I was thinking of a more formal *format* for the weekend note, so trying out a Wrap. Let me know how you feel about it!

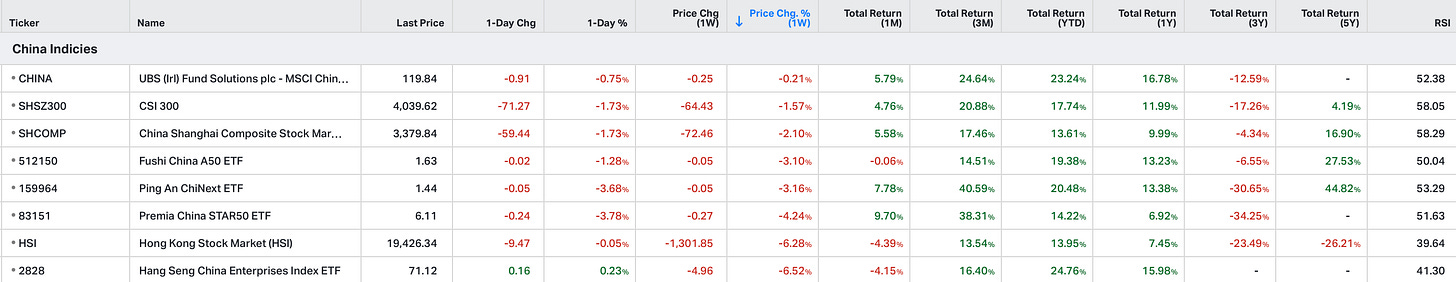

As of November 16, 2024, here’s a summary of the weekly, month-to-date (MTD), and year-to-date (YTD) performances of major Chinese and Hong Kong stock indices.

Notes:

• Shanghai Composite Index (SHCOMP): Tracks all stocks (A and B shares) traded on the Shanghai Stock Exchange.

• CSI 300 Index (SHSZ300): Represents the top 300 stocks traded on the Shanghai and Shenzhen Stock Exchanges.

• China A50 Index (512150 CH): Comprises the top 50 A-share companies listed on the Shanghai and Shenzhen Stock Exchanges.

• ChiNext Price Index (159954 CH): Focuses on innovative and high-growth enterprises listed on the Shenzhen Stock Exchange.

• SSE STAR 50 Index (83151 HK): Represents the top 50 companies listed on the Shanghai Stock Exchange’s STAR Market, emphasising science and technology innovation.

• Hang Seng Index (HSI): Measures the performance of the largest companies listed on the Hong Kong Stock Exchange.

• Hang Seng China Enterprises Index (2828 HK): Includes major H-share companies listed in Hong Kong.

Currency Considerations:

• Chinese Indices (SSEC, CSI300, China A50, CNT, STAR50): These indices are denominated in Chinese Yuan (CNY). To present their performance in USD terms, currency exchange rate fluctuations between the CNY and USD have been considered.

• Hong Kong Indices (HSI, HSCEI): Denominated in Hong Kong Dollars (HKD). Their performance in USD terms reflects the HKD/USD exchange rate stability, as the HKD is pegged to the USD.

5 Observations:

The further you move away from China, the worse the market performance becomes. This makes sense, as domestic investors likely have a better grasp of the local dynamics and processes, and the government is clearly prioritizing the performance of A-shares. However, the underperformance of H-shares is particularly intriguing. I find the current CSI/HSI performance gap of around 10% in a month unreasonable, which is steering my attention more and more toward H-shares as potential opportunities for the next investment candidates.

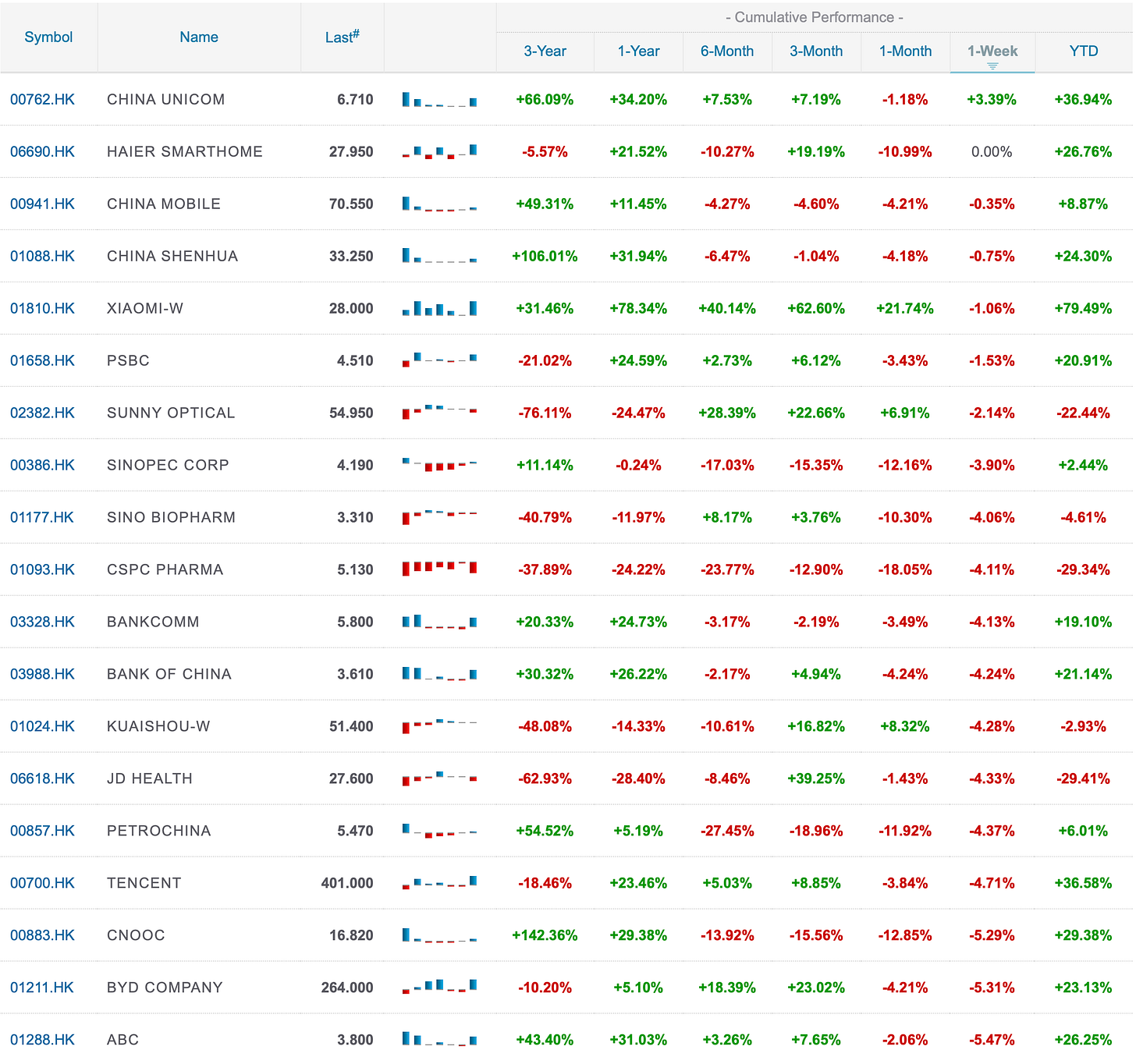

While many of the hottest themes have paused this past week, the year-to-date (YTD) performance of select names remains remarkable—brokers, in particular, come to mind with Eastmoney, Royal Flush and China Merchants securities all up over 140% in the past 3 months.

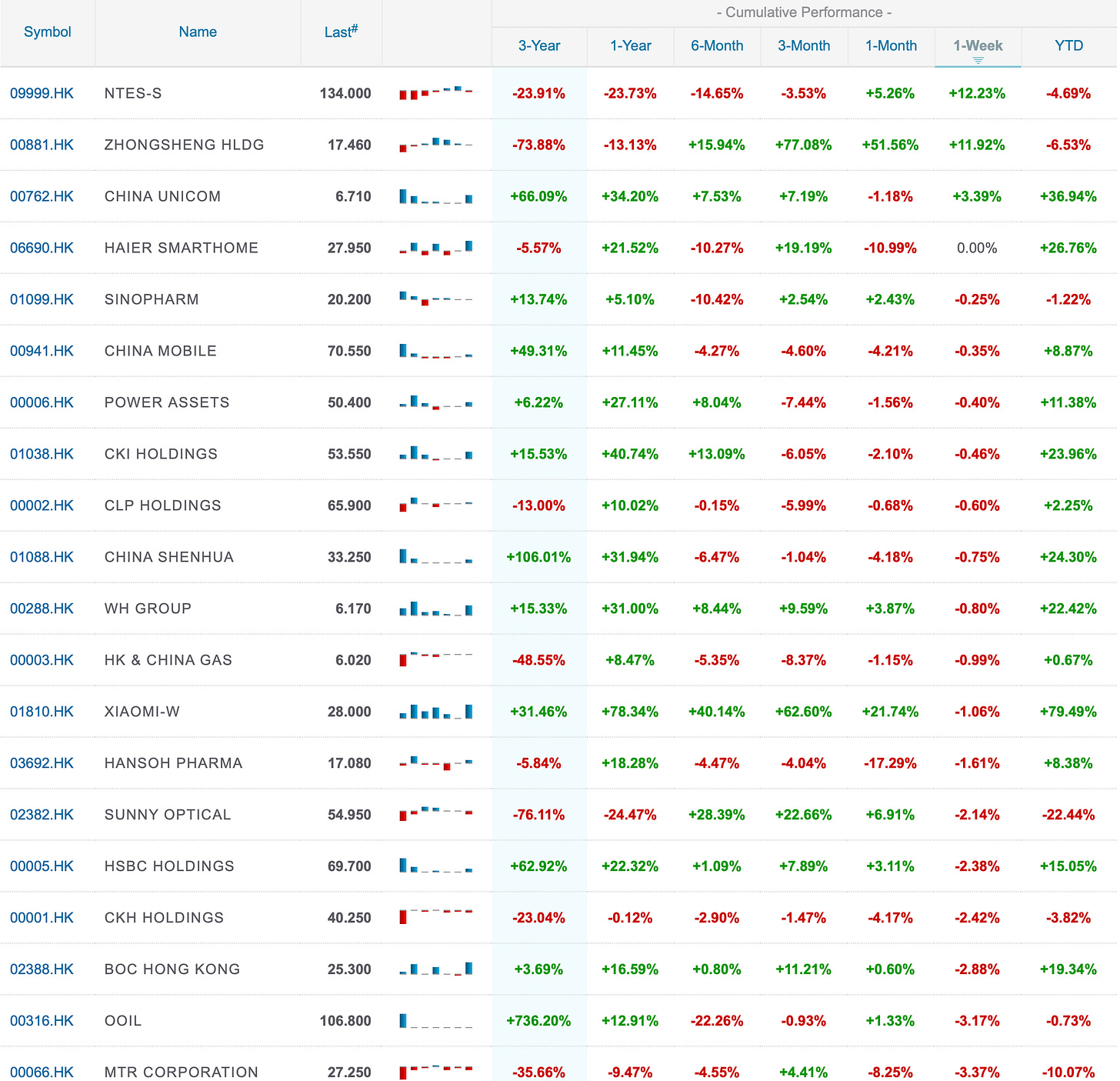

Interestingly, a surprisingly large number of well-known names have also delivered stellar YTD returns, signalling strength in key areas of the market - like CNOOC, Geely group, China Mobile, SMIC, Hygon - all well known companies on the verge of other 100% TR YTD.

ChiNext and STAR Market indices continue to lead the charge. This is logical, as we’ve seen a similar pattern in the U.S. with the QQQs during the bull run, and the Chinese market appears to be following that playbook by rewarding innovation and growth.

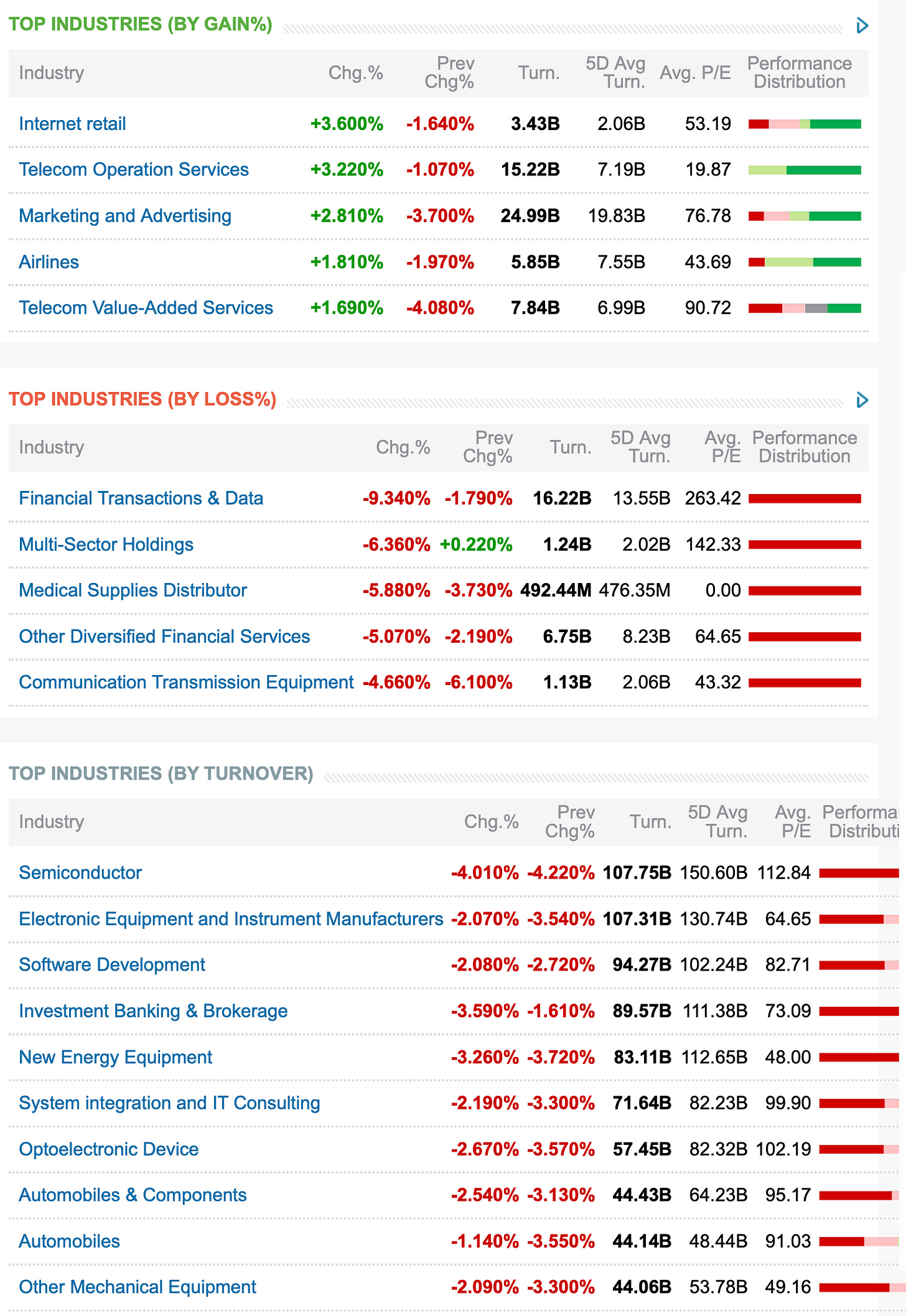

Building on that observation, it’s not surprising that semiconductors are trading at 112x earnings, as the inflows favour those high % of Semicondictor-heavy STAR. Oddly enough, this valuation makes sense to me, as the market is still in the process of evaluating just how much potential growth lies ahead for the sector. At the same time a stock that is almost 20% of ChiNext, CATL, is only on 15x. I don’t think I could get anymore bullish, but here we are.

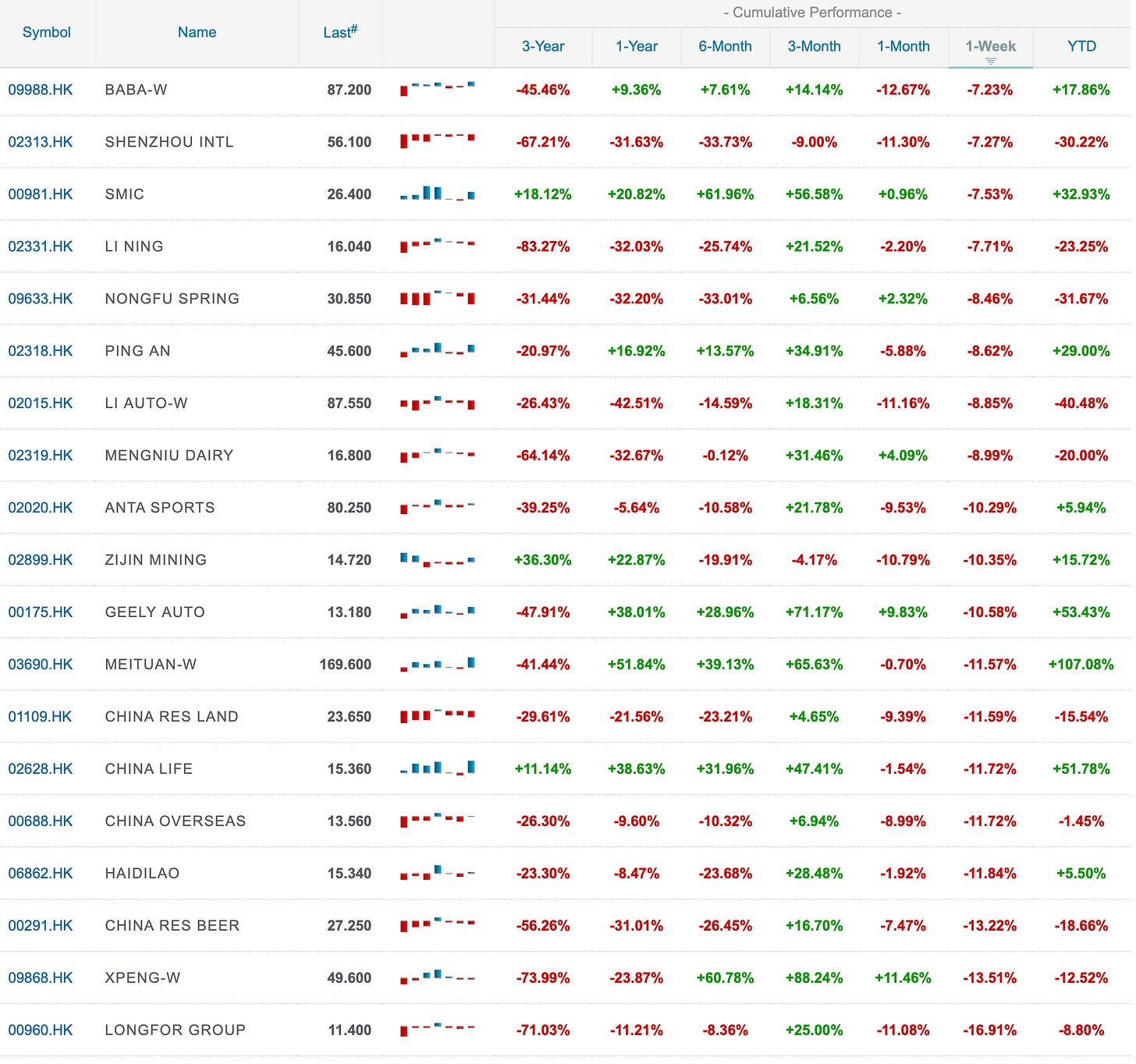

Best performing H-Shares

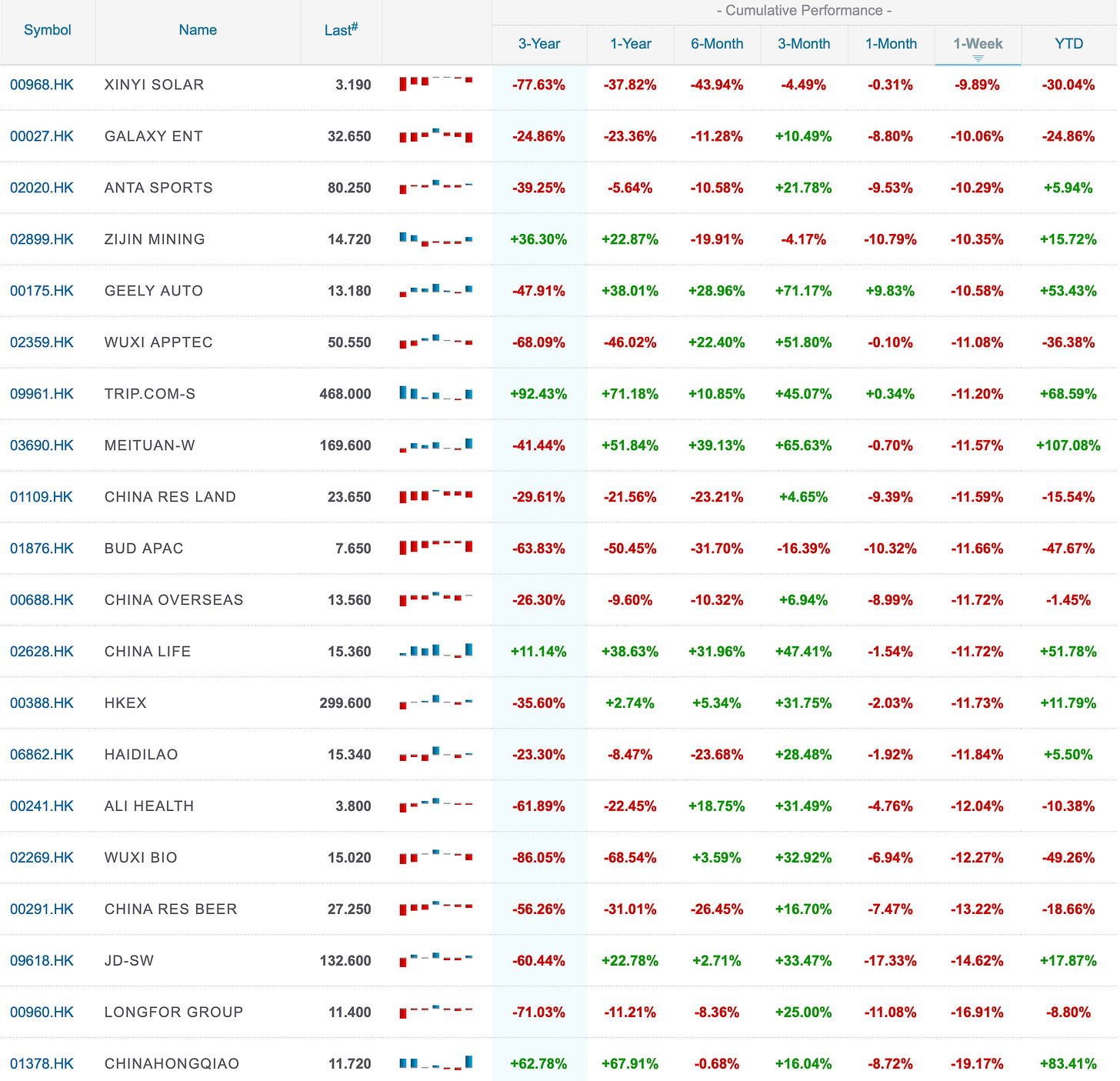

Worst Performing H-shares

Best Performing China Enterprises:

Worst Performing China enterprises:

Industry snapshot:

Leo - you have become a content beast!!