Good Evening,

It a big day in the Panda Perspective office - this is the day when we get to write about one of the Chine Champions - Alibaba Group. While we normally focus on industries or names that are more under the radar, we always have an opinion on the company, as we followed it closely since the IPO and it has been a portfolio company for the fund since then, and a Panda Portfolio company too.

This post is the first in our 6 part series on China internet, that we will aim to conclude just in time for the 2 sessions in early March. While Alibaba is first, JD will be the last and in between we’ll write about Baidu, Tencent, Meituan and PDD. Excited about all of them. This first one is free for the general public, but the rest will be paywalled. If you like this, and would like access to the rest of the series and the 100+ post archive it couldn’t be simpler - upgrade to a full membership, we’d love to have you!

One of the reasons we did not start with the coverage of the sector when we started Panda Perspectives was our conviction that there is no need - its so well covered and so front of mind, and such a high index share that its not a great use of our (finite) Panda resources. We would rather write about companies we love and are extremely excited about.

So what changed? First of all, we began to like the company a lot more. This has everything to do with the turnaround in earnings and earnings expectations, but also with the AI hype and Alibaba’s position in the space. But the message was intensified by out long term consultancy clients asking for our input on it. These people know the market very well and have access to a large chunk of the Street research, so if they are asking for our input it means its time.

This has informed the style of the report. We will certainly explain what the company is and what it does and where it makes money, but we will also go in to why some big investors have been buying the stock recently and why price targets are a funny exercise given the drivers behind the company.

This is coming out on the day of the quarterly earnings being released, but the report has been written well in advance of those. As such the bulk of the report is evergreen, or at the very least focusing on explaining the business of the company, the financial metics and where it’s headed. Teh results will be reviewed in the Weekly Wrap on Saturday, as per usual.

But before we get in to it, a reminder. Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.

With that, let’s dive in!

Alibaba’s story began in 1999 in Hangzhou when Jack Ma founded a modest B2B platform to connect Chinese manufacturers with global buyers. In 2003, the launch of Taobao—a consumer-friendly marketplace that allowed free listings—revolutionized e-commerce in China. The 2004 introduction of Alipay transformed online trust by ensuring secure transactions. These early innovations laid the groundwork for an ecosystem that, by 2023, generated over US$1.1 trillion in Gross Merchandise Value (GMV). (GMV measures the total value of goods sold through a platform and serves as a key indicator of overall marketplace activity.)

A pivotal milestone came in 2005 when Yahoo invested US$1 billion in Alibaba, acquiring a 40% stake—a decision that would later yield extraordinary returns. Fast forward to 2014, when Alibaba executed its record-breaking IPO, raising US$25 billion—the largest in history at that time. This landmark event not only catapulted Alibaba onto the global stage but also provided the capital needed to diversify its operations. The funds fueled strategic investments in logistics with Cainiao, bolstered its cloud computing division, and expanded its reach into digital media and entertainment.

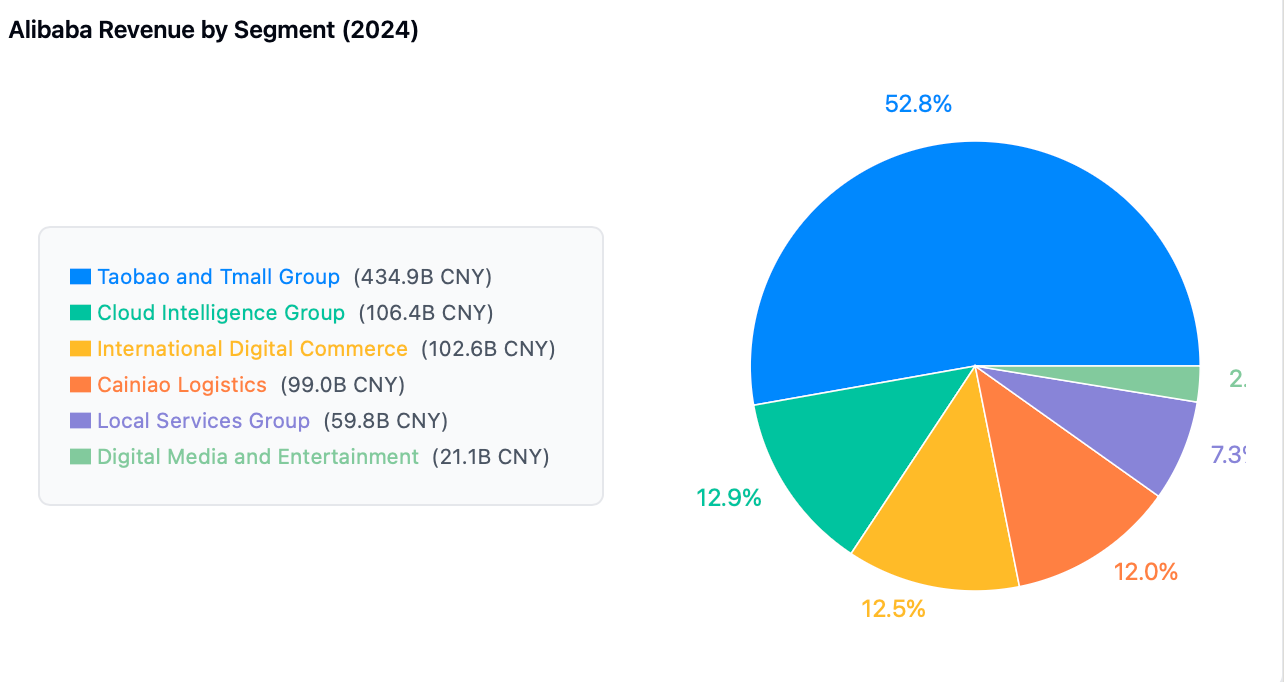

Today, Alibaba is a diversified digital conglomerate with multiple robust revenue streams. Its core commerce remains the backbone: FY24 China commerce retail revenue hit US$59,109 million (up 5% YoY), and international commerce retail surged 60% YoY to US$11,646 million. Cainiao Smart Logistics and Local Services delivered US$14,120 million (up 28% YoY) and US$8,528 million (up 19% YoY) respectively. Meanwhile, Alibaba Cloud—charging for computing power, storage, and AI-driven applications—generated US$15,169 million in FY24, growing 3% YoY and operating at estimated margins of 30–40%. Amid regulatory headwinds and a domestic consumption slowdown, Alibaba is pivoting toward high-growth areas such as AI, while its ecosystem enablers—reflected in its historic stake in Ant Group and its role as a key shareholder in the separately listed Alibaba Health—continue to reinforce its long-term strategic vision. We will not be addressing Ant Group or Alibaba Health in this report outside of recognising the equity value of the remaining stake.

Business Overview

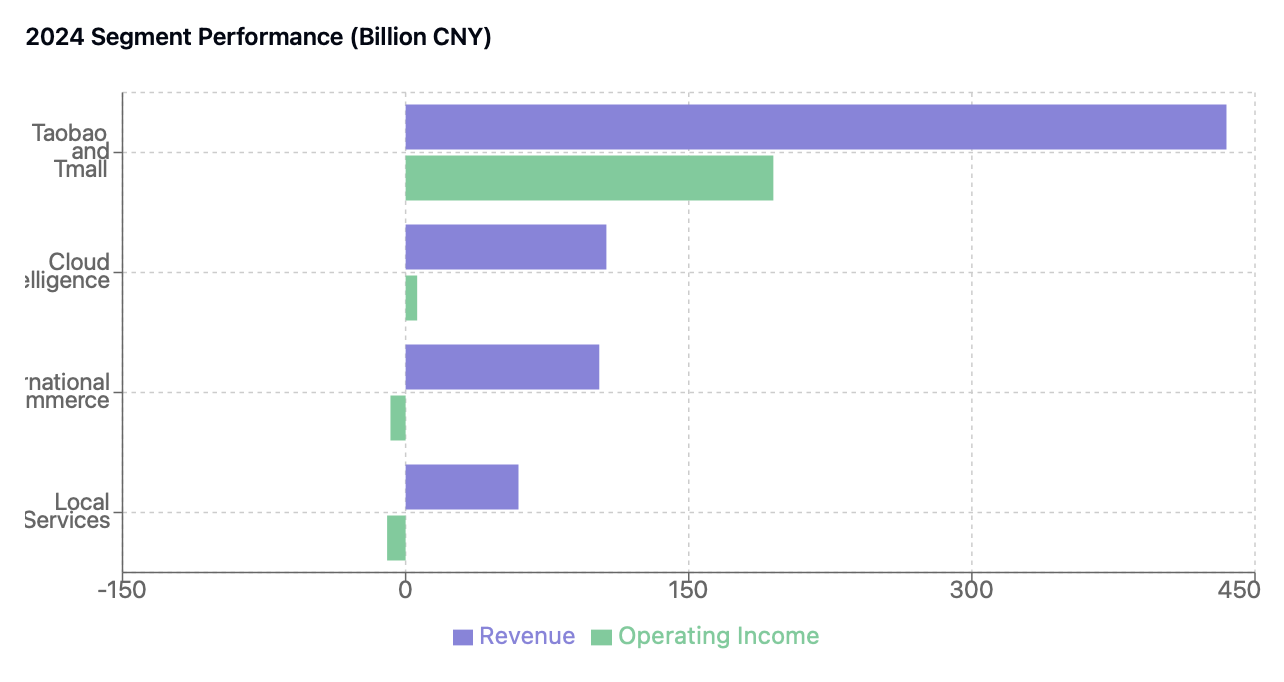

Taobao and Tmall Group (Online Services)

2024 Revenue: 439.438 bn CNY

2024 Operating Income: 194.638 bn CNY (approximately 44% operating margin)

Business Overview

Taobao and Tmall collectively form Alibaba’s flagship consumer e-commerce ecosystem. Taobao (C2C) empowers smaller merchants to reach hundreds of millions of consumers, while Tmall (B2C) hosts official brand stores, catering to more premium, brand-conscious shoppers. The platforms monetize primarily through merchant commissions, advertising tools (e.g., search ads, display ads, recommendation feeds), and promotional services that merchants use to boost visibility.

Recent Dynamics

Accelerated Order Volume: F2Q25 (September quarter) saw sequential double-digit percentage YoY order growth, propelled by higher purchase frequency. However, average order value (AOV) dipped slightly as users sought deals on lower-priced items.

Rising VIP Base: 88VIP members reached 46mn by quarter-end, underscoring Alibaba’s focus on loyalty-driven repeat spending. This group contributes a sizable chunk of GMV, bolstering revenue growth.

Stable Take Rate: Despite heavy promotional activities, the blended take rate has held steady, aided by new ad products and a software service fee of ~0.6% introduced in mid-2024.

Competition & Promotions: Rival platforms (e.g., Pinduoduo, JD.com, Douyin) continue to intensify price-based competition. Alibaba’s response includes deeper promotional campaigns—particularly around major shopping festivals like Double 11—which help drive traffic but also exert pressure on margins.

Margin Drivers

Advertising Efficiency: Growth in Customer Management Revenue (CMR) has outpaced GMV lately, thanks to improved ad targeting and the launch of new advertising tools.

Cost Control: While promotional spending remains high, cost discipline in logistics and technology infrastructure helps support robust operating margins (around 44%).

Higher-Value Transactions: Tmall’s focus on premium brands elevates average commission rates, partially offsetting price-driven promotions on Taobao.

Alibaba’s key differentiator—especially with Tmall—lies in the combination of premium brand presence, ecosystem support, and consumer trust:

Premium Brand Ecosystem

Authenticity & Quality Control: Tmall requires official brand authorisation, ensuring genuine products. This is especially appealing to consumers wary of counterfeits, and it’s a major contrast to platforms known for rock-bottom prices.

High-Value Brands: Tmall hosts flagship stores for top domestic and international labels. This curated, brand-centric environment attracts shoppers seeking reliability over bargain-basement deals.

Integrated Services & Data Synergies

Logistics & Payment: Cainiao’s fulfilment network offers timely delivery, while Alipay’s frictionless payment system enhances user trust and convenience.

AI-Powered Marketing: Alibaba’s ecosystem aggregates user data from Taobao, Tmall, Alipay, and more, feeding into precise ad targeting and personalised recommendations. For merchants, this translates into higher conversion rates; for consumers, a more tailored shopping experience.

88VIP Membership & Consumer Engagement

Loyalty & Benefits: With over 46 million members, 88VIP extends perks like free shipping, exclusive discounts, and priority customer service. These incentives keep users within Alibaba’s orbit, nudging them away from rival platforms.

Integrated Promotions: Events like Double 11 become ecosystem-wide festivals, driving huge traffic spikes and reinforcing user habit formation.

Wide Product Range & Strong Community Features

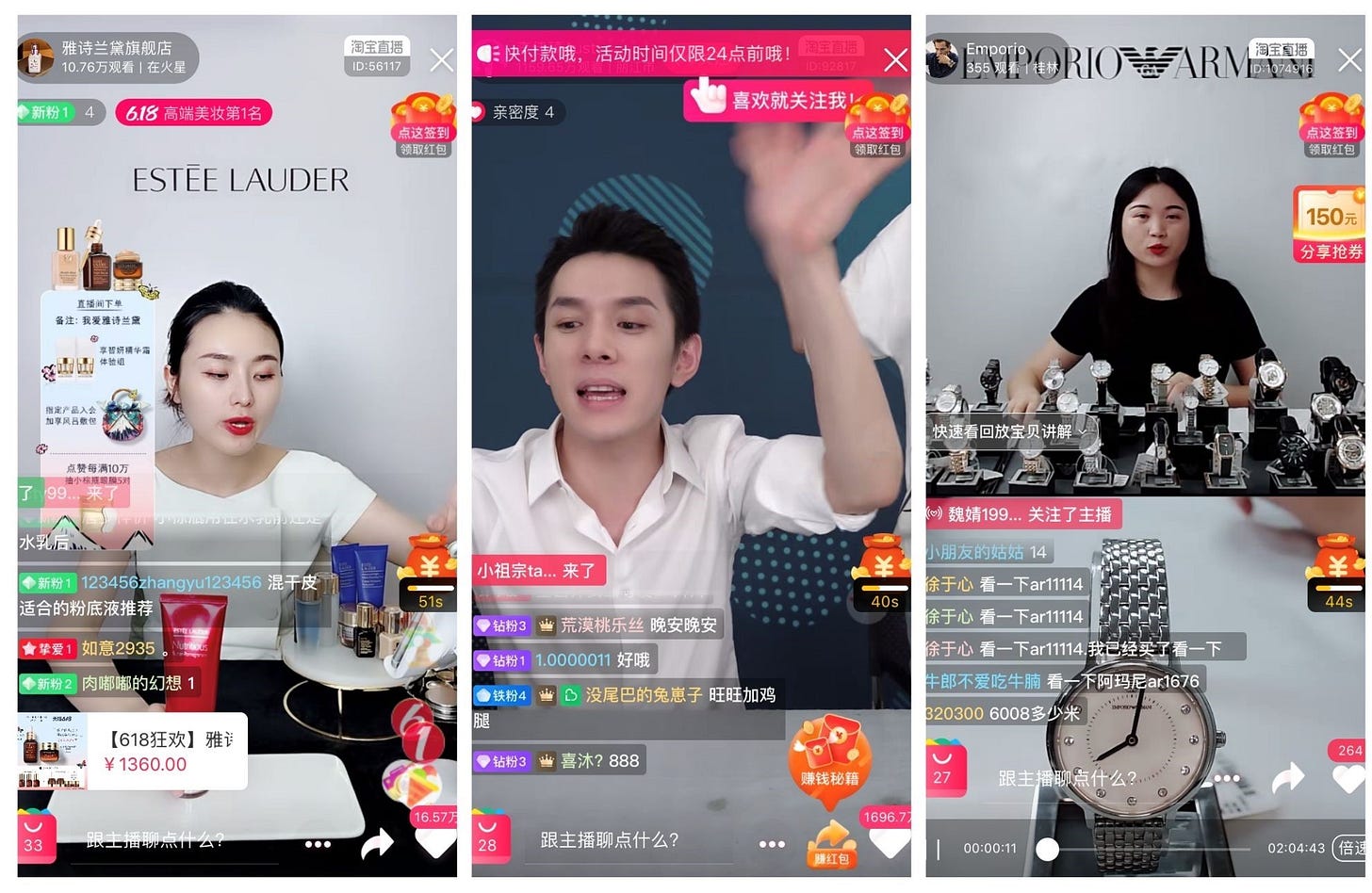

Taobao Live & Community: Beyond Tmall’s premium offerings, Taobao’s user-generated content, livestreaming, and social-sharing features create a stickier user experience.

Community Trust: Ratings, reviews, and real-time interactions with merchants or influencers enhance buyer confidence—another competitive advantage over more price-focused rivals.

Overall, Taobao and Tmall Group remain Alibaba’s central revenue engine, balancing competitive pressures with loyalty programs, targeted ads, and consistent innovation in monetization tools. This combination has kept operating margins relatively strong—even as the platform adapts to evolving consumer habits and an increasingly crowded e-commerce landscape.

Cloud Intelligence Group (Application Hosting Services)

2024 Revenue: 121.83 bn CNY (3% YoY growth)

2024 Operating Income: 6.128 bn CNY (~5% operating margin)

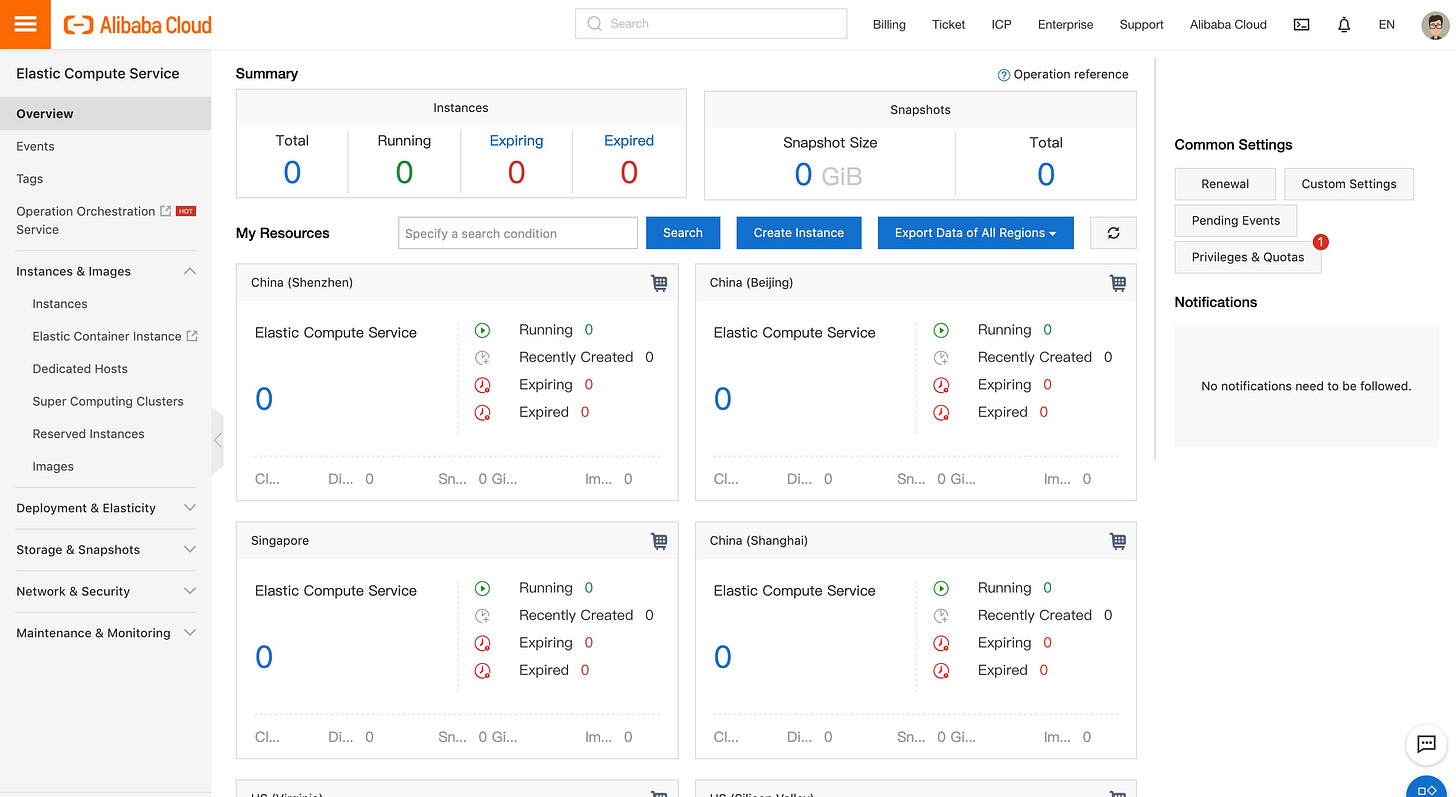

Business Overview

Alibaba’s Cloud Intelligence Group is anchored by Alibaba Cloud, which offers cloud computing, data storage, analytics, and AI-driven solutions. Initially serving Alibaba’s own ecosystem, it has expanded to third-party enterprises—ranging from startups to global corporations—seeking scalable infrastructure and data services. This business underpins Alibaba’s pivot toward technology and AI, positioning it as a key growth engine beyond core e-commerce.

Recent Dynamics

Moderate Growth Rate: After several years of double-digit surges, cloud revenue grew by a modest 3% in 2024. The uptick was fueled by AI-related computing demand, but partially offset by slower macro conditions and competitive pricing pressures.

Shift to External Clients: While still supporting Alibaba’s own ecosystem, the Cloud Intelligence Group is increasingly focused on external enterprise clients, particularly in finance, gaming, and logistics—segments hungry for big data and AI solutions.

AI Adoption: Management highlighted robust triple-digit AI revenue growth, reflecting a surge in demand for advanced computing workloads. This trend has helped stabilize top-line growth despite macro headwinds.

Margin Drivers

Economies of Scale: Although the 2024 operating margin (~5%) is below prior estimates of 30–40%, it still surpasses core commerce margins. As infrastructure matures and customer volume increases, operational efficiencies typically improve.

Value-Added Services: High-margin AI solutions (e.g., AI inference platforms, machine learning toolkits) and data analytics packages command premium pricing, supporting better profitability than basic cloud hosting alone.

Cost Optimization: Ongoing efforts to reduce server, power, and cooling costs aim to strengthen margins over the long run.

Competitive Advantage

China’s Leading Cloud Provider: Alibaba Cloud holds a top position in China’s cloud market, buoyed by local data center presence, regulatory compliance, and strong brand recognition.

Integrated Ecosystem: Cross-platform synergies (e.g., Cainiao for logistics data, Taobao/Tmall for retail data) feed into Alibaba Cloud’s analytics and AI products, giving it a data edge over standalone cloud providers.

AI & R&D Investment: Heavy investment in proprietary chips (e.g., AI inference) and AI frameworks distinguishes Alibaba Cloud’s offerings, especially for enterprises seeking end-to-end AI solutions.

Overall, the Cloud Intelligence Group is Alibaba’s strategic pivot toward technology-driven, higher-margin growth. While its operating margin remains tempered by competition and infrastructure costs, AI demand and an expanding enterprise customer base provide a clear runway for future profitability.

Local Services Group (Online Services)

2024 Revenue: 93.818 bn CNY (up ~19% YoY)

2024 Operating Income: -3.918 bn CNY (negative operating margin of ~4%)

Business Overview

The Local Services Group encompasses Alibaba’s on-demand platforms and location-based offerings, chiefly Ele.me (food delivery) and Amap (mapping and navigation). By integrating real-time logistics and geolocation services, the group aims to provide everything from hot meals to last-mile delivery and travel assistance. Although consumer demand is robust, especially in urban centers, this segment remains in an investment phase to expand user reach and capture local market share.

Recent Dynamics

Rising Order Volume: Both Ele.me and Amap have reported increased order counts, propelled by post-pandemic consumer spending. This momentum helped drive ~19% revenue growth in 2024.

Competition & User Acquisition: Rival platforms—most notably Meituan—are vying for on-demand market share, pushing Alibaba to offer consumer subsidies and promotional incentives, which in turn weigh on short-term profitability.

Geographical Expansion: Ele.me continues to broaden its presence in lower-tier cities, though success depends on local infrastructure, courier network efficiency, and user adoption rates.

Margin Drivers

Subsidies & Promotions: Heavy discounting to attract and retain customers directly impacts operating margins, contributing to the -3.918 bn CNY operating loss in 2024.

Logistics Costs: Food delivery and last-mile services are labor-intensive. Efficiency gains, such as optimised courier routes via Amap’s mapping data, help contain costs but have yet to offset expansion-related expenses.

Synergies with Alibaba Ecosystem: Integration with Alipay and other Alibaba properties can improve user retention and cross-platform marketing, gradually improving the segment’s profitability over time.

Competitive Advantage

Ecosystem Integration: Ele.me and Amap benefit from Alibaba’s broader user base and data resources, allowing for personalized recommendations and seamless payment experiences.

Technology & Data Insights: Amap’s real-time geolocation data not only powers navigation but also optimizes delivery routes, potentially lowering costs and improving delivery times.

Consumer Loyalty Programs: Bundling local services with Alibaba’s loyalty offerings (e.g., 88VIP) encourages repeat business and higher average order values.

Overall, while Local Services Group continues to post an operating loss, its revenue trajectory remains strong. Strategic investments in logistics, user acquisition, and cross-platform integration are expected to pay off in the long run, positioning Alibaba to compete head-on in China’s high-growth on-demand services market.

Alibaba International Digital Commerce (Online B2B/Retail)

2024 Revenue: 90.418 bn CNY

2024 Operating Income: -9.418 bn CNY (negative operating margin of ~10%)

Business Overview

Alibaba’s International Digital Commerce segment covers its cross-border retail and wholesale platforms, most notably AliExpress and its B2B marketplace. These channels enable overseas consumers and businesses to purchase goods directly from Chinese merchants, capitalizing on China’s manufacturing base and Alibaba’s logistical know-how. While this segment plays a crucial role in Alibaba’s global expansion, it remains in a high-investment phase to capture market share in competitive regions.

Recent Dynamics

Strong Top-Line Growth: International retail revenue jumped significantly in FY24 (by some estimates around 60% YoY), reflecting robust demand in markets like Europe and emerging economies.

Cross-Border Fulfillment: Cainiao’s global logistics network supports faster deliveries for AliExpress, but maintaining local warehouses and last-mile delivery partnerships increases costs.

Marketing Push: Heavy promotional campaigns, especially during global shopping festivals (e.g., Black Friday) and sporting events (Euros with David Beckham), drive user acquisition but also contribute to high marketing expenses.

Margin Drivers

Logistics & Fulfillment: Cross-border shipments require substantial investment in warehousing and delivery networks, inflating operating costs.

Localization Efforts: Tailoring user interfaces, payment options, and customer service to different countries raises overhead but is vital for gaining trust in diverse markets.

Competition: Rivals like Amazon and local e-commerce players force aggressive discounting, which keeps margins in the red for now.

Competitive Advantage

China Supply Chain: Direct access to manufacturers in China helps Alibaba offer competitive pricing and a vast product range.

Ecosystem Synergy: Integration with Cainiao and Alipay facilitates more reliable shipping and secure payments, giving Alibaba a leg up in international markets.

Scale & Brand Recognition: Ongoing global marketing—combined with large-scale shopping events—drives awareness and traffic, essential for long-term growth.

While Alibaba hasn’t provided a specific timeline for when its International Digital Commerce segment will break even, recent sell-side estimates suggest losses could narrow significantly over the next 12–18 months. There exist two main drivers of improving profitability:

Scaling Up Logistics & Warehousing:

As Alibaba’s global infrastructure matures—particularly via Cainiao’s expanding cross-border network—per-unit fulfillment costs should decline. This efficiency gain could meaningfully reduce operating expenses.

Greater Localisation & Brand Recognition:

Heavy upfront spending on marketing, local warehouses, and user acquisition is expected to taper off once a critical mass of consumers and merchants is reached in each key market.

Over time, rising order volumes and repeat purchases should help offset these initial investments, paving the way for operating margins to move toward positive territory.

While exact timing varies by region (some markets may reach scale faster than others), the consensus is that Alibaba’s International Digital Commerce segment could begin showing meaningful operating improvements by late 2025 or early 2026, assuming stable macro conditions and continued market-share gains.Overall, Alibaba International Digital Commerce is a high-growth but margin-challenged segment. The near-term focus remains on building global infrastructure and brand recognition, laying the groundwork for eventual profitability as economies of scale and local market familiarity improve.

Cainiao Smart Logistics Network Limited

2024 Revenue: 74.148 bn CNY

2024 Operating Income: 1.148 bn CNY (operating margin of ~1.5%)

Business Overview

Cainiao serves as the logistics backbone for Alibaba’s sprawling e-commerce ecosystem, managing everything from warehousing and inventory to cross-border shipping. Initially, Cainiao focused on domestic deliveries in China, but it has steadily expanded its international footprint, offering integrated supply-chain solutions for merchants and consumers alike.

Recent Dynamics

Shift to Profitability: Having operated at a loss for years due to heavy infrastructure investments, Cainiao now posts a modest operating profit, signaling a shift from capacity-building to efficiency.

Cross-Border Growth: Demand for cross-border fulfillment has surged, especially for platforms like AliExpress and Tmall Global. Cainiao’s international hubs reduce shipping times, improving customer satisfaction and boosting Alibaba’s global expansion strategy.

Tech-Driven Efficiency: Cainiao leverages AI-powered route optimization, real-time tracking, and automated warehouses. These innovations lower operational costs and enhance delivery speed, contributing to Cainiao’s profitability gains.

Margin Drivers

Economies of Scale: As shipping volumes increase—both domestically and internationally—fixed costs like warehouse leases and logistics tech are spread across more parcels, improving margins.

Service Upgrades: Cainiao has introduced value-added services (e.g., “Fulfilled by Cainiao”) for merchants who need end-to-end supply-chain management. These services command higher fees and bolster operating margins.

Collaboration with Alibaba Ecosystem: Integration with Taobao, Tmall, and AliExpress generates steady parcel flow, allowing Cainiao to plan logistics more efficiently and negotiate better rates with carriers.

Competitive Advantage

Alibaba Ecosystem Synergy: Cainiao is deeply woven into Alibaba’s platforms, guaranteeing high shipment volumes and consistent demand.

Global Logistics Network: Cainiao operates in over 200 countries/regions, giving Alibaba a reliable cross-border channel that few rivals can match.

Technology & Data: Real-time tracking, automated warehouses, and AI-based routing systems help Cainiao reduce delivery times and costs, enhancing its value proposition to merchants and consumers.

In short, Cainiao’s transformation from an investment-heavy project to a profit-generating arm underscores Alibaba’s broader strategy: build infrastructure at scale, then refine operations for efficiency and profitability. As e-commerce volumes continue to rise—both domestically and globally—Cainiao is well-positioned to capitalize on logistics demand while driving cost savings across the Alibaba ecosystem.

Digital Media & Entertainment Group

• 2024 Revenue: 21.188 bn CNY

• 2024 Operating Income: -2.588 bn CNY (negative operating margin of ~12%)

Business Overview

The Digital Media & Entertainment Group covers Alibaba’s forays into online video, music, film production, and other entertainment ventures—most notably through Youku, Alibaba Pictures, and other content platforms. While these initiatives often run at a loss, they aim to deepen user engagement, create cross-selling opportunities, and reinforce Alibaba’s position as a comprehensive lifestyle ecosystem.

Recent Dynamics

User Engagement Focus: With China’s online video market heating up, Youku has invested heavily in content, especially original series and exclusive licensing deals, to differentiate itself from competitors like Tencent Video and iQiyi.

Cross-Platform Integration: The entertainment platforms integrate with e-commerce campaigns (e.g., using celebrity-driven live streams for Tmall promotions), thereby boosting user stickiness and conversion rates across Alibaba’s ecosystem.

Competitive Pressure: Content costs remain elevated due to bidding wars for popular dramas, films, and variety shows, placing continued pressure on profitability.

Margin Drivers

Content Acquisition & Production: Licensing and production expenses represent the largest cost centre, often overshadowing advertising revenue and subscription fees.

Advertising & Subscriptions: Although advertising demand has rebounded somewhat, it has yet to fully offset content costs. Subscription packages see modest growth but remain a smaller revenue source compared to ad-supported models.

Ecosystem Synergies: Partnerships with Taobao/Tmall for co-branded promotions can drive incremental ad and subscription revenue, though these synergies take time to mature.

Competitive Advantage

Alibaba Ecosystem: Access to Alibaba’s massive user base (via Taobao, Tmall, Alipay) provides a built-in audience for content distribution and marketing.

Data & Personalisation: Alibaba’s data capabilities help tailor content recommendations and ad placements, improving user engagement.

Monetisation Opportunities: While the segment is unprofitable, cross-promotion with e-commerce and potential tie-ins with other Alibaba services offer multiple pathways to monetisation over the long run.

All in all, Alibaba’s Digital Media & Entertainment Group sacrifices near-term profitability for broader ecosystem benefits. By combining premium content, robust user data, and cross-platform promotional opportunities, the segment bolsters Alibaba’s user engagement and brand reach—despite ongoing challenges in turning a profit.

Financial summary and outlook

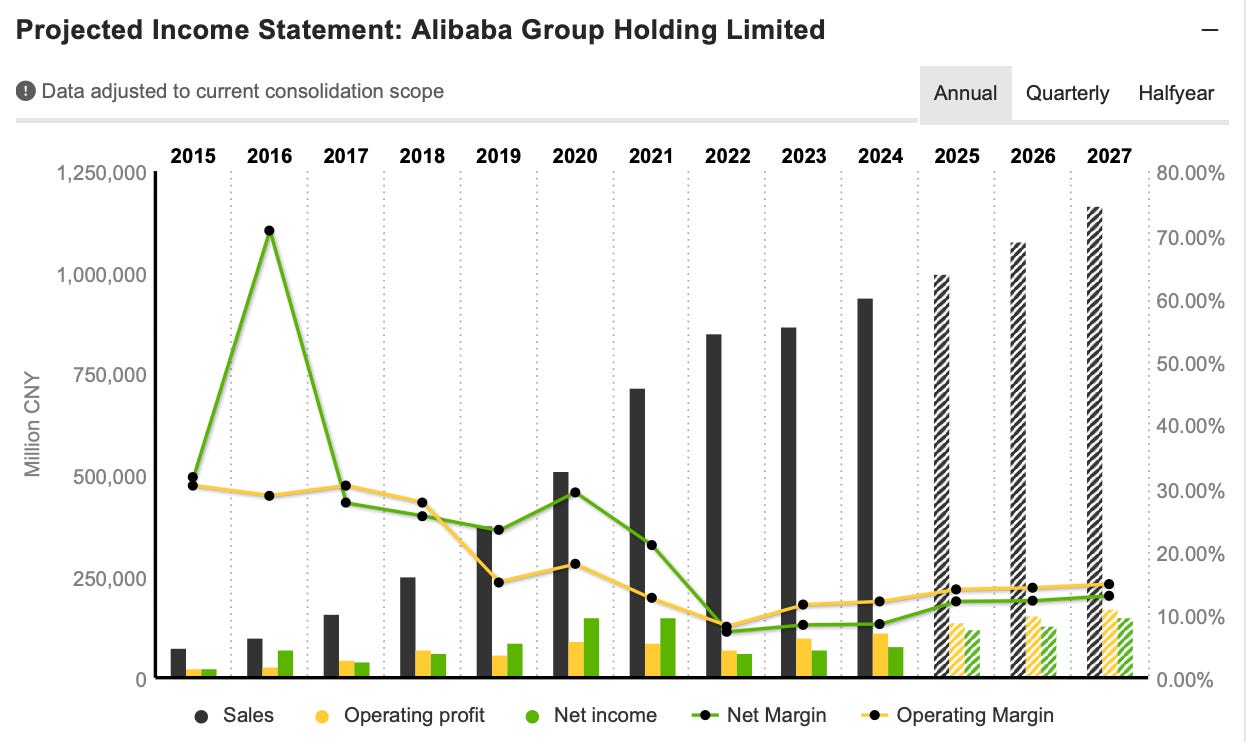

All those business segments do have a bottom line, given the maturity of Alibaba’s business its important to see the confirmation review of Alibaba’s financial performance and outlook, incorporating the latest data through FY24 and forward estimates to FY27. All currency figures refer to Chinese yuan (CNY) unless otherwise noted. Fiscal years end on March 31.

Revenue & Growth

Numbers & Trends

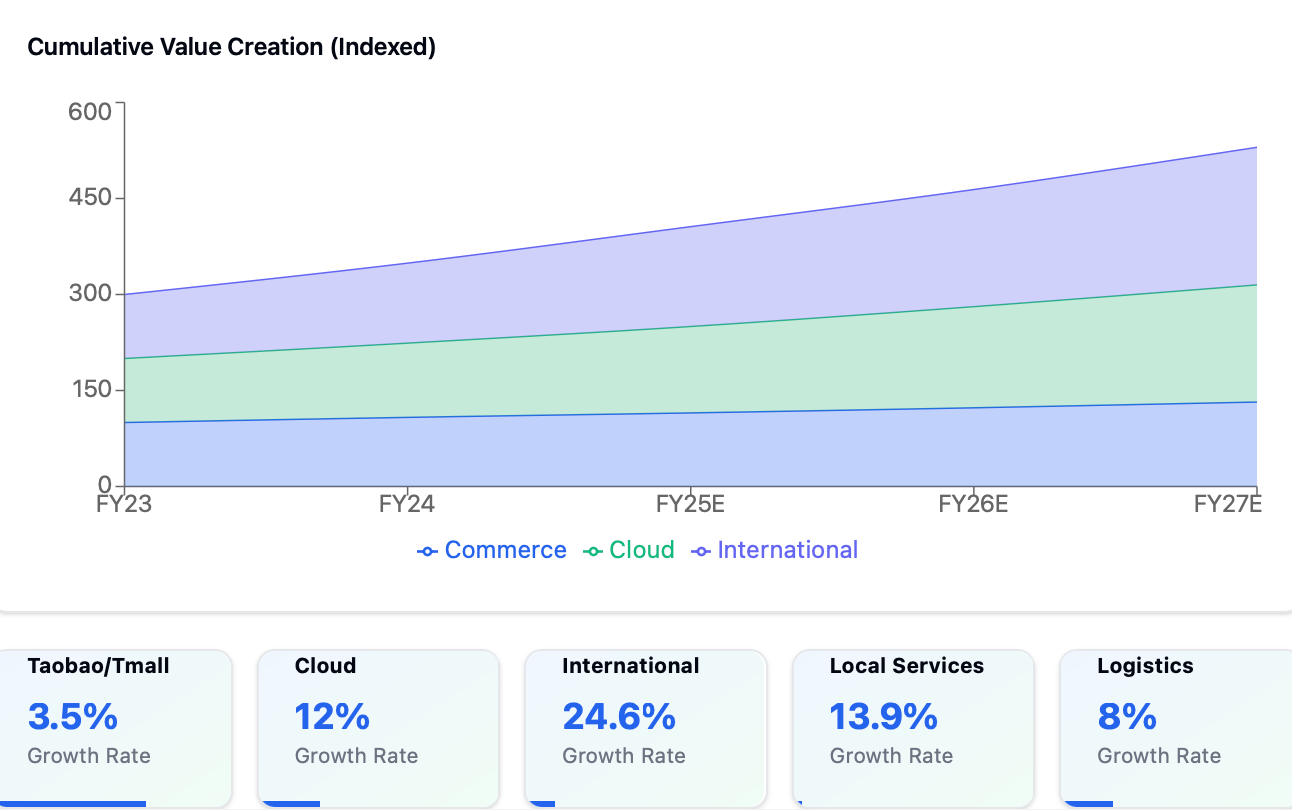

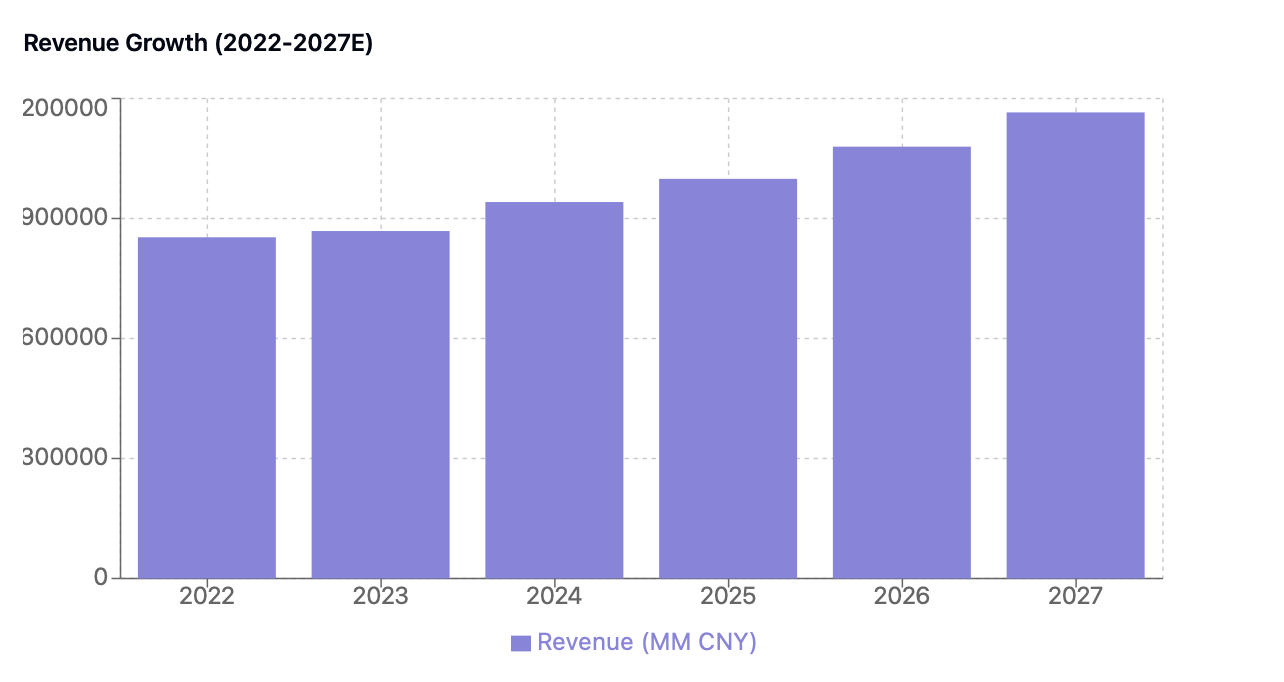

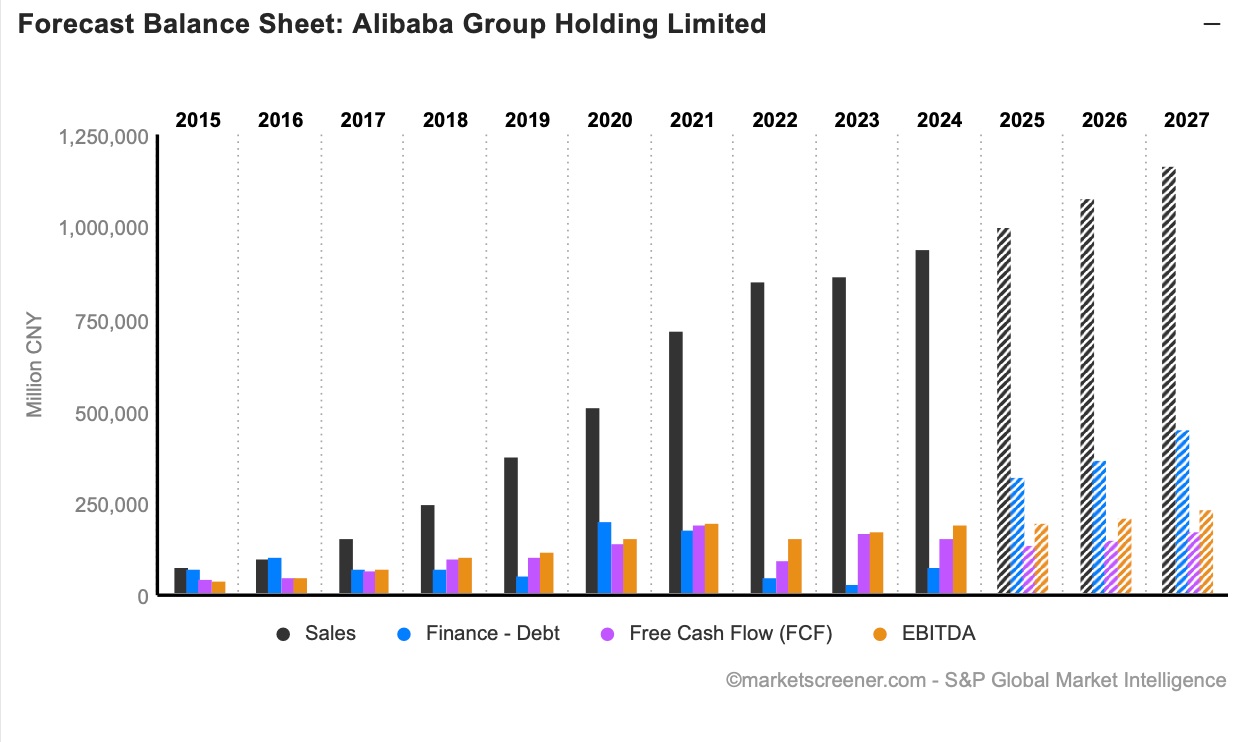

Historical Growth: Alibaba’s revenue climbed from CNY 853bn in FY22 to CNY 868.7bn in FY23, and then reached CNY 941.2bn in FY24. Although these absolute increases are robust, the year-over-year growth rate moderated compared to prior years due to heightened competition and macroeconomic softness in China.

Forward Outlook: Projections place FY25 sales near CNY 999bn, potentially exceeding CNY 1,165bn by FY27, implying a mid-to-high single-digit CAGR. This trajectory reflects a stable core commerce base, gradual recovery in consumer sentiment, and expansion in high-potential segments such as cloud computing.

Despite a more tempered revenue climb than in its hyper-growth phase, Alibaba remains a behemoth in digital commerce. The company’s multi-pronged approach—spanning e-commerce, cloud services, local consumer offerings, and international expansion—continues to yield incremental gains, albeit at a pace shaped by macro factors and fierce market competition.

Profitability & Margins

Numbers & Trends

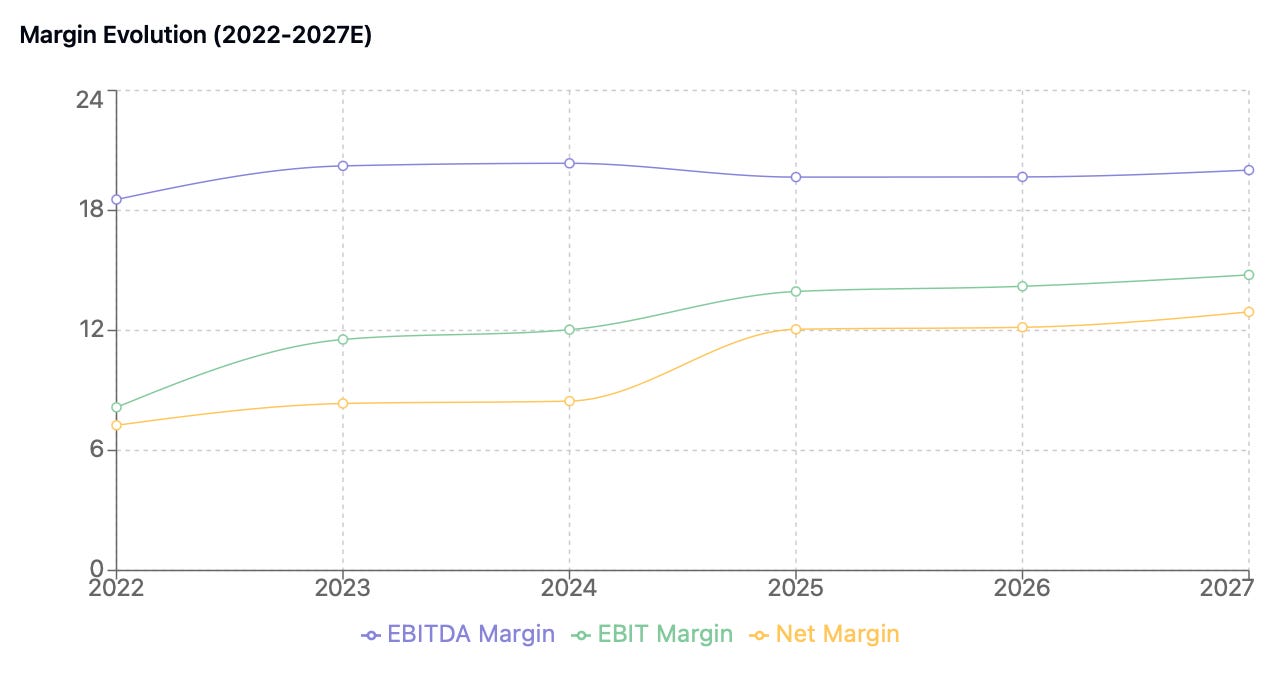

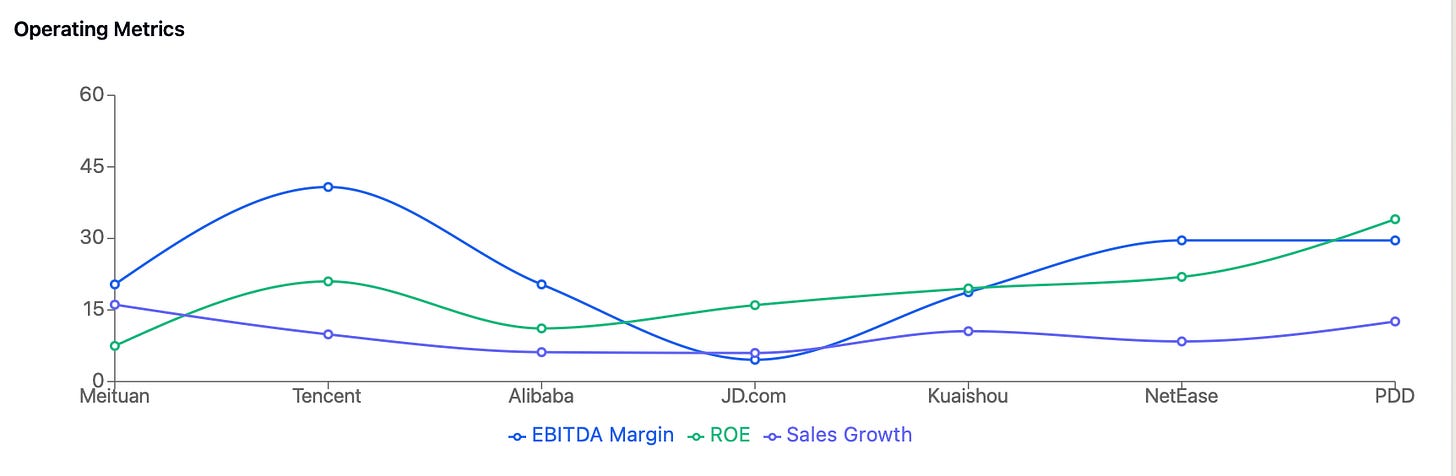

EBITDA & EBIT:

In FY24, EBITDA margin stood at around 20.4%, up slightly from 20.3% in FY23, reflecting incremental efficiencies in core commerce.

EBIT margin rose from ~9.1% in FY23 to ~10.6% in FY24. Analysts anticipate further improvement, targeting ~14% by FY26–FY27 as cloud services and logistics scale up.

Net Income & Net Margin:

FY24 net income reached ~CNY 79.7bn, translating to an 8.4% net margin.

By FY26–FY27, net margin could hover in the 12–14% range, assuming a combination of cost discipline, cloud margin gains, and a gradual rebound in domestic consumption.

Alibaba’s margins are rebounding from a phase of intense investment and regulatory scrutiny. The cloud segment, once viewed as a long-term bet, is gradually shifting toward profitability, while strategic cost controls in logistics and marketing are bearing fruit. That said, competition and expansion initiatives in local services and international commerce can still pressure overall margins in the near term.

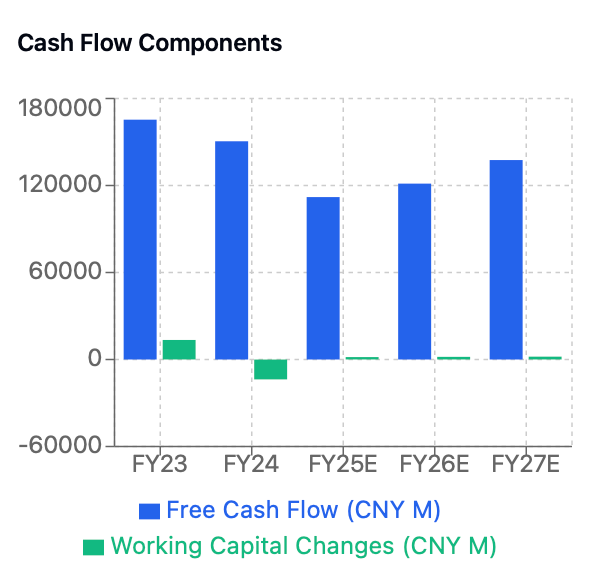

Cash Flow & Capital Allocation

Numbers & Trends

Free Cash Flow (FCF):

Historically, FCF often exceeded net income—exceeding 150% in certain fiscal years—due to a favorable cash conversion cycle.

By FY27, FCF is expected to surpass CNY 180bn, supported by stable core commerce cash generation and slowing capital expenditures in maturing segments.

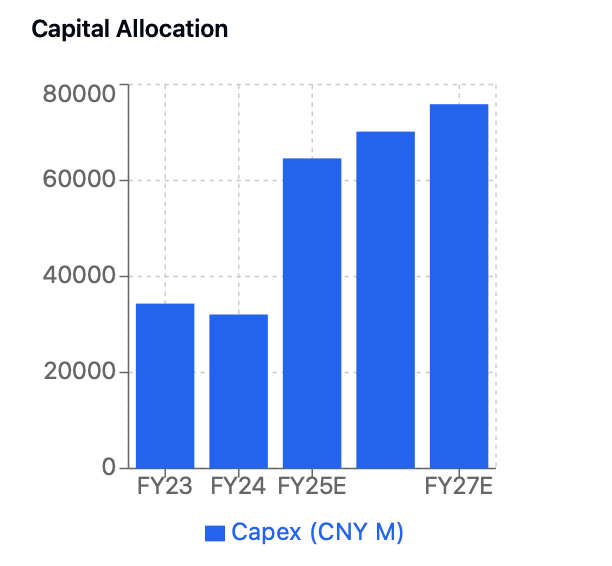

Capex & Capital Intensity:

Capex/EBITDA was ~26–27% in FY22–FY24, reflecting data-center expansions (cloud) and investments in Cainiao.

Forecasts suggest this ratio may dip to ~24–25% by FY27, indicating a shift from infrastructure build-outs to more software- and AI-driven spending.

Cash flow remains Alibaba’s trump card. Despite investments in AI, logistics, and international expansion, the company consistently generates enough cash to fund operations, strategic M&A, and shareholder returns. Over time, as infrastructure projects mature, capex demands should ease, further reinforcing Alibaba’s position as a cash-rich digital giant.

Shareholder Returns

Numbers & Trends

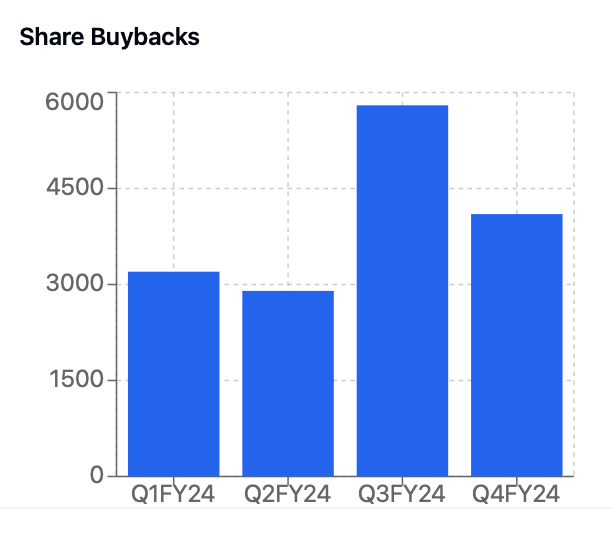

Buyback Program:

Alibaba has executed substantial share repurchases over the past year, with a reported US$4.1bn in buybacks in 2Q25 alone and US$5.8bn in the prior quarter, reducing total share count by about 4.4% over two quarters.

The existing buyback authorization stands at around US$25bn (and has been extended multiple times), reflecting management’s commitment to returning capital to shareholders.

Dividends:

Currently, Alibaba does not offer a significant dividend (c. 1%). Its capital return strategy focuses on buybacks, which management views as more flexible and opportunistic.

Alibaba’s buyback program is a clear signal of management’s confidence in the company’s intrinsic value. With ample free cash flow and a strong balance sheet, Alibaba has ample room to continue repurchasing shares, which can bolster EPS and mitigate dilution from stock-based compensation. While dividends remain minimal, ongoing buybacks underscore the company’s proactive approach to rewarding shareholders amid evolving market conditions.

Balance Sheet & Leverage

Numbers & Trends

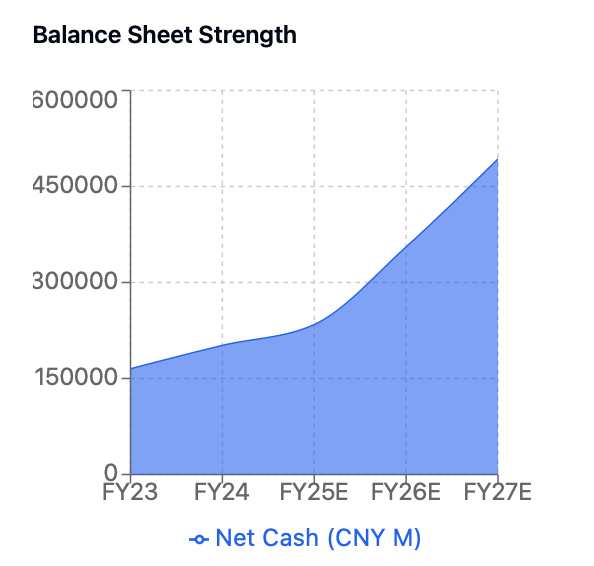

Net Cash & Liquidity:

Alibaba has traditionally maintained a solid net cash position. In FY24, net cash/equity stood at around 18%, and estimates suggest it may exceed 30% by FY27.

The company’s interest coverage ratio remains healthy, ensuring it can service debt comfortably while preserving capacity for strategic deals.

Debt Profile:

Alibaba carries moderate levels of debt relative to EBITDA, reflecting a cautious approach to leverage.

With consistent free cash flow, Alibaba’s balance sheet provides ample liquidity to fund AI initiatives, logistics expansion, and potential acquisitions.

Verbiage: From a capital structure standpoint, Alibaba operates from a position of strength. The company’s historically conservative leverage, combined with robust cash generation, positions it well to navigate regulatory changes, market fluctuations, and competitive threats. It also retains the firepower for opportunistic investments and M&A to further fortify its ecosystem.

Earnings Per Share (EPS) & Revisions

Numbers & Trends

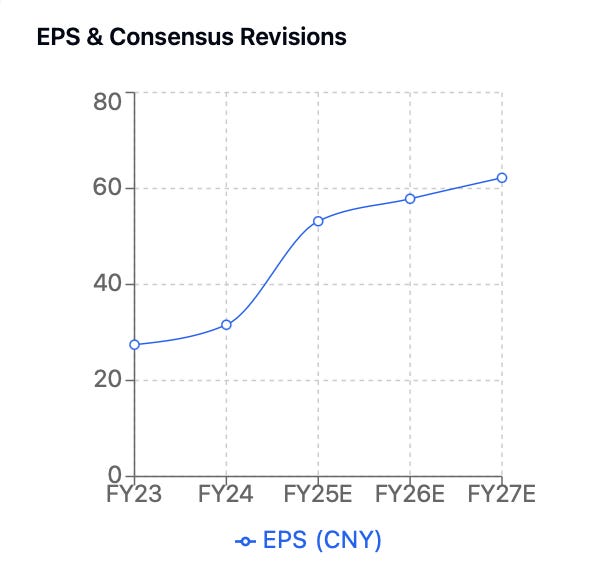

EPS Evolution:

EPS dipped in FY22 due to macro and regulatory pressures but rebounded in FY23–FY24 as margins recovered.

Its now projected that FY25 EPS in the mid-50s to low-60s CNY range, climbing toward 70+ CNY by FY27.

Estimate Revisions:

Over the past 18 months, EPS estimates trended downward amid macro headwinds and China’s zero-Covid policies.Recent quarters show a moderate uptick in revisions, fuelled by AI-driven optimism, improving margin profiles, and easing regulatory constraints.

Alibaba’s EPS trajectory underscores the company’s transition from an era of high investment and regulatory challenges to one of measured, profitable growth. While downward estimate revisions dominated the past year, it’s now clear that there are signs of stabilisation—particularly in cloud services, international commerce, and local consumer spending.

Key Financial Drivers & Risks

Drivers

AI Monetisation: Alibaba Cloud’s push into AI services could unlock premium pricing, lifting both revenue and margins.

Domestic Consumption Recovery: Any uptick in China’s consumer confidence would directly benefit core commerce GMV and associated advertising revenue.

Operational Efficiencies: Cainiao’s logistics scale and cost controls in marketing could further expand overall profitability.

Risks

Regulatory Environment: Antitrust measures, data privacy rules, or fintech curbs can introduce compliance costs and limit certain growth avenues.

Competitive Intensity: Platforms like JD.com, Pinduoduo, and Douyin may drive price wars, pressuring Alibaba’s take rates and promotional budgets.

Global Macro & Geopolitics: Fluctuations in global trade or foreign regulation (e.g., scrutiny of Chinese tech abroad) could affect Alibaba’s international commerce ambitions.

In the near term, Alibaba’s finances hinge on its ability to balance expansion with cost discipline. Longer term, success in AI, improved local services economics, and a steadier regulatory backdrop could reshape the company’s financial landscape. Still, investors should monitor competitive moves, consumer trends, and policy developments for potential disruptors.

Bottom Line

Alibaba’s financial profile reflects a mature digital conglomerate transitioning from an aggressive growth phase to a period of margin-focused consolidation and strategic expansion. While competition and regulatory scrutiny remain headwinds, the company’s extensive ecosystem, solid free cash flow, and improving profitability set a foundation for sustainable growth. For sophisticated investors, Alibaba’s blend of stable core commerce, expanding cloud potential, and active capital return strategies—particularly share buybacks—offers a compelling long-term story, albeit one tempered by the complexities of China’s evolving market and policy environment.

AI Potential & Outlook

Alibaba’s push into AI spans its entire ecosystem—from cloud infrastructure to consumer-facing applications—offering both near-term revenue catalysts and long-term strategic advantages. Below is a deep dive into the company’s AI initiatives, growth drivers, and challenges, drawing on recent disclosures and analyst commentary.

Cloud Revenue & Growth Trajectory

AI is projected to be a main engine for cloud growth, with generative AI workloads significantly increasing demand for compute and storage. Alibaba Cloud (AliCloud) has responded by focusing on public cloud services, where it can scale more rapidly and regain market share.

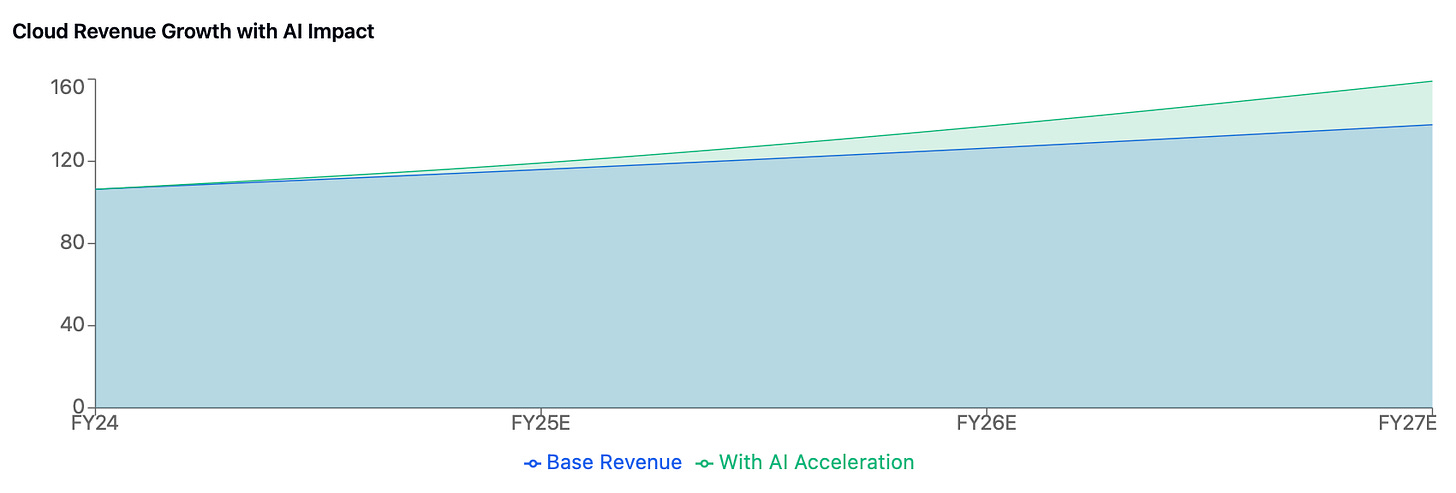

After a modest 3% YoY increase in FY24, AliCloud’s revenue growth could return to double digits—some forecasts point to 12% YoY in the near term, accelerating to around 15% as AI adoption deepens. Goldman Sachs projects a 14% CAGR for Alibaba Cloud over FY25–FY27, underpinned by enterprise AI uptake.

A robust cloud infrastructure capable of supporting large-scale AI workloads positions Alibaba to capture a greater share of China’s (and potentially global) AI spend. Monetisation hinges on high-value services, including AI model training, inference, and data analytics.

AI Applications & Ecosystem

Consumer-Facing AI

Alibaba has embedded AI assistants like “Taobao Wenwen” within its e-commerce platforms to enhance the user experience. Additional tools—such as Xiaomi (an AI-driven Q&A bot) and AI Business Manager—offer merchants customised product images and store-operation insights, creating a more interactive shopping environment.

Enterprise & Developer Focus

The upgraded Qwen2.5-Max model underscores Alibaba Cloud’s commitment to delivering advanced AI frameworks. Partnerships with academic institutions, like Stanford University’s S1 reasoning model (trained atop Qwen2.5), validate Alibaba’s technical prowess and highlight cost efficiency (under US$50 to outperform certain OpenAI benchmarks).

By integrating AI at both consumer and enterprise levels, Alibaba cultivates an ecosystem where data flows seamlessly from retail to cloud services, reinforcing user engagement and creating new revenue streams across the value chain.

Cost Reductions & Partnerships

Lowering Inference Costs

In 2024, AliCloud repeatedly slashed inference costs to encourage developers and enterprises to build AI applications on its platform. This strategy aims to drive adoption—especially among mid-sized merchants and startups—and expand AliCloud’s market share.

High-Profile Collaborations

Alibaba has partnered with Apple to develop AI features for iPhones in China, potentially integrating Alibaba’s AI tools into Apple’s localized ecosystem. This collaboration could serve as a blueprint for future alliances, blending Alibaba’s AI frameworks with global tech platforms.

By reducing costs and striking strategic partnerships, Alibaba accelerates AI adoption across its ecosystem, fueling cloud demand and reinforcing the company’s status as a leading AI infrastructure provider.

Challenges & Considerations

Monetisation Uncertainties

AI’s revenue potential, especially from generative models, is still a subject of debate. Convincing enterprises to pay premium prices for advanced AI services while competing with other cloud providers is not guaranteed.

Balancing Capex & Shareholder Returns

Alibaba must strike a balance between aggressive AI investments and maintaining buybacks or dividends. Geopolitical tensions and component availability could also cap the pace of data-center expansion.

Regulatory & Data Privacy

China’s evolving regulatory framework around AI and data usage may introduce compliance costs or slow product rollouts. Alibaba’s strong privacy policies and extensive experience with large commercial clients partially mitigate these risks.

Alibaba’s AI ambitions hinge on its ability to navigate an evolving regulatory landscape and maintain the right mix of capital investment and shareholder returns. Success in AI will likely rest on achieving scale and forging deeper enterprise relationships.

AI’s Near-Term EPS Impact (FY25–FY26)

Quantifying AI’s precise contribution to Alibaba’s bottom line is inherently speculative, especially given the nascent nature of generative AI. However, a commonly cited base-case range for incremental EPS uplift by FY26 is around 2–5%, primarily driven by:

Cloud Revenue Mix

AliCloud’s revenue could grow at a 14% CAGR (FY25–FY27), up from ~9–10% without robust AI adoption. As cloud now comprises roughly 15–20% of Alibaba’s top line, incremental gains from AI services (model training, inference) can meaningfully boost overall revenue.

Higher Margins on AI Services

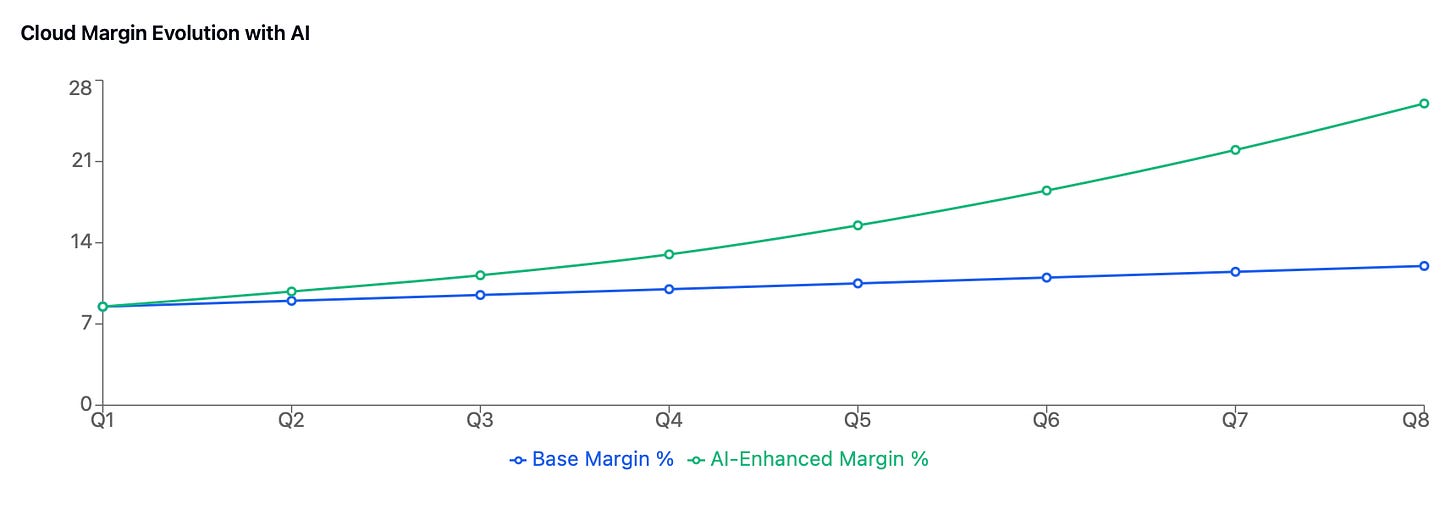

AI offerings, such as advanced language models and data-analytics solutions, command premium pricing and can operate at higher margins than basic cloud hosting. If Cloud’s operating margin moves from high single digits toward the 20–30% range in certain workloads, it can deliver a measurable lift to Alibaba’s consolidated EBIT.

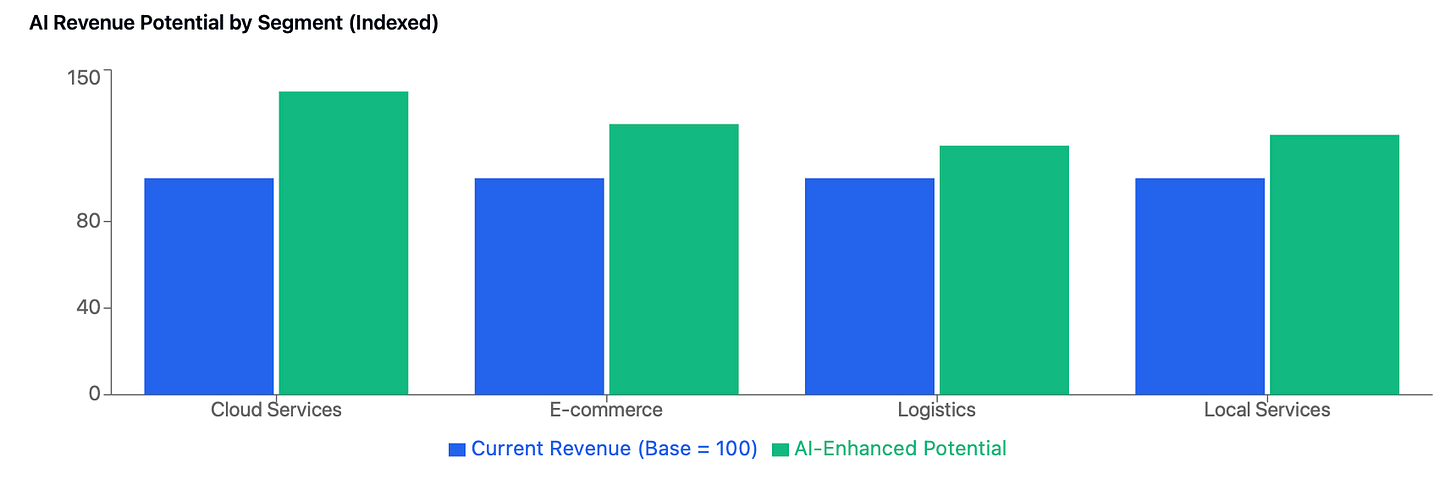

Operating Leverage & Ecosystem Synergies

AI tools integrated into e-commerce (e.g., personalised recommendations, AI-driven storefronts) can enhance conversion rates and average order values. Over time, these incremental improvements funnel through to the bottom line.

Investment & Depreciation Drag

In the near term, heavy CAPEX on AI chips, R&D, and data centres may partially offset revenue gains. Once infrastructure scales and usage ramps up, incremental AI revenue should flow more directly to net income.

In a more bullish near-term scenario, where Alibaba Cloud rapidly gains market share and AI services fetch premium pricing, the EPS uplift could stretch beyond 10% by FY26. Still, this depends on successful execution, competitive pressures, and regulatory conditions.

Optimistic Outlook Through 2030

Looking further out, Alibaba’s AI strategy could yield even more substantial EPS gains, possibly 10–20% or higherabove baseline projections by 2030. Several factors underpin this more bullish scenario:

Cloud Dominance & Market Expansion

If Alibaba Cloud cements a leadership role in AI workloads—especially in enterprise and public cloud settings—cloud’s share of group revenue may climb from ~15–20% toward 25–30%. This transition would significantly impact overall earnings.

Elevated AI Margins

Premium AI services (e.g., specialized large language models, turnkey AI business solutions) can carry margins well above basic compute and storage. Sustaining high operating leverage could move Cloud margins into the 20–30% range or beyond.

Deep Ecosystem Integration

AI enhancements across e-commerce, local services, and logistics could improve user experience, efficiency, and cross-selling. Over several years, these improvements compound, amplifying net income.

Key Assumptions & Risks

Aggressive Capital Deployment: Achieving this upside requires significant investment in data centers, proprietary chips, and R&D.

Regulatory & Competitive Landscape: Policies around data privacy and competition from both domestic (e.g., Tencent Cloud, Huawei Cloud) and global providers (AWS, Azure) may temper growth or margin expansion.

Technological Breakthroughs: AI advancements aren’t guaranteed to continue at the current pace. Slower innovation or hardware constraints could cap premium service adoption.

Valuations and Performance overview

Recent Share Price & Total Return Observations

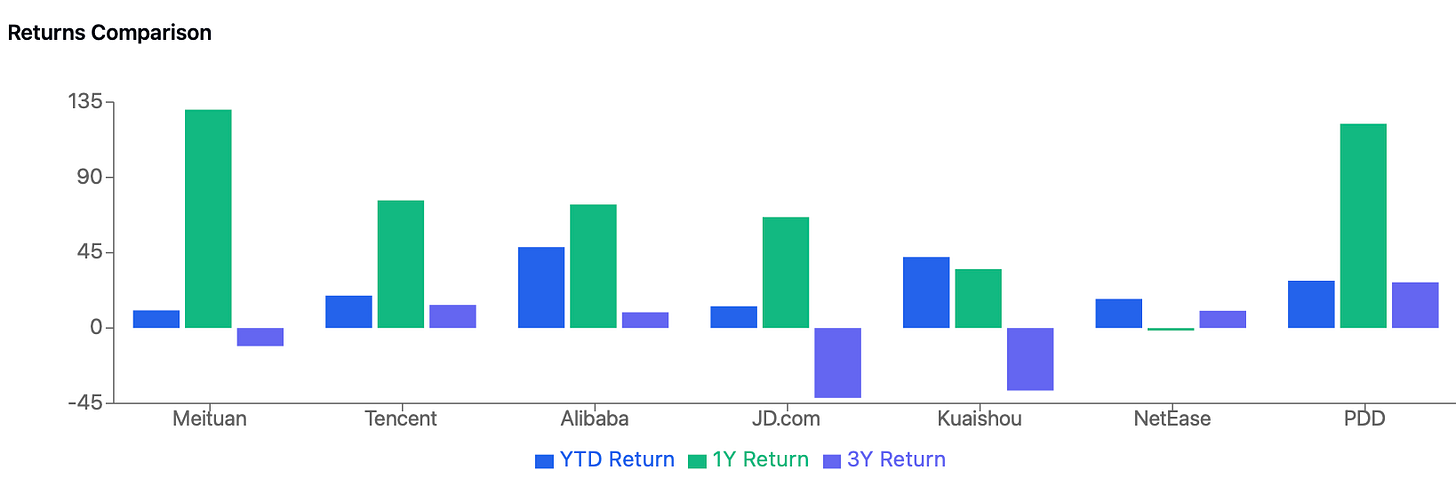

Recent data shows that Alibaba has surged by roughly 50% so far this year—an impressive rebound that reflects both improving investor sentiment and a gradual recovery in Chinese consumer spending. While the broader Chinese internet sector also rebounded from depressed 2022 levels, Alibaba’s gains underscore its position as a bellwether for the space.

The rally aligns with a broader pivot in market sentiment toward Chinese tech, spurred by easing regulatory pressures and a renewed focus on post-pandemic consumption.

Momentum vs. Broader Market Despite the robust YTD gain, Alibaba’s share price is still well below its historic peaks, reflecting the lingering impact of 2022’s macro headwinds.

Investor enthusiasm remains somewhat uneven across the sector, with certain segments (like local services or short-video platforms) drawing heavier inflows at different times. Nevertheless, Alibaba’s recent run underscores renewed confidence in its core commerce and AI-driven growth prospects.

Shareholder Returns & Buybacks Ongoing buybacks continue to support Alibaba’s stock. Over the past two quarters, management repurchased billions of dollars’ worth of shares, signaling optimism about intrinsic value and strengthening the overall return profile.

Valuation Relative to Peers

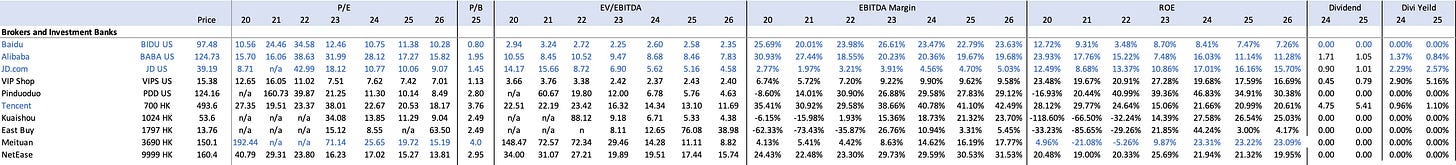

Forward P/E

Alibaba currently trades around 10–12x forward earnings, notably below many domestic peers (e.g., Pinduoduo often commands 15–20x, Meituan ranges from 30–40x). This discount partially reflects concerns over slower near-term GMV growth and regulatory overhang, but it also suggests potential value if Alibaba successfully reaccelerates growth.

EV/EBITDA & P/S

On an EV/EBITDA basis, Alibaba’s multiple typically sits in the mid-teens, again at a discount to pure-play growth stocks in China’s internet space.

P/S ratios further highlight the valuation gap: Pinduoduo and Meituan often trade at higher multiples due to stronger perceived revenue momentum, whereas Alibaba’s large e-commerce base and slower top-line growth dampen its P/S ratio.

Growth vs. Value Balance

Investors often see Alibaba as a “steady compounder” rather than a hyper-growth story. Its wide ecosystem, high free cash flow, and consistent profitability place it in a different category than some peers focused on rapid expansion or niche verticals.

Potential Re-Rating Catalysts

Cloud & AI: A successful pivot toward AI-driven cloud services could spur multiple expansion if investors view Alibaba Cloud as an independent growth engine.

Regulatory Easing: As antitrust and data-privacy pressures ease, Alibaba may regain investor favor, narrowing the valuation gap versus peers.

Consumer Recovery: A sustained rebound in Chinese consumer spending would likely have an outsized impact on Alibaba’s core commerce segment, lifting both revenue and sentiment.

Key Takeaways

Value vs. Growth: Compared to faster-expanding rivals, Alibaba trades at a notable discount on both earnings and sales multiples. This discrepancy reflects near-term macro uncertainties and competitive pressures but also highlights potential upside if the company delivers on AI, international expansion, and margin recovery.

Stability & Cash Generation: Despite the lower multiple, Alibaba’s consistent free cash flow and ongoing share repurchases make it attractive for investors seeking a more balanced risk-reward profile.

Catalysts Ahead: The market will be closely watching how Alibaba executes its AI strategies—particularly in cloud computing—and whether the broader domestic consumption landscape improves enough to spur re-rating.

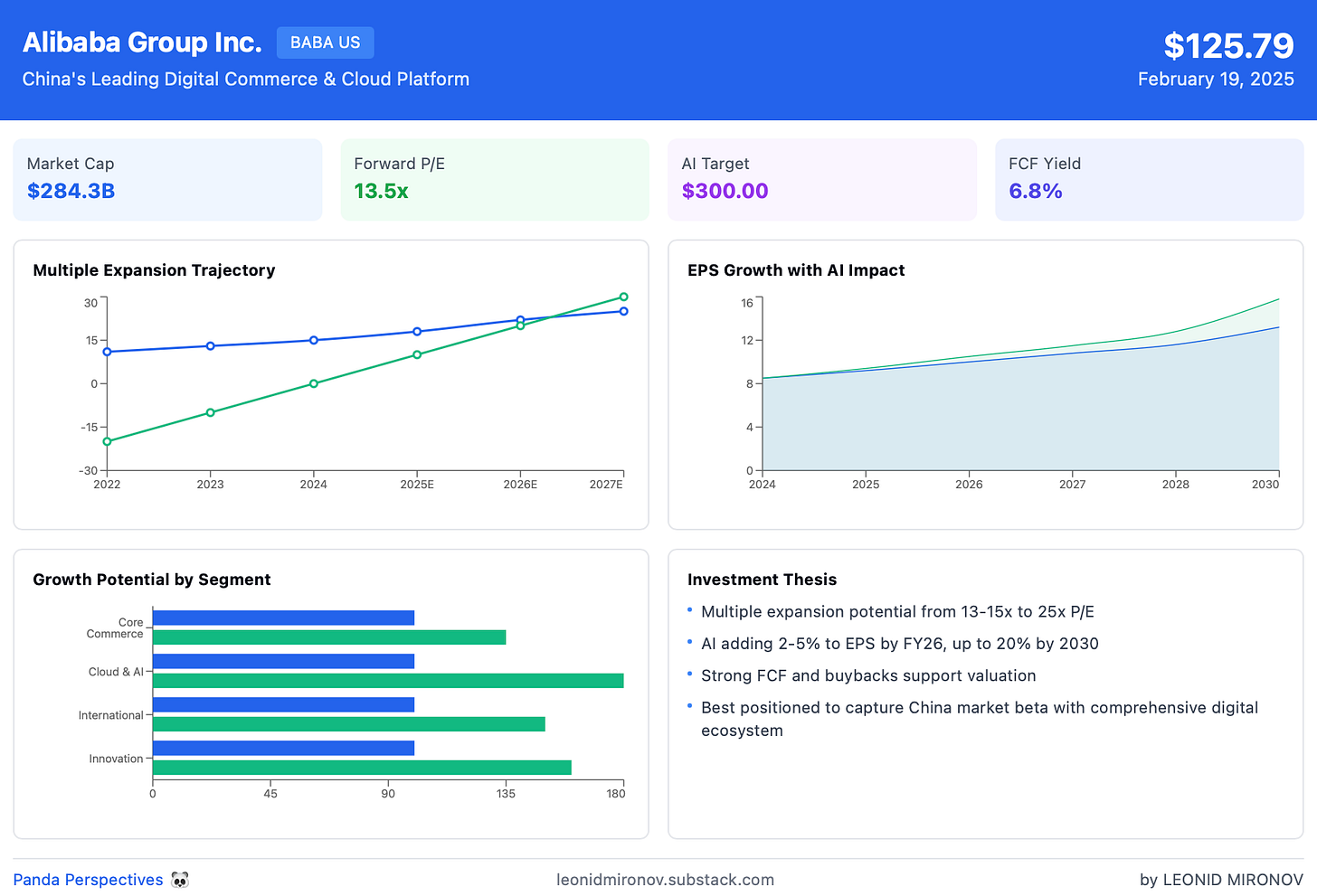

Panda Perspective:

Multiples in the equity market often expand and contract based on shifting investor sentiment rather than fundamental changes in a company’s earnings power. Over the past couple of years, we’ve seen this dynamic play out acutely in China. Despite Alibaba’s operational resilience—evidenced by steady revenue growth, improving cost discipline, and robust free cash flow—the broader Chinese tech sector fell out of favor with global investors starting in 2022. Geopolitical tensions, regulatory crackdowns, and macroeconomic uncertainties all contributed to a severe compression in valuations that, in many cases, appeared disconnected from companies’ underlying earnings trends.

Now, the pendulum is beginning to swing back. Renewed optimism about China’s post-pandemic economic recovery and signs of regulatory easing have buoyed sentiment toward Alibaba and its peers. Company-specific drivers—like a rebound in core commerce margins and accelerating AI initiatives in cloud—have added further fuel to the rally. While this newfound enthusiasm is promising, the pace and extent of multiple expansion are inherently difficult to forecast. Investors must weigh both the genuine improvements in Alibaba’s fundamentals and the volatility of market sentiment, which can drive valuations far above or below intrinsic value.

Looking ahead, Alibaba’s potential AI contribution and continued EPS growth could easily propel earnings above US$12 per ADS by the end of the decade. If we assume the market becomes more optimistic about Alibaba’s AI business and applies a premium multiple—say 25x—to its non-AI earnings base, it’s conceivable to arrive at a share price approaching US$300 per ADS. This rough calculation illustrates the substantial upside that a more bullish market narrative could unlock. Yet it also underscores the sensitivity of price targets to changes in sentiment: while fundamentals may indeed support higher valuations, sentiment can shift abruptly, emphasizing the importance of both a strong business strategy and a realistic appreciation for market psychology.

Alibaba stands out as a prime candidate for investors seeking to capitalize on the renewed enthusiasm in Chinese equities. Over the past 12 months, the stock has rallied significantly from its 2022 lows—yet it still trades at a forward P/E of roughly 13–15×, a notable discount to many global tech peers. Meanwhile, consensus forecasts upgrades Alibaba’s EPS could exceed US$10 within the next year or so, with additional upside if its AI-driven cloud and e-commerce segments outperform.

Looking further ahead, Alibaba’s robust free cash flow and steady share buybacks offer a degree of stability, while domestic consumption tailwinds and AI-led innovations provide clear avenues for growth. Indeed, AI alone could add 2–5% to consolidated EPS by FY26 in a base-case scenario—and potentially 10–20% by 2030 under more bullish assumptions. When combined with a broadening product ecosystem and a favorable macro backdrop, these factors position Alibaba at the forefront of China’s market revival. For investors seeking both near-term momentum and long-term optionality, Alibaba offers a compelling balance of proven fundamentals and significant upside potential.