It’s a Saturday after the Ching Ming Festival, yet we’re still at it.

We’re adopting a more grown up approach to the headlines on account of adding a paid option for this column. Not that it’ll change much, but I am very flattered by all the comments and commitments. Appreciate every one of those.

On to the update. Ministry of Finance top brass spoke at a press briefing, and outlined the extent of the Fiscal policy support they can offer *within the confines of the current budget*. However, while the steps laid out suggest a cautious and structured approach, notable gaps in specific figures leave room for market speculation. As a prolific commenter on Michael Fritzels excellent

, TridentD5 likened it to a process of wooing a bride but doing so in a work-to-rule kinda way:Q: Are you going to propose?

A: I love you.

Q: How much bride-dowry do you have in mind?

A: there is room to do more.

Q: Are you going to come and meet my parents?

A: I am going through the approval process, one step at a time.

And here’s the thing, we’re not really in a position to decisively claim that the gentleman in question will or won’t propose. To be clear, verbally he’s committed, and to me at the very least it is inconceivable that he backs out. But as usual we need to see the ring, and it has to go on the finger.

So in terms of where we are in the process, we have established that the trip to Chow Tai Fook is in fact warranted, but we’re trying to figure out if we can maybe rustle up enough petty cash to maybe figure something out.

So what was actually said?

1. Local Government Debt Management

China is set to enhance its strategy for managing local government debt, which remains a critical issue. The central government will issue large-scale debt swaps, a move aimed at addressing the opaque “hidden debt” local authorities have accumulated off the books. Local governments still hold 2.3 trillion yuan in available funds, providing some breathing room to manage obligations in the final quarter of 2024. These steps aim to steady the debt situation, though the path forward will undoubtedly be closely watched.

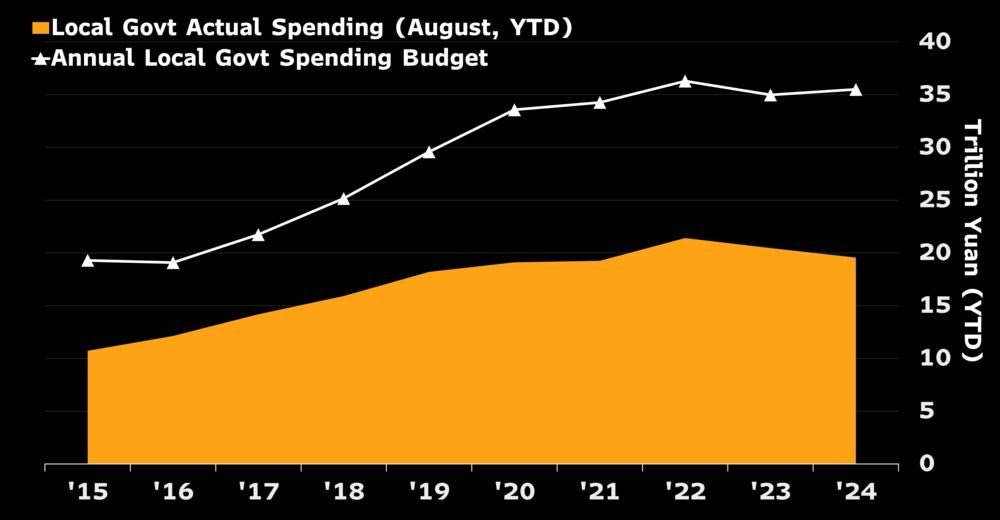

This was by far the most important part of the announcement. Look at this chart - the push on Local finances is real, and you can see what the pre-22 trend was an how far behind we are now. This is where *CURRENT* budgetary capacity is at its fullest. There is commentary out there to say that this is not new spending, I would counter with that yes, its not new per se, but its spending that would go in to this gap (authorised/unspent) but won’t anymore. So this is stimulative.

2. Fiscal Outlook and Central Government Flexibility

In a somewhat measured tone, officials reiterated that there is “significant” capacity for the central government to raise debt and widen the fiscal deficit if necessary. This hints at future flexibility, though details on specific numbers were conspicuously absent. The reality of lower-than-expected fiscal revenue adds pressure, yet the government remains committed to hitting its budget targets for 2024.

This to me means that the ball is in the NPC SC’s court. Future Flexibly is the name of the game, and the organ that can and should formulate number will be the NPC.

3. Property Market Intervention

With property markets showing persistent weakness, local governments now have the authority to deploy funds from special bonds to purchase unsold homes. These homes will be converted into subsidized housing—a dual-purpose measure to both alleviate property inventory and address housing affordability. It signals a nuanced, albeit gradual, approach to propping up the beleaguered real estate sector.

This is likely where most of that 2.3trn RMB mentioned in (1) will go. Again since the the property market is such a significant drag on the economy, this is reasonable.

4. Bank Support Measures

The nation’s banking giants will also see a boost, as the Ministry of Finance prepares to assist major state banks in replenishing capital. While we await concrete plans, this move underscores the government’s intent to maintain financial stability through targeted support for systemically important banks. Not that we doubted this to begin with.

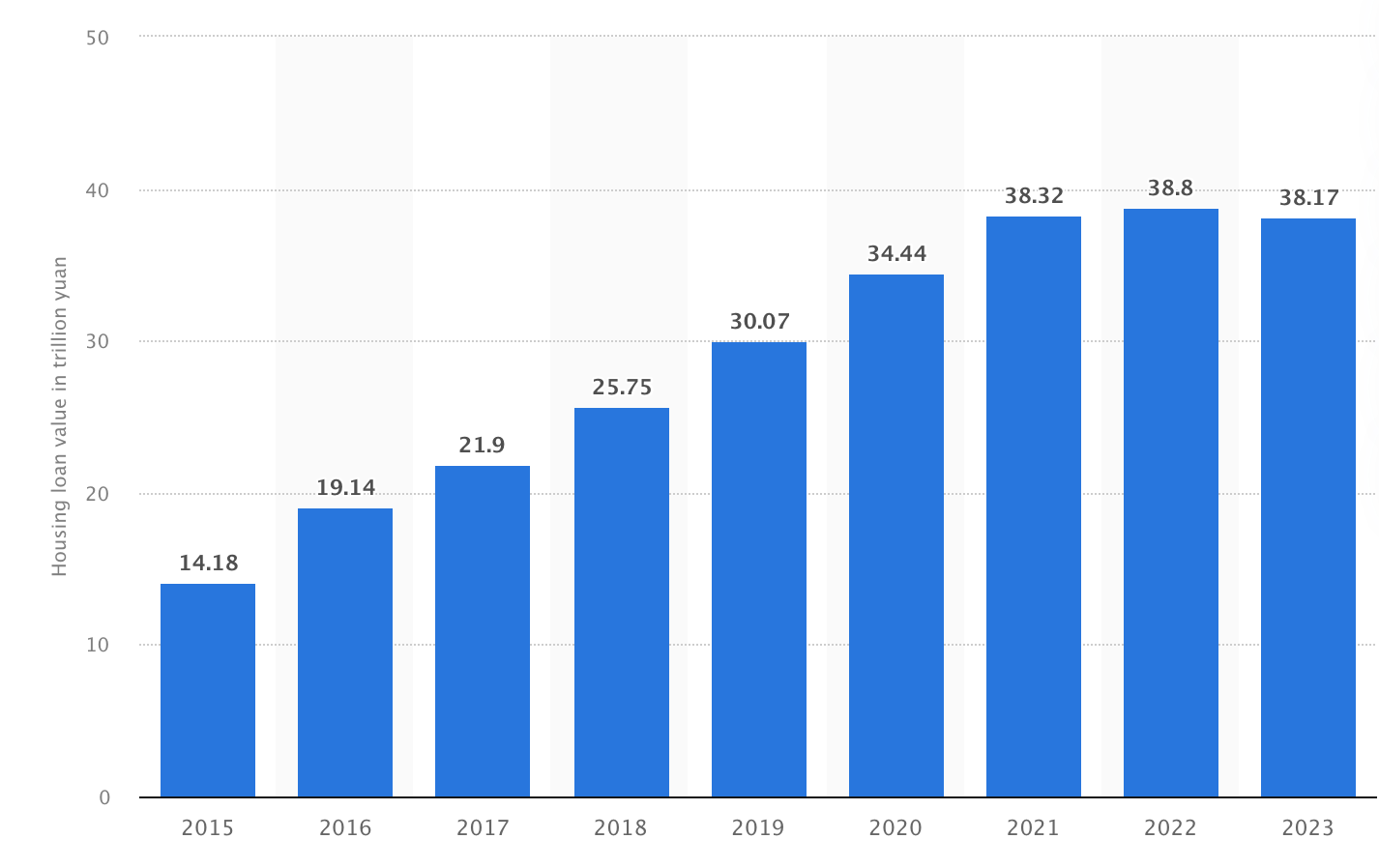

In return, and in line with recent People’s Bank of China (PBOC) directives, four major state-owned banks announced forthcoming cuts to existing mortgage rates. These rate reductions, effective from October 25, are part of broader efforts to ease financial pressures on households and further stimulate economic activity. again given the sheer amount of total mortgages outstanding (38 trn RMB at the end of ‘23, see chart), this is significant. PBOC expects an effective cut of about 50pbs on average.

5. Special Sovereign Bonds

Vice Minister Wang Dongwei confirmed that the Ministry is on track to issue 1 trillion yuan of special treasury bonds by year-end. This bond issuance forms part of a broader strategy to stabilize fiscal resources without overwhelming the market. There is around 240bn RMB left to go, and this is expected. Again the scope for further issuance will need to be adjusted by the NPC.

Perhaps the most telling aspect of the press conference was what remained unsaid. There were no specifics on the magnitude of additional fiscal stimulus or further bond issuances. Additionally, there was no precise indication of how much the fiscal deficit might increase—a critical piece of information many market participants were hoping for. But again I keep banging on teh same drums as in the NDRC post - these are policy corrective institutions, they can not formulate the policy they are implementing.

So now attention rightly shifts to the upcoming meeting of the National People’s Congress Standing Committee at the end of October, where further fiscal policy announcements are expected. With discussions circulating among Chinese academics and policy think tanks, the potential for larger stimulus measures, such as the issuance of ultra-long special bonds, could be on the horizon.

Initial market reactions have been mixed. The absence of key figures may have left some investors disappointed, particularly those anticipating more decisive stimulus measures. However, the acknowledgment of fiscal space and the possibility of future deficit expansions have tempered concerns. The optimism for a larger fiscal push remains, and many expect October to bring clearer guidance.

Conclusion: A Strategy of Caution, Awaiting Further Action

The Ministry of Finance’s approach at this juncture reflects a cautious yet deliberate strategy. While existing resources are being leveraged, and flexibility is maintained, major new initiatives have not yet been unveiled. All eyes now turn to the late October NPC meeting, where the prospect of more significant fiscal interventions could reshape the economic landscape for the year ahead.

Proposals already circulating include suggestions for issuing 3-10 trillion yuan in ultra-long special treasury bonds to tackle local government debt and stimulate infrastructure, social services, and consumption. Additionally, tax cuts and further debt swapping remain on the table as part of China’s broader fiscal toolkit.

It is quite likely that the trip to Chow Tai Fook will be worthwhile and we will have a great big wedding at the end.