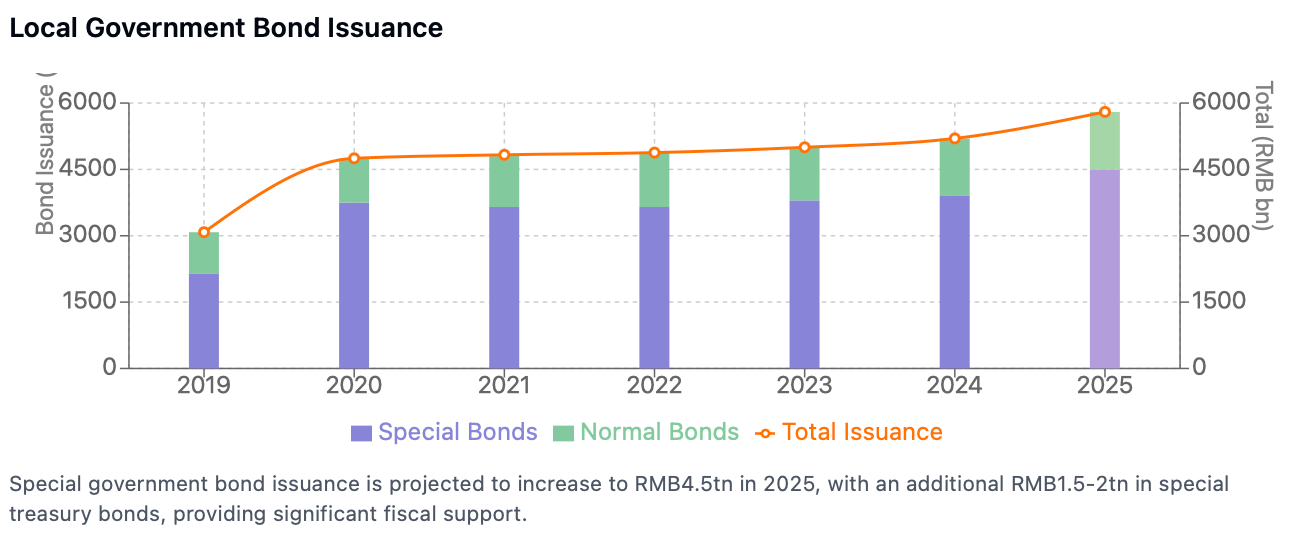

Fiscal policy remains a cornerstone of China’s strategy to stabilize the economy and lay the foundation for future growth. The Local Government Bond Issuance chart shows a projected increase to RMB4.5 trillion in 2025, with an additional RMB1.5–2 trillion in special treasury bonds. These funds are earmarked for major national projects, consumer subsidies, and other measures to stimulate aggregate demand. The Fiscal Deficit Ratio Trend visualization reinforces this expansionary approach, with the deficit expected to rise from around 3.0% to 4.0% of GDP.

Focus on Infrastructure and Public Projects

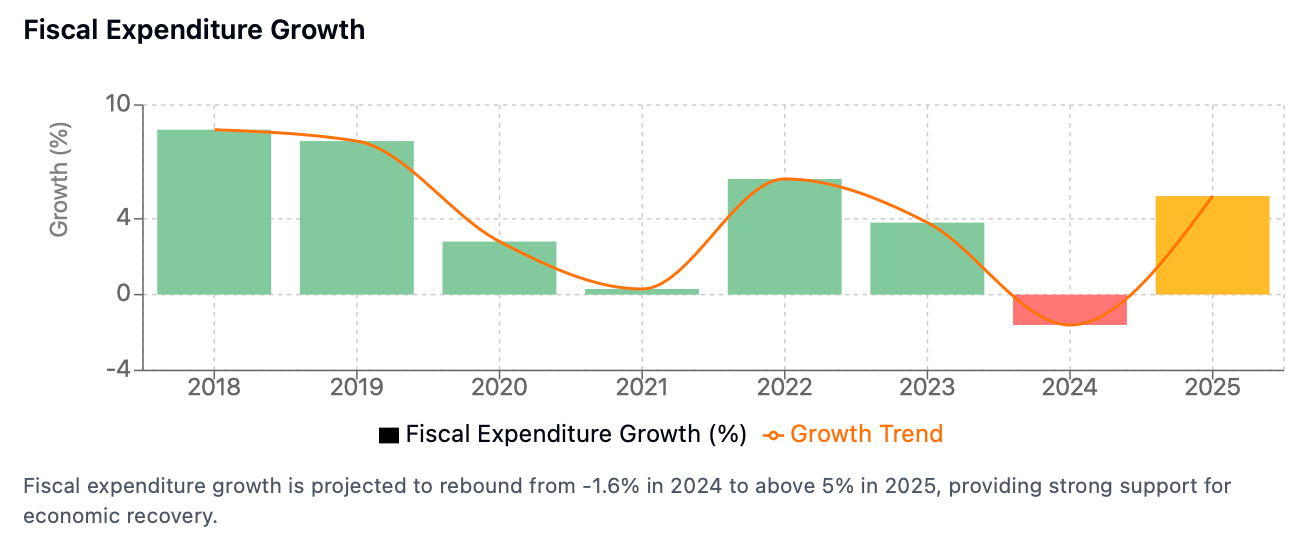

Infrastructure spending and public works are key targets of this increased fiscal capacity. Projections suggest that Fiscal Expenditure Growth will rebound from -1.6% in 2024 to over 5% in 2025, channeling resources into transportation, energy, digital infrastructure, and social welfare projects. This not only provides immediate economic relief but also strengthens the structural underpinnings of China’s long-term development.

Monetary Policy Adjustments

Moderately Loose Monetary Policy

Monetary policy serves as a critical lever to support growth. As illustrated by the Monetary Policy Rates Trend chart, the central bank is expected to cut interest rates by 30–40 basis points and reduce the reserve requirement ratio (RRR) by up to 100 basis points in 2025. These measures aim to maintain ample liquidity, bolster credit expansion, and keep borrowing costs in check.

Balancing Growth and Stability

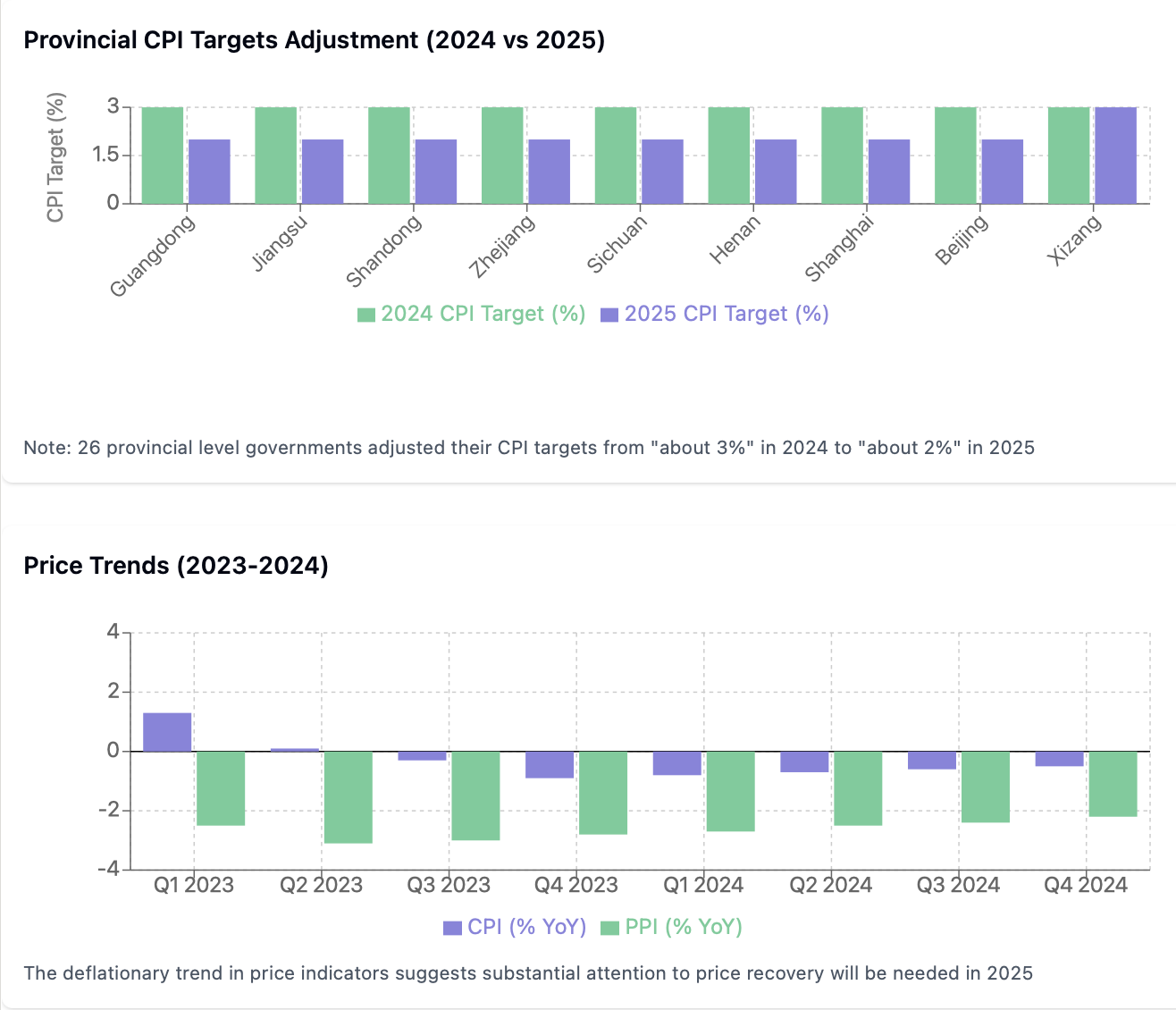

Despite easing efforts, the central bank remains cautious about triggering inflation or asset bubbles. The Provincial CPI Targets Adjustment (2024 vs 2025) chart shows that many provinces have adjusted their CPI targets from about 3% to around 2%, signaling heightened vigilance over price stability. Meanwhile, price trends (as seen in the Price Trends (2023–2024) graphic) suggest deflationary pressures in certain segments, reinforcing the need for a measured approach to monetary stimulus.

Trade and Global Supply Chain Dynamics

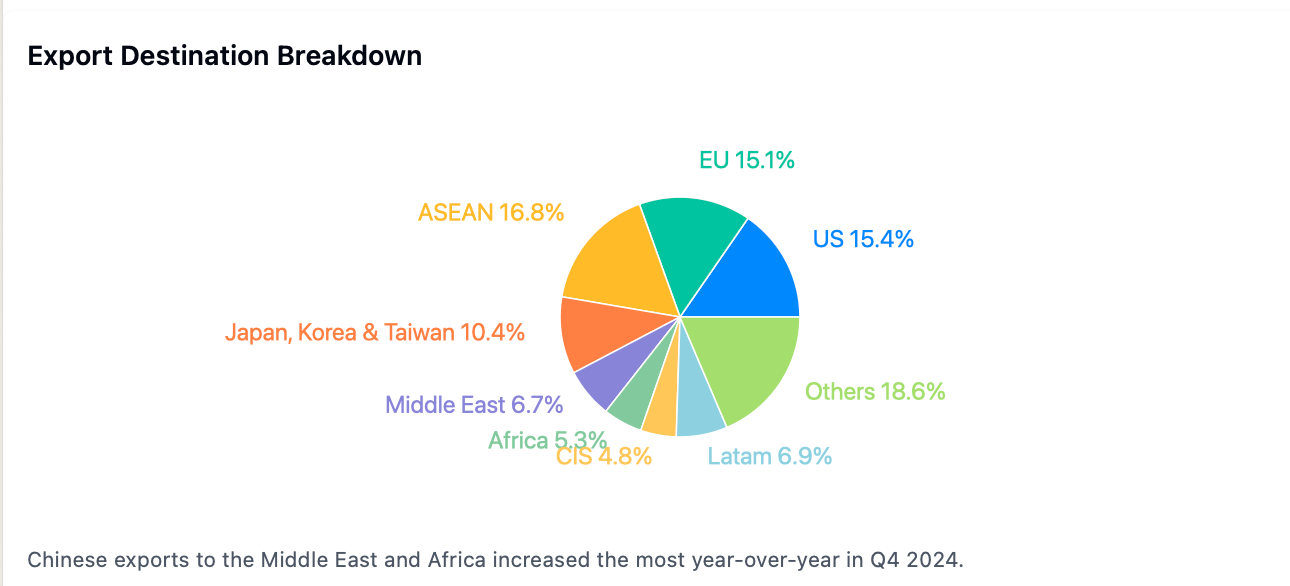

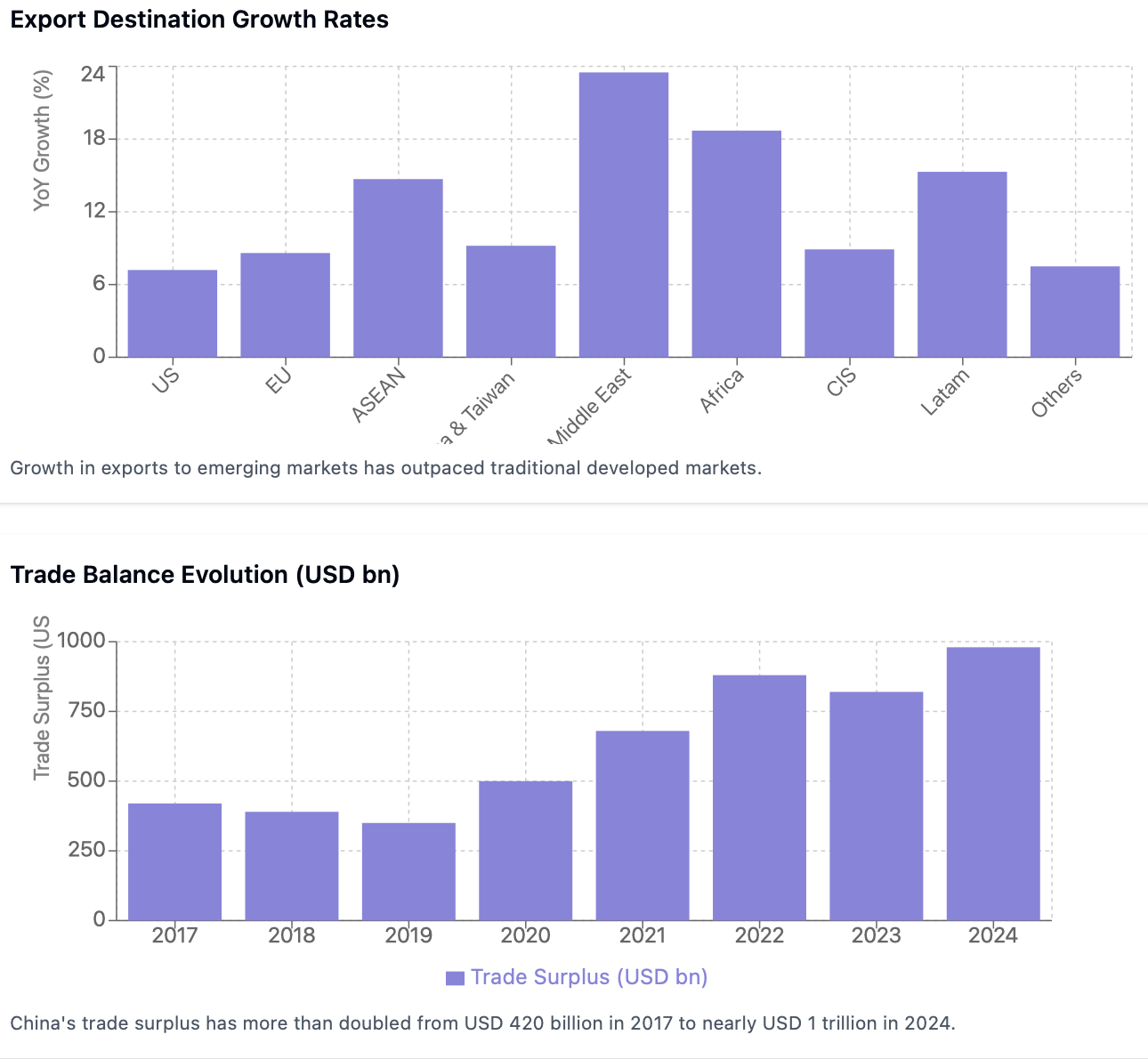

Chinese trade dynamics continue to perform robustly despite external trade tensions and shifting global market conditions. In recent quarters, real export growth has reached as high as 14.3% year-over-year, with nominal export growth around 9.5% annually. This resilience spans multiple product categories—especially transportation equipment, stone, glass, and metals—and is accompanied by a notable shift toward emerging markets. For example, exports to regions such as the Middle East and Africa have experienced the highest year-over-year increases, reflecting a strategic reorientation away from traditional developed markets.

Over the past seven years, the annual average growth rate for China’s nominal exports has been approximately 6.7%, compared to 5.1% for imports. This differential has led to a trade surplus that more than doubled from about USD 420 billion in 2017 to nearly USD 1 trillion in 2024. Concurrently, the share of emerging markets in China’s total exports has risen from 46% to about 55%. These structural shifts are reshaping global supply chain configurations, as China diversifies its export portfolio to include a broader range of products—from high-tech components to consumer electronics—to meet the demands of fast-growing emerging economies.

Credit Expansion and Financial Market Activity

Robust credit expansion is a key indicator of China’s vibrant domestic economy. Recent data shows that bank loans expanded by over RMB5.1 trillion in January, with total social financing growing by roughly RMB7.1 trillion over the same period. This rapid credit growth has significantly increased liquidity, fueling investments and consumption across sectors. However, the pace of credit expansion also raises concerns about financial stability, as it may lead to asset bubbles and heightened risk exposure in the banking system.

To address these challenges, policymakers are pursuing structural reforms in the capital markets. Recent measures include extending the performance evaluation cycles for institutional investors and mandating that public funds incrementally increase their holdings in domestic equities by at least 10% annually. In addition, state-owned insurers are being directed to allocate a substantial portion of new premium inflows to long-term equity investments. These reforms have contributed to institutional investors now representing nearly 45% of the market’s capitalization—a significant improvement that supports long-term market stability while mitigating the risks associated with rapid credit expansion.

Global Geopolitical Uncertainties

Global geopolitical uncertainties continue to influence China’s economic strategy, particularly in the area of trade. Ongoing external trade tensions—exemplified by periodic US tariff hikes, broader trends in trade protectionism, and various geopolitical realignments—create an unpredictable external environment that forces policymakers to remain agile. While overall export volumes have remained robust, nominal values have been affected by tariff-induced price adjustments, resulting in shifts in trade balances.

These external pressures are also reshaping regional dynamics, as global trade policies ripple through supply chain configurations and influence the strategic decisions of major economies. The increasing share of emerging markets in China’s total exports—from 46% in 2017 to over 55% in 2024—illustrates a broader global realignment driven by geopolitical factors. In response, China has prioritized measures that bolster domestic resilience, including an enhanced focus on boosting domestic consumption and accelerating structural reforms. This dual approach aims to sustain export resilience while reducing vulnerability to external shocks, ensuring a robust economic strategy amid a continuously evolving international environment.

Expectations and Surprises from the Two Sessions

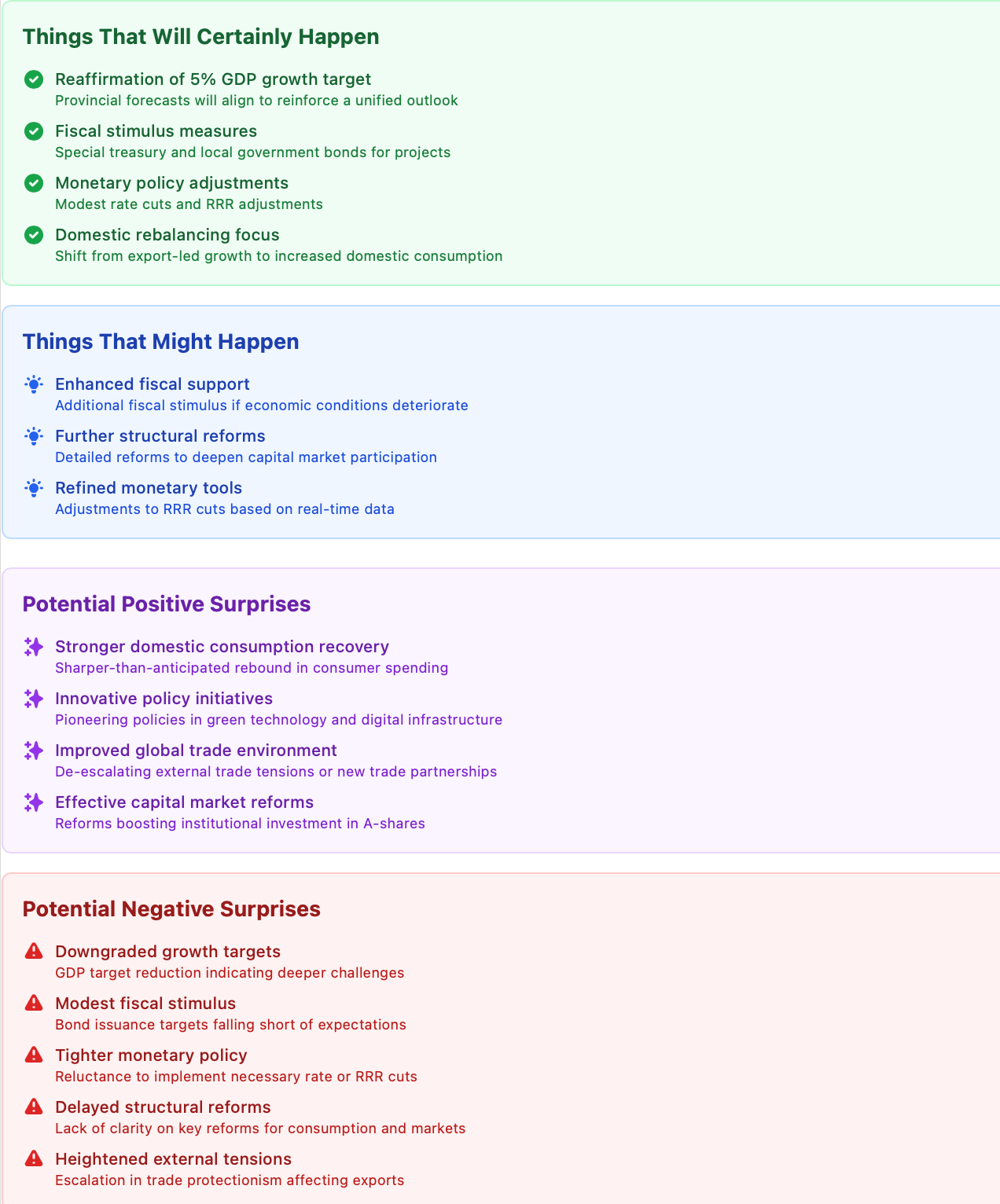

Things That Will Certainly Happen

Reaffirmation of Key Economic Targets: The government will restate its commitment to a 5% GDP growth target, with provincial forecasts aligning closely to reinforce a unified outlook.

Fiscal Stimulus Measures: Expanded fiscal spending through higher issuance of special treasury and local government bonds, with clear directives for funding major infrastructure projects, public works, and consumer subsidies.

Monetary Policy Adjustments: Modest rate cuts (around 30–40 basis points) and adjustments to RRR, accompanied by forward guidance to maintain a supportive yet balanced monetary environment.

Domestic Rebalancing Focus: Announcements promoting a shift from export-led growth to increased domestic consumption, alongside measures supporting long-term capital market reforms.

Things That Might Happen

Enhanced Fiscal Support: Additional fiscal stimulus or more aggressive bond issuance if short-term economic conditions deteriorate further; potential regional or sector-specific spending adjustments.

Further Structural Reforms: Unveiling of detailed reforms to deepen capital market participation and encourage long-term investments, as well as policies to further rebalance trade toward emerging markets.

Refined Monetary Tools: Adjustments to the pace or scale of RRR cuts in response to real-time credit and inflation data, with temporary easing measures in underperforming credit sectors.

Potential Positive Surprises

Stronger Domestic Consumption Recovery: A sharper-than-anticipated rebound in consumer spending, driven by fiscal measures and improved household confidence.

Innovative Policy Initiatives: Introduction of pioneering policies in green technology, digital infrastructure, or high-tech manufacturing that drive long-term growth.

Improved Global Trade Environment: Signs of de-escalating external trade tensions or new trade partnerships that further bolster export performance and stabilise global supply chains.

Effective Capital Market Reforms: Reforms that significantly boost long-term institutional investment in A-shares, enhancing market stability and investor confidence.

Negative Surprises

Downgraded Growth Targets: A significant reduction in the GDP growth target, indicating deeper structural or external challenges.

Modest Fiscal Stimulus: Fiscal measures or bond issuance targets falling short, suggesting constrained policy capacity to address economic headwinds.

Tighter Monetary Policy: Indications of restricted credit conditions or reluctance to implement necessary rate or RRR cuts, potentially stifling growth.

Delayed Structural Reforms: Lack of clarity or delays in key reforms, particularly those aimed at deepening capital market participation and boosting domestic consumption.

Heightened External Tensions: Unexpected escalation in trade protectionism or failure to pivot effectively toward emerging markets, leading to weaker export performance and disrupted supply chains.